nicolas_/E+ via Getty Images

Rocket Pharmaceuticals (NASDAQ: RCKT) is a biotechnology company headquartered in New York. They specialize in leading the charge in the development of first-of-their-kind genetic therapies. These gene therapies are target-specific, designed to target rare pediatric diseases. The most notable of these diseases is Fanconi anemia. Fanconi anemia is a genetic defect that affects the bone marrow. This disorder reduces the production of healthy red blood cells, increasing the amount of faulty red blood cells in the body which results in serious complications. Rocket has taken major steps on the path to bringing an effective product to market that treats this affliction.

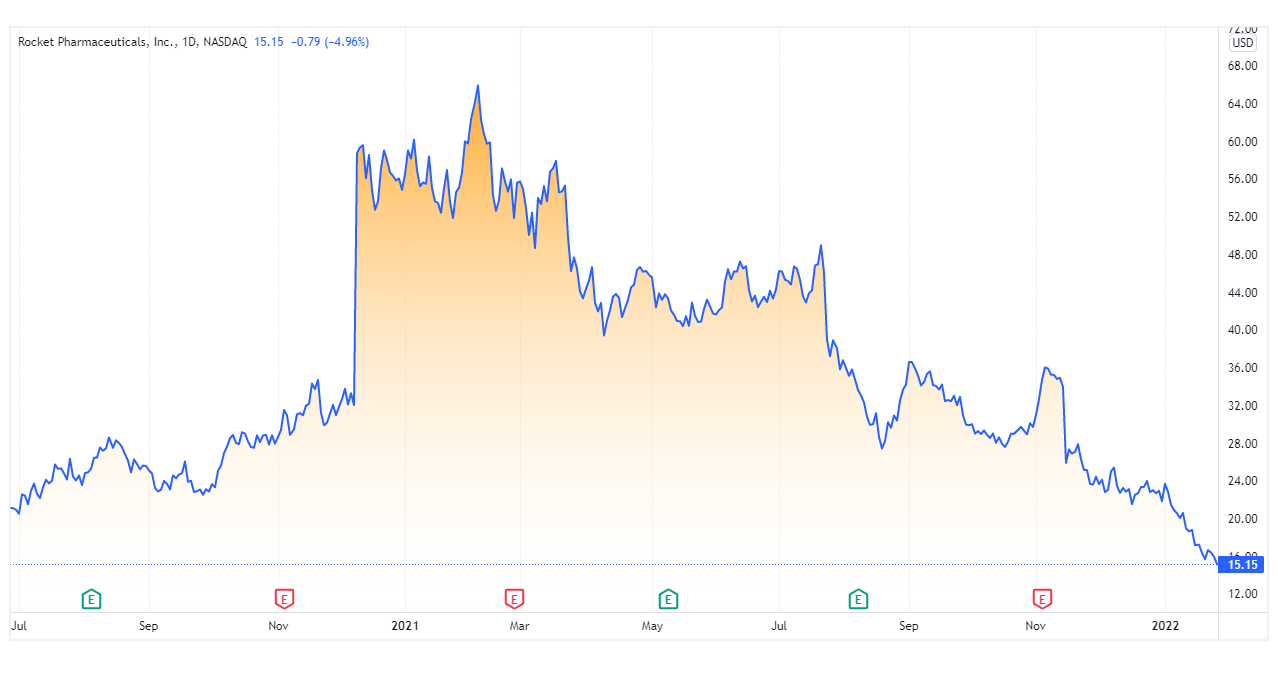

In this article, I will show that despite a steep decline in stock price, Rocket’s progress towards a breakthrough treatment warrants a closer look. Results from Rocket’s trials have been encouraging; the fact that this treatment appeals to a limited market, resulting in fewer competitors and more exclusivity, makes it an interesting candidate for investors.

tradingview.com

Promising Clinical Trial and Pipeline Developments

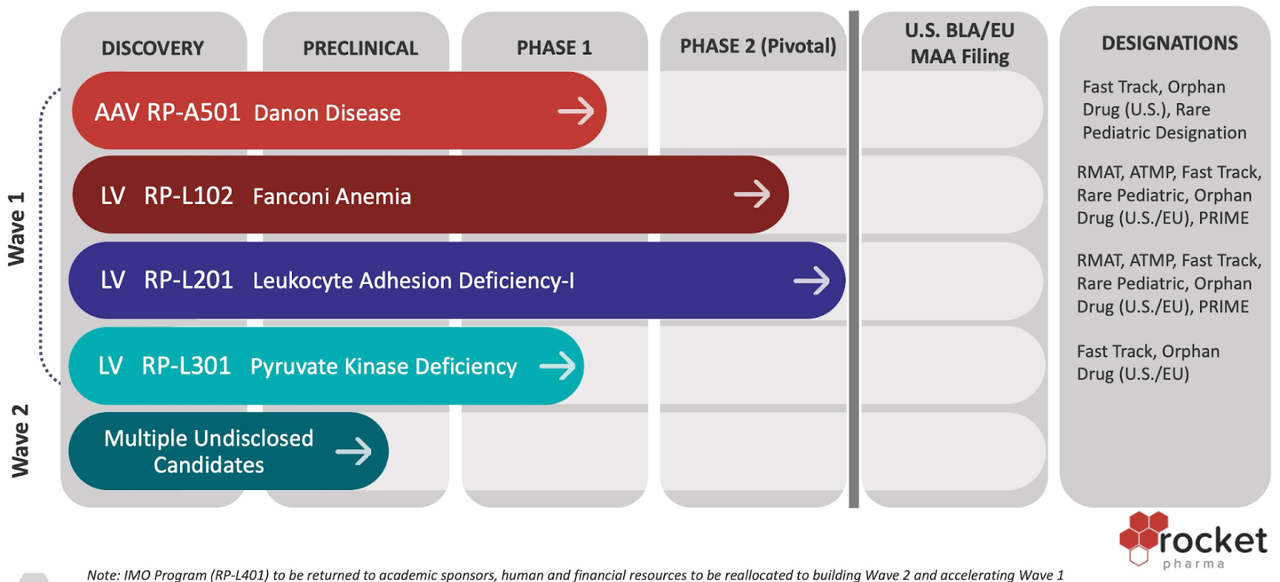

The company’s manufacturing products include RP-L102 for Fanconi Anemia, RP-A501 for Danon Disease, RP-L201 for Leukocyte Adhesion, RP-L401 for Infantile Malignant Osteopetrosis, and RP-L301 for Pyruvate Kinase Deficiency. The most important update to come out of Rocket this past year was the positive update regarding the RP-L102 Fanconi Anemia and RP-L201 Leukocyte Adhesion Deficiency – I (LADI) programs. In addition, the Rocket Pharmaceuticals pipeline and operational updates say that the company has announced positive preliminary clinical data from RP-A502 for Danon Disease.

The company received fast track designation for Infantile Malignant Osteopetrosis (IMO) and Rare Pediatric Designation for Danon Disease Programs from FDA. The Fast Track Programs of the FDA support the development of products intending to treat severe health conditions that can treat unmet medical needs. It permits greater access to the FDA to develop products, potential approval, and review. It offers Rare Pediatric Disease Designation for life-threatening illnesses that impact children aged 18 or younger. Fast track designation is coveted by biotechs who can use it as an opportunity to expedite drugs through the long FDA approval process, which is especially important when high R&D costs can remain a liability on their balance sheet while drugs wait to come to market.

In addition, the California Institute of Regenerative Medicine awarded Rocket a CLIN2 grant worth $3.7 million to support the clinical development of RP-L401 for IMO. It will further help the company with trial costs and offer manufactured drug products to the patients enrolled at the phase 1 clinical trial site at UCLA. The company has continued its build out of a new Research, Development, and Manufacturing facility. Rocket Pharmaceuticals in January announced its plans for new R&D along with Chemistry, Manufacturing, and Control (CMC) operation, which will also be its new headquarters, situated in Cranbury, New Jersey. It will support clinical development for the growing pipeline of AVV gene and lentivirus therapies. It will also support the quality control laboratories to support CMC development for the process and analytics. The company has expanded its (FA), Danon, LAD-I, and IMO trials, adding more to global excellence – the newly added sites will increase the patients’ accessibility to enroll in Rocket’s clinical trials across the globe.

How Rocket’s Unique Products Give Cause for Optimism

The general rule, even in the biotech sector, when it comes to the market value of a product is supply and demand. Many of the larger companies divide their assets, targeting subsects with the most demand. Covid was a good example of this. Other examples would be other well-known diseases without a cure, such as cancer or Alzheimer’s. The upside to breaking the market on treatment for any of these diseases is weighed against the cost of R&D. This formula helps forecast future valuations.

While most other pharmaceutical companies spend their time researching gene therapy treatments utilizing only one delivery system (either LLV (Lentivirus Virus programs) or AAV (Adeno-Associated Virus programs)), Rocket has taken the unusual approach of studying both. This has both risk and reward. The risk is that two separate delivery systems require two different processes of R&D, which is both costly and time-consuming. The reward is that it gives the company the best chance at developing a successful treatment option, with two possible paths to a viable product in case anyone fails during development or trials.

Rocket President and COO Kinnari Patel has bold visions for the company. In a statement to the press, he disclosed that “Rocket’s ambition is to become the “Genentech” of gene therapy.” Considering Genentech is the market’s largest name in the development of cancer drugs, it’s a bold statement. Despite the potential of biting off more than they can chew, Rocket has actually performed better than most of its independent counterparts in the market. Even though its target market is small, it provides value in its exclusivity. Considering this exclusivity with Rocket’s research into genetic delivery systems that could open doors into the treatment of many other disorders, it is clear that their potential market pipeline is extremely broad.

Potential Risk and Outlook

The risk factors plaguing Rocket Pharmaceuticals are twofold. The first is the fact that they currently do not have a viable product on the market. This means that they have no new means of revenue coming in. The second major risk factor is the sheer cost of research and development when it comes to breakthrough medical treatments. Due to the nature of the work and the likelihood of delays, obstacles, and potential failure, the cost includes both time and money. This means that potential investors investing in Rocket would have to prepare for a potential long-term hold in order to garner worthwhile profits. This can be a potential pitfall in the market, as a scientific breakthrough is anything but certain.

Rocket is currently trading at nearly $16 a share. This is a substantial 59% drop from just 6 months ago when it was trading at $39. While their (EPS) is an abysmal -3.04, this can be written off due to the fact that Rocket has no products on the market yet. Despite having no tangible revenue streams, the company has managed contracts and funding well enough to only hold $22.48 million in debt, making long-term outlooks more favorable.

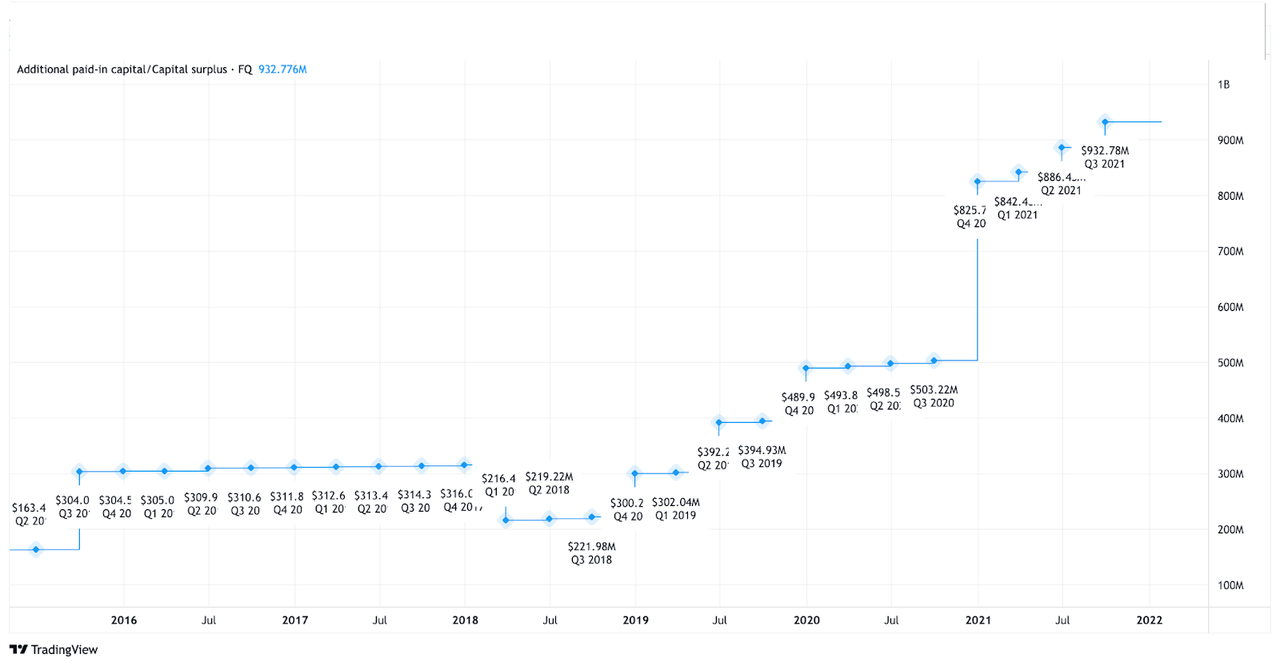

tradingview.com

A sharp rise in capital surplus could be another cause for concern when considering an investment. In Q4 2019, company financials reported a capital surplus of $489.9 million, while the Q4 2020 financial report showed a capital surplus of $825.7 million. However, if the company turns that surplus into capital gains, it could result in higher dividend payouts, which would prove beneficial to investors long term. That being said, a substantial jump in this metric is generally a red flag for potential investors. However, a rise in capital gains is not always a bad thing. Oftentimes, companies will issue additional stock as a way to gain more capital for company growth. Given Rocket’s aggressive company approach, it’s a fair bet to conclude that they are doing just that, and are preparing for an increase in R&D expenditure.

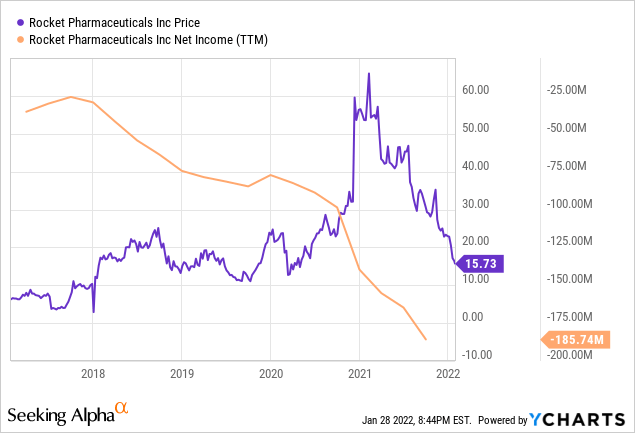

ycharts.com

Digging deeper into Rocket’s financials does not paint an appealing picture. In September 2021, the company posted a negative net income growth rate of -72.35%. However, there is a reason that many investors often overlook this statistic. While one root cause is that company had posted a loss on its books, or perhaps is losing money on its operations, another just as plausible reason is that the company is in a growth stage. This requires a period of reinvestment which appears on the balance sheet as a negative. While there is never any certainty as to which factor caused the negative rate, in the case of RCKT there is a viable reason to believe it is due to reinvestment. This is due to evolving technology in the biotech field, which leads to operational changes and often requires the reallocation of company resources.

Conclusion

Despite being plagued by the rigors of the scientific process and not having a tangible product to market, Rocket is still in a favorable position. As with any independent biotechnology company, there is always a certain amount of risk. When investing in the development of proprietary medical technology, there are numerous things to consider. A long development process, the expense of R&D, and the possibility of unexpected negative results in the trials could delay, or even prevent, a new product from reaching the market.

In spite of these risks, however, Rocket remains an attractive long-term investment. Results from the company’s trials have been encouraging – if they can offer a viable product to a niche market and open up a whole new pipeline of opportunity, then the rewards may prove to outweigh the risk. The fact that this treatment appeals to a niche market with more exclusivity is also encouraging, and it is unlikely that the company will perish to excessive competition. Growth investors focused on the long term may want to keep an eye on this company in the near future to establish a position.