wildpixel/iStock via Getty Images

Cryoport

“Such a study indicates that the greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits far more than industry as a whole.” – Phillip Fisher (Warren Buffett’s mentor)

When you invest in biotech, do not be afraid of volatility. In fact, you should leverage volatility to your gain. That is to say, even if your stock is fundamentally robust it can still undergo periodic volatility. Amid a big decline, you have the opportunity to buy more shares at a deep bargain. You then sit tight to wait for another bullish cycle.

That being said, I want to bring your attention another stellar growth company dubbed Cryoport (NASDAQ:CYRX). Like other stocks, Cryoport substantially depreciated amid this biotech bear market. Nevertheless, the company has been making prudent acquisitions and thereby logging in robust revenues increases. Hence, I believe that you should average down on Cryoport to wait for a huge comeback in the coming quarters. In this research, I’ll feature a fundamental analysis of Cryoport and share with you my expectations on this stellar growth equity.

StockCharts

Figure 1: Cryoport chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior research:

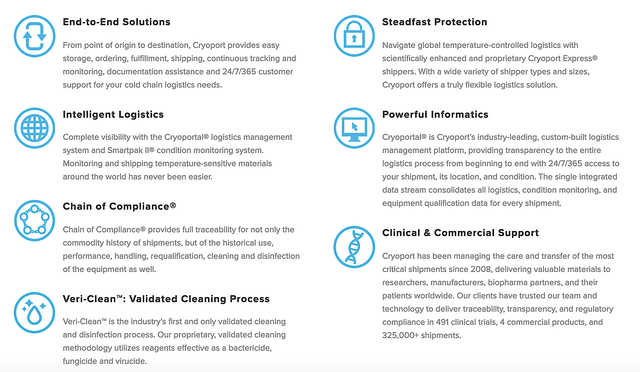

Operating out of Nashville, Tennessee, Cryoport provides logistic solutions for the CAR-T, gene-based therapy, and regenerative-medicine innovators. That is to say, the company offers strict temperature-controlled transport and storage of biological specimens to ensure their livelihood, efficacy, and safety. As you can see, these biological specimens are sensitive to temperature and other environmental factors. As such, it’s crucial to transport and store them in a highly controlled environment like what Cryoport is providing.

Cryoport

Figure 2: Logistic business

Strong Industry Tailwind

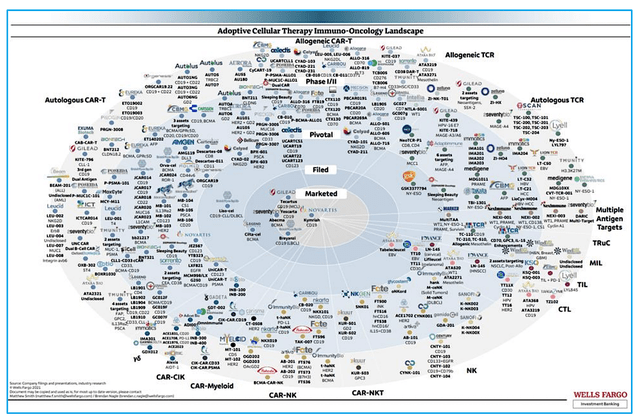

As you can see, it’s much more difficult if you swim against the current. Whereas, a little effort goes a long way when you swim downstream. That’s the situation with Cryoport, as it’s operating within the industry tailwind. From the figure below, you can see there are more and more companies entering the cellular therapy space. The same is true for gene therapy.

Cryoport

Figure 3: Cellular therapy landscape

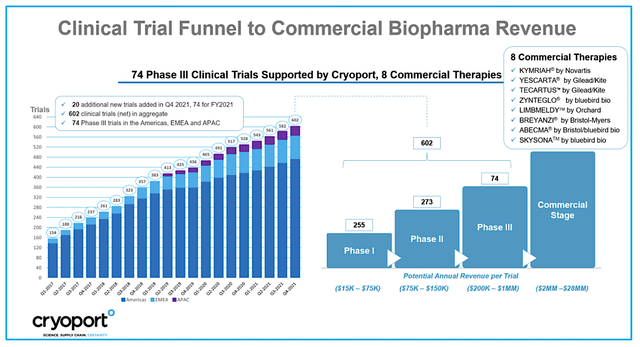

Being a leading logistic provider for those companies, there is an increasing demand for Cryoport business. Given that you’re dealing with therapies that mean life/death, most innovators tend to go to an industry leader like Cryoport. The proof in the pudding is that Cryoport is now supporting a total of 602 trials. And, the number of new trials being supported increased almost linearly. Aside from the clinical studies, the company is providing logistic services to the eight commercial therapies. They include all the big names such as Kymriah, Yescarta, Tecartus, Zynteglo, Breyanzi, Abecma, Limbmeldy, and Skysona.

Cryoport

Figure 4: Increasing business volume

Performance Updates

In addition to the industry tailwind and its leadership position in this market, Cryoport leverage the prudent growth approach by merger and acquisition (i.e., M/A). Using M/A gives the company leaping growth in revenues instead of growing incrementally.

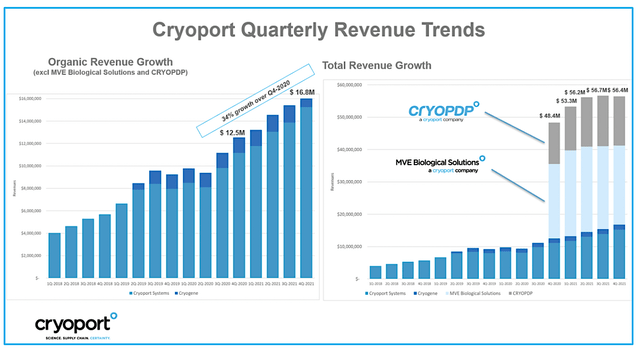

You can see from the figure below that revenues jumped from over $10M to over $48M in 4Q2020 with the acquisition of CryoPDP and MVE Biological Solutions acquisition. Meanwhile, revenues from organic operations are also increasing. As you’ll see in the latest quarterly update, sales growth are quite impressive. Thrilled with ongoing corporate development and the ample cash, the CEO (Jerrell Shelton) remarked:

Last year was an important year for Cryoport. Our total revenue grew to a record $222.6M driven by strong performance by MVE Biological Solutions and CryoPDP as well as significant organic revenue growth of 40% from Cryoport Systems and Cryogene… To meet our strong and accelerating demand, we have expanded our global network to 33 facilities in 15 countries, strengthened our presence in the high growth APAC and EMEA regions, and completed preparations for the upcoming opening of our first two new Global Supply Chain Centers in the United States. We closed 2021 in the strongest position in our company’s history…

Cryoport

Figure 5: Leaping growth from M/A

Financial Assessment

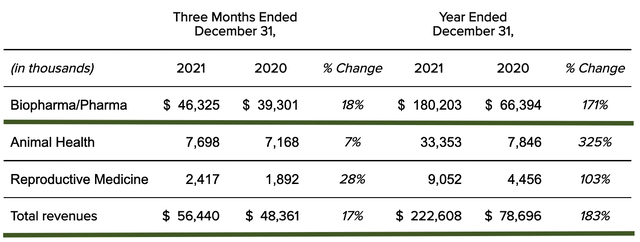

As you know, we briefly assessed the revenues growth in the previous section. Let us now take a closer look at the financial health of your stock. With that in mind, we’re focusing on the 4Q2021 earnings report for the period that ended on December 31. As follows, there were $56.4M in revenues compared to $48.3M for the same quarter a year prior.

On an annual basis, the revenue for Fiscal 2021 tallied at $180.2M versus the $66.3M for Fiscal 2020. As such, the yearly growth rate came in at a staggering 171%. Powering that phenomenal growth is the biopharma/pharma business segment. Though the 18% of the biopharma segment is less than the 28% growth for reproductive medicines, the absolute figure (i.e., $46.3M) of the biopharma business comprised 82.0% of the overall operations. And this figure is due to the increasing trials and approved products being supported by Cryoport.

Cryoport

Figure 6: Latest performance

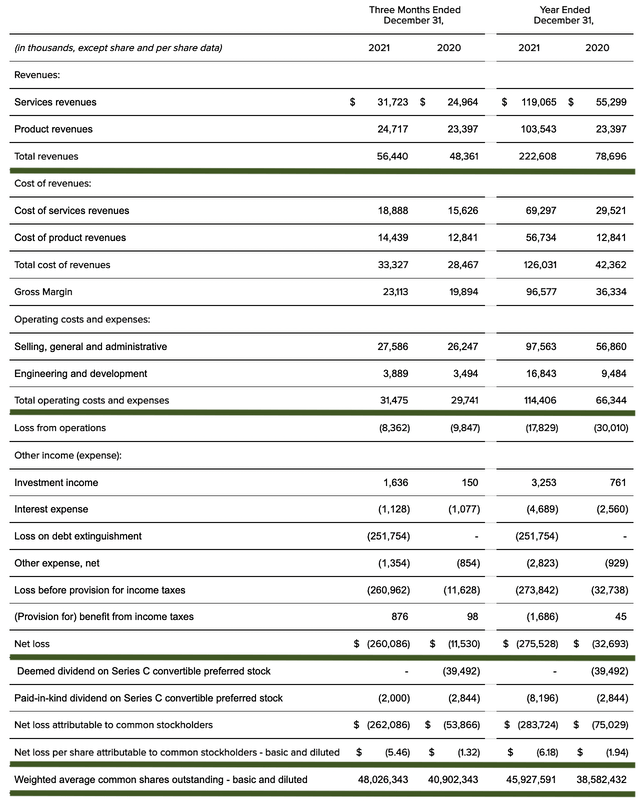

That aside, you should emphasize the top-line (i.e., revenue) growth rather than the bottom-line (i.e., net earnings) for a young grower. Over the years, as Cryoport grows larger, the bottom line will take care of itself. That is to say, there will be net earnings due to the “economy of scale.” Another way of looking at it is that a larger company is better at cutting costs.

On that note, there were $260.0M ($5.46 per share) net loss compared to $11.5M ($1.32 per share) net decline for last year. Interestingly, that depreciation is not an issue. Rather, it’s due to the recent $251.8M in non-cash debt extinguishment.

Cryoport

Figure 7: Key financial metrics

On the balance sheet, there were $628.8M in cash, equivalents, and investments. Against the $31.4M quarterly OpEx, there should be adequate capital to fund operations into the next 5-years (i.e., year-end 2026). Simply put, the cash position is extremely strong. Notwithstanding, I would expect the company to use some of that cash for more acquisitions.

While on the balance sheet, you should check to see if Cryoport is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 40.9M to 48.0M, my math reveals a 19.5% annual dilution. At this rate, Cryoport comfortably cleared my 30% cut-off for a profitable investment.

Competitor Landscape

Regarding competition, there are emerging players and established companies. In my opinion, the strongest competitor is BioLife Solution (BLFS). Between Cryoport and BioLife, these two innovators capture the most dominant market shares. Clients’ biopharmaceutical companies also give the most business to these two firms due to their strong service and brand.

Due to the lucrative profits in this logistic business, you can expect more companies to enter this niche. It’s just like what Buffett said when you have a honey jar, expect more bees will fly to it. In spite of the competition, there is plenty of space for many more competitors.

Valuation Analysis

It’s important that you appraise Guardant to determine how much your shares are truly worth. Before running our figure, I’d like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 48.0M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Biopharma business |

Currently procuring $180.2M for Fiscal 2021 and projected to increase to $3B (estimated based on the $36.92B cell/gene therapy market that is growing at the 39.62% GAGR) | $750M | $156.25 | $140.62 (10% discount because uncertainty in market penetration) |

| Animal Health | Currently $7.8M for Fiscal 2021 (Will wait for more substantial revenues before valuing) | N/A | N/A | N/A |

| Reproductive Medicine | Currently $2.4M for Fiscal 2021 (Will wait for more substantial revenues before valuing) | N/A | N/A | N/A |

|

The Sum of The Parts |

$140.62 |

Figure 8: Valuation analysis (Source: Dr. Tran BioSci)

Shares Buyback

On March 11, Cryoport announced that the company issued a $100M shares repurchase program. Scheduled to expire on December 31, 2025, the shares buyback will occur depending on the prevailing market condition. As an investor, this is highly favored for you. After all, whenever there is a shares buyback, that means the company believes its shares are substantially undervalued. As such, the management wants to use their cash to retire those shares to the company’s treasury. If that is not a loud scream that Cryoport is trading at a deep bargain, I don’t know what is. Comment on the said development, Chief Shelton enthused,

The authorization of the repurchase program reflects our constant focus on shareholder return and effective capital allocation. The authorization of this repurchase program demonstrates the Board’s confidence in our business model and outlook, our financial performance, and our commitment to delivering value to our stakeholders. We plan to opportunistically repurchase shares of our common stock and convertible senior notes, while maintaining ample liquidity to support our growth organically and through potential acquisitions.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this stage in its growth cycle, the biggest risk for Cryoport is if the company can continue to ramp up revenues (i.e., top-line growth).

There is also a concern that various future acquisitions might not bear fruits. Buying another company is only one-half of the hurdle cleared. The other more difficult half is the successful integration to deliver synergy as well as the economy of scale. Cryoport might also not be able to cut costs fast enough in the future.

Conclusion

In all, I maintain my buy recommendation on Cryoport with a five out of five stars rating. As you can appreciate, it’s rare to find a growth company that leverages the M/A model, which is also an industry leader like Cryoport. Being the logistics provider for the growing cell/gene therapy innovators, Cryoport is basking in the industry tailwinds. Both organic and M/A revenues are growing and leaping aggressively. Concurrently, the company is building and expanding its infrastructures to support future growth. During this bear market, you have another chance to pick that same great company at a fraction of its intrinsic value. The management realized that their shares are trading at a bargain. As such, they are buying back shares.