Valerii Apetroaiei/iStock via Getty Images

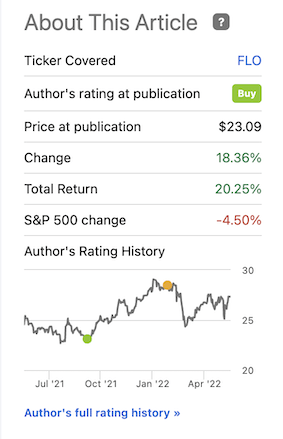

My late 2021 article on Flowers Foods (NYSE:FLO) back when I still was positive about the company, showcases exactly what can happen when you buy a company cheap. The follow-up then shows you what happens short term when you buy too expensively.

Flowers Foods Article (Seeking Alpha)

In this article, we’ll give an update to Flowers Foods to see what makes this company a relatively clear “HOLD” at this time.

Revisiting Flowers Foods

Flowers Foods is a great business. It deserves a lot of the premium it has and gets. Why? Because it’s the #1 loaf, organic, and gluten-free bread brand, gaining market share in stable categories of products that are and will continue to be bought for the foreseeable future. The US fresh bakery market is a retail market with $24B of annual sales. It’s also one of the most profitable categories for retailers, where consumers are historically willing to pay premiums.

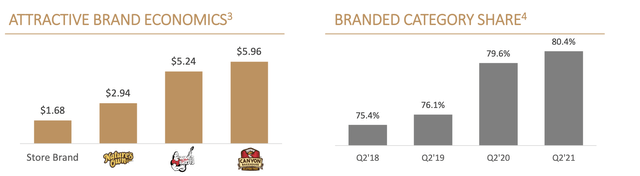

98% of US households buy from the “bread” category every 12 days. And this is where the company operates. It’s also one of the few categories of products where store brands have yet to even come close to overtaking branded. As a matter of fact, the trends show the exact opposite development.

Flowers Foods Presentation (Flowers Foods IR)

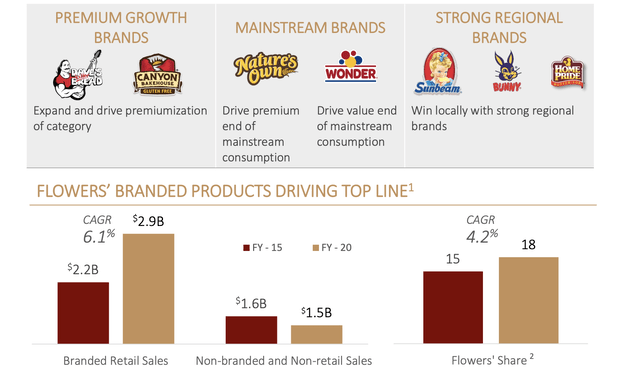

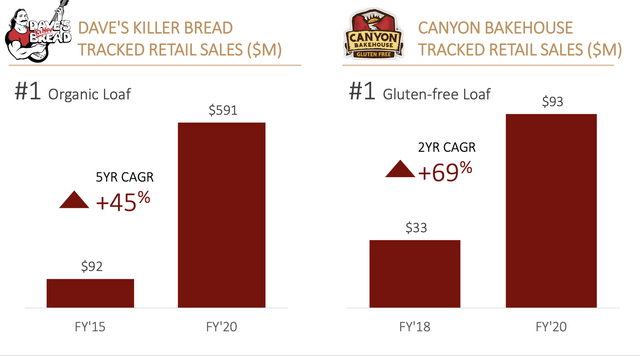

The company operates one of the most appealing brand portfolios in the entire space. It has massively premium growth brands, such as Daves and Canyons, the #1 mainstream bread brands, and also comes with a strong regional brand portfolio. Where other operators in other sub-segments have failed, Flowers has clearly succeeded in pushing its brand advantage.

Flowers Foods Presentation (Flowers Foods IR)

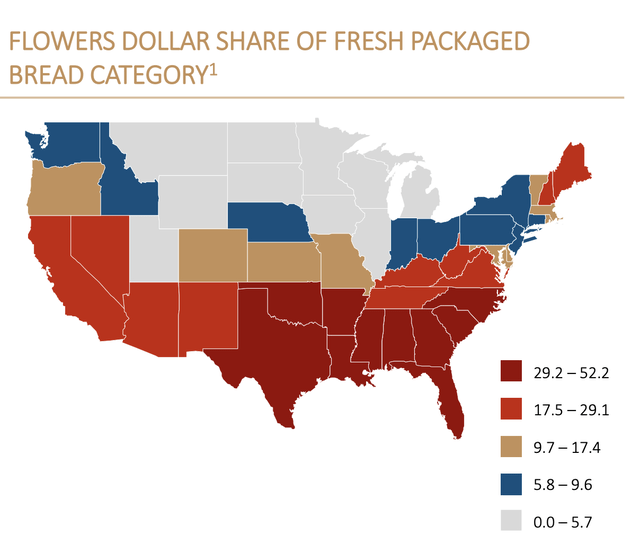

The company has a very strong geographical foundation, being home in Texas and the southeast of the USA, and you can virtually follow the company’s geographical expansion path as it slowly moves northward, capturing new and interesting geographies on a yearly basis. As of now, the company’s products are found and represented in more states in the US, than states it’s not found in.

Flowers Foods Presentation (Flowers Foods IR)

The company is also starting to expand using e-commerce, which at the latest was above 9% of omnichannel sales, driven in no small part by COVID (more than double to pre-pandemic numbers).

The company has been working to lessen its dependency and focus on store-branded retail products in favor of its own branded retail products. This strategy has been significantly driving margins. As I said, people are willing to pay premiums for good bread – myself included. That’s why margins are almost 200 bps higher on an EBITDA basis compared to 2 years ago, and why the sales mix has shifted to much more branded retail (over 66%) as opposed to store brands (less than 15% now).

Bakeries and bread companies of course face intense cost inflation and SCm challenges, requiring centralized procurement strategies, leased labor to save costs, saving on ingredients – which isn’t even going into distribution efficiencies, inventory rationalization, and a great deal of overhead.

Flowers Foods is also one of the most effective M&A’eers in the entire space. Just look at what it has done with its two massive premium businesses.

Flowers Foods Presentation (Flowers Foods IR)

This is a company that I really enjoy investing in – the unfortunate fact is that has been a hard thing to do for the past few months. Many investors have seen FLO with as favorable a view as I myself have, seeing the company as a safe bet in an unsafe world. This brings with it a certain premium, and this is an issue.

1Q22 was excellent. Food is food, and despite inflation and other global issues, people need food and people need bread. The company reported unchanged trends, including strong sales, and gains in market share for its premium brands.

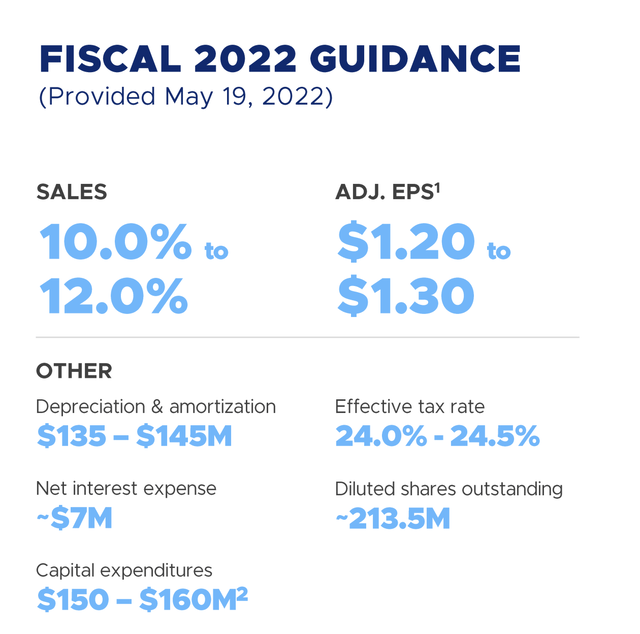

FLO has also aggressively met the ongoing inflationary trends by bumping prices – and is guiding for increased revenues, if only to offset inflation, while expecting somewhat lower actual earnings and cash flow due to – you guessed it – inflation and supply chain disruptions.

Unless some companies, FLO does not expect to be fully able to offset costs and issues with simple price increases on a full-year basis.

For the quarter, sales increased by 10%, and adjusted EBITDA was up 2.4%, but margins were down from record-breaking 12.5%. For the time being, the company is able to offset cost increases, but due to the macro situation the company expects this to change, to where the YoY EPS increase from 2021 is only up to 6 cents on a diluted GAAP EPS basis.

This the official guidance the company delivers for 2022.

Flowers Foods Presentation (Flowers Foods IR)

If the company manages to deliver this, it will still be a good year for Flowers Foods. I don’t see much risk in that they’ll be able to do just this, but the fact is that risks and uncertainties have increased. The company’s overall market share is extremely sticky at 17-18% – it hasn’t shifted for 2 years, and market share in cakes has remained steady as well, with organic sales showing a nice increase since 2017, and gluten-free sales up almost 6X since 2017.

More importantly, and what I want to focus on, is that FLO is successfully pushing its branded, higher-margin products. A few pps of increase might be a fluke, but we’re talking about a multi-year sales growth trend that have brought branded to an 81% sales share from 75% in 2017. This is not a fluke – it’s very clearly indicative of fundamental consumer trends and preferences.

This builds what I see as a very attractive base case for FLO, but one we must look at through the lens of valuation.

Flowers Foods Valuation

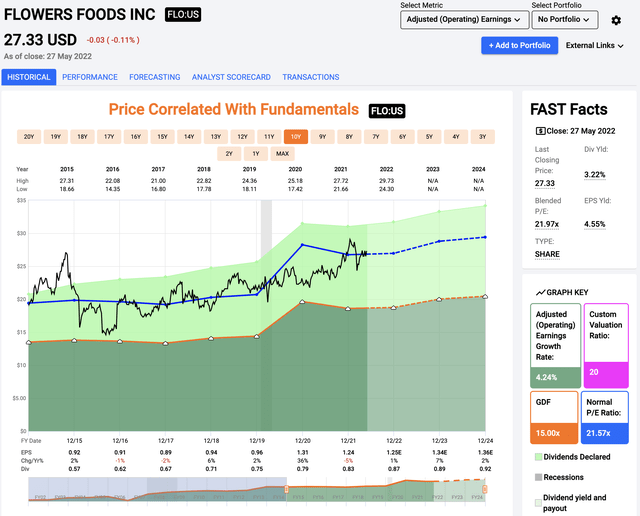

And here we run into a couple of issues. Flowers Foods trades at a premium. That’s not the issue – the company deserves as much, as I see it. The problem is that since early 2021, that premium has expanded to where it’s now above 21X P/E, and approaching 22X, even if we include an EPS growth for 2022.

That’s a bit much for my preferences. I bought FLO closer to 15X P/E, and at any time in the company’s last 10-year history that it was bought at over 21X P/E, it was a bad deal, if we look at market trends. If bought at, or below 14-18X P/E, that’s a different story, with the investment providing investors market-beating growth.

Flowers Foods Valuation (F.A.S.T graphs)

Even if we assume outperformance to a 22-23X consistent premium forward P/E, and this would not be in the company’s historical trend, all we get is between 6-9% annualized RoR. Not exactly something to be excited about, and certainly not something to go out of our way to invest in.

Flowers Foods is a company best bought at most at fair valuation. That valuation, if you really push it, is 19-20X P/E.

I’m completely unwilling to pay more, and even if we average out future earnings until 2024E, that indicates a price of no more than $26.5/share – and that’s the higher end. I’d personally prefer no more than $25/share.

My position in Flowers Foods has delivered annual outperformance since I bought it – but it has done so because I bought it cheaply.

Valuation targets for this company have remained very steady during the course of the pandemic. Current average price targets have the company targeting $25.5/share (Source: S&P Global), which notes a downside from today’s share price. I would agree with this price target, which by the way hasn’t shifted substantially since the onset of the pandemic.

For this reason and this reason alone, I sadly cannot consider Flowers Foods a “BUY” at this particular time. Everything I do is, in the end, centered around attractive valuations. And those valuations need to be “met” in order for me to make the returns I’m looking for.

Flowers Foods at over $27/share, cannot meet those required targets.

I consider the company a “HOLD”.

Thesis

My current thesis on Flowers Foods is:

- The company is a qualitative defensive consumer business with a clear downside for the next few years based on conservative valuation.

- Still, with the market in overvaluation and instability, I view defensive and conservative companies favorably and Flowers Foods is certainly one such business – at the right price.

- Based on a 20-21X P/E premium price target, I view Flowers Foods as currently overvalued and a “HOLD” with a $25.5/share PT.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Flowers Foods is currently a “HOLD”.

Thank you for reading.