BackyardProduction/iStock via Getty Images

Article Thesis

T-Mobile US (TMUS) is a fast-growing telecom company with strong execution. It is, on the other hand, not offering any dividends and trades at a steep valuation compared to its peers. AT&T (T) is a very different telecom company, with strong dividends and a very inexpensive valuation, but weaker execution. Due to interest in our community in this question, we’ll pitch these two telecoms against each other to see which company is the superior pick for different kinds of investors.

Company Overview

T-Mobile US is the publicly-traded US daughter entity of Deutsche Telekom AG (OTCQX:DTEGY). T-Mobile US is only active in the United States, Puerto Rico, and the Virgin Islands. Deutsche Telekom’s ownership stake in T-Mobile US is 48%, with the remaining 52% of T-Mobile US being owned by institutional and retail investors.

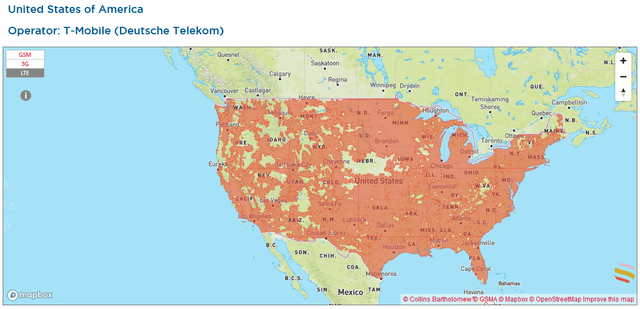

T-Mobile US offers typical telecom services such as voice, messaging, and data to its more than 100 million customers. Following its merger with Sprint that closed in early 2020, T-Mobile US has become one of the largest telecom players in North America. Its LTE coverage in the United States looks like this:

TMUS LTE coverage (gsma.com)

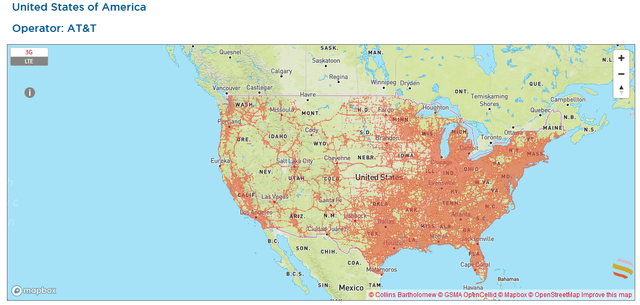

For reference, this is what the AT&T LTE coverage looks like in the United States:

AT&T LTE coverage (gsma.com)

We see that T-Mobile’s LTE coverage actually is superior to that offered by AT&T (at least according to GSMA’s data). In non-urban areas in the Western parts of the US, AT&T’s LTE coverage is lacking, while T-Mobile is offering LTE services in many of those places. Of course, the majority of the population does not live in these areas, but rather in more urban markets on the coasts, in the midwest, in the sunbelt, etc. The superior LTE coverage that is offered by T-Mobile is thus not necessarily a huge selling point for the majority of consumers. But still, T-Mobile’s strong coverage shows that it is a highly competitive player in this industry.

AT&T’s business model is somewhat different when compared to T-Mobile US. On top of offering wireless voice and data communication, AT&T also is active in additional industries such as broadband (including fiber). AT&T also owns a vast media & entertainment company, Warner Media, which will be merged with Discovery (DISCA) later this year (shares in the new company will be spun off to investors). AT&T is active in the US, but also in additional markets such as Latin America.

T-Mobile US is thus the more narrowly focused company compared to AT&T, which is a larger, less focused company. On one hand, this means that AT&T is more diversified and less exposed to a single industry. On the other hand, T-Mobile’s narrow focus, both geographically and when it comes to the services it provides, allows it to operate a more nimble, efficient organization. This could explain how T-Mobile has been making gains in the telecom industry in recent years, versus both AT&T and Verizon (VZ), which is, like AT&T, a less focused company. This brings us to the next item to look at, which is the recent growth performance of the two companies.

AT&T Versus T-Mobile US: Recent Developments

T-Mobile US reported its most recent quarterly results in early February. The company grew its revenue by 2% year over year, slightly missing estimates. T-Mobile has, however, easily beaten estimates for its earnings per share, which came in more than twice as high as Wall Street analysts had predicted. This was the result of excellent cost controls, which helped T-Mobile to beat its own guidance easily. The company’s CEO Mike Sievert stated:

“T-Mobile had our strongest year ever. We didn’t just meet the bold goals we set for 2021 around customer growth, profitability, merger synergies and network buildout – we crushed all of them.”

This naturally is great for investors, which benefit from T-Mobile’s strong execution. The company has added 5.5 million postpaid customers in 2021, on a net basis, i.e. adjusted for those that left the company. This is a strong feat and better than the performance seen by AT&T and Verizon. In other areas, T-Mobile also executed well, e.g. by adding 550,000 high-speed internet customers during the last year. Thanks to a combination of business growth and synergies that could be captured following the Sprint takeover, T-Mobile US was able to grow its adjusted EBITDA by 16% in 2021, to $24 billion for the year.

AT&T, on the other hand, has not managed to grow its business at a comparable pace during 2021. The company beat analyst expectations, but revenue was down 10% year over year during the fourth quarter. It should be noted, however, that the weak top-line performance was the result of some divestments that AT&T made in 2021. In Q3, AT&T sold its U.S. Video business, while the company sold Vrio during the fourth quarter. Adjusted for those portfolio changes, AT&T actually managed to grow its revenue as well, primarily thanks to a strong Warner Media performance — the media/entertainment business grew its revenue by 15% year over year, thanks to a strong HBO Max performance. Since Warner Media will be spun off in the not-too-distant future if everything goes according to plan, growth beyond that point should be lower again.

AT&T Vs. T-Mobile: Cash Flows And Balance Sheet Strength

Telecom companies usually utilize a lot of debt in order to finance their costly infrastructure. Looking at the balance sheets of AT&T and T-Mobile US thus makes a lot of sense, I believe.

AT&T is well-known for its high debt levels in absolute terms. At the end of the fourth quarter, AT&T’s net debt totaled $157 billion, per the company’s 10-K filing. Short- and long-term debt of $178 billion was partially offset by cash of $21 billion. It should be mentioned that AT&T’s net debt will decline further when the company spins off its media business, as it will also pass on billions of dollars in debt to the new company. T-Mobile had a net debt position of $63 billion, as $70 billion of short- and long-term debt was partially offset by $7 billion in cash (here’s the 10-K).

At first sight, TMUS seems like the clearly stronger company from a debt perspective, but looking at debt levels purely in absolute terms is not overly telling. Instead, investors should also factor in the EBITDA/cash flow picture for the two companies.

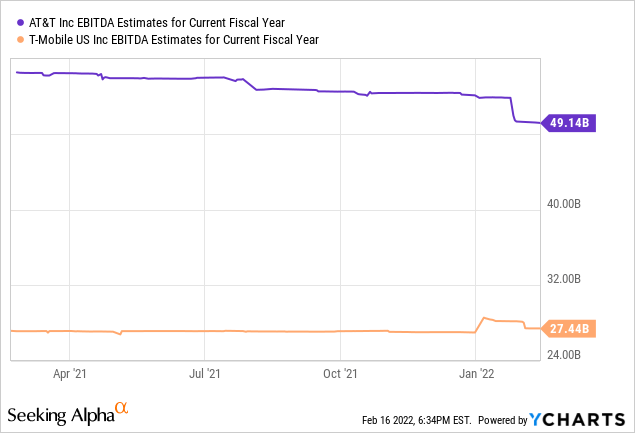

AT&T is forecasted to generate EBITDA of $49 billion this year, which means that its net debt is equal to around 3.2x its EBITDA. Following the spin-off of the media business, that ratio should drop below 3. T-Mobile, meanwhile, is leveraged at a ratio of 2.3, based on $63 billion of net debt and forecasted EBITDA of $27 billion. TMUS is thus the company with the stronger balance sheet, but the difference is not as large as the absolute debt levels suggest (where AT&T’s debt is around 2.5x as high as that of TMUS).

Looking at the cash flows the two companies generate, we get a relatively similar picture — AT&T’s business is throwing off way more cash. In 2021, AT&T has generated $42 billion of operating cash and $25 billion in free cash. T-Mobile, on the other hand, has generated operating cash of $14 billion, and free cash of $6 billion. When we look at net debt relative to the free cash flow the two companies generate, AT&T actually is the one with less leverage. It could pay off all of its net debt in about 6 years, while it would take TMUS about 10 years to get rid of its net debt if all free cash flows were diverted towards debt reduction.

AT&T’s vastly superior cash flows also allow it to return more cash to its owners compared to TMUS. AT&T has paid a dividend yielding 8.7% in the past, following a dividend cut the yield will drop to around 5%, not accounting for the shares in the media company that current holders of AT&T will receive later this year. T-Mobile does not pay any dividends right now, and is also not buying back shares — its share count has risen over the last year. The cash flows of the two companies also play a huge role in the next field — valuation.

AT&T Versus TMUS: Valuation

AT&T is valued at $170 billion today, while T-Mobile US is trading with a market capitalization of around $160 billion. This would make sense if both companies were roughly equal in size, but that is not the case. As we have seen earlier, AT&T generates free cash flows that are roughly 4x as high as those of TMUS. AT&T is trading with a free cash flow multiple of 7 today, which pencils out to a free cash flow yield of ~14%. T-Mobile, meanwhile, is valued at around 27x its free cash flow, which makes for a sub-4% free cash flow yield. Even when we account for somewhat better execution at T-Mobile, the huge valuation premium relative to AT&T seems overdone.

AT&T is also way cheaper on an EV/EBITDA basis, which already accounts for differences in debt usage. When we account for AT&T’s upcoming media spin-off, its valuation looks even lower. Shareholders will receive about $6 worth of stock in the new media company, which means that core AT&T is valued at a little less than $130 billion today. Per management’s guidance, core AT&T will still generate $20+ billion of free cash flow per year going forward, which makes the free cash flow multiple drop to 6-6.5. This equates to a free cash flow yield of around 16% for core AT&T, which is, from a business perspective, relatively comparable to T-Mobile US.

Takeaway

The telecom industry is capital-intense, and both companies thus employ significant debt. AT&T is more indebted relative to the EBITDA it generates, but based on recent free cash generation, it could actually reduce its debt load faster than TMUS if it wanted to (and if it was, like TMUS, not paying any dividends).

T-Mobile has executed well in the past and has a strong network, but its current valuation seems too high. The quality of the company is not high enough to warrant a premium as large as what we see today, relative to AT&T. With core AT&T trading at just around 6x forward free cash flow and with a forward dividend yield of around 5%, it seems like the way better value compared to T-Mobile — even though TMUS could be the better choice if both companies were trading at a similar valuation.