Nordroden/iStock via Getty Images

Ternium S.A. (NYSE:TX) is a stock to buy for several reasons, especially in the present global inflationary circumstances. Not only is this steel stock a great store of value in the present time, but also is extremely well suited to grow tremendously given its market positioning in the Latin American market.

Company Overview

Ternium SA is one of the leading steel manufacturers in Latin America that has industrial facilities established in Argentina, Brazil, Colombia, Mexico, Central America as well as in the United States. The company’s business strategy is focused on two core areas that are aimed at economic value enhancement, which are manufacturing and mining.

Ternium was established in 2005 and was the product of a consolidation between Hylsa of Mexico, Sidor of Venezuela, and Siderar of Argentina. The name ‘Ternium’ is an indication of its origin with ‘Ter’ being the Latin word for three, and ‘Erenium’ meaning eternal. As of May 11, 2022, the company has a total market capitalization of $8 billion, whilst employing over 20,000 individuals in its various locations across the Western hemisphere.

The TX historical price trend is an indication of how the stock has fared against wider disruption within the region and across the globe. In the two years following early April 2018, TX had been riding a persistent bearish trajectory, falling nearly 50%. The outbreak of the coronavirus pandemic in March 2020 brought TX to a crashing fall, worsening its two-year performance to its lowest since 2016.

Seeking Alpha

The period after the initial Covid-19-related selloff subsequently led to a remarkable recovery, with the TX stock reaching unprecedented heights. Demand for steel products continued to soar as industries rushed to rebuild supply chains. The stock hit its all-time high in mid-August 2021, hitting the $56 mark.

This remarkable trajectory had been the result of a range of factors which included a reduction in steel production output by China in 2021. This coupled with an increasingly impressive financial performance by Ternium had justifiably led to hype amongst market participants, driving up its price. Moreover, 2021 brought record-high levels of inflation amongst steel products, further enhancing the company’s profitability.

Ternium’s Potential During Present Inflation

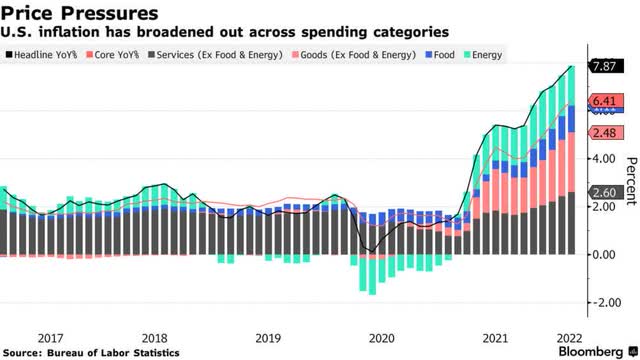

2022 began with record-high levels of inflation that were significantly exacerbated as a result of the Russian invasion of Ukraine. With the supply chain disruptions, and the economic sanctions placed on Russia, supply to meet growing demand had further been under strain. The substantial increase in crude oil prices ultimately lead to a domino effect, increasing the cost throughout markets and industries, and effectively compounding the inflation severely:

Image via Bloomberg

Given the presently adverse economic climate, the main priority amongst market participants would be investing in stocks that can adequately insulate their portfolios against the impact of inflation. Failing to follow a strategy of this nature could potentially lead to a loss of value for shareholders if they are not adequately positioned to hedge against the rising costs.

Industrial metals such as steel are a category of commodities that are highly suited to act as a hedge against the present inflationary climate. This is primarily due to the high correlation these have held with movements in the consumer price index, as is indicated in the chart below:

Bloomberg

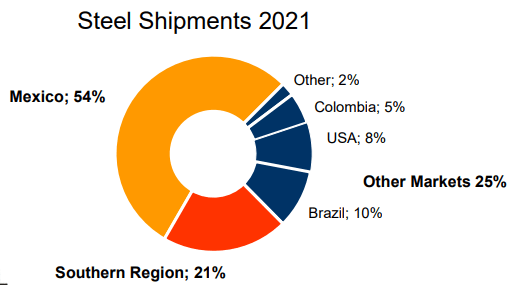

Ternium SA in particular is extremely well suited given its market position and wider business strategy to act as a strong value store given the current economic trends. Ternium has established a position in the lucrative and high-growth markets of Latin and South America. It’s positioning in Mexico, especially inspires confidence, because I believe the country has significant growth potential. The country holds one of the most dynamic manufacturing sectors, due to which demand for steel has consistently been on a rise.

Ternium Investor Presentation – May 2022

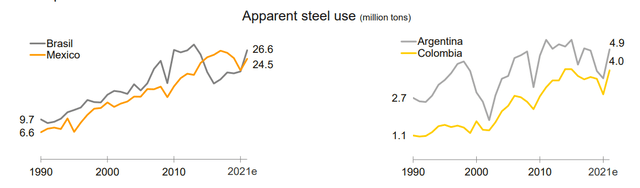

Moreover, the steel usage in the regions that Ternium serves further incentivizes investors to park their funds in TX, to gain from the exposure to these high-growth developing regions.

Ternium Investor Presentation – May 2022

Following the invasion of Ukraine, one severe shortage that has hit global markets is that of pig iron, which is a raw form metal used in steel production. This has understandably resulted in surging steel prices, a phenomenon likely to catalyze TX growth.

These inflationary periods are reminiscent of a similar rise in commodity prices from 2003 to 2013 onwards. One clear outcome of that inflationary decade had been a boom in Latin American economies which saw millions of individuals being pushed out of poverty. The present economic climate holds stark similarities to this phase, and could similarly see a boom in these economies.

TX is extremely well suited in the present context as it not only deals with steel, which is an excellent hedge against inflation but also has incredible exposure to the looming opportunity surrounding the Latin American markets.

Financial Performance

To assess the growth that is inherent to Ternium, we need not look further than the company’s recent earnings release for Q1 2022. During the quarter, the company delivered total revenue of $4.21 billion, against the prior year’s first-quarter figure of $3.24 billion. This increase, which amounts to an impressive 32% is an indication of how the company is faring amidst increasing economic uncertainties within the present inflationary climate. This revenue growth had translated into an improvement in the company’s EBITDA figure, climbing up from $1.06 billion in Q1 2021 to $1.21 billion in Q1 2022.

The company’s liquidity position remains strong, with its cash equivalents climbing up from $1.28 billion in December 2021, to $1.79 billion in March 2022. Alternatively, the company’s total borrowings across the quarter had shrunk from $822 million to $708 million.

However, it is important to point out that the growth seen in the recent quarter is not impacted by the recent inflationary conditions and the spiking up of interest rates by the US Federal Reserve. These gains are likely to be reflected in the earnings release of the second quarter of 2022, as net realized prices in steel had seen a surge in Mexico and Latin America from onwards of April 2022. EBITDA in the coming quarters is likely to be at record high levels for the company as a result of these price booms, as well as by factoring in the organic growth that the company is increasingly capitalizing upon over time.

Valuation

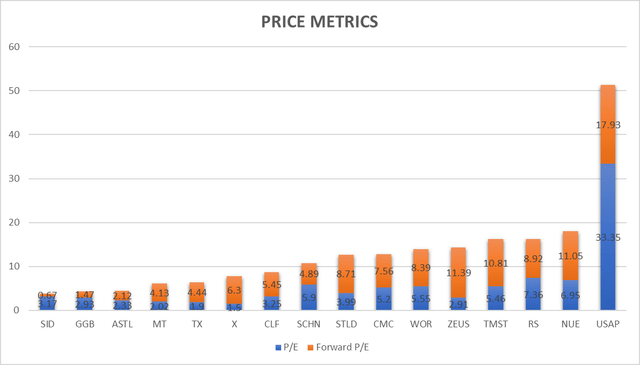

In comparison to competing stocks in the steel industry, TX holds impressive valuation metrics, which reinforces the view that it is undervalued.

Created by Author using data from Finviz

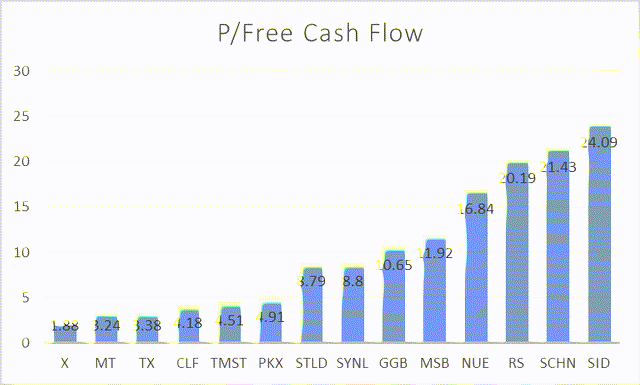

These metrics indicate that TX is amongst the most impressive stocks in terms of its PE and Forward PE ratios. As a result, the stock is significantly undervalued in contrast to its peers, both in terms of its present earnings, as well as in terms of its future earnings as per analyst expectations. Similarly, in terms of its PFCF ratio, which is far more appropriate given the nature of the steel industry, the stock ranks highly attractive, with one of the lowest figures in the steel industry:

Created by Author using data from Finviz

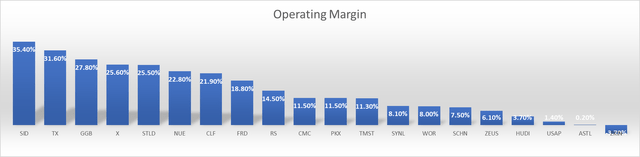

The stock’s operating margin of 31.6% makes it the second-highest in the entire steel industry, further demonstrating the degree to which the stock is a value creator for its shareholders.

Created by Author using data from Finviz

TX is undervalued by a significant degree, and when considering the present value of its growth potential given the present inflationary climate, the growth anticipated with the stock is immense.

Risks

One noteworthy area of concern is the increasing interest rates by the US federal reserve as a mode to tackle the worsening inflation. As a result, the opportunity cost for investment in TX, along with that for any other stock increases significantly. For TX to remain a viable investment opportunity, its returns would need to be higher than the rate of return for standard debt investment. This understandably places greater pressure on Ternium’s management to deliver exceptional results.

Additionally, the prospects of various business aspects of Ternium remaining fully immune to inflation remains at a low probability and could creep into areas that adversely impact the company’s prospects. For instance, the company could see an increased cost, which despite increasing revenues, may not necessarily result in increased profitability. Furthermore, raising finances could become costlier, given the increasing interest rates amidst inflation. This therefore would directly bear an impact on the valuation of the present value of the company.

Conclusion

Ternium is a company that is incredibly well suited to not only survive the present inflationary climate but is likely to thrive in it. This is why I believe the stock to be a buy, as its market positioning, its financial performance, as well as its valuation factors each point to the strength the stock potentially has to sail through economic uncertainties. Investors that buy TX could potentially see their portfolios expanding rapidly, as the last time similar inflation was seen the Latin American economy had enjoyed a terrific boom.