supergenijalac/iStock Editorial via Getty Images

In this article, we’ll take another look at Porsche (OTCPK:POAHY). This is going to be an interesting article because I’m actually going to shift my stance on the company – from a “HOLD” to a “BUY”, after covering the company for little over a year in a variety of pieces.

The reason for the move is simple.

Valuation.

Since my last article, the company has moved in this fashion.

Porsche Development (Seeking Alpha)

Let’s look at why the company is now a “BUY” for me.

Revisiting Porsche

Since I wrote my last article, some things have changed for Porsche. First of all, we have more data on the potential IPO of the Porsche car brand. The company has given us more detail on this IPO, important the important breakdown of company share capital.

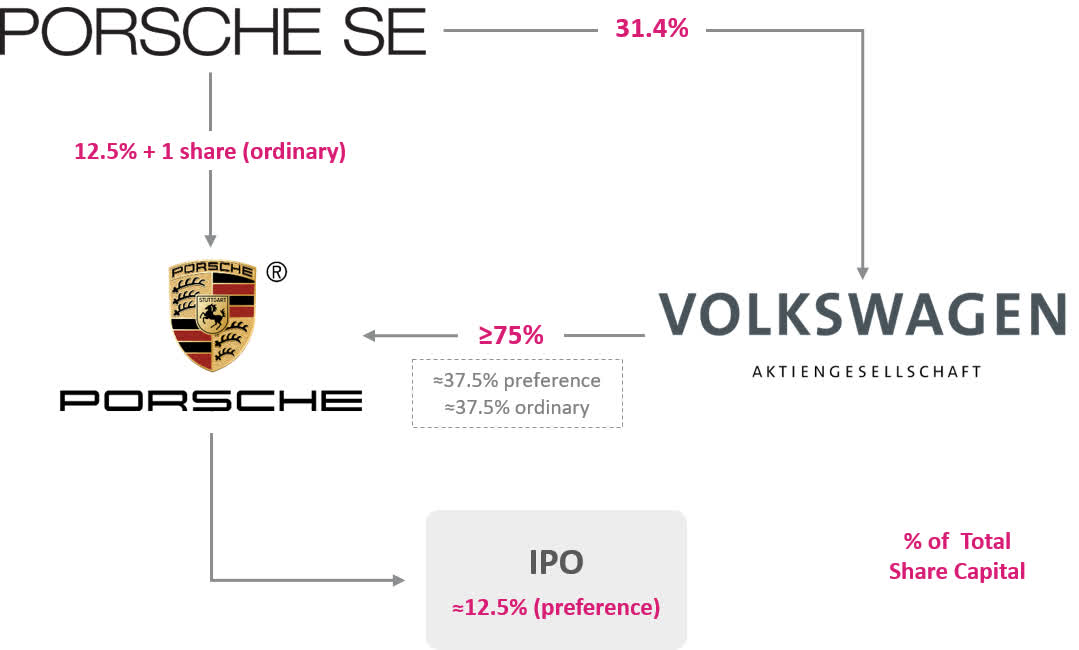

To very briefly go through this, the Porsche/Piëch family’s holding company takes a direct stake in the automaker, but Volkswagen (OTCPK:VWAGY) will remain the principal/majority shareholder of the post-IPO company.

A framework agreement has been signed by the VW Group and Porsche SE to cover the current talks that have been done, as well as the preliminary agreements of a listing of Porsche. Porsche AG’s share capital would be divided into 50% preference and 50% ordinary shares. Porsche SE would purchase 25% + 1 of the ordinary shares (around 12.5% of the total share capital), while Volkswagen would hold 75% ownership of the automaker, with 25% of the preference listed publicly.

For existing Volkswagen shareholders, a special dividend of 49% of the pre-tax proceeds would be proposed.

This is a good representation of this post-IPO structure.

Porsche post-IPO structure (Alpha Value)

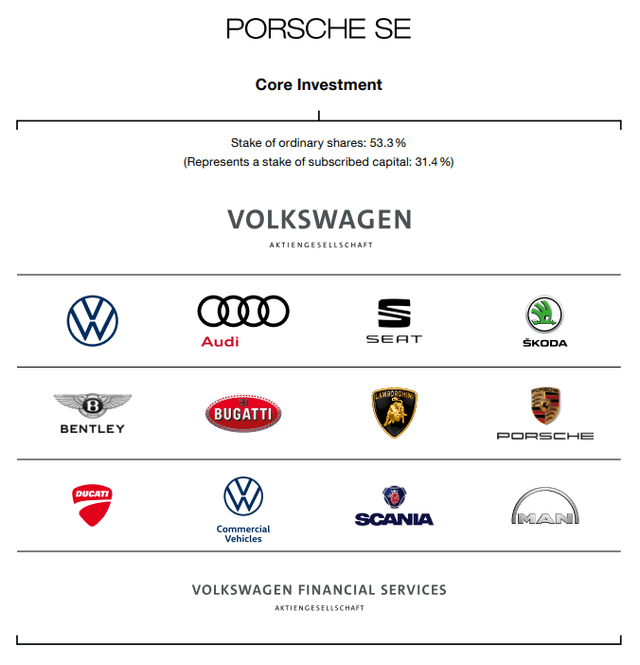

We can compare this to the current structure and ownership in Porsche, and the way Porsche operates.

Porsche Current structure (Porsche)

If you look into the further details, you’ll note that as usual, preference shares have a non-voting characteristic, which means that company control will remain in VW and the Porsche/Piëch families. This makes absolute sense given the company’s history and the fact that the company once tried to unsuccessfully take over VW, resulting in the family letting go of its control of the company. The proposed terms of the IPO — with the Porsche/Piëch family holding over one-quarter of the voting shares — would see us returning, in a way, to that structure that we saw before 2008.

There is no doubt that Porsche can be seen as one of the most attractive sports car brands on earth. It’s every bit as premium as Ferrari (RACE), Lamborghini, and others.

For VW, Porsche represents only 3% of sales volumes, but at the same time it’s almost 24% of the VW operating result. The only way this is possible is through market-leading operating margins. Porsche has exactly this, at almost 16.5%. To compare this to other major car brands, this is almost 6-9X as high in terms of operating margins.

Through the IPO, VW hopes to enable the market to view Porsche in the same light as other luxury automakers like Ferrari, where multiples would be closer to luxury businesses – closer to 25-40x P/E.

The current estimated Porsche AG stand-alone EBIT is forecasted at between €4.3-€4.6B based on recent results, assuming a 16-16.5% margin and around €28B in annual revenues. Drawing parallels between Porsche and Ferrari is inevitable, as it is likely to be considered its closest peer by investors.

We’ll look at valuation specifics more in the next section.

For now, let’s highlight the fact that the 2021 results were good. Porsche SE, under its current structure, reported solid 2021 results with strong VW operating performance due to a good mix and strong pricing. These upsides managed to completely offset the semi shortage impact the company is currently seeing due to global uncertainty and SCM impacts.

So on that level, things are working out swimmingly. As a result of a solid annual result, the proposed dividend for the coming year is up 15.9% YoY for the preference and for the ordinary share, and the next liquidity for the company is up to close to €650M for the year.

For 2022, the forecast includes a result of between €4-€6B for the Holdco, as well as improving net liquidity to over a billion euros at the end of the year. This is even prior to any investment activity, including the Porsche IPO.

In short improved results added to buy the prospect of an accrediting IPO, including an extraordinary dividend of €7.5 per ordinary share held by Porsche SE should account for another €1.2B for the company.

I have included these numbers in my valuation and increased my price target accordingly, rolling forward estimates to 2024-2025.

Let’s go into what this does to the valuation.

Porsche Valuation

Let’s rapidly look at things in terms of valuation. My last valuation thesis posted back in January still holds. Porsche has, since 2018-2019 closed the valuation gap and outperformed not the only sector but index trends significantly. It would have been a great buy following the pandemic crash – and it’s starting to become a decent buy here as well.

I will be writing a more comprehensive article on Porsche as a solid investment going forward – but for now, I’ll do a quick review as to why I view the company as a decent potential “BUY” here.

At current prices, 13 S&P Global analysts come in at a low PT of around €90/share, close to today’s target price, and a high of €130/share. Equity analysts consider Porsche at similar upsides of 10-30% (Source: AlphaValue). I’ve previously targeted a sub-€77 for the company.

As of this article, I’m raising it to €85 to reflect the increased potential, the IPO possibilities, and the improved 2022-2024 for the company. That’s why I consider Porsche a “BUY” here.

Why am I doing this?

Porsche has always been a play on understanding what the company actually does. The company’s potential has always been held back a bit by the fact that it’s more of an investment business, not a stand-alone luxury-level automotive-like RACE. That is about to change.

On a P/E-basis compared to other peers, Porsche is significantly undervalued. Both in terms of comparisons to Luxury peers like Ferrari, but also compared to investment businesses. Even discounting Porsche 50% as an investment business due to the complications of the company, there’s still a massive peer-based upside to a sector average of 20X P/E, not to mention luxury valuations.

NAV is an excellent way to value Porsche due to the structure of the company. The company’s stake in VW is as of most recent data and listed valuation (53.3%) worth just north of €24.1B gross. Less of debt and other considerations, this comes to a NAV/share of nearly €81/share based on 306M shares net of treasury.

Company underperformance for the past year has made sure that even at today’s price of below €81 but above €80/share, this company is technically at fair value, or slightly undervalued here today.

The positives of this investment are clear. As long as the majority family shareholders are well off, preferred shareholders will also be well off. With a recovery from Dieselgate and VW coming into its own with the ID.3 and ID.4, the company is now a working EV manufacturer. Anything that’s good for VW is good for Porsche shareholders as well here.

Going forward, I apply a higher weight to DCF and P/E-multiples, giving us an upside of at least 3-5% to a PT of €85. I justify the rising of the target price by the company’s successful navigating of Dieselgate (or VW, which impacts Porsche), the upcoming IPO, and the improved results, including a 15.9% dividend bump.

Porsche, as of 2022, yields over 3%, which is a great yield compared to its peers.

I remain at a PT that’s significantly below market-average PT’s of almost €110/share for S&P Global analysts, and over €95/share for equity analysts. At the current price, I see a solid upside to Porsche, and an IPO of the luxury Porsche AG could benefit things here.

I’m now moving to a “BUY” on Porsche.

Thesis

Here is the thesis for Porsche:

- Porsche is, to me, a more interesting investment than VW due to the corporate structure and holdings. With the recent information on the IPO and the dividend bump as well as improved results, the company’s portfolio is ready for improvement and higher returns.

- These changes justify a change in the price target, and I now consider Porsche to be a “BUY” with an upside to a PT of €85/share.

- Expect more exciting news for 2022 as details on the IPO come out.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Porsche is a “BUY” here with an upside to a price target of €85/share.

Thank you for reading.