Solskin/DigitalVision via Getty Images

Investment Thesis

Charles River Laboratories International (NYSE:CRL) is a high-quality business that is critical to the entire drug discovery lifecycle, which includes discovery, development and manufacturing. It operates as a pick-and-shovel play in the healthcare industry and functions as a royalty on the growth of others. It also operates relatively under-the-radar and has consistently grown revenue, earnings and free cash flow. The stock has fallen more than 50% from its peak in September 2021 but the underlying business continues to grind on, which gives investors a good opportunity to pick up shares in a wonderful business at a fair price.

Background

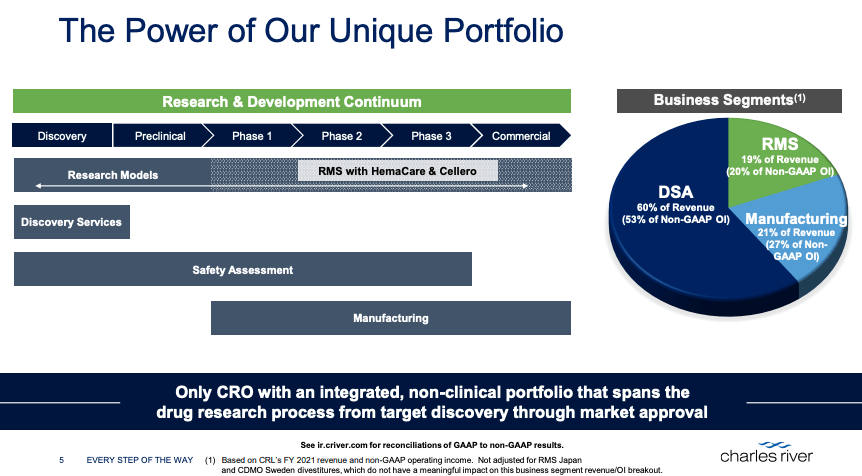

Charles River Laboratories International was founded in 1947 and is a leading drug discovery, non-clinical development and development company (or non-clinical contract research organization- “CRO”). They provide the research models required in the R&D of new drugs, devices and therapies. They currently operate under three segments:

-

Research Models and Services (RMS): supplies research models to the drug development industry, a global leader in the production and sale of the most widely used rodent research model strains and purpose-bred rats and mice; ~19.5% of total revenue

-

Discovery and Safety Assessment (DSA): provides services that enable clients to outsource their drug discovery research, related activities, and regulatory-required safety testing of potential new drugs, vaccines, industrial / agricultural chemicals, consumer products, medical devices, etc…; clients may choose to outsource their discovery, development and safety activities to reduce fixed costs and to gain access to additional scientific expertise and capabilities; also the largest provider of drug discovery, non-clinical development and safety testing services worldwide; ~59.5% of total revenue

-

Manufacturing Solutions (Manufacturing): works with clients and the biopharmaceutical industry to ensure the safe production and release of products; consists of 3 businesses (Microbial Solutions, Biologics Solutions and Avian Vaccine Services); ~21% of revenue

In short, CRL has the capability to work with clients (global pharmaceutical companies, biotechnology companies, government agencies, hospitals and academic institutions) who want to outsource some (or all) of their research capabilities through the full cycle of drug development:

-

Discovery: early stage, takes ~10-15 years and costs up to $2.5b; aims to identify, screen and select a lead molecule with potential

-

Development: follows discovery, which can take between 7-10 years; aims to demonstrate safety, tolerability and efficacy of the selected drug candidates

-

Manufacturing: follows development, requires companies to scale up and bring their products and services to the market safely and effectively

June Investor Conference Presentation

As the company puts it:

Our objective is to be the preferred strategic global partner for our clients.

Our strategy is to deliver a comprehensive and integrated portfolio of drug discovery and non-clinical development products, services and solutions to support our clients’ discovery and early-stage drug research, process development, scale up and manufacturing efforts, and enable them to bring new and improved therapies to market faster and more cost effectively.

Separately, through our various Manufacturing segment businesses, we aim to be the premier provider of products and services that ensure our clients produce and release their products safely.

To show how integral CRL is, the company worked on >85% of FDA-approved novel drugs in 2021, including 100% of CNS drugs and >90% of oncology drugs. It would be fair to say that it would be near impossible to have any clinical trials without companies like CRL.

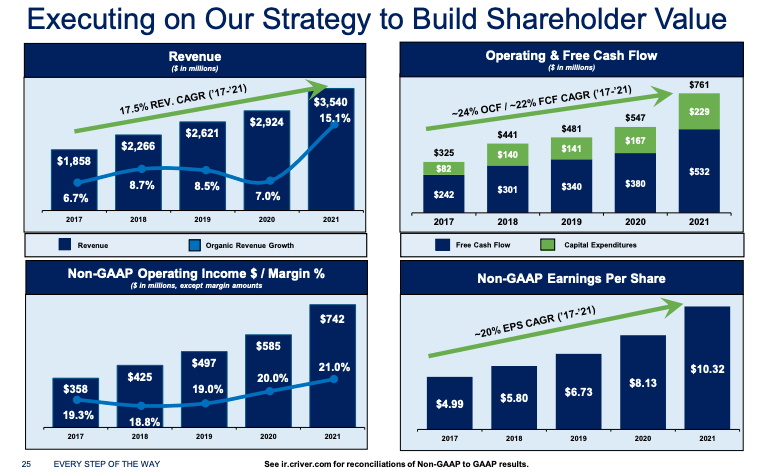

The company grows at a fairly consistent clip of ~12% a year (revenue) over the last 10 years and has been steadily increasing revenue, income, free cash flow, and operating margins.

June Investor Conference Presentation

The company operates in over 110 locations in over 20 countries worldwide and employs ~20,000 employees. Each commercial client accounted for less than 4% of total revenue and the current backlog is ~$2.8b.

Valuation

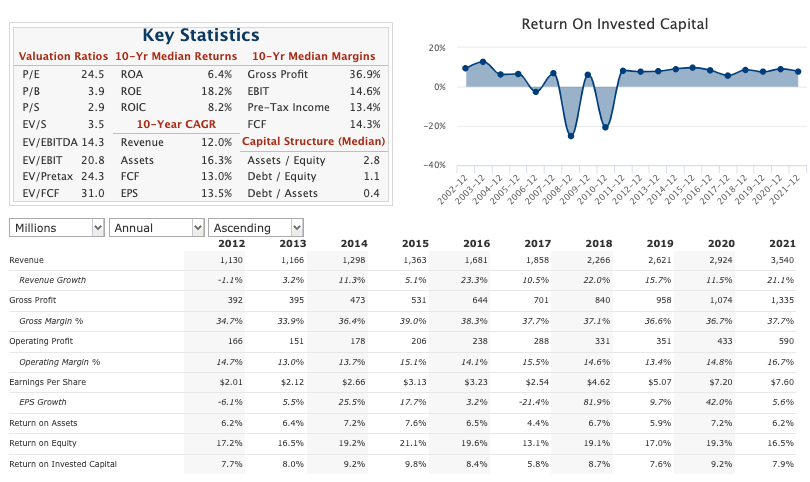

With ~50m shares outstanding and with a current price of $208, the market cap is currently $10.5 billion.

QuickFS (Charles River Laboratories)

At first glance, CRL doesn’t screen terribly cheap:

-

P/E: will probably earn $7-8 per share, which puts the P/E at ~26-29x

-

P/B: ~3.9x

-

P/FCF: ~25x

-

P/S: ~3x (total 2021 revenues was $3.5b)

-

Yield: no dividend

-

Leverage: not terribly leveraged, with a debt/equity of 1.1x

But I would argue that since CRL is a company of higher quality, it makes more sense to value it based on its returns on equity and to consider more “qualitative” factors, such as the economic moat and underlying business model (think Buffett’s See’s Candies). CRL has been consistently in the ~18% ROE range (keep in mind that average ROE is probably ~10-12%). If you assume that the return of an asset will approximate ROE, then CRL is a clear high-quality business to hold for the long term (even if you pay up for it).

Underlying Business Model

Turning to the business model, it’s hard to envision a better pick-and-shovel play in the healthcare space. CRL allows companies around the globe to outsource their drug discovery and development efforts, which allows the companies to hit the ground running without the need to invest a lot of capital upfront in equipment. In a sense, and feel free to correct me if I’m wrong, CRL is similar to Amazon’s AWS, which allows companies to launch applications / services without having to worry about buying their own servers / infrastructure. As a result, companies can proceed without having to initially invest heavily in equipment, which lowers expenses dramatically and speeds up the development lifecycle.

Catalysts

-

Continued execution and organic growth alongside the growth of the healthcare industry (which grows ~7-8% a year). It’s interesting to note, though not surprising, that the growth of CRL has slightly outpaced the growth of the global healthcare industry. CRL expects low-double digit organic growth until 2024.

-

CRL has steadily expanded its business via acquisitions (e.g. HemaCare, Cellero, Distributed Bio, Retrogenix, Cognate BioServices, Inc. (Cognate), and Vigene Biosciences, Inc. (Vigene)). They have spent over $4.5b in acquisitions ( >25 acquisitions) over the last 10 years.

Risks

-

Low Insider Ownership: insiders own ~1.1% of the shares outstanding. Normally I would like to see a higher percentage, but I think the quality of the business model outweighs the low insider ownership.

-

Global Slowdown of Healthcare Spending / Development: with an ever increasing global population (and with Covid-19 fresh in our memories), it’s hard to see governments and companies not willing to spend more money on better treatments and novel drugs

Takeaway

The best business is a royalty on the growth of others, requiring little capital itself. – Warren Buffett

CRL is uniquely positioned to benefit from the growth of the healthcare industry without having to take on binary risks, such as biotechnology companies whose futures depend mainly on a yes or no from the FDA. In other words, CRL benefits as a royalty on the growth of others (e.g. healthcare and biotech companies, governments, etc.) and satisfies Buffett’s criteria for a “best business”.

Frankly, I had never heard of Charles River Laboratories before and I would say that most people have never heard of it. Yet, it operates quietly in the background with little need for advertising and is integral in the entire drug discovery lifecycle. Those are the high-quality businesses that one should yearn to own.

Based on the analysis above, I recommend a long position in CRL with a holding period of a few years (maybe even forever). I have no idea what the stock price will do in the short term, but I would look to add more if it continues to decline, as I see the company having the ability to compound for many years to come.