Marc Mueller/Getty Images Entertainment

The current case within the broader auto industry is that parts shortages and Chinese lockdowns have continued to impact production, with Toyota (TM) the most recent to halt production in Japan, with other high-profile names such as Ford (F), Tesla (TSLA), GM (GM), Stellantis (STLA) and others all facing similar impacts since the start of the year. As such, vehicle production and sales have taken hits, especially in China, which saw a staggering decline in April. As these OEMs face increasing competition and potential margin pressures, turning to a select group of EV component suppliers provides safety in value-driven picks with some dividend safety.

Continental AG’s (OTCPK:CTTAY)(OTCPK:CTTAF) results reflect that parts and component demand is strong, and solid growth potential stemming from both EV and ICE, capitalizing off of both opportunities, and outlets in the vehicle-software realm are long-term positives. Underlying headwinds of cost inflation and increased transportation and logistics costs and delays remain major challenges — projected at ~€3.5 billion for 2022. Even with headwinds likely persisting early in to 2023, Continental’s attractive valuation and limited downside risk provide an opportunity to tap into EV growth via a profitable, dividend-paying investment.

Headwinds, Headwinds

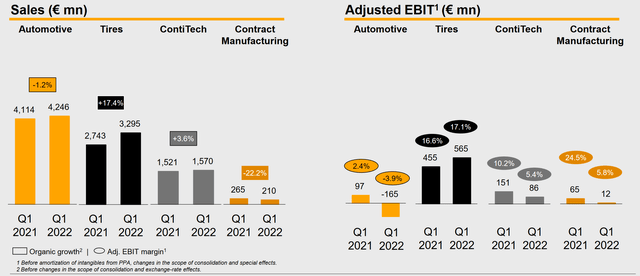

Conti noted that “cost increases” and “inflation headwinds” were present in its reporting segments, but Conti still eked out an 8.2% y/y increase in consolidated revenues on the backs of strong demand and a robust order backlog. Bottom-line performance struggled: net income slumped 45.3% y/y, with FCF nearly half a billion lower than the year ago quarter. Tires drove results, up 17.4% y/y as EBIT margin expanded 50 bp to 17.1%.

Continental Q1 Sales and EBIT Performance (Continental AG)

Although adverse effects from cost inflation “are becoming significantly more material,” Conti still has a strong year ahead — it’s projecting a marginal bump in sales to €38.3 billion to €40.1 billion, with a 3% boost to Tires revenue guidance, and a ~4% boost to ContiTech. However, margins are expected to shrink, with EBIT margin down 80 bp from the prior forecast to 4.7 to 5.7%.

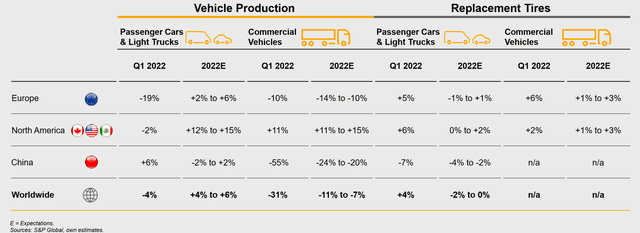

Looking forward, Q1 and especially Q2 look to be the worst of the worst for Conti — Q2 is setting up a major challenge for results, but production and tire volumes are expected to recover substantially in 2H. Note China’s recovery in commercial vehicles, and Europe’s strong recovery from a 19% decline to an estimated +2% to +6% increase for 2022 in passenger vehicles.

Continental Vehicle Production, Tire Forecasts (Continental AG)

With the most challenging operating environment soon to pass (even with some adverse effects persisting), Continental’s attractive valuation, numerous growth opportunities across ICE, EV and in tech, and a dividend present a potential opportunity to seize the weakness for long-term growth.

Conti pointed to a handful of areas for future growth in its earnings presentation, and those underscore long-term tailwinds to growth.

Autonomous Mobility, ADAS

Although the segment recorded a small half-billion revenue sum for the quarter, autonomous and semi-autonomous capabilities (such as ADAS) are quickly evolving as major OEMs challenge each other in the tech — for example, Mercedes (OTCPK:DDAIF) unveiled its level-3 ADAS DrivePilot in Germany, with sales commencing last week; Honda (HMC), GM (GM), BMW (OTCPK:BMWYY), Ford (F), etc., the major players with volume are implementing ADAS in vehicles, which serves as a tailwind for Conti and ADAS tech suppliers as the systems are growing substantially in volume.

Conti noted it has “new launches, especially in the second half of this year in the autonomous mobility and VNI,” which should translate to improved growth pushing into ’23 and extending into ’24 with radar and camera volumes expected to grow alongside the growth in ADAS-equipped vehicles, as both ICE and EV OEMs scale up (such as the new players Rivian (RIVN) and Lucid (LCID)). Take Lucid, which sources products for its DreamDrive ADAS from Conti and peers — as it scales from hundreds to tens of thousands of vehicles by 2025, the volume growth from vehicles equals near exponential growth for camera, radar and lidar units.

Autonomous mobility does not just include cars, however; Conti is working to deploy autonomous mobile robots in factories, with series production recently beginning in a market that is on the verge of exploding as warehouses seek to automate to increase and improve efficiency.

ADAS – a part of autonomous driving, Conti’s products in ADAS, including cameras, radars, lidars, HPC [high-performance computers], ECUs [electronic control units], and other sensors are poised to potentially see tremendous growth, again, as ADAS-equipped vehicle volumes begin to increase. OEMs competing on the tech front are essentially competing on ADAS and in-vehicle computing power (check Nio (NIO) vs. XPeng (XPEV), Tesla (TSLA) vs. Mercedes, Nvidia’s (NVDA) involvement with DRIVE Orin). A single vehicle can include dozens of these different products, and thousands of units of volume and more design and contract wins can solidify significant growth in the segment.

Various ADAS projects are part of Conti’s €5.8 billion order book, signaling that OEMs are beginning to hop on board with the company.

Connectivity, Display Solutions

An oft overlooked segment, Conti’s connectivity business helped offset some weakness in the Vehicle Networking and Information segment [VNI]. As mentioned in autonomous mobility, VNI is expecting new launches in 2H, which should translate to more strength in connectivity.

In addition, vehicle display solutions (dashboard screens) holds a €2.5 billion lifetime sales opportunity just from two orders. Note that while the revenue is lifetime, it demonstrates the depth of the order book and potential long-term revenue generation that could be captured if more orders are secured. Some display solutions in launch include BMW, Renault, and Great Wall Motor. Another German OEM (possibly VW for its MEB EV platform) and Asian OEM are expected to see display solution order production commencing in 2023.

5G connectivity and V2X communication are two other bright spots to watch for the future – as autonomous mobility rolls out within vehicles, 5G connections are necessary to support vehicular communication and improve safety. Fully autonomous vehicles, with much higher data and communication needs, are substantially more reliant on V2X and 5G to facilitate real-time data transfer and V2V communication, pedestrian identification, and ultimately the vehicle’s ability to drive itself. Conti’s ability to grow within these fields offers a significant long-term opportunity as the future of mobility (enhanced V2X communication, autonomous mobility) rolls in.

Tires

What may seem like quite a basic, simple segment is actually a cornerstone for growth, and much more complex than it seems. Conti’s Tire segment saw strong double-digit growth even as vehicle production declined as aftermarket replacement volumes remained strong. Increased guidance in the segment and a fair 12% to 13% EBIT margin reinforce Conti’s view of a favorable recovery in the segment as production volumes recover in Q3 and beyond (barring any unforeseen production halts/shortages).

Regardless of how quick ICE vehicles are phased out, or how quickly EVs and autonomous vehicles erupt, Conti’s tire business will always find an end market. Tires are not exclusive to a certain type of vehicle – Conti supplies motorcycles, passenger and commercial vehicles, bicycles, and more – meaning that growth outlets always exist. As shown in Q1, it’s not just new production that defines tire growth, but also aftermarket demand and volume. Serving a strong aftermarket with high demand for replacement parts, in light of a surge in new and used vehicle prices leading to consumers keeping vehicles longer and repairing/replacing more parts, serves as a strong tailwind for the segment.

In addition, innovation in tires, such as what Conti calls “autonomous tires”, or tires equipped with sensors, can transform vehicle maintenance and save fleets (such as AV fleets) time and money via predictive maintenance. These tires can alert drivers when maintenance is needed, improving the safety of the driver/occupants, reducing the risk of failure, while also demonstrating the capabilities of V2X tech and creating another outlet of growth via aftermarket repairs.

Earnings, Dividend and Attractive Valuation

Assuming a slight recovery through 2H and a similarly challenging Q2, Conti’s net margin is likely to end the year depressed from last year’s 4.3% at around 2.8% (potentially 2.95-3.05% depending on the scope of price increases). Definitely a sharp drop, but given the challenging macro environment, vehicle production, industry and inflationary headwinds, a decent performance nonetheless.

A 2.8% net margin on about €39.5 billion in revenue translates to about €1.1 billion in net income. This represents around a 25% decline y/y from FY21’s €1.45 billion earned; while a 25% decline seems like a bit of a warning sign, Conti has made it through the most challenging quarters of the year, and has recovery in sights, aiding a recovery in earnings in the back half of the year and for FY23 and FY24.

Given Conti’s dividend policy for a 15% to 30% payout, net income of €1.1 billion could translate to €165 million to €330 million in a payout. Compared to FY21’s €440 million payout, another substantial decline. However, at those levels, Conti’s annual dividend would be €0.83 to €1.50. With the approval of the €2.2/share dividend for FY21, expectations for another near 30% payout ratio approval seem likely, assuming net margin does not fall below 2.8% for the year. At a ~€1.5/share dividend for the parent, Conti’s ADRs (OTCPK:CTTAY) can yield €0.15/share, or an ~2% yield.

For the long term, recovery in earnings above FY21’s levels to a net margin on 6-7% supports a substantial boost to Conti’s dividend. For example, say Conti generates €45 billion in sales in FY24, and nets 6% — that implies net income of €2.7 billion, nearly double FY21’s figure, and implies a dividend near €0.40/share, which would be an impressive ~6% yield on cost to today’s share price.

On the valuation side, as the market tumbles, Conti’s relatively low valuation even amidst falling profits seems to offer some downside protection, and limited downside risk. With €1.1 billion in net income, or ~€0.55/share EPS, Conti trades at about 13x earnings. Given the expected recovery in business segments, a projected ~2% dividend with dividend and net income recovery over the next couple years, and opportunities aplenty in emerging vehicle technologies supporting margin expansion to a long-term 6% rate, Conti’s valuation picture looks quite positive for an investment.

Outlook

Conti is in an interesting situation as vehicle production has suffered, with a strong aftermarket sending tire sales soaring by double-digits. Another challenging quarter is due in Q2, but signs of a recovery are emerging, with Conti forecasting a relatively flat end-of-year after substantial declines, suggesting a quick recovery in vehicle production, aiding demand and sales. Conti’s growth outlets are plentiful, as tires remain solid, autonomous mobility and ADAS wins starting production and revenue generation this year through FY24 and beyond, and a strong order book in display solutions with more opportunities ahead supporting a diversified portfolio of products. Conti’s recovery in earnings and dividend policy support a ~2% yield for 2022, even in a challenging environment, and a ~13x P/E and 0.5x EV/sales alongside that yield offer downside protection in a volatile, choppy bear market with upside potential in both earnings and dividends looking to drive long-term upside.