Dzmitry Dzemidovich/iStock via Getty Images

American Tower Corporation (NYSE:AMT) is a stock that you cannot go wrong with, especially during inflation. Its financial fundamentals, along with the essential nature of real estate in the critical telecommunications industry make it a safe bet to place. This stock is a buy, especially given the macroeconomic conditions the market faces.

Company Overview

American Tower Corporation is a large, globalized player in the telecommunications real estate domain that is categorized under the real estate investment trust (REIT) structure. The company owns, operates, and develops real estate projects that are critical to the communications ecosystem of the global markets.

With its market capitalization of $117 billion, as of late April 2022, AMT stands as the largest REIT in the world, with almost 200,000 communication sites across North America, Latin America, Europe, Asia, and Africa. Given its substantial size, and dynamic scale of operations, American Tower Corporation is ranked 410 in the list of Fortune 500 companies.

The Potential of REITs during Inflationary Periods

During times when macroeconomic conditions lead to inflations, participants in the investment domains tend to revise their appraisal methods and investment criteria. The focus typically is to outrun the rate of inflation, amidst reducing disposable incomes and constraining consumer budgets. The equity market in particular had been a go-to choice to act as a safety cushion during periods of inflation. This is because, despite the typical volatility seen amongst stocks, the long-term appreciation protects investors from seeing a monetary devaluation in their savings over the long term. Moreover, businesses tend to increase their prices during such economic conditions, which makes stocks similar to commodities, increasing in price throughout inflation.

However, the typical stock is still likely to take a hit during such macroeconomic conditions, given the impact on profitability that comes about as a result of the inflation. With shrinking disposable incomes and economic uncertainty, the market is far more hesitant to spend on non-essential industries. These conditions indicate that investment in standard equity stocks remains a risky option for market participants.

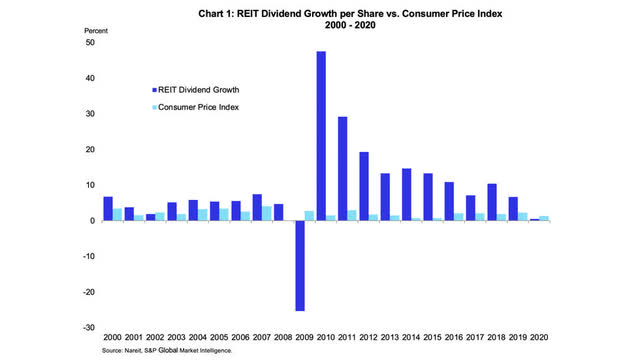

Alternatively, REITs are seen as far more viable investment options to consider in times of inflation, as opposed to regular equity stocks. Regular stocks, especially of companies that deal in non-essential products or services, see a fall in price due to reduced profitability. Alternatively, REITs see high growth, which is significantly higher than the consumer price index on an annual basis. This has consistently been seen from the years 2000 to 2020, except for only three years:

Nareit, S&P Global Market Intelligence

As can be seen in the data represented above, REITs are a significantly viable option to consider during times of inflation, given their dividend growth which overwhelmingly surpasses the consumer price index.

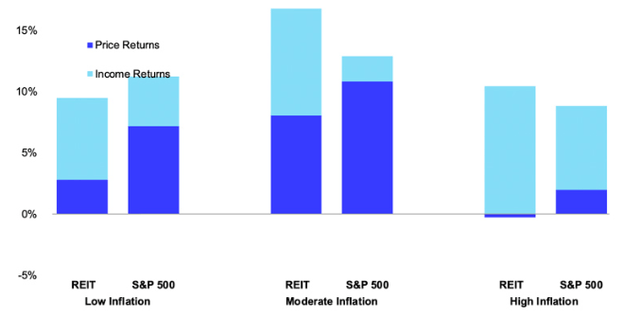

In a similar study, the returns for standard equity stocks (as measured by using the S&P 500 index as a standard) had been compared against those of REITs, during periods of differing levels of inflation. The study classified inflation below 2.5% as ‘Low Inflation’, between 2.5% and 6.9% as ‘Moderate Inflation’, and above 6.9% as ‘High Inflation’. This is represented below:

Nareit, S&P Global Market Intelligence

As is evident from the figures showcased above, REITs consistently outperforms the S&P 500 index during periods of moderate and high inflation. Although the S&P index delivered higher price returns, REITs outperformed overall given their substantial income returns during this period. Price returns typically shrink for REITs to significantly low levels during high inflation periods, yet dividend payments see a tremendous growth surge.

Moreover, the asset-based business model of REITs such as AMT gives the company a fair value advantage during periods of rising costs. In the case of AMT, which deals with communication-related real estate, it is potentially unlikely that the company’s profitability would see a significant hit, given the essential nature of its real estate communication assets. The communication ecosystem is critical for the functioning of the global order and is one of the few industries that will continuously see steady demand, even during periods of high inflation. Cutting out telecommunications is never an option considered by market participants, despite macroeconomic stresses.

Financial Assessment

One reason why AMT is a good REIT option to pin one’s hopes on during periods of high inflation is its financial performance, which makes it a prime candidate to consider delivering higher income amidst rising costs throughout the markets. A high-income REIT stock could correct the reduced disposable incomes experienced by individuals.

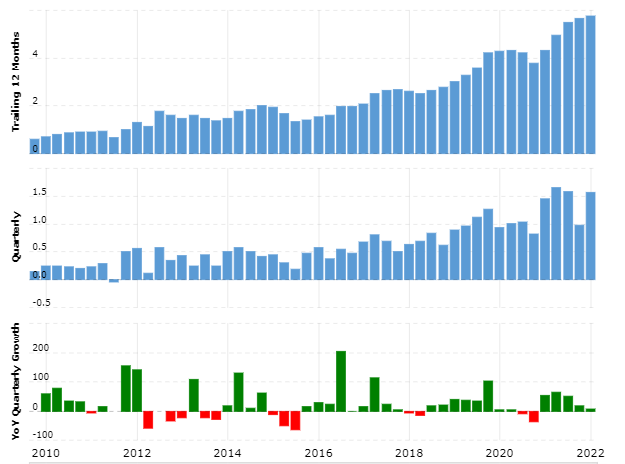

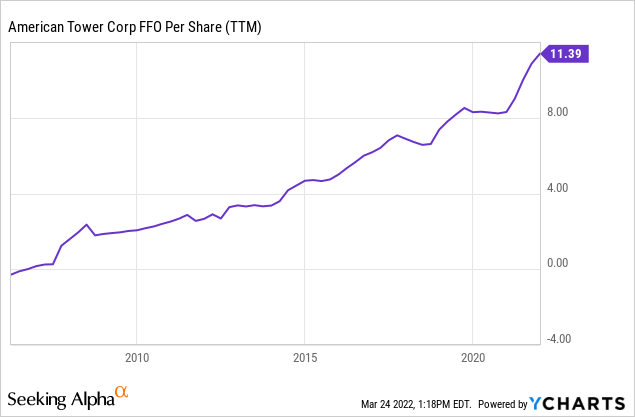

In its latest earnings report, which was for the first quarter of FY22, AMT surpassed analysts’ earnings expectations and delivered a quarterly FFO of $2.55 per share. As a result, the company’s bottom line saw an almost 4% year-on-year improvement. This FFO growth is a consistent feature of AMT, and has been observed since the stock’s early years:

Macrotrends

During a high inflation period, such a consistent growth trend, despite macroeconomic shocks such as the COVID-19 outbreak, and the Ukraine-Russian disruptions, is seen as a highly favorable investment option to be considered in high-inflation periods. One reason for this is the increased interest rates that accompany high inflation periods, which reduces the present value of future cash flows. For this reason, high-growth earnings stocks are seen as favorable investment options.

In addition to surpassing FFO expectations of analysts, another area where AMT shone was in its revenue figure. The company delivered $2.66 billion in quarterly revenue, which stood at 2% above the Zacks consensus estimate placed. As a result of the stellar performance, the company’s top line jumped by over 23%, substantially increasing its long-term potential, further adding to the reasons why the stock is an optimal choice during inflationary periods.

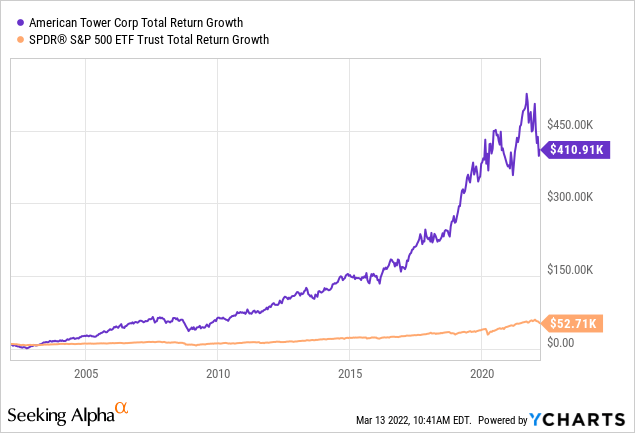

Seeking Alpha

Assessing AMT Valuation

AMT appears to be a highly valuable stock, which I believe is currently not reflected in its current share price of $241. Given its advantages and an impending high inflationary environment, I believe the stock stands undervalued, and will likely see a rise in its price as its investment viability becomes more apparent.

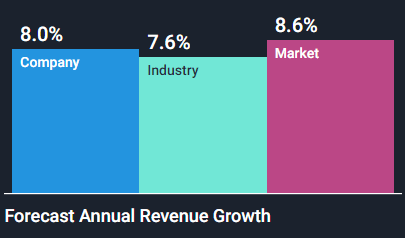

Simply Wall St

Based on analyst growth forecast, AMT outperforms the specialized REIT industry by 0.4%, but, is below the overall American stock market. However, as has been described above, this is because of the fundamental difference REIT holds to ordinary stocks, especially during times of moderate and high inflation.

What is more remarkable in the case of AMT is its funds from operations (FFO), and the growth trend it has been on over the years. FFO is a far more appropriate measure in REIT valuation, in comparison to EPS, as it eliminates impacts of depreciation, amortization, along with gains and losses on asset sales. On this basis, the view of AMT being undervalued is reinforced:

Seeking Alpha

Based on these valuation metrics, I firmly believe AMT is significantly undervalued, especially considering the potential rise in its demand as higher levels of inflation hit the US economy.

Risks

American Tower’s most significant risk that could potentially impact its financial sustainability is the threat of customer consolidation. As key players from the communications industry embark on consolidation strategies such as mergers or strategic partnerships, service duplication would be eliminated, which could potentially reduce the demand for AMT’s assets. If such a trend sees momentum, AMT profits could break its growth trend and profitability would become increasingly difficult to maintain.

Similarly, consolidation between customer firms could bring about modernization of communications infrastructure, which could lead to an outdating of AMT assets. This too could lead skeptics to question whether or not the company could continue to grow if it sees a demand reduction to such a degree. In the case where such consolidations do occur, several customers could choose to terminate their leases and agreements with American Tower, directly impacting its contractual revenue stream.

To prevent exposure to this significant risk, AMT would need to strategically focus on innovation, and determine how to better add value to its customers, despite a potential wave of consolidations. Such innovation could be driven by research and development of new assets in the communications ecosystem, that are superior to those of competitors in terms of quality and price.

Conclusion

AMT is a great REIT stock that you do not want to miss, given the oncoming inflationary pressures impacting the global economy. REITs outperform ordinary stocks in terms of income, during periods of moderate and high inflation, and AMT shows to have the most robust profile among the broader REIT market. The company’s financials, including its revenue, earnings, and FFO per share indicate a remarkable growth trend, making it ideal for inflation-period investors. This view is reinforced by its growth consistency which has shown to be immune to macroeconomic shocks due to COVID-19 and the Russian invasion of Ukraine, given the essential nature of AMT assets to the global communications industry.