jetcityimage/iStock Editorial via Getty Images

Tesla, Inc. (TSLA) has become almost synonymous with the EV revolution, leading the forefront in terms of deliveries as the OEM is on track to hit ~1.2 million deliveries this year alone (should capacity support that), after nearly reaching the million-milestone in 2021. Tesla is not alone, nor all that far ahead in the race, with GM (GM), Ford (F), Volkswagen (OTCPK:VWAGY), Stellantis (STLA), BYD (OTCPK:BYDDY), NIO (NIO), XPeng (XPEV), Geely (OTCPK:GELYF), and others all pushing ahead with electrification plans and scaling deliveries. Startups including Rivian (RIVN) and Lucid (LCID) are also involved in the race, but facing production crunches as the industry deals with some major supply constraints.

However, infrastructure currently acts as a headwind to EV adoption – range anxiety and a lack of charging points/stations may be limiting widespread consumer adoption in the near-term. The $7.5 billion Bipartisan Infrastructure Law (part of the Infrastructure Investment and Jobs Act) aims to change that, allocating federal funds to states in an effort “to install 500,000 public chargers…nationwide by 2030.” However, McKinsey estimates that “America would require 1.2 million public EV chargers and 28 million private EV chargers” by 2030 if 50% of auto sales are zero-emission vehicles [ZEV]. This does serve as a positive to the charging players – EVgo (EVGO), ChargePoint, (CHPT), and Blink (BLNK) – but Blink’s CEO Michael Farkas’ view of the industry not being near a point of profitability speaks volumes in today’s macro environment.

While some or many of these stocks may indeed turn out to be major players in shaping the EV future, the current investment case does not seem hands-over-fist bullish — the outlook is not necessarily the brightest, with long-term margin pressures stemming from cost competition, and risks from multiple shrinkage.

EV Market Share: Is The Gap Closing On Tesla?

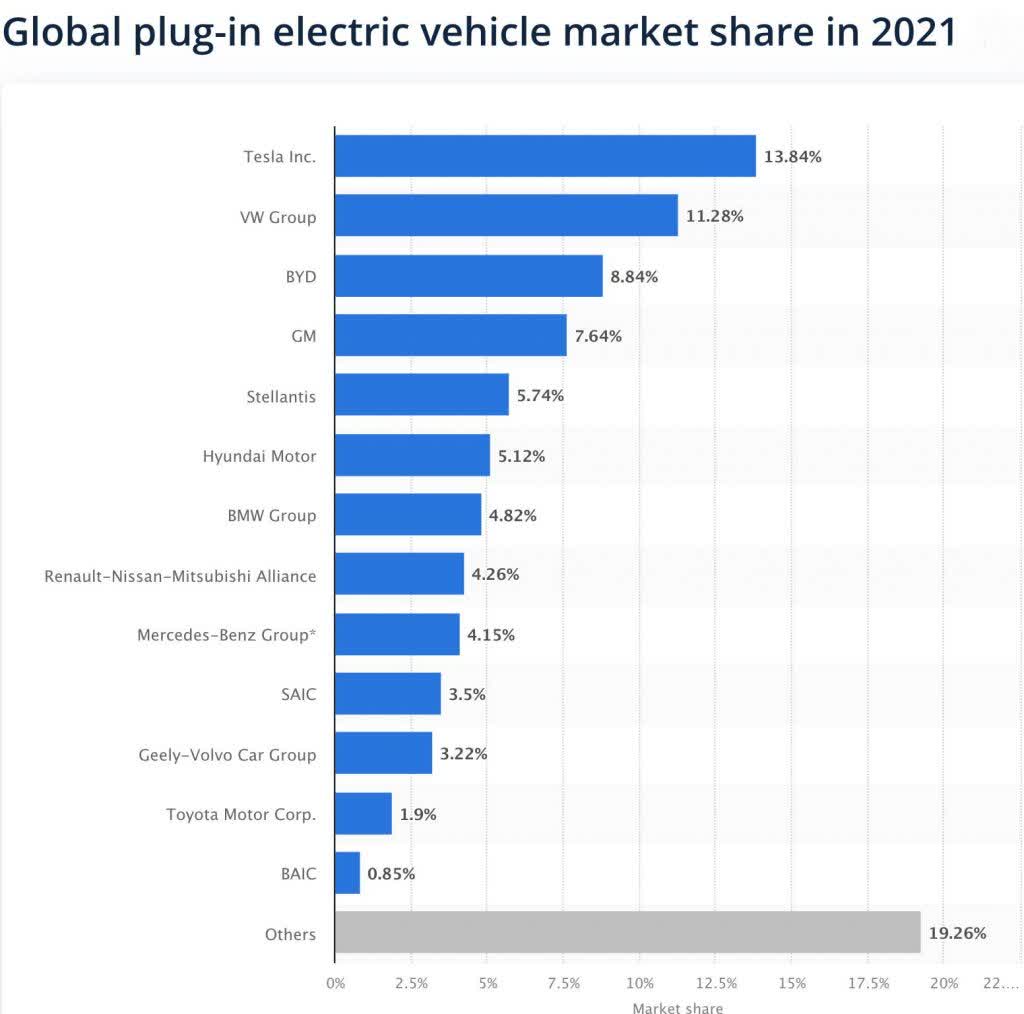

The EV revolution is still in the early innings, but expectations for growth and higher rates of adoption are increasing. While Tesla still leads the race in the plug-in EV market, with double-digit market share, it’s not alone in that realm, as BYD and VW are two leading the charge and closing in on Tesla’s market share.

EV market share 2021 (Statista)

Per Statista’s calculations, Tesla led 2021 with nearly 14% market share, while VW breezed past 10% to reach 11.3% share. BYD and GM, buoyed by the success of its JV mini-EV with SAIC, were closing in on the 10% milestone. Tesla is no longer the outright leader – while it still does hold the top spot, others are moving in with aggressive electrification plans to take the throne. GM CEO Mary Barra believes the OEM can win the race against Tesla this decade, due to cost efficiencies allowing it to be more cost competitive, while Stellantis and VW are among the others in the running.

For Q1, the EV industry performed spectacularly, bucking a 15.3% decline in total auto sales to record dazzling growth in the US, placed at +76% per Cox Auto.

Tesla, for example, logged a 68% increase in deliveries globally. Ford notched a nearly 38% gain in the quarter as it pushed ahead with popular models, the Mach-E and F-150 Lightning. Hyundai and Kia noticed small volumes, between 5,000 to 7,000 units as their market entries in the US started off strong. While it won’t happen quickly, other OEMs are progressing forward with electrification plans and can (and very likely will) start to chip away at Tesla’s dominance as the market is flooding with dozens upon dozens of new models.

Hyundai plans to invest $16 billion to reach about 1.4 million unit volume in EV by 2030, half of its planned 3.2 million unit electrified volume. At such a scale and competitive price advantage, Hyundai certainly could find market share gains in the mass-market and ~$35,000-$45,000 price segment in the long-run

EV Projections Expect Massive Growth

While it’s still early, and may be too early to draw a concrete conclusion, the performance of the EV industry in Q1 while the broader auto industry suffered due to chip and parts shortages and supply chain headwinds may signal that electrified models are beginning to take hold. Over the next couple of years, until 2025, xEV models (BEV/PHEV) are only set to increase as OEMs push ahead with electrification plans.

This accelerated shift to electrified models is set to envelop all vehicle segments quite dramatically by the end of the decade. Passenger vehicles are projected to grow almost 15-fold by 2030 to over 44 million vehicles, assuming federal emissions targets are met. Light commercial vehicles are expected to see strong growth to nearly 4 million vehicles, taking almost 8% share. All told, the outlook for the EV industry remains bright, with tremendous growth potential.

EV segment growth (McKinsey)

Cost Competition, Margins, Valuations: A Headwind To Tesla, EV OEMs

A key factor needed to usher in that degree of EV growth over the course of the decade will be cost competition, i.e., bringing to market a mass-market vehicle at a sub-$25,000 price tag. EVs are on the path to that key level, but have not yet reached it at scale. Once that occurs, EV adoption can quickly accelerate and overtake ICE with a majority of market share.

During Tesla’s Q4 earnings call in January, Elon Musk ditched the idea of a $25,000 EV from Tesla for now — he said that because of chip constraints, Tesla “will not be introducing new vehicle levels this year. It would not make any sense.” Musk did not ditch the $25k EV plans entirely, however, clarifying that “at some point we will. We have enough on our plate right now.”

Although Tesla may not be, other OEMs are working to drop prices to challenge Tesla. BMW’s (OTCPK:BMWYY) recent announcement that it plans to “deliver a 30 percent drop in costs” with next-gen battery tech from CATL reflects the growing amount of cost competition in the industry. According to people familiar with the development, the “energy density of the new BMW cells will be higher than Tesla’s round cells by at least a low double-digit percentage.” VW is working on a sub-$25,000 vehicle via the ID.Life concept, and regardless of whether that actually comes to fruition, it signals the German giant’s willingness to attack the mass-market segment head-on.

And while exact price differences between BMW’s next-gen batteries set to be ready in 2025 and Tesla’s 4680-pack, the development goes to show that OEMs are serious in fighting for creating lower priced vehicles. Back to GM’s Barra’s bold statement that the OEM can overtake Tesla by 2025 from cost competitive stemming from increased operating efficiency — this highlights the aggressive nature that GM aims to take in an effort to reach the top, with the Ultium platform’s standardization potentially leading to greater economies of scale, allowing GM to target a low $20,000 price point with volume, such as how it is succeeding in China via SAIC-GM-Wuling’s Hongguang Mini, at a ~$5,000 price point. Volume with the mini EV has nearly reached 1 million, and has quite consistently ranked amongst the top selling models in the nation.

If $25,000 becomes the benchmark price target, it seems reasonable to expect substantially more battery cost decreases (with efficiency increases) and more lower-priced, high-volume models flooding the market.

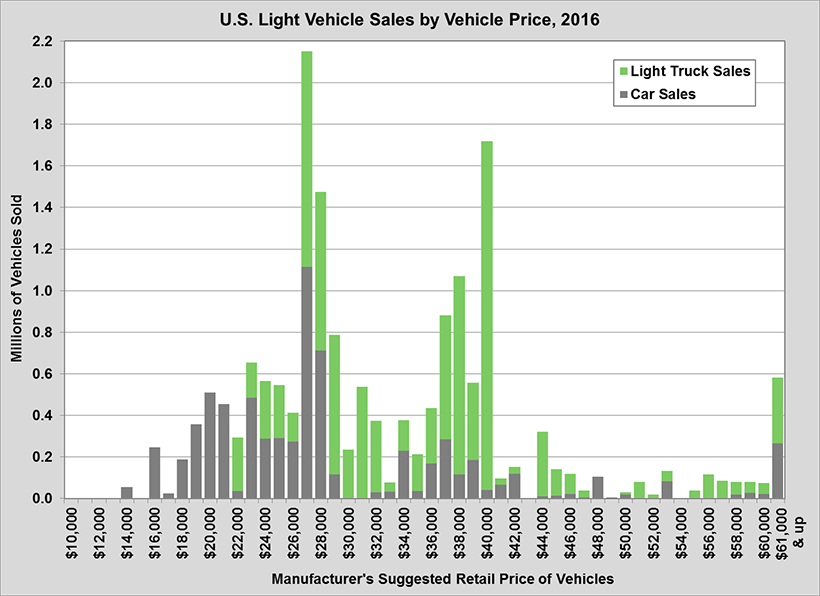

Light vehicle sales by price, 2016 (DOE)

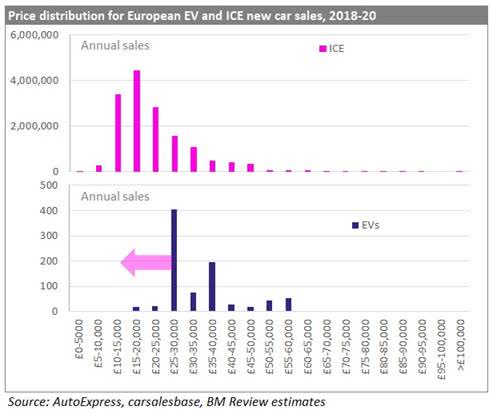

EV, ICE vehicle sales by price, 2018-20 (Kitco)

Vehicle sales data (while slightly dated) points to the $25,000 price point as the key level to attract high volumes of sales – this marks the mass-market point. US light vehicle sales found a majority of volume between the $20,000 and $28,000 mark in 2016, while European mass market sales between 2018 and 2020 sat between €15,000 and €20,000, with substantial volumes in the segments above and below (€10,000 to €30,000 overall). European EV sales, however, sat quite higher, between €25,000 and €30,000, suggesting that cost parity has not yet been reached.

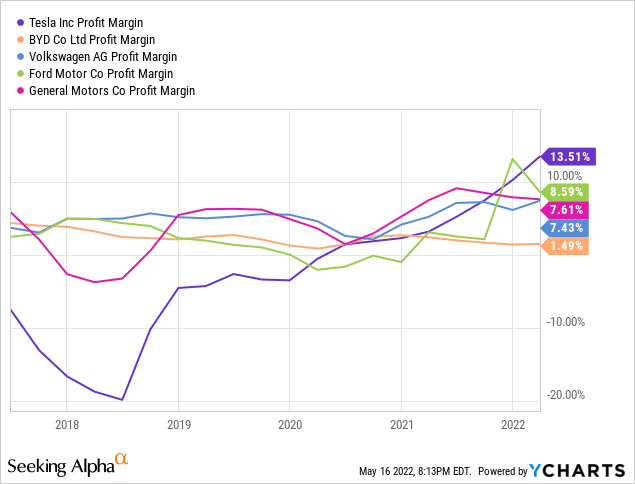

Cost competition to reach the mass-market segment will likely lead to a decrease in vehicle margins, and ultimately net margins – with prices falling, the degree to which costs can furthered be decreased falls. At some point, OEMs will reach a point where critical components cannot be cheaper, where costs can no longer be decreased easily; and as competitors fight for share, lowering sales prices to undercut competition will eat into margins.

Tesla’s net margin has risen quite consistently as it scales, surpassing the 10% level on a path to a 15% net margin. Ford, GM, and VW, which are scaling up in EVs, see net margins between 7-9%. Disregarding the differences in some margin calculations between Tesla and other OEMs (such as in gross margin), Tesla takes strong pricing power from high brand recognition, high customer interest and demand for its vehicles, as well as tech. Selling software such as FSD and infotainment upgrade packages can pad margins by tacking thousands on to a vehicle’s sales price. Tesla also has solid operating leverage, and has decreased costs to a higher degree than decreases in ASP. Price hikes late in Q1 are also likely accretive to margins for the fiscal year, even with headwinds.

But the big question here is, how sustainable are these margins, and how sustainable is margin growth?

As noted before, OEMs are racing to develop and source the cheapest, most efficient batteries to reduce costs and improve performance and range, which becomes a double-edged sword. Reducing costs improves operating leverage and boosts the bottom line (and margins), but sparks cost competition and undercutting prices to deliver vehicles to consumers for cheaper and really attack those mass-market segments.

Tesla reached its highest margins with vehicle price hikes and record volumes even as commodity headwinds and component shortages weighed on production (and still do, with production again limited in Shanghai). Tesla’s maintenance of such margins depends on two key factors:

- scaling volumes – higher volumes drive margin expansion, with higher levels of production and deliveries offsetting cost increases and increased expenditures to drive international expansion/product line expansion

- cost reductions – Tesla remains confident that it can continue to reduce costs of batteries and increase operational efficiency to drive margins

However, this leaves Tesla vulnerable – halting production and losing some volume can hit margins. And this is currently a major industry headwind, with many OEMs feeling production pains from component shortages and supply chain disruptions. So, as a whole, the auto industry faces a challenging macro environment to margins in the near-term, as well as in the long term.

From a long-term perspective, it’s likely that in the race to reach the cost-conscientious consumer in the mass-market segment, EV ASPs will have to fall. But in order to protect healthy margins and allow for margin maintenance, production costs must fall. Tesla, NIO, and Mercedes are all asking drivers to pay for additional services such as ADAS or battery swapping, a move that both boosts margins and provides recurring revenue. That can pad margins should costs fall significantly – but that has not happened.

At the moment, Tesla’s average cost of production hovers around $35,400, GM‘s at $33,800, Ford at $30,800, VW at $39,200, as it clears the 100,000-unit EV milestone, and Hyundai at just $19,000.

Is the industry ready for a $25,000 EV with volume? No, not in the slightest. Production costs simply are not low enough. $30,000 is on the way, but options near that range with solid range and tech are limited. ICE models with volume (Hyundai, with 4 million volume in 2021) can have much, much lower costs of production, and can be sold with a 10-12% vehicle margin at a 38% lower price than a comparable EV ($21k vs. 34k for Hyundai’s 2022 Kona).

Combine that with a lack of adequate charging infrastructure, and it’s simple to see why EV adoption needs subsidization – mass-market price parity is not in sight. For consumers in more rural areas or on more limited budgets, a $10,000 to $15,000 price tag difference and availability of public chargers versus gas stations plays a role in prohibiting widespread adoption.

A Widespread Shift And Valuations

To reach 50% to 100% share over the next two decades, EVs will become the ‘golden standard’, just as ICE vehicles are today – there will be dozens of available models spanning all price segments from mass-market to luxury.

When EVs reach that golden standard, it’ll be tougher to hold on to higher margins in the teens – take a look at ICE leaders, where net margins range from 5% to 8%. Technological advancements and add-ons like Tesla’s FSD are likely to become more common, and a more utilized method to boost margins.

But assuming that margins must fall due to manufacturers all competing in the segment, flooding the market with models and increasing price competition and cost reductions, valuations in the industry look stretched. While debt-laden, ICE leaders trade near 1-2x EV/sales. Taking BYD, which is among the leaders in China in EV, its 37% forward revenue growth only earns a 2x EV/sales multiple. Compare that to Tesla, which earns a 9x multiple for ~53% forward growth. A bit of a discrepancy, given the landscape ahead.

Back to Tesla – analysts estimate a 15% net margin in 2025 ($19.50 EPS on ~$157B in revenue, 1.2B shares outstanding with some dilution from today), projecting a bit of a slowdown as new productions and expansion ramps up. Thus, its valuation still is quite high compared to peers, a 37x PE and a 5x EV/sales; obviously, the premium for growth does exist, but Tesla is not untouchable, and can’t fully withstand the breadth of competition it faces over the course of the decade. A 10% cut to that margin forecast, projecting 2025’s margins equal to today’s at 13.5%, puts Tesla earning about $17.70, a 42x forward PE from today.

The downside risk to Tesla stemming from a margin slowdown outweighs the growth potential in the current macro environment, as the Fed moves ahead with rate hikes. In the broader industry, parts shortages halting production and increasing costs will impact margins and profitability, while newer players like Lucid and Rivian will struggle to initially scale. Raising cash may come at a higher cost as well. Missing estimates to deliveries or profits/revenues is likely to be met negatively.

Outlook

As the EV industry progresses forward, downside risks to valuations as EVs move to take majority market share presents a long-term headwind to returns on the investment. EV infrastructure players do not see the industry being that profitable in the near-term, and infrastructure is vital to accelerate adoption. OEMs may struggle to hold on to currently ‘high’ margins in the teens, and could see margin declines stemming from increased competition leading to lower operating leverage and thus slower earnings growth than expected. While it still may be almost-certain that EVs can take the auto industry by storm, the investment case in EV OEMs such as Tesla, Lucid, Rivian, and others, and ICE leaders transitioning to EVs, looks bleak at the moment.