Hello my names is james,I’m photographer./iStock via Getty Images

Thesis

Under the current conditions, both BHP Group (NYSE:BHP) and Rio Tinto Group (NYSE:RIO) provide far more attractive investment opportunities than the overall market. The following graph serves as the foundation for the main argument in this article. This chart is also THE road map we use to choose our stock holdings (and also used in our marketplace service).

You will see from this roadmap and the remainder of this article that:

- Both are projected to provide double-digit returns in the long-term under their current conditions. BHP is projected to return about 12% annual return (“ROI”) and RIO even higher at about 15%, while the overall market is only about 6%.

- The fundamental reason is both BHP and RIO have superior ROCE (return on capital employed). Their ROCEs are both in the range of about 30%, higher than the overall market by 10% (or ~50% in relative) terms. Such higher ROCE gives them the ability to grow faster and return more cash to shareholders, leading to far superior total returns.

- We also will detail the reasons why favor RIO more. As mentioned in our earlier article on RIO published on April 29, we think RIO is a strong buy below $70. And our limit buy order was triggered at $70 during that time thanks to market volatility. We have been accumulating RIO shares since then with an average cost of around $67/share. As you will see, the primary reasons we favor RIO more are A) its profitability level and prospects are identical to BHP, B) but it features a stronger balance sheet, and C) yet it trades at a heavily discount valuation compared to BHP.

- Finally, we want to emphasize that there is nothing wrong to hold both. We like both. And we hold one only because of our own preference for a simpler and more concentrated portfolio.

Author

How did we build our roadmap?

The key in building this road is to think like a business owner, not a stock trader. As detailed in our earlier article:

- The long-term ROI for a business owner is simply determined by two things: A) the price paid to buy the business and B) the quality of the business. More specifically, part A is determined by the owner’s earning yield (“OEY”) when we purchased the business. And that is why PE is the first dimension in our roadmap. Part B is determined by the quality of the business and that is why ROCE, the most important metric for profitability, is the second dimension in our roadmap.

- Now, the long-term growth rate is governed by ROCE and the Reinvestment Rate. These are the two most important growth engines, and they mutually enhance each other. High ROCE means every $1 reinvested can lead to a higher growth rate, which leads to more future profits and more flexible capital allocation to fuel further growth, and so on. So to summarize:

- Longer-Term ROI = valuation + quality = OEY + Growth Rate = OEY + ROCE*Reinvestment Rate

The remainder of this article will show how the above roadmap applies to BHP and RIO.

Profitability

As you can see from the following chart, the profitability comparison between these two leaders is a bit nuanced and ultimately involves some subjective judgment. My overall verdict is that they are equally profitable even though there are variances among the different metrics. For example, BHP enjoys a much higher gross margin of 85.2% than RIO’s 49.4%. However, RIO made it up with a much higher net income margin of 33.2% compared to BHP’s 24.8%. To put things under perspective, the average profit margin for the overall economy fluctuates around 8% and rarely goes above 10%. And both RIO and BHP’s net margins are more than 3.3x and 2.5x than the overall market. For us, we think the almost identical return on total capital (27.7% for BHP and 27.1% for RIO) is more telling than the other metrics for these two similar mining businesses.

Seeking Alpha

In addition to return on total capital, also, we want to see a more fundamental measure over a longer period of time. And as explained in our earlier writings, to us, the most important profitability measure is ROCE because it considers the return of capital ACTUALLY employed.

As seen, their ROCE have tracked each other in lock-steps over the years because both correlate to commodities prices closely. In recent years, their average ROCE has been almost identical: around 27% for RIO and around 28% for BHP. Also, note that their average levels of ROCE are almost the same as their return on total capital mentioned above, indicating that all their capital is currently efficiently employed, i.e., there is no idle capital.

Author using Seeking Alpha data

Looking forward, we like the profitability and growth prospects from RIO a bit better, as RIO CEO Jakob Stausholm commented below (the emphases were added by me). And I will elaborate on the implications of these comments on capital allocation and shareholder returns in the next section.

Turning to our financials. Our results were very strong. They demonstrate both the quality of our assets and the strength of our business model. We are firing on all cylinders in terms of our financial performance. Each of our 4 product groups were highly profitable, achieved significant EBITDA growth and double-digit return on capital employed and delivered strong free cash flow. Our iron ore business continues to be the primary contributor. But we also benefited from an increased contribution from the other 3 product groups, not least aluminum that recorded 20% return on capital employed in the second half of 2021, up from just 3% during 2020. In aggregate, we achieved the strongest financials in our history with EBITDA of $38 billion and net earnings of USD 21 billion. A highlight for me comes when you compare to base results with our performance during a similar period of strong demand and high commodity prices a decade ago.

Financial strength and capital allocation

As mentioned in the CEO comment above, RIO’s profitability during this round of the commodity cycle is even better than the last round 10 years ago. This suggests more efficient operation and better assets to me. Thanks to such record profitability, its balance sheet strength is also near a peak level in a decade. Do not get me wrong here. BHP also boasts a strong financial position at this point. It’s just as you can see from the following comparison, that RIO is even stronger. First, RIO sits on a larger cash position of $15 billion (or $9.5 per share) versus $12 billion for BHP.

Second, RIO also carries a lower debt burden than BHP ($11.4 billion long-term debt vs $13.6 billion for BHP).

And then you have to consider that ROI is a bit smaller than BHP in total size ($120B market cap vs $158B). As a result, the differences in financial strength become even more pronounced in relative terms such as total debt to equity ratio (RIO is at 23.9% compared to BHP’s 36%, almost 1/3 lower), quick ratio (RIO is about 1.46x compared to BHP’s 0.86, almost 1.7x higher), and long-term debt to total capital ratio (RIO is about 17.6% compared to BHP’s 22.3%, almost 22% lower).

Seeking Alpha

In our view, RIO’s profitability and balance sheet strength also translated into better shareholder returns. As RIO CEO Jakob Stausholm commented (the emphases were added by me),

In 2021, we converted a far higher proportion of strong commodity prices into earnings. And subsequently, because of our strict capital allocation, we converted the earnings into far higher free cash flow. This enabled us to declare record dividends of $16.8 billion, a 79% payout ratio. This performance reflects our tight cost control, disciplined capital allocation and the fact that our balance sheet is the strongest it has been for at least 15 years.

All told, a larger portion of RIO’s returns is supported by current dividends, which is what we prefer to see in our conservative holdings. RIO currently pays a 10.8% yield on a TTM basis, a whole 100 basis points above BHP’s 9.8%. In the past 4 years, RIO’s average dividend yields have been around 9.4%, almost 260 basis points above BHP’s 6.8%.

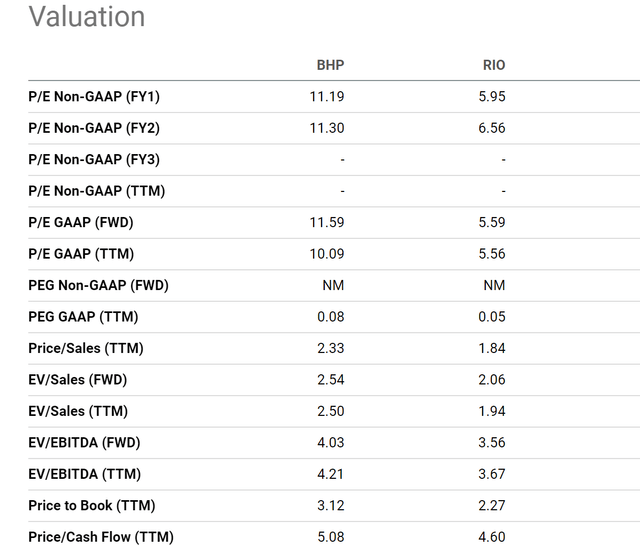

Valuation

Despite identical profitability and stronger financial strength, RIO is currently trading at a substantial discount compared to BHP. As you can see from the following chart, the discount is too large and cross too many metrics to ignore. Take the forward PE as an example. RIO is trading around 6x of its FY1 earnings, while BHP is at 11.2x, a discount of almost 50%. In terms of topline metrics, RIO is trading at 1.8x sales and BBHP at 2.3x. But remember that we’ve mentioned before that RIO’s net profit margin is actually higher than BHP’s. Yet, RIO’s sales are valued at an almost 20% discount. Finally, in terms of cash flow multiple, RIO is valued at 4.6x, compared to almost 5.1x from BHP, again a sizable discount of about 10%.

Seeking Alpha

Final verdict

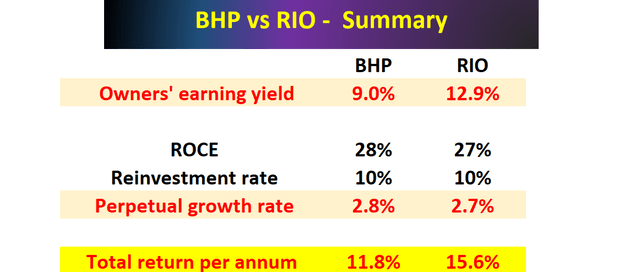

Due to their valuation differences as aforementioned, the OEY (owners earning yield) is ~9.0% for BHP and about 12.9% for RIO. Note that here I used the free cash flow (“FCF”) as a conservative approximation for the owners’ earnings.

The growth rate is projected to be about the same for both BHP and RIO given their similar ROCE and capital allocation priorities ahead. BHP’s reinvestment rate is projected to be 10% and its growth rate is projected to be about 2.8% organically (28% ROCE * 10 % reinvestment rate = 2.8% organic growth rate). And RIO’s organic growth rate is similar (2.7%).

As a result, the total return is projected to be about 11.8% for BHP and 15.6% for RIO. And this brings us back to the roadmap. The overall market is currently valued at about 26.4x PE, resulting in an OEY of about 3.8%. The overall market’s ROCE on average 20%. And assuming the same 10% reinvestment rate, the growth rate would be about 2%, leading to a long-term ROI of about ~6% per year only.

Author

Final thoughts and risks

Both BHP and RIO are far more attractive opportunities than the overall market. Especially during our current time, BHP and RIO, as two of the leading commodity stocks, provide an excellent hedge against inflation. We ourselves favor RIO and started accumulating RIO shares recently whenever prices dipped below $70 (and whenever we have funds). There is nothing wrong to hold both. The main reasons we hold RIO only are:

- Our personal style is a concentrated portfolio with few stocks. And we limit our holdings to one per sector typically.

- Despite its comparable profitability and stronger balance sheet, RIO trades at a heavily discounted valuation. Its FY1 PE is almost at a 50% discount compared to BHP. As a result, it provides a higher long-term total return potential (15.6% compared to 11.8% from BHP).

- A larger portion of RIO’s returns is supported by its current higher dividends (10.8% dividend yield vs 9.8% from BHP). Ultimately, safety is what we prefer to see in our conservative holdings.

There are a few risks to consider though for both BHP and RIO:

- Both BHP and RIO are under the pressure of inflation and costs control themselves. Due to a combination of the COVID pandemic and inflation, both BHP and RIO are dealing with labor shortages, higher energy costs, higher operation expenses, et al.

- The CAPEX may not materialize due to labor shortages and supply chain congestions. For example, In RIO’s case, it upgraded its CAPEX guidance in the Pilbara. But it may not be able to actually spend the money.

- Finally, in the longer term, both face uncertainties in terms of our world’s focus on environmental sustainability and renewable energies. Both have been asked why they are not investing (or not investing enough) in green energy like solar and wind farms. I tend to agree with their strategy as exemplified by BHP CFO David Lamont’s comments below (the emphases were added by me). However, policymakers and environmental groups may not agree. And policy or regulation changes can be unfavorable to both.

So if you look at the renewable energy space, we certainly think the best thing that we can do to help the decarbonization and that energy transition is continue to mine effectively copper, which goes into the solar side of things and is critically important. And we also continue to support the steel industry, which is paramount into the wind farms. And we think by doing that and looking at our capabilities, which are far more orientated towards mining, gas and oil rather than infrastructure, we’re going to get a better payback than actually going into those areas.