Gti861/iStock via Getty Images

It Will Take an Arsenal of Treatments to Fight Alzheimer’s

There is more reason for optimism now than ever before.

H. Fillit, MD, Co-founder and CSO of the Alzheimer’s Drug Discovery Foundation, Wall Street Journal, June, 9, 2022

Thesis

After the severe drop on not meeting its primary endpoint for the entire study population, Athira Pharma (NASDAQ:ATHA) has just dropped immensely below cash value.

I believe the data generated by this company is actually more compelling than the market is seeing, as the readout occurred in one of two ongoing AD studies, the drug has again proven to be safe, and results from the monotherapy subgroup at 24 weeks are actually good.

With the company already trading at cash level before the readout, and the subsequent huge drop, I find myself actually being much more excited than the market.

Solving Alzheimer’s disease may require more approach than one, and targeting the HGF/MET pathway could well be one, albeit in a subgroup.

Athira Pharma, its pipeline and expected readout

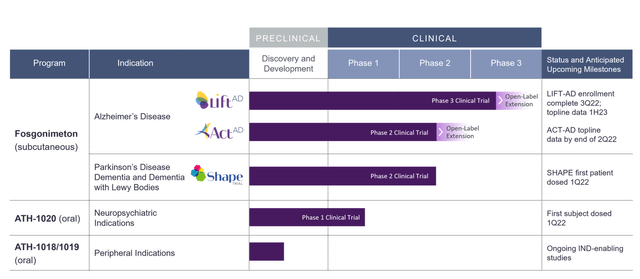

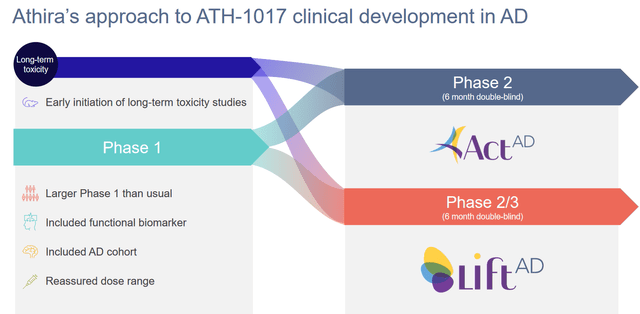

Athira Pharma (“ATHA”) is a clinical-stage biotech company focused on neurodegenerative disorders. It has IPO’d on the Nasdaq in September 2020, with Jefferies as bookrunner. The company has one lead asset, fosgonimeton, targeting the HGF/MET pathway. The company has two Phase 2 trials and one Phase 2b/3 trial ongoing, with a readout in its Phase 2 Alzheimer’s trial, ACT-AD, imminent. This is its pipeline.

Athira pipeline (Company website)

This article will focus on its Alzheimer’s programs with ATH-1017 or fosgonimeton, which the company itself focuses on primarily and which has two trials ongoing, entitled ACT-AD for the Phase 2 trial and LIFT-AD for the Phase 2b/3 trial. ATH-1018, ATH-019 and ATH-1020 are oral HGF/MET modulators in earlier stages of development.

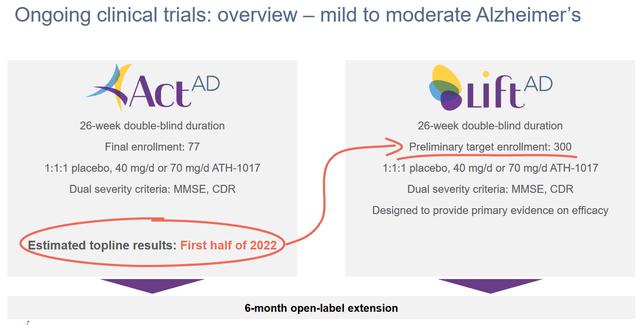

Estimated topline results (Athira corporate website)

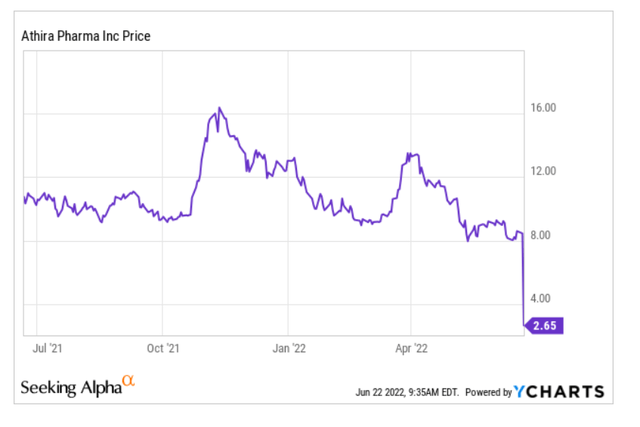

As one can see from the above, a readout was expected for the first half of 2022, and it has just come out. Athira had IPO’d at a share price of $16, had risen to above $32, then dropped again in July 2021 due to allegations of scientific misconduct of its CEO. It was last trading around $8, and at the time of finalizing this article with the readout just out, the share price has cratered. Important in that regard is that a share price around $8 is actually cash level.

And then this happened.

Athira Pharma share price (Ycharts for Seeking Alpha)

ATH-1017 for Alzheimer’s disease

Mechanism of action

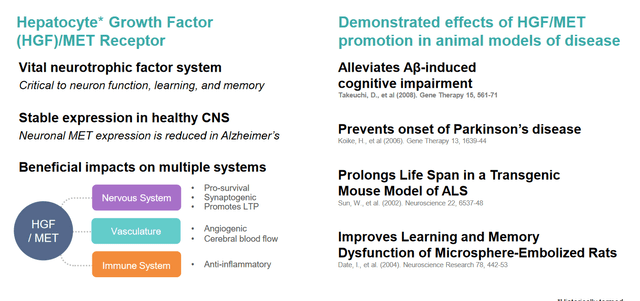

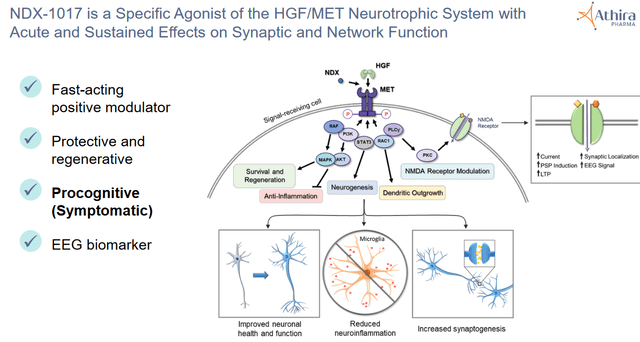

Athira’s lead drug candidate is Fosgonimeton, or ATH-1017, to be delivered by way of a subcutaneous injection, much like an insulin shot, and designed to enhance the activity of hepatocyte growth factor (“HGF”) and its receptor MET. Hepatocyte growth factor is a ubiquitous molecule that regulates cell growth and cell motility, among others, and acts as a chemical messenger (cytokine). It plays a role in angiogenesis, tumorigenesis and regeneration of tissue.

ATH-1017 can penetrate the blood-brain-barrier and to date, has been seen to be safe and well-tolerated in a 88-subject Phase 1 study.

According to Athira, the HGF/MET pathway is critical to normal brain function, and compromised in Alzheimer’s disease and other neurological diseases.

Detail as to HGF/MET pathway (Athira corporate presentation)

Detail as to HGF/MET pathway 2 (Athira CTAD presentation December 2019)

HGF, which would be reduced in people with AD but not in healthy individuals, is a novel target for Alzheimer’s disease (AD) and other neurologic diseases. It is supposed to protect neurons, promote synaptogenesis, induce regeneration and diminish neuroinflammation. Preclinical research has shown that activation of the HGF/MET pathway led to neuroprotection in neurodegenerative diseases such as AD, Parkinson’s, ALS and MS, and influences the activity of glial cells.

For full clarity, this is an alternative approach which is fully different from any traditional amyloid or tau-approaches, the last one of which – an amyloid approach by Roche (OTCQX:RHHBY) in collaboration with AC Immune (ACIU) – has yet again led to a failure in recent days.

Results of the Phase I trial

A phase 1 trial is essentially about safety. A total of 88 patients have been treated over the course of 8 days. Most of these were healthy subjects. The placebo-controlled patient group consisted of 48 healthy young male volunteers, 29 healthy elderly volunteers and 11 Alzheimer’s patients.

ATH-1017 was found to be safe and well-tolerated.

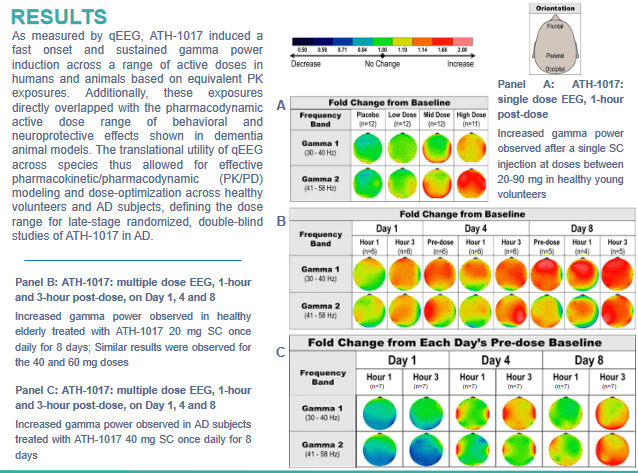

Athira chose quantitative electroencephalogram (qEEG) and event-related potential (ERP) P300 latency as additional biomarkers, and it’s mostly the second biomarker which has led to positive reviews by analysts. Complete results can be found here.

Study design

This is Athira’s study design for both of its ongoing AD trials.

Study design (Athira corporate presentation)

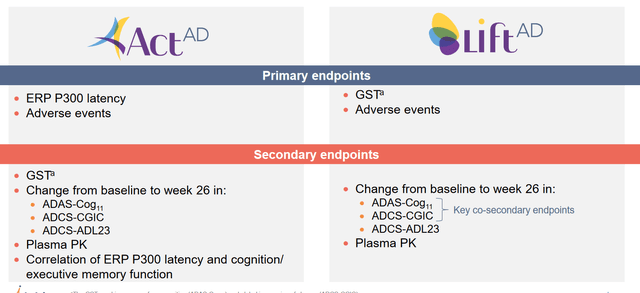

These are the trials’ primary and secondary endpoints.

Trial endpoints (Athira corporate presentation)

The ACT-AD trial’s primary focus is to evaluate how the ERP 300 latency measure looks like in patients after six months, and whether there would be any adverse events. The secondary endpoints may be more important for the investor community, as they will say something about how cognition, which normally declines in AD patients, has evolved in those patients. The three cognition measures in this trial are ADAS-Cog, ADCS-CGIC and ADCS-ADL23. These are the same in the LIFT-AD trial.

In both trials, patients will receive either the low dose of 40 mg/day, the high dose of 70 mg/day, or placebo. The ACT-AD trial was supposed to enroll 77 patients. Patient demographics can be found here.

The larger and longer LIFT-AD trial was supposed to enroll 300 patients, but has been expanded to 420 patients so as to bolster powering of cognitive endpoints.

Athira has extended the Open Label Extension trial for both trials, with patients now being able to continue open-label treatment up to 18 months, versus 6 months before. Apparently, the majority of patients have chosen to participate in this extension.

Two biomarkers reported, with P300 being the most important

Those who have read my articles before know how I love biomarkers to de-risk a company’s assets, in any disease. In most diseases, this is self-evident. For diseases of the brain, many have focused on vague endpoints such as cognition and motor function.

The quantitative EEG Phase 1 results showed a pretty much immediate induction of gamma power in patients. Gamma waves are associated with cognition and learning, and gamma power is reduced in AD patients. These results, for Athira, were indicative of improved brain activity, network recovery, synaptic NMDA receptor activity and synaptogenesis.

qEEG results (Athira poster AAIC 2021)

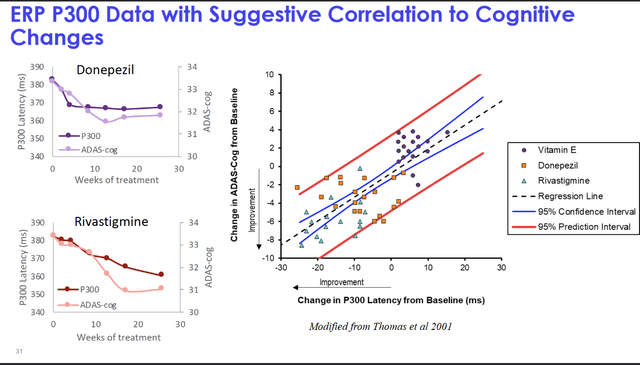

Athira has made P300 latency its main biomarker focus, a measure of working memory processing speed. The technical details of this measure are well explained in the company’s November 5, 2021, KOL webinar (slides here, summary here). In short, P300 is a measure of brain activity that correlates with cognitive performance, and it is delayed in patients suffering from AD, dementia or epilepsy. Athira has indicated that P300 latency correlates with cognition in acetylcholinesterase inhibitor trials, which before Aduhelm, have been the standard.

P300 as an AD biomarker (Athira KOL webinar November 5, 2021)

The Phase 1 trial showed that ATH-1017 improved P300 latency in all study subjects, contrary to placebo, with two patients with the worst scores improving most. In healthy patients, however, the P300 latency did not change when ATH-1017 was taken, and even more, AD patients on ATH-1017 seemed to revert to a latency in line with healthy patients, all this over the course of 8 days. The analyst reports I have read were often going in-depth on this P300 latency measure, and used it to support their buy-theses. Literature review has shown that not only the approved AD drugs prior to Aduhelm, which had pro-cognitive effects (for a while), but also other drugs that improve cognition showed increased P300 latency. Vice versa, scopolamine, a drug that has a negative impact on cognition, showed a worsening of the measure.

The June 2022 readout

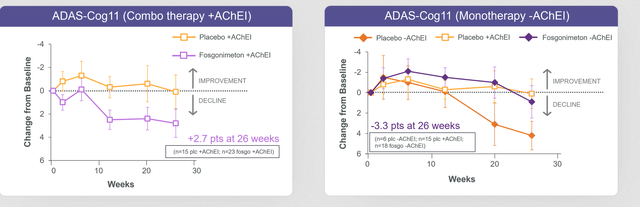

All the above boded well for Athira. Clearly, there was a drug effect in the short term. With such a strong effect, the question was how the six-month data would look like in a larger randomized trial. The results are out at this point, and I will spin these to the positive to see whether there is anything the company can work with (which it believes it can, as clearly and repeatedly stated in the press release). These are the ADAS-Cog11 results, in combo therapy with acetylcholinesterase inhibitors and in monotherapy without acetylcholinesterase inhibitors.

ADAS-Cog measures ACT-AD trial (June 2022 readout)

In the monotherapy group, there is very clear cognitive benefit of -3.3 points compared to placebo. That basically means there is less decline than in placebo, or stabilization of disease. This may be a good-enough scenario for FDA approval in my eyes, with the right trial design. Essentially, it means that monotherapy works. Apparently the combination with acetylcholinesterase inhibitors does not work.

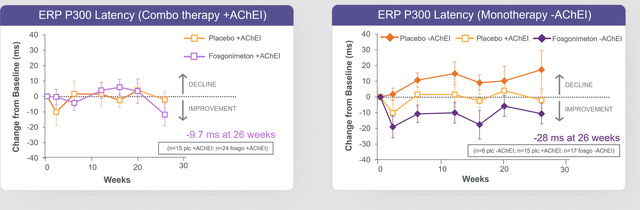

Now, in the ACT-AD trial, contrary to intuition perhaps, the company had chosen to have ERP300 latency as its primary endpoint. In the June 2022 readout, the company stated that the change in biomarker ERP P300 latency was not statistically significant for the full study population, as combination of fosgonimeton and acetylcholinesterase inhibitors showed potential diminished effect of fosgonimeton. These are the results for this biomarker, both in combination therapy and in monotherapy

P300 latency measurements (June 22 readout)

Once again, one sees that there is a signification reduction in the monotherapy group. Hence, the company is correct in stating that the monotherapy group analysis suggests improvement in both P300 latency and ADAS-Cog11 at week 26. This basically means, to me, that the drug works, just not in combination with acetylcholinesterase inhibitors.

Phase 1 results on P300 latency were a reduction of 74ms. The -28ms over 26 weeks means a significant lowering, and in fact also an improvement over previously reported P300 latency measures on acetylcholinesterase inhibitors. These inhibitors had reported reductions of 15ms (donepezil) up to 22ms (rivastigmine) over the course of 6 months. With -28ms, fosgonimeton clearly does better, and that reduction also correlates with cognition.

And this is actually what I was expecting. I was not expecting fosgonimeton to improve the P300 latency measurements over the course of 6 months. But they are clearly there, and they do correlate with cognition.

Hence, I believe the market is missing the point here; we have a new drug that treats Alzheimer’s disease, with a novel and entirely different pathway. The jury is still out as to whether it is symptomatic or not, but in any case, its mechanism of action is fully unrelated to acetylcholinesterase inhibitors (which are symptomatic).

Where to go from here?

Athira Pharma has two ongoing trials in AD, one in PD, and others in earlier development, all targeting the same pathway. Do the current results mean the HGF/MET pathway is a lost cause? I don’t think so.

The company phrases it as follows (excerpts from the June 22, 2022 press release):

ACT-AD was designed as a learning study to further investigate the ERP P300 biomarker signal over 6 months. […]

These data points are very encouraging as they indicate the expected pharmacological activity of fosgonimeton by parallel improvement on ERP P300 latency and ADAS-Cog11 and show a favorable safety profile over six months. […] We will use these insights for a rational optimization of the ongoing LIFT-AD trial. We plan to seek advice from our scientific advisors, investigators, and ultimately regulators on how to expeditiously analyze and potentially adapt the LIFT-AD study […].

We are in the fortuitous situation that we have a much larger trial ongoing with more than 200 patients completing at least 20 weeks of treatment providing us with an opportunity to obtain more insights in an expedited manner. Our strong cash position allows us to continue to progress fosgonimeton development.

If the company is able to optimize its ongoing LIFT-AD trial, and I believe this should be possible as the change of focus to monotherapy is not so immense, then the AD trials may still be on track. This also bodes well for the further trials and preclinical work.

In my draft article prior to the readout, I had defined success of ATH-1017 as a reduction of the P300 latency at six months to a point where it is still well above the measure of AD patients, and above the measure of acetylcholinesterase inhibitors, and a stabilization or reduction of cognitive decline that accompanies such measure. This is actually where we’re at, in patients on monotherapy. That, for me, could give ATH-1017 a chance of approval.

How did this happen?

I see trial design and the market often ignoring that Alzheimer’s seems a much more complex and multifactorial disease than many imagine. This is shown in many of the recent scientific articles I have read, and I have used the above quote by Howard Fillit to highlight that.

I am of those that see an individualized treatment for patients suffering from neurodegenerative diseases coming up, and some of those treatments may even be symptomatic, or may only be able to show their strongest effects for a while (such as in cancer drugs).

The fact that the drug’s effect significantly outlasts its half-life of 90 minutes is sign of a continued effect on the disease itself. This could be indicative of the fact that, contrary to acetylcholinesterase inhibitors, ATH-1017 is not a symptomatic but a disease-modifying treatment.

Finally, the P300 latency measure having come out of the Phase 1 trial was simply stunning, and that’s also what the analysts have been consistently writing. This has led to some of them stating that the upcoming readout may be unprecedented. Perhaps hopes were still too high, even though the company was trading at its lowest point ever.

Simply stated, if the primary endpoint would have been cognition in the monotherapy group, then the results would have been seen as successful. And I believe they actually are, more than I expected them to be.

There may be other AD drugs in the making

Contrary to companies such as INmune Bio (INMB) which has reported numerous biomarkers of inflammation, microglial activity, synaptic evolution of neurodegeneration in its Phase I trial, or Cassava Sciences (SAVA) which has reported quite some in its Phase 2 trial, the P300 measure remains just one measure of brain activity. We do not know what is going on in the body or in the brain with inflammation, synapsis, axons, neurons etcetera, nor how this evolves, and over what timeframe. Other companies I like have reported such information.

In that sense, the jury is still out on what is actually going on in the brains of those patients. their correlation with cognition, I do not see a one-on-one relationship either, as mentioned above.

Financials, ownership and short interest

Athira actually has quite some cash available. As of March 31, 2022, it had $301.2 million cash, cash equivalents and investments. Its last quarterly cash burn was $18.5 million.

That means that, before the readout, Athira was trading near its cash level. That also means that any jump above that percentage would only be the start of the market giving it an actual enterprise value.

Institutional ownership is at 74.82%, short interest stands at 9.66% and insider ownership is at 4.96%.

Risks

Some are considering that the biotech sector may be the first to reverse out of this downward-spiraling market, with the biotech bear market having started first and corrections having taken place. In a biotech bear market which has yet to be officially declared ended, no one is safe.

Furthermore, the results that I consider to be good enough above may not necessarily be good enough for approval by the FDA.

I add one further risk. Even if at this time, there are no indications that the ATH-1017’s HGF/MET targeting has led to any increased tumor risk, the risk here is important, as the concerned pathway has been associated with tumorigenesis. If the drug would lead to tumors, chances of approval may be revised downward. Most chances of any effect at this level could be assessed at the readout of the LIFT-AD trial, and/or its open label extensions. For now, however, the drug candidate is considered safe and well-tolerated.

Conclusion

I see Athira Pharma’s drug candidate ATH-1017 as a novel and actually quite interesting Alzheimer’s drug candidate. The readout here is actually positive in my eyes, and the drop may provide a more than excellent opportunity here.

As said above, cognition is key in Alzheimer’s, and ATH-1017 improves it more than traditional standard of care. The drug is well-tolerated without side effects.

It is now up to the company to see to it that it organizes its ongoing, bigger LIFT-AD such that it focuses on monotherapy with ATH-1017. The company has hinted to it, and I believe this should be possible.

There is not one cure, for Alzheimer’s, and though I have my clear pick in the field, the market is big enough for several players with different mechanisms of action.

Athira is trading ridiculously low at this point. The market is missing the point here, as it is focussing on an unimportant miss on an endpoint for the entire cohort, even though the cohort on monotherapy actually showed improvement in P300 latency that correlated with cognition. That’s where the opportunity lies, and I believe these opportunities are there for early investors to find them.

For all of the above, I am rating Athira Pharma as a buy. At the time of writing, I did not take a position yet, as I was awaiting the results. I may do so while the share price drops.