CasarsaGuru/E+ via Getty Images

Clovis Oncology (NASDAQ:CLVS) continues to report lackluster earnings which have destroyed the share price and investor sentiment. At one point, Clovis had a promising outlook and was considered a prime acquisition target following Rubraca’s initial approval. Sadly, Rubraca failed to outcompete other PARP inhibitors that were coming onto the market and the company’s cash burn accelerated to support the commercial and clinical efforts. Furthermore, the pandemic put the brakes on new ovarian cancer diagnoses which hurt Rubraca’s growth. Consequently, the company’s financials disintegrated and Clovis has been running on debt and secondary offerings to maintain operations.

On the bright side, the company recently reported impressive data from their ATHENA-MONO Phase III study that triggered a strong spike in the share price. The ATHENA-MONO data should support the use of Rubraca in the first-line ovarian setting. In addition, it improves the prospects ATHENA-COMBO study with Bristol-Myers Squibb’s (BMY) Opdivo in ovarian cancer.

The market’s fixation on Rubraca’s performance appears to control CLVS’s fate, however, I believe Clovis has much more to offer than just a PARP inhibitor. Therefore, I am attempting to take on a fresh perspective with a new thesis and time horizon.

I intend to provide a brief backstory on Rubraca. In addition, I take a look at the company’s recent earnings report and company updates to identify key materials needed to forge a new thesis for CLVS. Finally, I analyze the Monthly and Daily charts to map out my next buy.

Rubraca… The Fallen

It wasn’t that long ago when poly adenosine diphosphate-ribose polymerase “PARP” inhibitors were seen as a promising oncology agent. PARP inhibitors are a type of targeted therapy that prevent cancer cells from repairing by blocking the PARP enzymes (PARP 1, PARP 2, PARP 3), thus, permitting them to perish. PARP inhibitors have shown to be effective in a variety of cancer types including ovarian, breast, prostate, fallopian tube, peritoneal, and pancreatic. The main battleground between FDA-approved PARP inhibitors has been ovarian, fallopian tube, peritoneal, and prostate cancers, where Rubraca is taking on GlaxoSmithKline’s (GSK) Zejula, plus, AstraZeneca’s (AZN) and Merck’s (MRK) Lynparza.

For a while, Tesaro and Clovis used to go head-to-head with who was going to be the primary competition to AstraZeneca and Merck, which turned out to be injurious for both companies in so many ways. When Tesaro or Clovis made progress with their PARP product, the other company’s share price took some damage. When one company reported acceptable earnings, the other one writhed. However, when one reported bad earnings, the other company’s stock took a hit.

In fact, the only time I can recall both tickers experiencing a positive boost was when there were rumors about one of the tickers getting acquired. Subsequently to Tesaro being acquired by GlaxoSmithKline, Clovis had around a month of momentum from speculators expecting CLVS to be next. Well, that never came and the buyout hype wilted.

Luckily, Rubraca is not a one-trick pony and the company was taking aim at mCRPC with TRITON 2 program, which demonstrated a 44% ORR in patients with the BRCA 1 or 2 mutation. The FDA granted Rubraca a Breakthrough Therapy designation and Clovis began working on filing an sNDA for BRCA mutated mCRPC. Unfortunately, AstraZeneca and Merck recently reported positive grades from their Phase III PROfound trial of their PARP inhibitor, Lynparza in mCRPC, and it looked as if they were going to be the first PARP approved for the indication.

As soon as the news hit the wire, CLVS experienced elevated selling pressure as investors began to fear that Rubraca was going to lose to both Lynparza and Zejula. What is more, Pfizer’s (PFE) PARP inhibitor, Talzenna, already had a firm grasp on the breast cancer market. It was obvious that Rubraca was struggling to outpace the competition in the clinic.

Over the next couple of years, the company had its ups and downs with some beats and misses on earnings. In addition, the company pushed Rubraca ahead in the clinic in both ovarian and prostate cancers. Regardless of the progress, it was apparent that the Street was fixated on the notion that Rubraca was not likely to be the first or the best performing PARP inhibitor on the market. Consequently, CLVS became a trading ticker rather than a promising investment.

Into the bargain, the pandemic had a significant impact on the number of ovarian cancer diagnoses in the U.S. and Europe. As a result, Rubraca sales for Q4 2021 were only $36M, which was a 5% drop from Q3 and a 17% drop year-over-year compared to Q4 2020.

To recap, Rubraca was at one point viewed as a potential leading PARP inhibitor thanks to its strong performance in the clinic and commercial prospects. However, Rubraca has strong competition from other PARP inhibitors which are owned by big pharma companies who were able to outpace and outmuscle Clovis. Furthermore, the pandemic has impacted Rubraca’s market, thus, hurting the PARP inhibitor’s potential of reporting a turnaround. Even if the ATHENA MONO data does trigger a turnaround rally in the share price, we cannot expect the market to be sold on CLVS until there is clear evidence in the commercial numbers. For that reason, I think investors should consider deprioritizing Rubraca from their CLVS thesis at this point in time.

Forging A New Thesis

I believe investors should take a step back and see that Clovis has the ingredients to forge a new thesis and move beyond Rubraca vs the competition.

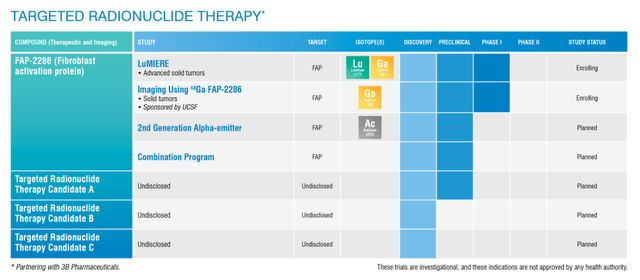

Back in September of 2019, Clovis entered a global licensing and collaboration pact with 3B Pharmaceuticals for their targeted radiopharmaceutical drugs and diagnostics for oncology indications. The 3B Pharmaceuticals deal expanded the company’s pipeline and gave the company a new future.

Targeted Radionuclide Therapy Pipeline (Clovis Oncology)

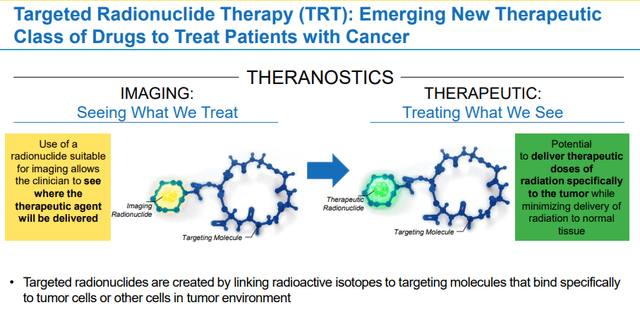

Clovis has a chance to be a leader in targeted radionuclide therapy “TRT”. FAP-2286 is the company’s lead fibroblast activation protein “FAP” program and will be the first TRT to enter the clinic.

Clovis TRT Overview (Clovis Oncology)

FAP is prominently expressed in cancer-associated fibroblasts “CAFs”, which are found in most cancerous tumors. CAFs have a vital role in tumor activities including immunosuppressive actions that assist tumors in developing resistance to immunotherapies such as PD-1 or PDL-1 inhibitors. What is more, high FAP expression is common in both primary and metastatic tumors.

Higher FAP expression was observed in 16 solid tumor cancer types, including salivary gland, pancreatic ductal adenocarcinoma, sarcomas, non-small cell lung, mesothelioma, colon, bladder, and head and neck cancer. The company is looking to take on multiple tumor types in the Phase II expansion cohorts of the LuMIERE study for FAP-2286. Clovis anticipates they will start the LuMIERE Phase II expansion cohorts later this year.

In addition to monotherapy, Clovis is investigating using their TRT assets in combination such as PD-1 or PDL-1 therapies, as well as with Rubraca, and other oncology agents.

Besides FAP-2286, Clovis is collaborating with 3B Pharmaceuticals in the discovery or preclinical phases of three supplementary targets. If all goes to plan, we could see multiple TRT programs in the clinic, making Clovis the unofficial leader in targeted radionuclide therapies. I believe investors should focus their thesis on these new programs.

Don’t get me wrong, Rubraca is still part of the long-term thesis… In fact, I think Rubraca still has plenty of growth left in the coming years as the pandemic subsides and the company adds supplementary indications. The ATHENA-MONO data should lead to a label expansion into first-line maintenance treatment in ovarian cancer. The company expects to submit an sNDA in Q2 for the U.S. and Q3 for the EU. Clearly, having this label should lead to a solid boost in revenue in the coming quarters and years.

What is more, Clovis is expecting two more Phase III read-outs this year.

- TRITON3 in the second-line prostate cancer for selected patients in Q2.

- ATHENA-COMBO in combination with Opdivo in the first-line ovarian cancer maintenance treatment in the Q4.

These two studies could help expand Rubraca to even larger patient populations in early lines of therapy for both ovarian and prostate cancers, which could drive growth in Rubraca sales in both the U.S. and Europe. Accordingly, it is likely Rubraca can still provide respectable growth in the coming years and help offset costs in the coming years as we wait for the 3B programs to get through the FDA.

When looking at the financials, the company’s Q4 R&D expenses totaled $41.8M and $186.6M for 2021, which were down 26% and 28% respectively. The drop in R&D expenses was caused by decreased spending on Rubraca clinical trials. SG&A expenses came in at $33.3M for Q4 and $128.4M for 2021, down 18% and 22% respectively. The drop in SG&A expenses was attributable to the company’s cost reduction efforts.

Together, the company reported a net loss of $64.4M for Q4 and a net loss of $264.5M for 2021, which was down from $99M for Q4 2020 and $369.2M for full-year 2020. Cash burn in Q4 2021 was $31.6M, down 23% from the Q4 of 2020. Considering these points, we can say that the company’s efforts to reduce cash burn in 2021 have reduced the gap between cash burned and cash earned.

So, Clovis has some potent ingredients for a bull thesis.

- Latent Growth From Rubraca

- First Mover Status in TRT

- Improving Financials

A New Thesis

Unlike with Rubraca, Clovis has the opportunity to be first-to-market with their TRT programs. This provides me with a fresh thesis that is centered on the company’s TRT programs that are could be supported by growing Rubraca sales. The company has the potential to be considered the leader in TRT, which if successful, could deliver substantial revenue in the coming years.

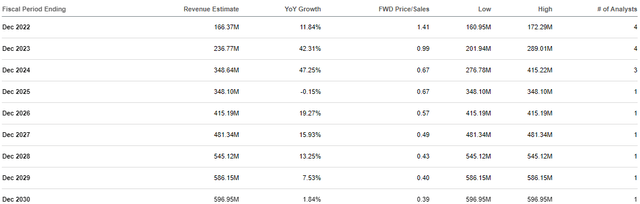

CLVS Analyst Revenue Estimates (Seeking Alpha)

The combination of growing Rubraca sales and a new line of TRT programs could lead to double-digit revenue growth in the coming years. Moreover, the ATHENA-MONO data in combination with a unique TRT pipeline should reignite buyout speculation chatter.

Essentially, the company’s TRT programs give the company another chance to be an innovative oncology company and provide the opportunity to be a commercial success, plus, regain the “buyout target” hype. These ideas form my CLVS thesis that the company is at a point of being “renovated”, where it still has the original structure of Rubraca but has been updated with modern cutting-edge technology to make it operative for the future.

Still Speculative

Despite my fresh outlook, I have to admit CLVS is still speculative due to its concerning financials. In terms of cash, the company finished 2021 with $143.4M in cash and cash equivalents. At the end of 2021, the company only had $27.8M available to draw under the THENA clinical trial financing with Sixth Street Partners. So, it appears the company will have to continue to use the ATM and secondary offerings to fund the company. Obviously, this will likely weigh on the share price until the company finished the ATM and we have a clear line of sight to profitability. Consequently, CLVS is still very speculative and will remain in the Bio Boom portfolio.

My Plan

CLVS has been a “Top Idea” in my Compounding Healthcare Seeking Alpha Marketplace Service since it was launched near the end of February. I have used CLVS as a trading vessel for the past few years and if you take a look back at my previous CLVS articles, you can see how my viewpoint has changed to more of a long-term investment outlook. This is due to the unrelenting share price erosion into a small fraction of what it used to be in conjunction with a shrinking trading range.

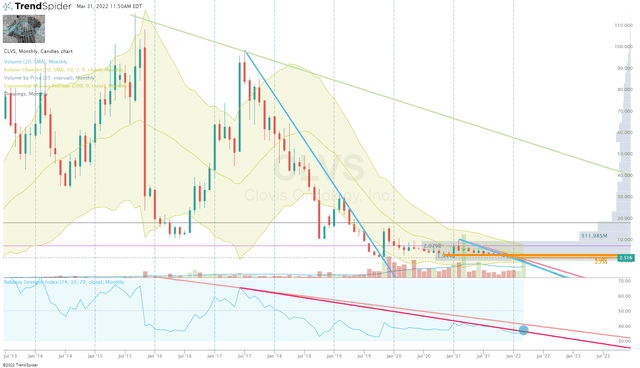

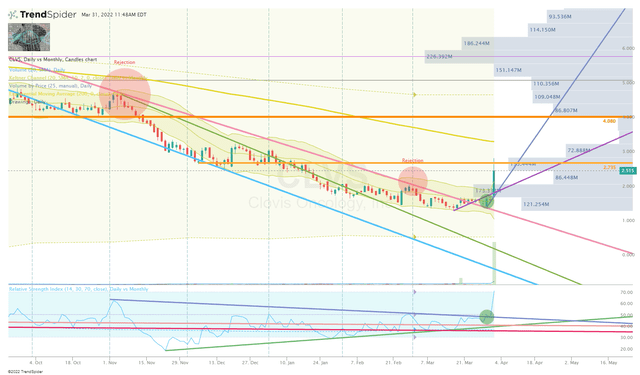

CLVS Monthly Chart (Trendspider)

CLVS Monthly Chart Enhanced View (Trendspider)

Recently, the share price has pressed to new lows thanks to the ticker being roped into the November 4th small-cap healthcare sell-off. But, the stock is now trading up on the ATHENA-MONO news and is starting to break the long-term downtrend on the Monthly RSI.

In addition, it has broken the long-term downtrend on the Daily Chart and is beginning to show signs of reversal after retesting that trendline.

CLVS Monthly Chart (Trendspider)

CLVS Monthly Chart Enhanced View (Trendspider)

What is more, the ATHENA-MONO data conjured enough trading volume to break the downtrend of the Daily RSI. It has been a long time since we have seen so many signs of a potential reversal.

I am looking to add once I see the share price tests the uptrend ray to confirm a new trend. My goal is to get my average under $3.00 per share. Once I have averaged down under $3.00, I will immediately set sell orders in order to generate some profit to be compounded in my other portfolios, while also transforming my CLVS position into a “house money” state.

Long term, I am still looking to extend my CLVS time horizon for at least 5 more years in anticipation Rubraca is able to report steady growth and the company can get at least one of their TRT programs into a late-stage trial.