jetcityimage/iStock Editorial via Getty Images

Since I wrote my “avoid CSX Corporation” (NASDAQ:CSX) article just under 6 months ago, the shares are down about 15.75% against a loss of 17.85% for the S&P 500. I thought I’d revisit this name for a few reasons. The most important of these is that this gives me the chance to brag, and a fragile ego like mine never passes up such an opportunity. Far less important than my strong desire to take a victory lap is the fact that what was a bad investment at $35 may be a great one at $29.30, so I’ve got to fire up my computer machine, and spread some virtual ink around my virtual page as I try to answer the question of whether or not it makes sense to buy CSX at current prices. In this article, I’ll try to make that determination, and I promise that I’ll try to avoid bloated sentences like the one I just subjected you to. I’ll make the determination by reviewing the recent financial history, paying particular attention to the $1 billion the company spent buying back stock. As is my wont, I’ll look at the stock as a thing distinct from the underlying business. I also recommended selling put options previously, and I am champing at the bit to brag about that trade, too.

It seems a fact of modern life that we’re all much busier now than our ancestors, in spite of the fact that we are surrounded by time-saving devices. I try to be empathetic to the needs of my readers, so I offer a thesis statement paragraph at the beginning of each of my articles. I do this for the benefit of people who somehow skip the title and the bullet points above. You’re welcome. I think CSX is a wonderful business, and I like the fact that revenue and profits were up nicely over the most recent quarter relative to both last year, and the pre-pandemic era. I think the buyback was a mistake, given that shares were retired to treasury at a relatively rich valuation in my view. Also good is the fact that the valuations are much more compelling than they were when I last reviewed the name. The problem is that “more compelling” is not the same as “compelling”, so I’ll remain on the sidelines.

That said, I am willing to sell more of the puts I wrote previously. In particular, I like the January 2023 puts with a strike of $27.50. These offer a 6.2% yield for seven months of what can only be very loosely described as “work.” While these may not offer the greatest returns, they offer the greatest risk-adjusted returns in my view, and that’s what this is all about.

Financial Snapshot

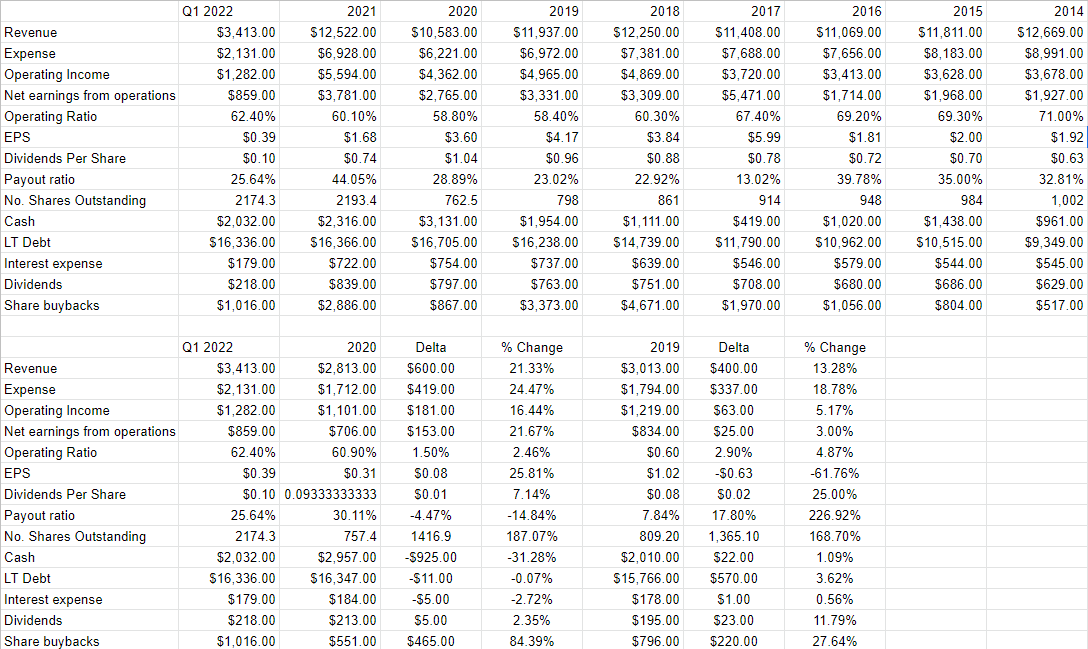

The first three months of the year have been rather good for CSX in my opinion. Revenue and net income were both up over 21% relative to the same period in 2021, and the capital structure improved somewhat with long-term debt down just under 1%. As a result of this performance, the company raised its dividend by 7% from last year to this (please note that in the table below, I’ve adjusted the dividend per share figure to reflect the 3 for 1 stock split announced in early June of last year).

When we move our focus beyond the immediate, we see that things are better now than they were in 2019. The top line is about 13% higher, and net earnings from operations are up by about $25 million, or 3%.

While the company returned $218 million to shareholders in the form of dividend payments during the first quarter, it spent 4.6 times that figure ($1.016 billion) on buybacks. Just over $1 billion is a significant amount for a company with $16.33 billion of debt is a significant amount of money, so I want to spend some time writing about it.

Reviewing The Repurchase

From note 2 of the company’s latest 10-Q, we learn that the firm spent $1.016 billion buying back 29 million shares. Using the arithmetical skills not so lovingly imparted to me by the good sisters at Holy Spirit School many, many, many decades ago, I calculate that they bought these shares back at an average price of $35.03 per share.

I’m initially quite neutral about that figure. This $1 billion may or may not have been well spent, depending on the valuation the shares were retired at. While some investors describe a buyback as being “good” if it happens at a price below the current market price, and “bad” if it happens above the current market price, I take a different view. This is because I’m of the opinion that we shouldn’t hold the current market price up as some gold standard of truth. This is why we’re all here, isn’t it? Because we want to take advantage of the disconnect between the current price, and a longer-lasting truth?

Anyway, I judge the quality of the decision based on the valuation at which shares were retired. If the company managed to retire them at a decent valuation, that’s good. If it bought back shares at morbidly elevated levels, that’s very bad. Thus, I’ll just keep this $35.03 price in my increasingly tenuous memory and will revisit it when I write about the stock valuation.

CSX Corp. Financial History (CSX Corp. investor relations)

The Stock

It seems that I have attracted many new followers recently, which prompts a few responses from me. First, welcome. I’m flattered, I guess. Second, for you new people I’ll point out something I’ve droned on about for years. I apologize to the people who boarded the Doyle train years ago, but I need to bring the newbies up to speed. I am of the view that the business and the stock are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company (Microsoft (MSFT), for instance) can be a terrible investment at the wrong price. Not to pick on Microsoft, but I think the people who bought the stock at the beginning of the year and are down about 27% year to date would agree with me on this point.

Another way to conceive of this idea is that business is an organization that buys a number of inputs, performs value-adding activities to those, and sells its “thing”, whether that “thing” be transportation services, wine and spirits, software, or whatever else at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. The crowd is capricious and changes its views about the company relatively frequently, and these changing views drive the share price up and down. Added to that is the volatility induced by the crowd’s views about a given sector (Walmart (WMT) goes up or down if Target (TGT) has a good or bad quarter). Add to that the fact that a company’s stock can be buffeted by our collective view about “stocks” as an asset class, and we see that the stock is often a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. I don’t know about you, but I get the sense that people are feeling particularly down in the dumps at the moment.

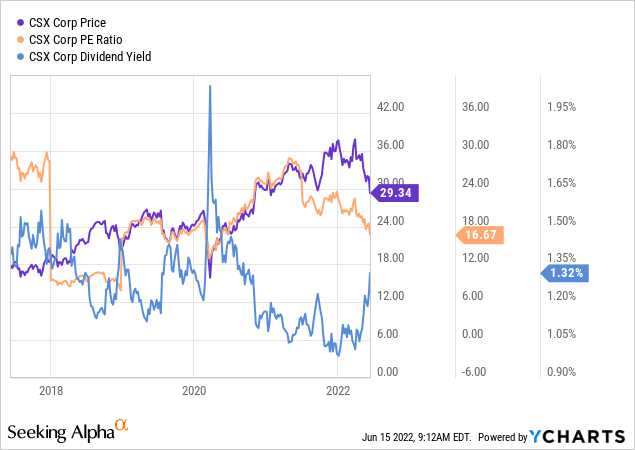

Those who read my stuff regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. In my previous missive on CSX, you may remember that I got a bit salty when the P/E on this stock hit a multi-year high of 22.17 and a multi-year low dividend yield of 1.06. I clutched my pearls over this valuation, because, as I noted at the time, it was in the teeth of much lighter freight traffic. We see from the chart below that the shares are about 24.5% cheaper on a P/E basis, and, coincidentally enough, the yield is 24.5% higher.

In addition to the simple ratios described above, I want to try to work out what the market is currently “thinking” about a given company’s future. If the market assumes a growth rate that is too optimistic, that’s a bad sign in my view, because great expectations are often dashed, with predictable results for the stock. On the other hand, if the market is overly pessimistic about a company’s future, that’s a very good thing.

The way I work out what the market is assuming about the future is to take a standard finance formula and isolate the “g” (growth) variable. This requires the magic of high school-level algebra, but it is a useful exercise in my view. By doing this, you’re mining the current price itself for information. If you’re interested in playing at home, I would strongly recommend picking up a copy of “Accounting for Value” by Penman and/or “Expectations Investing” by Mauboussin and Rapport. The former is a bit more academically dense, the latter a bit more breezy and accessible.

Anyway, when I apply this method to CSX at the moment, I see that the market is assuming something like a long-term (i.e., perpetual) growth rate of ~5% here. While that’s cheaper than the 6% growth rate when I last reviewed this name, it remains elevated in my view. Given the above, I’m neither bullish nor bearish on the name. I’d certainly be willing to buy at a (slightly) more compelling valuation, which is where short puts come in.

Options as Alternative

I hope you appreciated the smooth transition from “the stock” section to “the options” section of this article. That’s just one of the many value adds I try to offer you readers with my articles.

Anyway, in my previous missive, I offered up a very thinly veiled brag when I pointed out that I had to that point earned $16.80 per share in options premia selling put options on this name over the years. In my previous missive, I recommended adding to this return by selling the January 2023 puts with a strike of $27.50. I ended up selling 5 of these for $1.39. In spite of the fact that the shares have dropped fairly massively, these are currently priced at only $1.70-$1.90. So, the trade is “under water” at the moment, but not egregiously so in my estimation. The trade remains compelling to me, and so I’m recommending repeating it this morning.

I consider it to be a win-win trade, because the results are very good no matter the outcome. If the shares fall below $27.50, the put seller will be obliged to buy, but will do so at a price another 6% below the current level and at a dividend yield of about 1.5%. If the shares remain above this price, the put writer will simply pocket the $1.70 per share in premium, which is also a decent outcome.

Now that I’ve hopefully enticed you with the prospect of a “win-win” trade, we come to the portion of the article where I get to indulge in my semi-sadistic tendency to spoil people’s moods by writing about risk, no matter how some stranger on the internet characterizes it. This trade, like all others, comes with risk. I consider the risks associated with put options the way I trade them to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts either “willy” or “nilly” simply because they sport a high premium. In my view, that strategy would lead to disastrous results. So, my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. I would urge people to learn from my painful history here.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that CSX’s stock price goes parabolic and hits $60 per share between now and the third Friday of January 2023. Obviously, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price from the puts, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls than me.

Secondly, it can be emotionally painful when the shares crash below your strike price. As of this writing, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of the way that they can play with your emotions.

If you understand these risks, and can tolerate them, I would recommend that you sell puts. Although the stock is much more compelling than it was, I think puts offer a lower-risk alternative to buying the stock at the moment. You may not get as much of a return as you would from the rising stock, but I’ll remind you: we’re not after returns. We’re after “risk adjusted” returns.

Assessing the Buyback

Remember way back in time when I pointed out that the company spent over $1 billion of owner capital to buy back stock at an average price of $35.03? It’s time to assess whether that was a good or bad use of owner capital. Holding all else constant, the company bought these shares at a TTM P/E multiple of ~19.9 times. A quick look at the history of P/Es for this stock suggests that this was on the high side. Thus, if management insisted on paying this out to owners, I think shareholders would have been better off if they were given a special dividend. If there was a worry about the tax consequences of such a move, this $1 billion might have been better spent paying down debt. Either way, I would give the latest buyback activity a “C” grade.

Conclusion

I think CSX is an excellent, durable business, and I think owners benefit from its enormous moat. Additionally, I like the fact that management rewarded shareholders with an increase in the dividend. I would have preferred that they not spend $1 billion to buy back stock at the levels they did, but life goes on. I’m also impressed by the fact that the stock is much cheaper than it was when I last reviewed the name. Unfortunately, “cheaper” is not the same as “cheap”, and for that reason, I’m going to continue to eschew the shares. That said, I’m obviously comfortable buying at $27.50, so I’ll be selling more of the puts I wrote 6 months ago. These may not offer the best potential returns, but I think they offer the best risk-adjusted returns.