Marti157900/iStock Editorial via Getty Images

Distractions usually occur because of failures. People and Institutions don’t like admitting expectations are unrealistic, and if the leaders of companies and governments can’t show success, the second-best tactic is often to distract from what isn’t working.

Since the pandemic is all but over now, many industries have seen a strong bounce back from pent-up demand. One industry that has not seen a substantive post pandemic recovery is the movie industry, and companies such as AMC (NYSE:AMC) have struggled since the pandemic began to cripple their business models in 2020.

AMC is one of the largest theatre operators in the world. The company operates 9,500 theatres and has 10,600 movie screens and is the largest operator of theatres in the United States.

AMC was struggling before the pandemic, and the company got hit harder than most when COVID first began to take a toll on the US in early 2020.

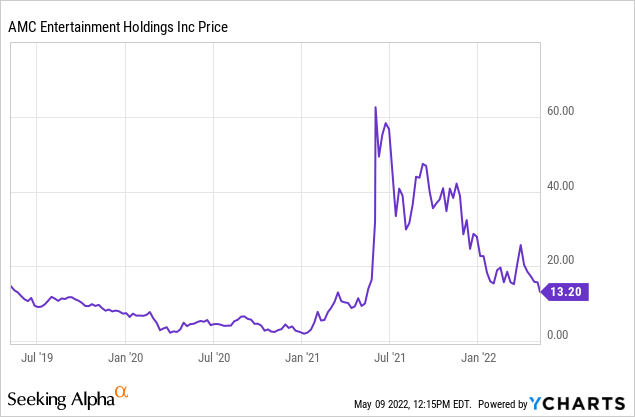

The stock price has been predictably volatile since the pandemic. AMC’s stock rose significantly for a brief period of time in early 2021 on a short squeeze and expected bounce back in the box office scene as the pandemic was ending, but reality has set in since then.

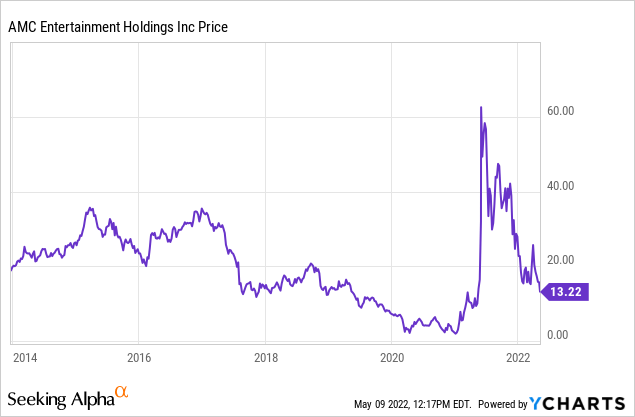

AMC’s stock was also a poor performer for years before the pandemic as well.

AMC’s stock has gone nowhere since 2014, and the stock was performing poorly even before the pandemic began to hit the company’s business hard in early 2020.

AMC’s business model has been struggling for some time, the pandemic just further exposed the company’s many significant challenges. The core problem that AMC has faced and continues to struggle with is that as content increasingly moves online the margins in the movie industry are deteriorating. This trend only accelerated during the pandemic, and a return to previous more profitable times in the movie industry is highly unlikely.

AMC’s revenue growth had already stalled between 2017 and 2019, before the pandemic, with earnings per share and net margins negative for most of that period. Earnings per share have been negative since 2017, and net margins have been negative since 2018. In 2018, AMC reported revenues of nearly $5.4 billion, and in 2019 the company reported revenues right around $5.4 billion. Still, net margins have been negative since 2018, and margins haven’t recovered since the pandemic. Between 2017 and 2019, AMC saw revenue growth of just 4% per year, earnings per share was negative. Even though AMC saw revenues grow from $1.2 billion in 2020 to $2.5 billion in 2021, revenues still remain significantly depressed from pre-pandemic levels. Net Margins and earnings per share numbers have still been mostly negative as well.

AMC’s recent earnings report showed the continued trend of disappointing net margins and profitability. Even though the company reported a nearly 80% boost in EBITDA, management still reported a loss of $337.4 million and $.63 a share. The company also benefited from 2 of the biggest hits in years, a new Batman and Spider man movie. Management announced more investments to diversify out of the theatre business as well, with new equity positions announced in Crypto, popcorn, NFTs, and credit cards.

There are a number of specific reasons the box office has not bounced back strong, and AMC should see lower levels of revenue and revenue growth moving forward because of several factors. AMC got hit hard in 2017 when MoviePass introduced a subscription service for movie watchers, and Netflix and Hulu continue to introduce more streaming content every year. Many companies are opting to introduce movies exclusively online now too. Warner brothers announced that all the company’s movies that came out in 2021 would be available online the same day, before negotiating a 17 day delay between the theatrical release and when this content would be available online.

A Picture of an AMC Movie Theatre (Getty Images)

Still, the move to online and digital content continues even with the pandemic mostly over. AMC has tried to distract investors from the company’s deteriorating business model with acquisitions, buybacks, and even a recent investment of nearly $28 million in a mining company, Hycroft Mining (HYMC). Management has also indicated that there may be additional investments in areas outside of the movie industry as well. These tactics have failed. The revenue growth from management’s Carmike acquisition in 2016 has already stalled, and the company has tried to rely on price increases to offset declining income levels. The company’s investment in Hycroft isn’t big enough to have a significant impact on the business model anyways.

Obviously, price raises also have their limitation with inflation levels at the high current rate we are seeing. AMC raised ticket prices from $8.45 in 2019 to $9.91 in 2021, but no company can raise prices over 10% annually on a consistent basis with expecting eventual demand destruction. AMC gets 55% of revenues from ticket prices, and 34% from food and beverages. With inflation high and digital content getting better every year, AMC will not likely be able to consistently raise prices at any significant rate.

This is why the company’s heavy debt load is concerning. AMC has a manageable $80 million in interest expenses this year, but in 2023 the company has $560 million in debt related expenses due. AMC’s cash flow has inconsistent, so the company will likely have to find a way to refinance or restructure the current debt load, possibly with a secondary equity filing. The company also has significant long-term debt at 10.5% and 7.5% interest rates as well. AMC’s 2026 bonds are now yielding over 16% as well, showing the heightened risk of bankruptcy this company faces. Even though AMC has nearly $1.6 billion of cash on the balance, the total current debt load is nearly $11 billion.

AMC’s stock also looks overvalued using a number of metrics. AMC trades at 3.7x enterprise value to forward sales, and a 1.6x price to forward sales ratio. The industry average is 2.2x enterprise value to forward sales and 1.4x price to forward sales. Even though some analysts are projecting the revenues will get back to close to $5 billion, those estimates seem optimistic as content continues to move online, and the company is not expected to have positive earnings per share growth next year, and the debt load and high interest rate payments on the company’s bonds loom large.

AMC’s investments in mine companies and the company’s discussion of possibly taking new equity stakes in areas such as digital currencies are a distraction from the failing business model. This company saw almost no revenue growth from 2017 to 2019, with net margins negative and earnings losses continuing. The pandemic only accelerated the move to digital content. While AMC’s management team was able to somewhat offset falling revenues with short-term price increases, this tactic isn’t sustainable long-term, and the business model is still broken.