FG Trade/E+ via Getty Images

Author’s Note: This is the shorter version of a full article posted on iREIT on Alpha on the 5th of May 2022.

A lot of investors and contributors seem to be looking at Legal & General Group (OTCPK:LGGNY) these days. The combination of security, high yield, and a seeming-massive moat gives many readers and investors a positive view of this company.

Indeed, there is a lot to like about this company. Reviewing insurance and finance companies is something that It feels like I do for a living at this point – so I’ve applied a few days’ worth of research and work on looking into this company, to see how we should treat the company.

11% yields don’t come along every day. When they do, and if we think they are safe, this needs to be justified.

Here I will attempt to do just that.

Legal & General Group – The Company

If you tend to read my articles, you know my style. I don’t use a whole lot of graphics and illustrations except where I view them as valuable. I try to condense the information into very effective, below-3000-word pieces.

Let’s do the same here.

Legal & General, hereafter called L&G, is a British-based multinational financial service and asset management company.

What it does involves investment management, so-called lifetime mortgages (a type of home-secured loan that doesn’t need to be repaid till death/moving), pensions, annuities (an insurance contract paid into by the investor, paid out typically during retirement), and also life insurance.

The company did have a standard, in-force insurance segment, but sold this to Allianz (OTCPK:ALIZY) back in 2020. Geographically speaking, the company’s operations are now found in the UK, US, and investment businesses in Europe and Asia.

The investment management arm, knowns as LGIM is the 10th-largest in the world in terms of AUM, and it’s the second-largest institutional investment management firm in all of Europe after BlackRock (BLK).

I cannot emphasize enough the importance of you understanding at least the basics of what a company like this does, more than just looking at some basic valuation data. Insurance is a very complex area, and when you’re talking about investing in an 11%-yielding company, it gets more so. Yield is usually a somewhat accurate risk indicator, after all.

L&G is the biggest provider of life insurance in the UK. After leaving non-core markets, the company’s focus is organic growth in life insurance and products, as well as growth in the investment business, with a focus on the US, UK, China, and Japan, as well as providing insurance coverage in India.

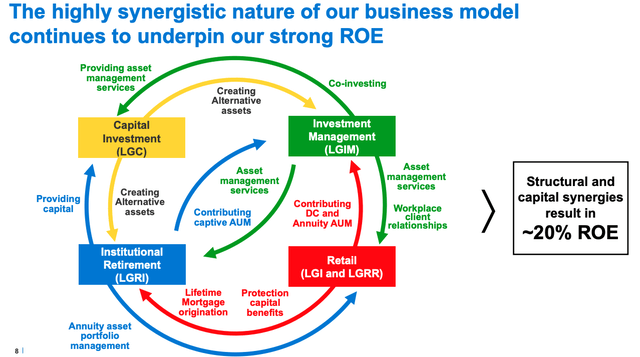

L&G seeks to maximize the synergies between these operations. In Investing/annuities, the company operates as an Asset gatherer that revolves around the market of pension de-risking. This has become more difficult due to the low-interest rates and moving away from equity investments. This segment was the major profit contributor for the company, thanks to more than one million people in the institutional arm of LGRI. Strong customers and transactions here include huge UK companies such as British Airways, Nortel, Rolls-Royce, and others, coming to around £30B of bulk annuities under the company’s wings. It further intends to write another £40-£50B worth of annuities in the coming years. The company also intends to grow its US-based business.

The company is now one of the major players in lifetime mortgages, with a market share of nearly 25% in the UK. Additionally, the company continues to grow in individual annuities.

Some of the issues companies like L&G have been facing during a period of extremely low-interest rates will be fading as interest rates start to rise. These pressures have been fee-related, to some part. While fund performance challenges will certainly remain in a down-market cycle and a bear market, which may result in fund outflows, contributing to poor performance.

While the reverse trend for interest rates will improve this environment some, it’s unclear how it will be impacted by overall market movements, and what the eventual turnout will be.

The company is, in part, a play on how strong synergies the company can develop between its retirement/investment/capital arms, its insurance operations, and other areas, while managing the highly competitive home markets in the UK.

The company is the largest insurer in the UK with 2 million in group protection and over 4 million in individual protection. It’s a natural assumption that the insurance arm will continue to see modest overall growth rates on the back of continuing as-is, while maintaining a pricing discipline. The company also has very strong partnerships with lover 9,000 mortgage brokers, another part of its business.

The company’s strategy is fairly clear.

Achieve international expansion of the investment management business, progressing in digital, and pushing growth in the US.

On a high level, the retirement arm, LGR, is the profit driver, with more than 50% combined share of the profit on an annual basis. Both annuities and other product portfolios are generally performing well, and the company reports good solvency ratios. These segment earnings depend on the quality of the assets backing the annuity liabilities – usually dominated by bonds. The company traditionally has very good sector allocations, with low exposure to volatile sectors such as airlines, retail, hotels, and leisure. During the worst of it all, less than £300M worth of assets were downgraded to sub-investment grade, and none of the company’s backings was served with a default.

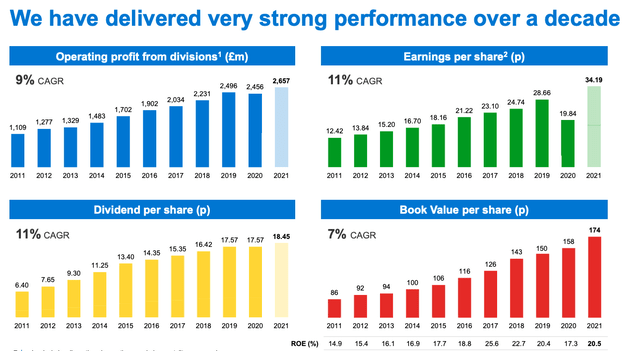

Asset management is a smaller profit contributor, but growing, and what the company hopes to back its growth upon. However, despite what could be viewed as a very profitable overall market, the company only managed a 5-year operating profit CAGR of 3% between 2015-2019 – and it seems unlikely given worsening market conditions, that asset managers like L&G will perform massively better going forward.

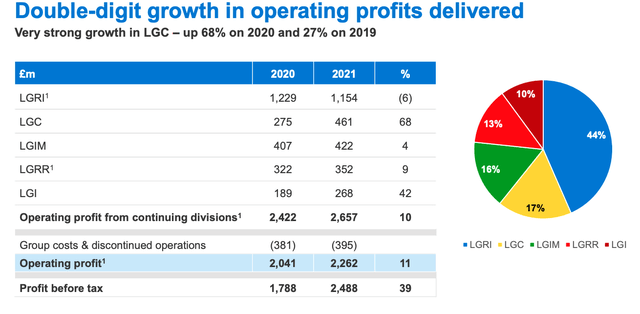

L&G Results (L&G IR)

With expected large profit increases largely coming from analog business models and markets, such as Asia, this also comes at a higher risk level. Expanding into emerging markets is never easy, but without such expansion, L&G is limited to single-digit growth in legacy home markets, such as the UK.

L&G is well-rated at an A-rated S&P credit rating and has excellent solvency ratios above 180%, with less than £4B of net debt. It’s fair to say that L&G is a conservative and generally positive business with a lot of potential. Some are calling L&G’s model and approach the “New Way” of leading the asset management and pension industry, and given the way interest rates seem to be going, we could very well see L&G as Europe’s #1 asset aggregator.

That, at least, is the hope for bulls.

In fact, it’s fair to say that L&G overall can be simplified into those two words. Asset manager. The company’s core business idea is about managing the pension liabilities for corporations in exchange for a fee – and these fees are 100% undisclosed, either through a “buy-in” or “buy-out” transaction, describing where the assets are located (in terms of balance sheets). L&G has been able to, through this, build a very well-working asset management factory.

L&G Results (L&G IR)

Collected pension plan assets flow into company asset management, which also gathers insurance reserves as well as some of the capital assets.

This structure allows L&G to generate significant economies of scale, reflected in a superb 43% OM as well as overall appealing assets. Only French company Amundi (OTCPK:AMDUF) is a larger European asset aggregator.

L&G combines low gearing at around 35% including operational borrowing with a strong net cash position. Combine this with a favorable potential higher interest rate environment, and you’re looking at a company that even could go the M&A route to find grow.

L&G is heavily influenced by interest rates as well as market movements.

From a historical record from 2020, we know that a 100 bps increase in interest equated to a near-£450M pre-tax positive profit impact, and since 2015, the company has been increasing its exposure to such interest rate environment increases. This means that L&G is very well-positioned for rising interest rates, and to enjoy the fruits of such trends.

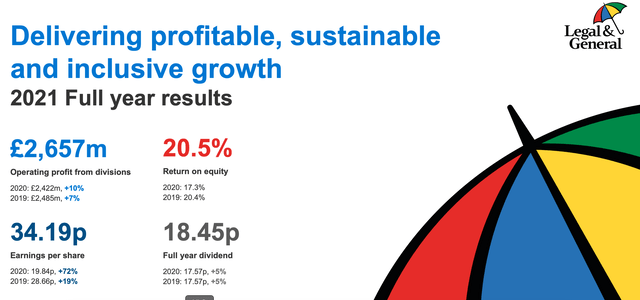

L&G Results (L&G IR)

On the flip side, equity market drops cause a negative profit impact. A 25% equity market drop would cause around a £500M impact on the company’s pre-tax profits. This means that the company has actually increased the volatility to which profits will react to interest rates, as well as equity market drops.

If interest rates rise faster than forecasts call for, we could see severe market drops or a recession. In such a scenario, gains from rates would not necessarily outpace the drop impact from equity markets. After all, L&G reported, for 2020, a negative £482m on the pre-tax profit for a 25% fall in equity markets. Rate increases are expected to also have a tremendous impact on the Solvency ratio from a balance sheet point of view as well as a market risk one, freeing more capital available either for distributions or acquisitions.

L&G Model (L&G IR)

Indeed, under IAS 19, insurers use AA+ Corporate Bonds yield to discount their pension liabilities on their balance sheet. With rates increasing, Corporate Bond yields should hike and help discount pension obligations further, which is another potential upside for the company. Obviously, the reasoning only applies to pension liabilities booked on L&G’s balance sheet and stemming from buy-out transactions – buy-ins are not affected.

As I said in the initial part of this article. Investing in insurance, you should understand the basics of the operations. I hope this cursory overview does something to that effect. This is what the company does, and how it makes money to pay that 10%+ yield you want.

Because hold your horses, we’re moving to risks.

Risks With L&G

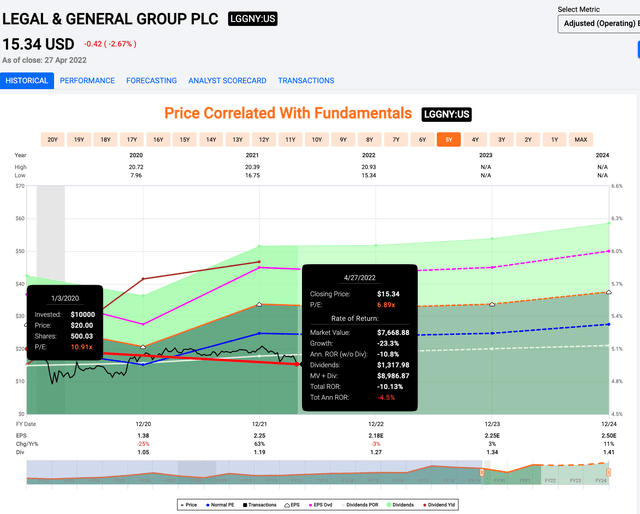

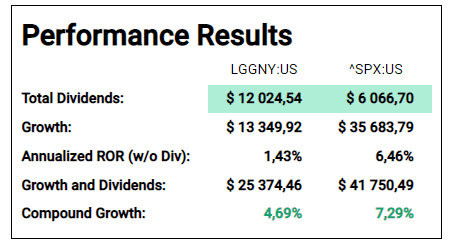

It should never be said that L&G is a business without risk. The company’s 5-year performance for shareholders can actually be called “poor”. Returns are negative, and shareholders have actually lost 10% of their invested capital, despite what can be called great results.

L&G results (F.A.s.T graphs)

This sort of poor performance doesn’t come out of nothing. If the company was the free-money sort of investment many investors want to make it out to be, then we probably wouldn’t be seeing these sorts of trends as strongly as this.

These risks are also why I’ve personally stayed mostly out of the company until very recently when I started a small position following the drop.

I’ve done extensive work mapping Russian exposures across European companies following the Ukraine conflict. I’ve identified several companies with high exposures, and many with very low rates of exposure.

The tricky part with L&G is that I know based on filings that the company has Russian exposure – potentially even not unsubstantial exposure – but it’s uncertain exactly how high or how “bad” this exposure is on an overall level. Therefore, the company’s risk with regards to Russia isn’t negligible, but unclear.

In addition, the company’s reliance on UK as a market for more than 85% of its current pre-tax profits isn’t exactly an advantage. Other companies, including Allianz (OTCPK:ALIZY) and Munich Re (OTCPK:MURGY) or AXA (OTCQX:AXAHY) have home-market advantages, but a lower overall exposure to one national market. This gives the company a bit of market concentration – not just in things like FX and market specifics/trends, but given their exposures to real estate, asset risk in case of a downturn.

There have also been cases of recent management shake-ups in the company that would be cause for concern by some. I personally view them, for now, as business as usual given excellent results, but they are nonetheless worth noting.

This gives us two relatively clear cases, for and against the company.

On one hand, and for the Bullish camp we have what is essentially the next-gen asset/pension manager/life insurer with market dominance, interesting growth plans, and a positioning for a higher interest rate environment that will virtually ensure a continuation of the dividend and potentially good RoR here. Such considerations call for the company to be valued well above its 10X historical normalized P/E-multiple, and also call for returns of upwards of 18-25% annually – potentially even higher.

On the other hand, the moderate/bearish camp points to the company’s relatively poor historical performance. Over a 20-year period, investors in Legal & General Group have underperformed the market by a wide margin.

Legal & General 20-year performance (F.A.S.T graphs)

There’s a lot of volatility in the stock we could, and should point to at the very least as a consideration. Most of the growth here comes from the company’s very generous dividend, but not even this has saved L&G over the long term. While the company has indeed positioned itself to profit from a changing interest rate environment, its fundamental asset exposure virtually ensures that a drop in equity markets would flow down to pre-tax profit in terms of near-equal negative amounts, provided the drop is hard enough.

Being bullish on L&G is therefore predicated on the assumption that interest rate hikes – or some outside factor like a war – don’t cause the market to dip down lower, in which case L&G would be unable to fulfill its forecasts.

Let’s look at valuation.

Legal & General valuation

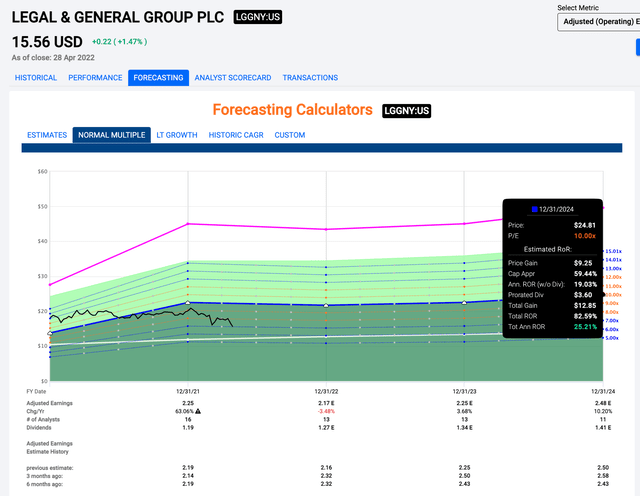

It should not be a surprise to you, based on recent dips, that I take a stance that’s generally more aligned with the bullish view on L&G. However, this is not as bullish as some. Until the recent drop when the company dipped from $18-$21/share for LGGNY, I held a fairly somber view of the company’s prospect, assuming an 8-12% annualized RoR at best.

Today, that is different. Because obviously, the company is now cheaper.

In terms of peer-average multiples, L&G is currently undervalued. Peers include Swiss Life (OTCPK:SZLMY), ageas (OTCPK:AGESY) M&P PLC and Storebrand (OTCPK:SREDY). These peers trade at around 10X or so, with L&G currently at south of 8X. The company’s book-specific multiples are an area where they currently aren’t an undervaluation, but this is due to the company’s balance sheet and structure, not to any inherent overvaluation on part of the company.

Weighting the average peer multiples, we can see an upside of around 20-25% to a peer average, which is enough of an indication for me to consider it valid. However, as you can see and given the recent 4 months of drops, the company wasn’t necessarily undervalued on a peer multiple prior to this drop.

Looking at Embedded value for the company at a WACC of 8.15% comes to around £3.4/share, bringing the company again, to an undervaluation here of around 29-30% depending on the exact level of valuation.

NAV, the somewhat more interesting perspective, has us valuing the company’s segments at P/E multiples of 9-10X. I’m unwilling to go higher than this despite some of my peers going to 11X on some of the sectors, as I want to stay more conservative given the company’s volatile history. This gives us around £20B, which at 6.27B shares comes to around £3.18/share.

As I mention initially, I’m ready here to clearly state that the company is undervalued to every metric here. S&P global gives us an upside of around 30% on average as well, with a price target of £3.25/share, with a range of £2.25-£4/share.

So, every single metric we’re looking at is giving us an upside either on historical metrics, peer metrics, analyst averages, NAV averages, of at least 20% and as high as 30%. Putting it conservatively and weighting it conservatively, I’m willing to go up to £3.1/share here. This puts me below most of the targets out there, but comfortably within a good upside.

The company’s ADR is LGGNY, a 5X ordinary share ADR. A 10X P/E for this company forecasts, implying a $21.5 2022E forecast, implying a double-digit upside, and a multi-year upside to a 10X 2024E P/E of 25% annually.

F.A.S.T graphs L&G Upside (F.A.S.T Graphs)

In short, things are looking good in terms of upside – and the past few days’ worth of decline have highlighted this upside further.

I would now consider L&G one of the better investments in the insurance space – but it’s not as much better than Allianz (OTCPK:ALIZY) or Munich Re (OTCPK:MURGY) or AXA (OTCQX:AXAHY) as some might want to make it out to be. At least if you view the company as a conservative investment, which I always prefer to do.

Let’s look at the thesis here.

Thesis

So, Legal & General is a great investment at this valuation. But it wasn’t as great half a year ago, or even just 3 months ago. Successfully investing in finance business requires not only a good yield but understanding of the specifics.

The company’s fundamentals are a big advantage here, and we’ve been through operations that seem to be optimized on every level. The corresponding risks exist, in the form of British concentration, risk control issues due to the size of its assets, and exposure to £25B+ worth of British and international real estate. These are relatively small concerns when seen to the upside.

Perhaps the largest risk is, to my mind, the company’s poor performance in terms of valuation. The company has been a poor investment over time. it is, of course, unfair to say that L&G is unique in this in the sector. However, investing in a company such as this requires a significant valuation-related upside – and that’s what we have here.