Rawpixel/iStock via Getty Images

Investment Thesis

Advanced Micro Devices, Inc.’s (NASDAQ:AMD) delivered another record-breaking quarter in FQ1’22, against the global supply chain issues and semiconductor crunch. Despite delivering excellent revenue growth with an impressive CAGR of 27.9% in the past five years, AMD investors have multiple reasons to rejoice moving forward, given that it promised another 60% YoY growth for FY2022. In light of the company consecutively beating consensus estimates in the past two years, we expect AMD to report another stellar year, similar to its FY2021 execution.

Combined with the massive market moderation in the past six months, it is a no-brainer that the AMD stock remains one of our top picks for any tech investor’s high-growth portfolio.

AMD Reported Stellar FQ1’22, Despite Macro Issues

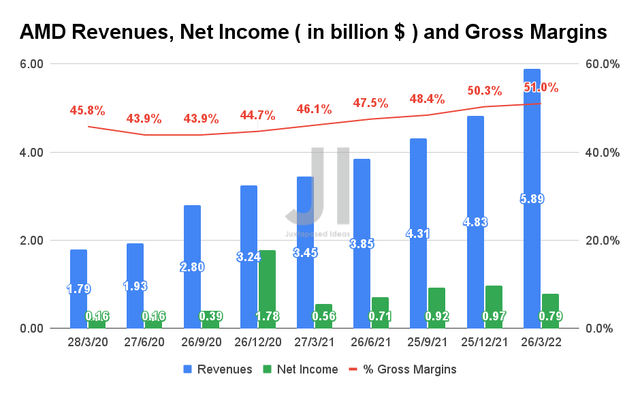

AMD Revenue, Net Income, and Gross Margin

S&P Capital IQ

AMD reported a stellar FQ1’22 revenue of $5.89B and net income of $0.79B, representing impressive YoY growth of 70.7% and 41%, respectively. In addition, the company also steadily improved its gross margins YoY, from 46.1% to 51% (excluding the Xilinx segment), by 4.9 percentage points.

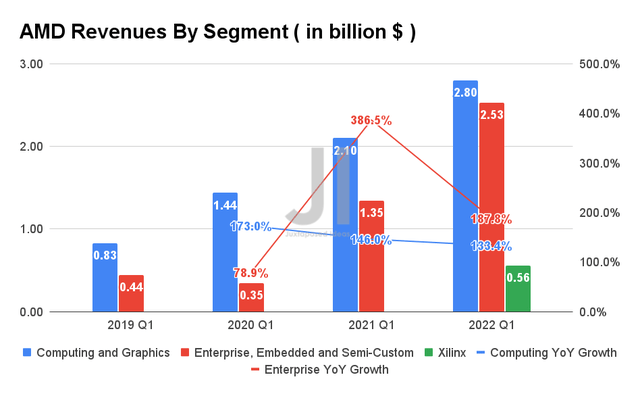

AMD Revenue By Segment

S&P Capital IQ

Now, based on the chart above, it is evident that we can perceive a deceleration in YoY revenue growth for AMD’s Computing and Graphics segment. Nonetheless, we are not concerned, since the company still reports excellent sales from the premium products in the segment, aided by the exponential growth of the Enterprise, Embedded, and Semi-Custom segment.

Furthermore, AMD continues to take significant market share from its main competitor, Intel (INTC) over time. By FQ1’21, the company reported an expanding market share in the overall x86 CPU share of 27.7%, compared to 20.7% in FQ1’21. Furthermore, AMD grew its presence in the server and mobile CPU segment, with market shares of 11.6% and 22.5% in FQ1’22, compared with 8.9% and 18% in FQ1’21. As a result, we are still confident of its forward execution, despite the slight decline in the desktop CPU share, from 19.3% in FQ1’21 to 18.3% in FQ1’22.

We also believe that this is the result of AMD’s aggressive expansion into the server and mobile segment, seeing how both markets are expected to grow faster than the personal computer market over time. The global cloud computing market size is expected to grow from $368.97B in 2021 to $1.55T in 2030 at a CAGR of 15.7%, while the global smartphones market will grow from $507.5B in 2021 to $920B in 2030 at a CAGR of 6.8%, with the aid of 5G adoption. In contrast, the personal computer market will grow marginally in comparison, from $161.93B in 2021 to $337.5B in 2030, assuming a CAGR of 8.5%.

In April 2022, AMD also announced its plan to acquire Pensando to further expand its cloud offerings, while also expanding its partnership with global cloud providers in FQ1’22, including Alibaba (BABA), Amazon (AMZN), Microsoft Azure (MSFT), and Alphabet (GOOG). It is evident that AMD had simply moved on to greener pastures, since its Enterprise segment also contributes a higher operating margin of 34.8% in FQ1’22. In addition, its Xilinx segment also reported an elevated operating margin of 41.6% in the six weeks of FQ1’22, after the acquisition is completed. With robust consumer demand for Genoa launching by H2’22 and Bergamo by H1’23, we are certain that AMD’s cloud segment will prove to be a robust revenue driver moving forward, amongst others.

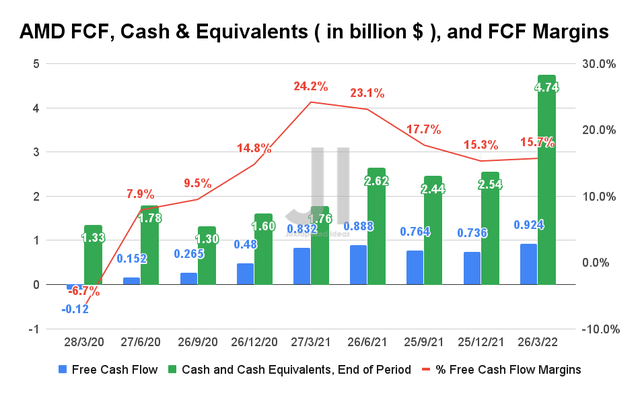

AMD FCF, FCF Margins, and Cash & Equivalents

S&P Capital IQ

It is evident from the chart that AMD is a Free Cash Flow (FCF) positive company with $3.31B of FCF and 17.5% of FCF margins in the last twelve months (LTM). By FQ1’22, the company also reported increased cash and equivalents of $4.74B and FCF of $0.92B, though the former is partly attributed to its completed acquisition of Xilinx.

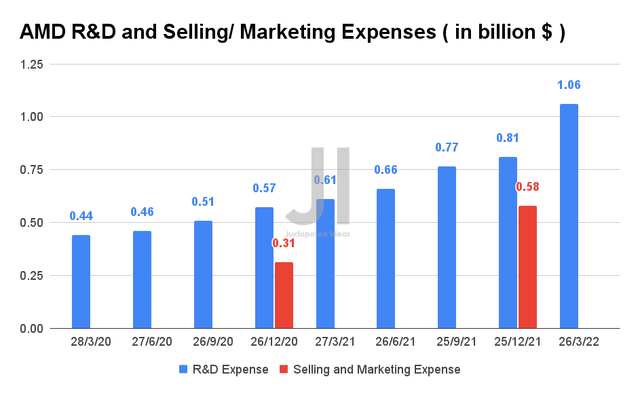

AMD R&D and Selling/Marketing Expenses

S&P Capital IQ

As a result, AMD would have more than enough capital for its expanding R&D expenses, which grew at a CAGR of 29.94% in the past five years. In FQ1’22 alone, the company reported R&D expenses of $1.06B, representing a significant increase of 30.8% QoQ and 73.7% YoY. For FY2022, we may expect AMD to report R&D expenses of over $4.3B, given its guidance of 24% operating expenses/revenue%. With these reinvestments into the business, we can be sure that the company can remain highly competitive in the semiconductor industry, by providing the critical foundation for product innovations in the future.

An Upwards Rerating To AMD’s Revenue Growth Is Possible Through SaaS

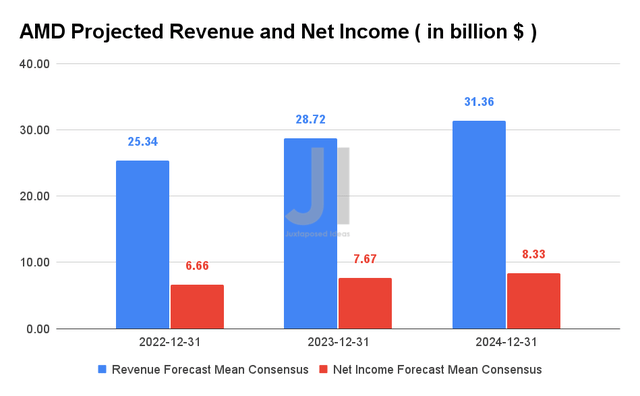

AMD Projected Revenue and Net Income

S&P Capital IQ

Over the next two years, AMD is expected to grow its revenues and net income at a CAGR of 11.25% and 11.84%, respectively. Consensus estimates that the company will report revenues of $25.34B and a net income of $6.66B, representing impressive YoY growth of 54.1% and 210.7%, respectively. Furthermore, AMD had guided even more aggressive YoY growth of 60% (partly attributed to the Xilinx addition), with revenues of $26.3B and improved non-GAAP gross margins of 54% for FY2022. In addition, the company also guided FQ2’22 revenues of $6.5B, representing excellent growth of 10.3% QoQ and 68.8% YoY. Consequently, it is no wonder that the AMD stock had recovered by 9%, from $91.13 to $99.42 post FQ1’22 earnings call on 3 May 2022, given the strength of its global supply chains.

Furthermore, we suspect that AMD would start looking at the Software as a service (SaaS) segment moving forward, given its Pensando acquisition and the deployment of its AI capabilities in current embedded applications. Assuming so, the upwards rerating of its projected revenues is highly possible moving forward, while also putting more pressure on its peers, NVIDIA (NVDA) and QUALCOMM (QCOM). We expect AMD to further elaborate on this promising pipeline in its upcoming Financial Analyst Day on 9 June 2022. Let’s stay tuned.

In the meantime, we encourage you to read our previous article on AMD, which would help you better understand its position and market opportunities.

- AMD: Cloud Computing (And Gaming) Will Bring It To New Heights

So, Is AMD Stock A Buy, Sell, or Hold?

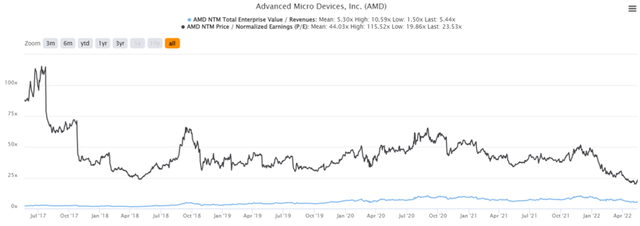

AMD 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

AMD is currently trading at an EV/NTM Revenue of 5.93x and NTM P/E of 23.53x, lower than its 3Y mean of 7x and 41.82x, respectively. As evident from the chart, the stock is also trading at near-bottom valuations now, given the recent market correction in the past six months. The stock is also trading attractively at $102.47 on 17 May 2022, down 37.6% from its 52-week high of $164.46, though at a 40.8% premium from 52 weeks of $72.76.

AMD 5Y Stock Price

Seeking Alpha

In the past five years alone, AMD’s stock price had grown by 808.42%, with a similar price total return. As a result, given the undervaluation, historical stock appreciation, and growth potential, consensus estimates also rate AMD as attractively priced now.

In light of macro issues and perceived weakening PC demand, there is a small chance that AMD may retrace in the coming weeks. In addition, bottom fishing tech investors may want to wait for the post FQ1’22 earnings rally to be digested before adding some exposure, given the reduced margin of safety to our price target of $130.

On the other hand, while there may be some risks to AMD’s supply, given that Taiwan Semiconductor Manufacturing Company Limited (TSM) manufactures most, if not all, of their products, we do not expect any political issues in the short term. China’s President Xi has shown a desire to achieve a 5.5% GDP growth target for the year, while also securing his third term by November 2022. TSM is also expanding its production capabilities in Japan and the US, while AMD could also consider INTC as an alternative foundry partner by 2025, following NVDA. As a result, investors should still take this opportunity to add this excellent high return stock during the dip.

Therefore, we are reiterating AMD stock as a Buy.