Maksim Safaniuk/iStock Editorial via Getty Images

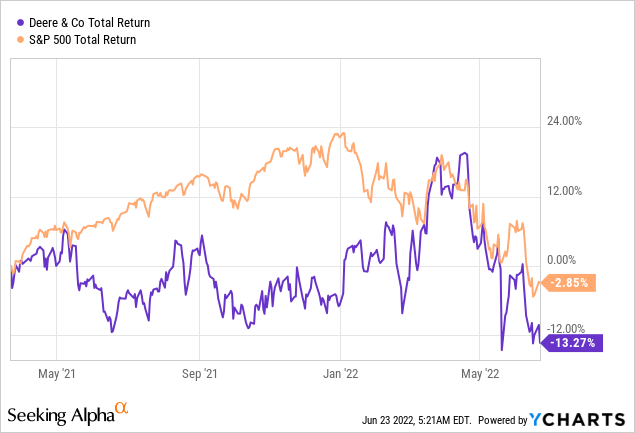

Following the wave of optimism that brought Deere & Company (NYSE:DE) to unsustainably high levels, the company has now significantly underperformed the broader market since March of last year, when I first covered it. My initial thesis revolved around the risks associated with the excessively high valuation in combination with the cyclical nature of the industry.

Since then, Deere’s performance has been largely disappointing relative to the broader market.

As DE traded near all-time highs in April of this year, I once again warned of the aforementioned risks and took a closer look at the company from a cash flow perspective. Although I will not reiterate the free cash flow analysis in this article, the problems associated with fading capex and net working capital tailwinds have not gone away.

Deere’s share price divergence from the broader equity market also highlights some important implications for the future as the share price still prices in years of future growth and high profitability. That is why, it should come as no surprise that as both top and bottom line of Deere continued to improve over the past year, the share price stagnated.

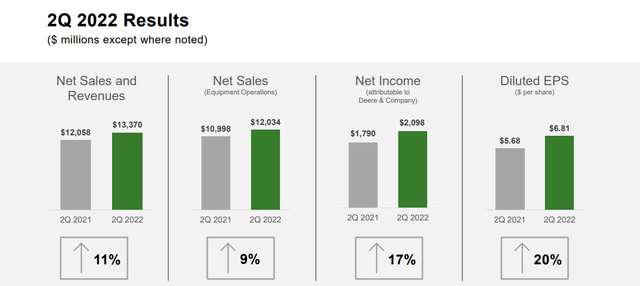

Deere Investor Presentation

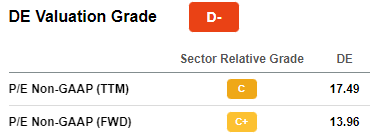

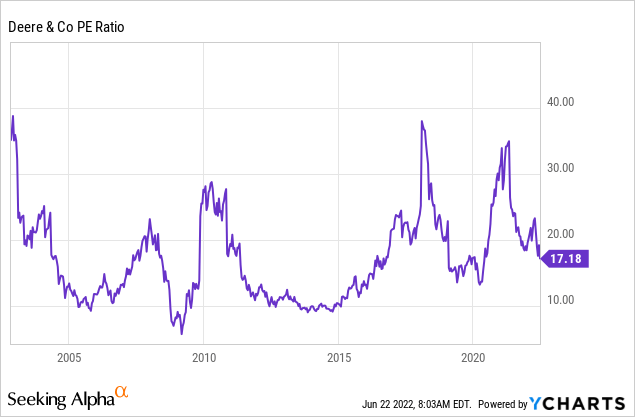

In the meantime, inexperienced investors could fall easily for the narrative that Deere is priced conservatively due to its low earnings multiple (see below).

Seeking Alpha

However, these multiples are highly volatile throughout the business cycle and can often lead to disappointing results. On a GAAP basis, Deere’s P/E ratio rarely goes above 20 and even when it does, it is only temporary.

Stitching everything together with an exciting narrative of autonomous farming equipment and a software business for these intelligent and connected vehicles is the final piece necessary to dispel any fears of future risks for Deere’s share price.

Nevertheless, the reality is that Deere is not cheaply priced once we account for industry related risks and the disappointing performance of the past year is unlikely to be a one-off event.

Short-term Optimism

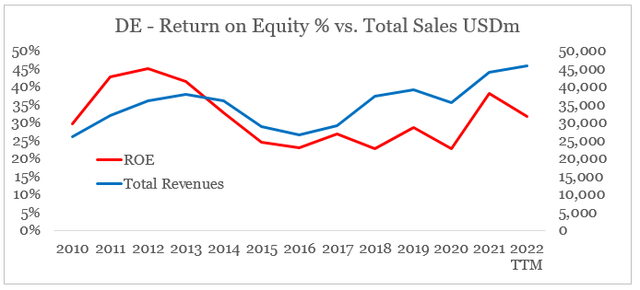

For a capital intensive business, Deere relies on high volumes and capacity utilization in order to drive high return on capital. Therefore, both sales growth and return on equity tend to move together throughout the business cycle.

prepared by the author, using data from Seeking Alpha

In recent years, however, Deere’s ROE remained low even as sales growth accelerated since 2017. But that has suddenly changed in 2021, when ROE noted a large increase which as we will see later on was largely due to transitory factors, such as unconventional fiscal policy decisions, interest rates and commodity prices.

Even though the company’s return on equity has fallen sharply in 2022, the rest of the year is expected to be particularly strong from both sales and inventory turnover point of view.

Overall, we expect to have more production days in the second half of 2022 than the previous year, and we expect to grow production progressively from the second quarter through the fourth quarter, meaning we expect Q4 to be our highest revenue quarter for the year.

Additionally, supply disruptions led to inefficiencies at factories resulting in unusually high inventory of partially completed machines. As soon as we get parts, we will be able to complete and shipped product, providing confidence in the second half shipment schedule.

Source: Deere Earnings Transcript Q2 2022

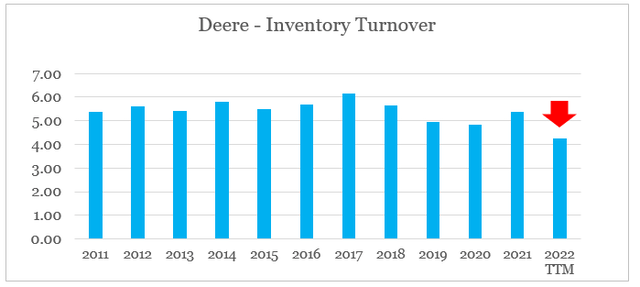

As we see in the graph below, inventory turnover fell significantly over the past few months due to the aforementioned supply chain disruptions.

prepared by the author, using data from Seeking Alpha

As supply chains normalize, a rebound in Deere’s inventory turnover and sales in the second half of 2022 will likely lead to improved ROE, all else being equal. Expected higher price realization for the rest of 2022 is yet another short-term tailwind that is impacting this year’s forecasts.

For the quarter, operating profit was down year-over-year at $520 million, resulting in a 14.6% operating margin. The decreased profit was primarily due to higher production costs, specifically material, and an unfavorable sales mix. These items were partially offset by price realization….

At this time, our forecasted price realization is expected to outpace both material and freight costs for the entire year. The first two quarters are expected to be our most difficult material and freight inflationary cost compares, while the third quarter comparison to last year should improve slightly.

Source: Deere Earnings Transcript Q2 2022

The Mid-Term Issues

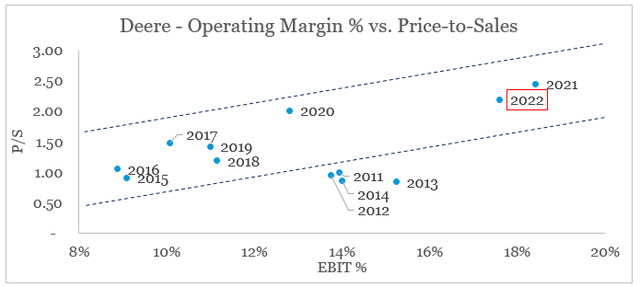

All these rosy expectations, however, span less than a year ahead and do not reflect a sustainable long-term trend. At the same time, Deere’s sales multiple is currently in line with the company’s exceptionally high margins during the peak of the cycle.

prepared by the author, using data from Seeking Alpha

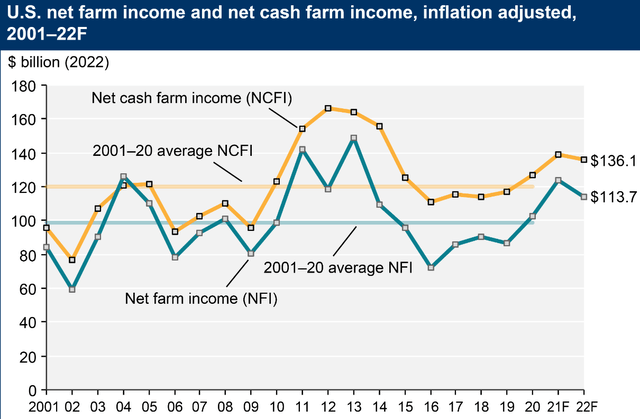

If we observe the 2011-14 period in the graph above, we will notice that the achieved P/S multiples were far lower than what the operating margins back then would suggest. The reason for that is the cyclical peak of U.S. net farm income which coincides with the period mentioned above.

USDA

The reason for the low valuation back then was that the market was correctly pricing in a drop in future net farm income from the cyclical highs. This time around, however, this does not appear to be the case and Deere is priced as if the company could sustain operating margins of close to 20% indefinitely.

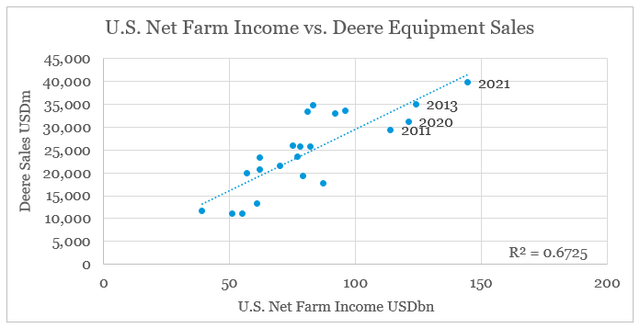

Unfortunately, however, the company’s sales are still highly dependent on the well-being of U.S. farmers’ bottom line and are not immune to cyclical swings.

prepared by the author, using data from Seeking Alpha, SEC Filings and USDA

While forecasting the level of net farm income over the next few years is speculative, higher government spending, lower interest rates and high commodity prices were among the key drivers of the massive jump in the farmer’s income in 2020-21 period. As these tailwinds subside, Deere’s total revenue is also at risk of reversal, similarly to the 2011 and 2013 periods.

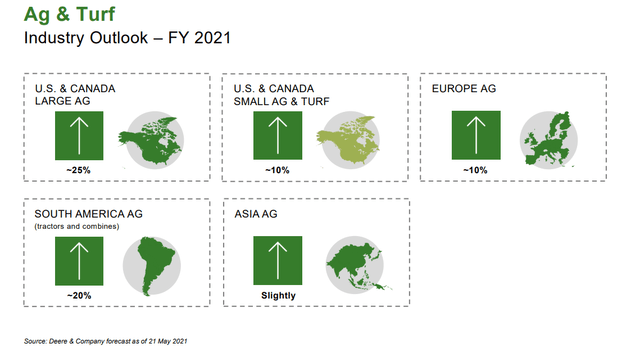

Moreover, the industry outlook seems to be already worsening from a year ago. Down below is the industry outlook as provided by Deere in May of last year for fiscal year 2021.

Deere Investor Presentation

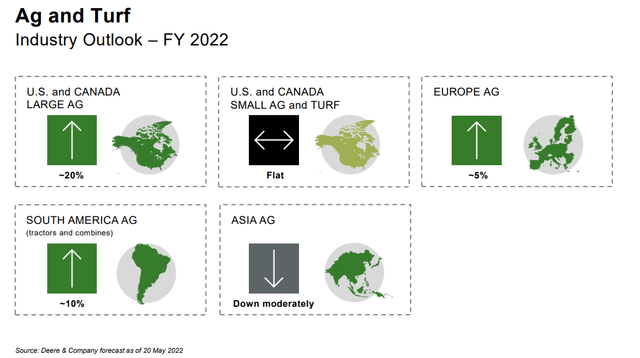

One year later and we already see a deterioration across the board in the outlook for fiscal year 2022.

Deere Investor Presentation

Conclusion

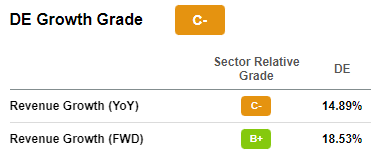

Current expectations for Deere’s top and bottom line for fiscal year 2022 appear to be on a high note. The company is expected to achieve both double digit sales growth and improved margins for the current fiscal year.

Seeking Alpha

Through a simple extrapolation of these short-term expectations, one could easily conclude that Deere’s share price will experience a double whammy effect of higher sales and expanding multiple (due to the higher margins).

However, we should not ignore history and the fact that the market is forward looking. While Deere could indeed experience yet another strong year in terms of strengthening business fundamentals, the medium-term risks are mounting. Sales remain highly cyclical and all major tailwinds during the 2020-21 period are now at risk for reversal. At the same time, Deere is still valued as if the current environment and exceptionally high margins will remain indefinitely. All that creates a significant downward risk, while the upside is limited.