Lemon_tm/iStock via Getty Images

Grindrod Shipping Holdings (NASDAQ:GRIN) is on a growth trend that I believe is not going to stop anytime soon. Having successfully captured market opportunity in 2020, the stock continues to grow at an impressive rate. As a result, I recommend investors immediately cash in on this growth opportunity by buying this undervalued stock.

Company Overview

Grindrod Shipping Holdings is a Singapore-based small-cap shipping company that owns, operates, and charters a fleet of dry-bulk tankers and carriers across the globe. The total fleet consists of 8 long-term ships and 23 dry bulk carriers, each of which is used in the transportation of both bulk and breakbulk commodities. Additionally, Grindrod has within its fleet, four fully owned tankers that are used in the transport of petroleum-based fuels. Given the nature of its business, the company is crucially sensitive to shifts in the global supply chain and works alongside its robust clientage that includes players from various sectors such as shipping, heavy industry, oil, mining, and trading houses.

Historical GRIN Price Movements

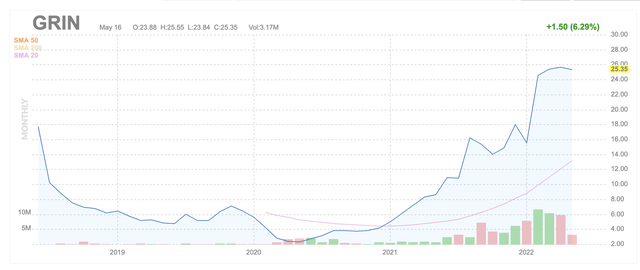

GRIN Historical Price (Finviz)

There is no better way of telling the GRIN story than by assessing the ups and downs its price had undertaken amidst internal and external shifts. Taking a broader look at GRIN’s price trajectory since its trade initiation in mid-2018, a clear U-shaped path can be observed. The company began to trade on NASDAQ following its spinoff as a shipping division by its parent company, Grindrod Limited.

GRIN started with a high price of $17 per share that saw a brief 5% climb during the first 10 days of trade, jumping to a high of $17.80. The two years following brought on a bearish slide, which saw GRIN plummet by 87%, and trading at its all-time low of $2.21.

April 2020 was when the tides for GRIN saw a turn, and the stock began its momentous growth ride, which lasts well into early 2022. This period had seen the stock balloon from $2.21 to $26.32 by 1st April 2022. This impressive swing reflects an almost 1100% raise, which is far beyond the gain even the most optimistic market bulls aim for. This was largely due to the growth surge collectively experienced by shipping stocks following the outbreak of Covid-19 and the subsequent demand for import shipments.

2021 Earnings Release

On February 16, 2022, GRIN disclosed its annual earnings release for the year 2021. The performance in this report was found to be stellar and mobilized bulls in the market to continue the GRIN price drive-up. Grindrod’s annual revenue figure stood at $455.84 million, which was 63.3% high, above 2020’s revenue figure of $279.2 million. The sales improvement highlighted an impressive degree of growth, which investors had been eagerly anticipating. The climb proved that the company’s demand opportunities were neither temporary nor limited to surging demand for shipment services amidst the Covid-19 pandemic. The growth proves the company has unlocked a forward-looking potential that it stands ready to sustain in the long term.

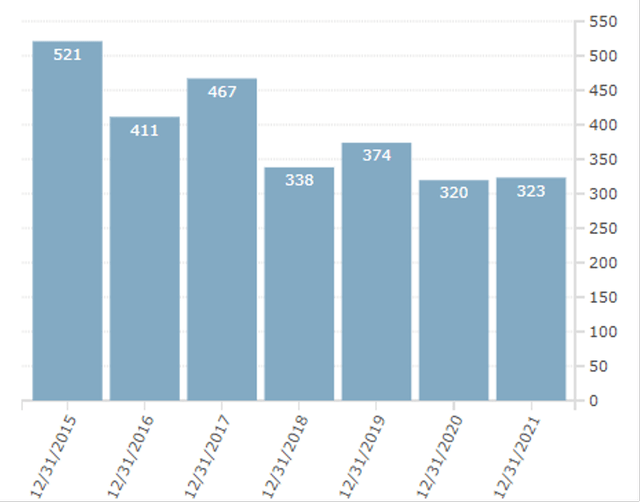

Additionally, the company’s gross profit figure for 2021 was an impressive $176.9 million, over eleven times the gross profit figure of $15.11 million for 2020. GRIN’s value-adding potential can further be perceived by a look at its comparative net earnings figure of $119 million. This came as a substantial turnaround against the net loss worth $38.8 million for the year 2020. What is even more impressive to this assessment is the improvement in the overall operating expense front, which indicates enhanced optimization and cost reduction, despite the explosive revenue growth:

GRIN operating expenses (Finviz)

The company understandably stands as a value maker for its shareholders, with its momentum accelerating at full throttle. Whilst it is understandable that market participants hold concerns about the continuity of the company’s bullish growth path, its financial fundamentals indicate the GRIN has just started and is set to achieve high growth in the long term.

Competitive Analysis

|

Ticker |

Company |

Market Cap |

P/E |

P/S |

Dividend Yield |

EPS (TTM) |

Shares Float |

Return on Investment |

Current Ratio |

Total Debt/Equity |

Price |

|

CPLP |

Capital Product Partners L.P. |

288.51 |

1.56 |

3.81% |

0.00 |

14.84 |

6.50% |

0.40 |

16.12 |

||

|

DSX |

Diana Shipping Inc. |

420.42 |

8.52 |

1.96 |

15.47% |

0.61 |

59.61 |

9.50% |

1.90 |

1.08 |

5.46 |

|

GRIN |

Grindrod Shipping Holdings Ltd. |

433.83 |

3.88 |

0.95 |

12.08% |

6.14 |

11.18 |

22.20% |

1.60 |

0.87 |

25.29 |

|

KNOP |

KNOT Offshore Partners LP |

539.27 |

13.38 |

1.92 |

12.48% |

1.25 |

24.34 |

4.70% |

0.60 |

1.89 |

16.82 |

|

NAT |

Nordic American Tankers Limited |

461.79 |

6.84 |

1.99% |

-0.72 |

167.34 |

-17.60% |

1.60 |

0.64 |

2.72 |

|

|

SB |

Safe Bulkers, Inc. |

479.29 |

2.87 |

1.46 |

4.96% |

1.40 |

73.27 |

18.10% |

1.40 |

0.56 |

4.18 |

Source: Finviz.com

GRIN holds the lowest P/S ratio amongst its competitors which suggests it has the lowest market price against every dollar of revenue it generates. As a result, revenue generation from similar stocks is far costlier, and thus, I believe it is fair to assume GRIN is seriously undervalued.

In comparing Grindrod to similar small-cap shipping stocks, it becomes apparent why the stock is a clear favorite amongst market bulls targeting long-term growth. The stock’s comparative metrics against industrial benchmarks point to its potential and value-enhancing capability.

What makes GRIN most impressive to investors looking to gain exposure to the shipping industry is the stock’s dividend yield of 12.08%. This had been initiated in November 2021, with the company announcing a $0.72 dividend payment on each quarter. This consistent income against the stock points towards its demand and subsequently soaring price in the market. It further points to the strengthened liquidity position of Grindrod in its ability to pay out cash to every shareholder. Moreover, this dividend yield comes despite GRIN reporting the highest EPS amongst any competing stock. Grindrod delivered an EPS of $6.14, which stood at a substantial distance from the second-highest EPS of $1.40, by Safe Bulkers, Inc. (SB).

Finally, as a cherry on top, investors can gleefully look toward GRIN’s ROI figure of 22.2%, which is far above that of competing stocks. The efficiency of the company’s investment profile is therefore the most impressive, making GRIN far more valuable than similar-sized stocks within the shipping realm. Investors therefore can stand content that the capital invested into the firm is indeed resulting in substantial value addition, which is far more remarkable than any other options within comparable stocks. This further points to why I believe GRIN is a big winner, as its metrics show it as having a substantial edge above its competitors.

Valuation Metrics

Using comparable competitive analysis, the net worth of the company can be determined as follows:

|

Ticker |

Company |

Market Cap |

Forward P/E |

EPS growth this year |

EPS growth next year |

EPS growth past 5 years |

Price |

|

CPLP |

Capital Product Partners L.P. |

288.51 |

3.36 |

0.00% |

4.58% |

-14.90% |

16.10 |

|

DSX |

Diana Shipping Inc. |

420.42 |

4.09 |

137.40% |

-18.12% |

18.00% |

5.46 |

|

GRIN |

Grindrod Shipping Holdings Ltd. |

433.83 |

4.55 |

398.30% |

-11.34% |

36.00% |

25.27 |

|

KNOP |

KNOT Offshore Partners LP |

539.27 |

8.34 |

-28.60% |

11.73% |

-10.80% |

16.82 |

|

NAT |

Nordic American Tankers Limited |

461.79 |

19.02 |

-414.50% |

98.30% |

2.73 |

|

|

SB |

Safe Bulkers, Inc. |

479.29 |

3.45 |

683.10% |

-3.39% |

30.20% |

4.18 |

Source: Finviz.com

Based on valuation metrics alone, there is a clear indication that GRIN stock is undervalued as per the competitive benchmark. The stock’s forward P/E figure stands at 4.45, which is significantly lower than NAT with 19.02 and KNOP with 8.34. The stocks with lower forward PE ratios fail in other crucial domains, such as CPLP, which has an EPS which declined by nearly 15% in the last 5 years, along with DSX and SB which have had drops in their EPS across the previous year. This indicates that there is a strong incentive for investors to select GRIN over its peers, given its robust valuation profile which, when coupled with its stellar financial performance, suggests a high growth potential. As a result, the company’s valuation includes the present value of the stock’s growth potential. This growth anticipation is backed and supported by the historical performance of the stocks and is reflected by the largest EPS growth in the last 5 years, with a 36% climb.

Risks and Countermeasures

Despite the robust fundamentals and financial performance of GRIN, its investors must remain cautious towards broader, external risks which could potentially impact the sustainability of the stock. One threat, in particular, is the Russian invasion of Ukraine, which the global shipping industry has expressed its concerns regarding. March 2022, which saw the initiation and escalation of the conflict brought severe macroeconomic disruptions to the shipping world. Rising demand, economic sanctions as well as supply chain complications had each triggered heavy inflationary pressures threatening the demand for tankers and transporter ships.

Similarly, the obstacles brought about by the conflicting extending to the Ukrainian port city of Mariupol further add to inflationary pressures felt in this industry, which is highly sensitive to macroeconomic triggers. For a stock such as GRIN, the company’s management would need to ensure a strategy that cushions its business model against shockwaves causing distress to the company’s financial position and overall sustainability.

However, it is important to point out that a key strength for Grindrod may lie in its small size. As opposed to a giant shipping conglomerate, the company has a small fleet and an organization with less than 600 employees. As a result, the company stands far better suited than a giant shipping company such as ZIM Integrated Shipping Services (ZIM) which has a fleet of ships and tanks well into the hundreds and employs nearly 5000 employees. Grindrod can better restructure its business model against dynamic shifts that are brought up on the macroeconomic front. Its smaller fleet size also exposes the company to a lower degree of risk as opposed to larger companies. However, at the same time, this may prove to be a challenge for the company by limiting its ability to raise finances as well as scaling up its operations. At present, the company is faring well on its organic profitability-based growth strategy.

Conclusion

I firmly hold a bullish stance on GRIN, as I believe is justified by its financial performance following its capture of market opportunities presented in 2020. The subsequent growth the company has experienced is far from over, and investors would be wise to hop on to this bullish ride that is bound to reach new heights. In comparison to similar stocks in the market, GRIN is a far more impressive investment choice that shows clear indications of being undervalued.