vitpho/iStock via Getty Images

Old Dominion Freight Line, Inc. (NASDAQ:ODFL) shows a robust performance amidst a still uncertain market environment. Growth and expansion are impressive, matched with its lower financial leverage. It is very profitable and liquid, showing it may expand its service centers and carriers. There are more opportunities, given the border reopenings and the e-commerce boom. Likewise, potential overvaluation in the stock price is evident.

Company Performance

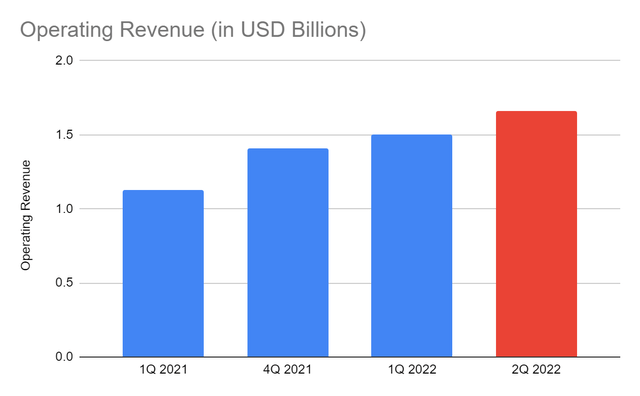

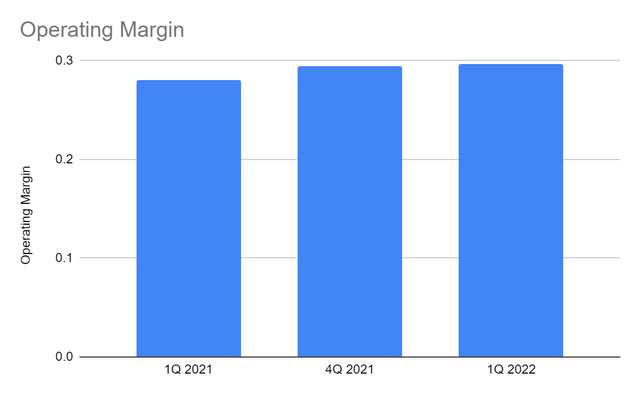

The operating revenue in the most recent quarter amounts to $1.5 billion, a 33% YoY increase. Thanks to the increased LTL revenue per hundredweight and tons LTL tons per day. The strategic pricing and fair fuel surcharges help it to offset inflation. It also allows it to operate at a larger capacity with manageable costs and expenses. ODFL has strong domestic market visibility and impressive on-time services. Its moved towards growth and efficiency with a larger network capacity is paying off. The increased demand matched with strategic pricing leads to higher revenues and margins. Currently, the operating margin is 0.30 vs 0.28 in 1Q 2021.

Now that the second quarter is about to close, it continues to show an impeccable performance. In its second quarter update for May, ODFL had a 26% YoY increase in daily revenue. Its primary revenue growth drivers are the same as in the first quarter. It shows that it remains consistent with its corporate strategies and goals. If we assume the average growth in April and May for June, 2Q revenue may reach $1.66 billion.

Operating Revenue (MarketWatch )

Operating Margin (MarketWatch)

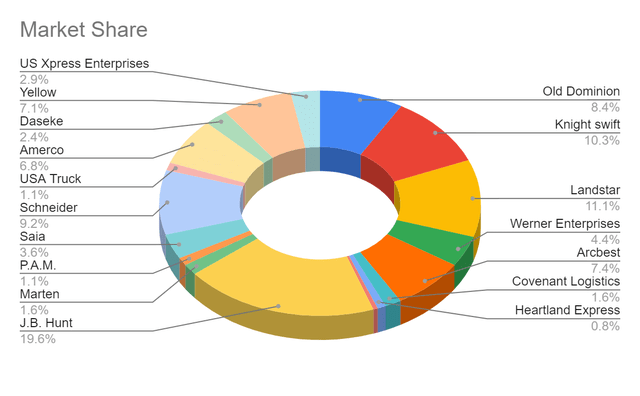

Relative to its selected peers, its revenue growth is within the average. Its market share is higher at 8.44% vs 8.38%. It is proof that it is one of the staple carriers in the US. To sustain its expansion, it is dedicated to increasing its spending on infrastructure. It has a strong market positioning, given its focus on increasing its operating capacity. It expects its annual CapEx to amount to $825 million, 50% higher than in 2021. The amount is for its real estate and service center expansion strategies. It also aims to buy new tractors and trailers and increase its digital capabilities. It is timely as it aims to penetrate e-commerce further.

Market Share (MarketWatch)

External Factors

In most of my articles, I always tend to focus on the financial condition of the company. But now, the external factors are crucial, especially for the logistics sector. The pandemic scourge had been a burden for the trucking industry in the last two years. And even if borders are starting to get better, market challenges remain evident. Today, inflation, geopolitical tensions, and supply chain disruptions add more pressure to it. Lately, I’ve been eyeing more shipping and trucking companies. They are still hammered by the rising fuel prices and still low orders or shipments. But, I am optimistic about the opportunities that may come their way in the following years.

The trucking market is still recovering. And these macroeconomic pressures are hampering its potential. For instance, backlogs are high as port congestion remains a problem in the US. Also, geopolitical tension fuels rising fuel and oil prices. Russia is a primary source of energy commodities. Given all these, retailers and manufacturers may have to adjust their production levels.

High inventory levels and lower consumer spending amidst inflation may hurt freight demand. Why? Retailers and manufacturers have to rethink their orders. The combination of lower consumer demand with high inventories leads to higher costs. Note that the inflation rate is now 8.6% so the prices of products and raw materials are on the rise. As such, they may decrease or halt their orders to manage their inventories better. In turn, companies have a weaker control over prices amidst the rising costs and expenses.

In a recent update by SONAR’s Container Atlas, global shipments and container bookings plunged by 8% and 36%, respectively. The thing is, retailer giants are quick to cancel their orders due to their responsive supply chains. Also, they have sufficient supply chain networks to manage their inventory capacity. That is why trucking companies are vulnerable to port congestion and lower shipments. But with the emergence of e-commerce, more opportunities are present today.

What’s in it for Old Dominion Freight Line, Inc.?

With almost 90 years of existence and a large operating capacity, ODFL remains a household name in the US. It covers a broad range of LTLs with over 52,000 combined tractors and trailers. In its recent update, it has 254 service centers in 48 states vs 251 in 2021. It is an excellent attribute, which helps it address supply chain problems. Its wide market presence allows it to maintain its distribution efficiency. Maintaining multiple service centers may not be easy, but it is an edge for the company. It also helps it save fuel and avert fuel shortages. As such, it is capable of setting strategic prices and fuel surcharges. Its capacity alone speaks about its significance in the LTL market.

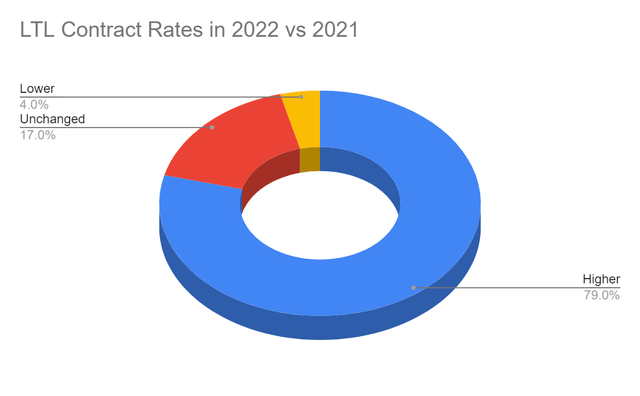

LTLs are also competing with water and air carriers. But of course, it has a more defined niche. Note that LTLs are meant for relatively short distances and domestic transport of goods and services. It focuses more on the domestic movement of goods and services. That is why LTLs still thrive with contract rates increasing in 79% of LTL companies in 2021-2022. ODFL has a larger domestic presence today. It remains strong amidst external pressures and driver shortages. In fact, it has about 10,000 drivers out of its 24,000 employees, making it unfazed by driver shortages.

LTL Contract Rates (Logistics Management )

Even better, its corporate strategies are geared towards growth and efficiency. First, roughly 70% of its shipments are on the next or second day. It is no surprise, given its multiple service centers, tractors, trailers, and drivers. It can manage its operations and remain efficient amidst its continued expansion. So, its on-time service reaches 99% this year. With its strong performance, demand, and market visibility, its pricing remains strategic. Today, it works on expanding its service centers, increasing its carriers, and adapting to technological trends.

How Old Dominion Freight Line, Inc. May Sustain Its Robust Performance

We have seen how ODFL has maintained its robust performance amidst market disruptions. Its increased domestic presence, sufficient capital and labor, and strategic pricing are its best attributes. Yet, it is more important to determine how capable it is to sustain its growth and expansion. Thankfully, its stellar Balance Sheet shows its impressive liquidity and low financial leverage.

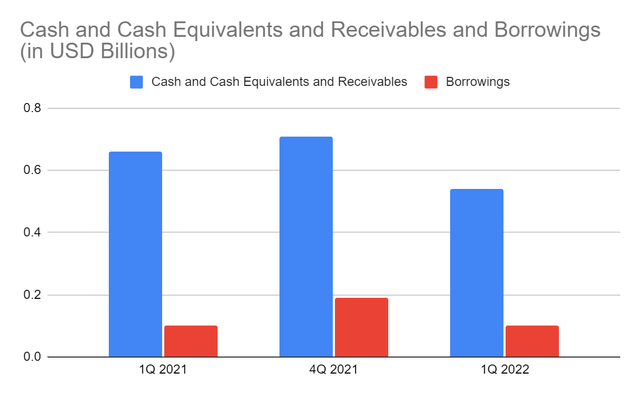

Its cash and equivalents of $541 million are way lower than in 1Q and 4Q 2021. But, we can see that borrowings dropped by 47%. Receivables are also higher than in the two quarters. It shows that the outflows this quarter are mostly used for deleveraging and strengthening its operations. Even better, it has more than enough cash to cover its borrowings. Net debt is a negative value. Even if we do not deduct cash from borrowings, Debt/EBITDA is still lower than one. It means that the company is viable enough to cover all its borrowings. Its cash inflows for the period are adequate, making the company more liquid. It is a very important aspect, given that trucking companies are capital-intensive.

Cash and Cash Equivalents and Borrowings (MarketWatch)

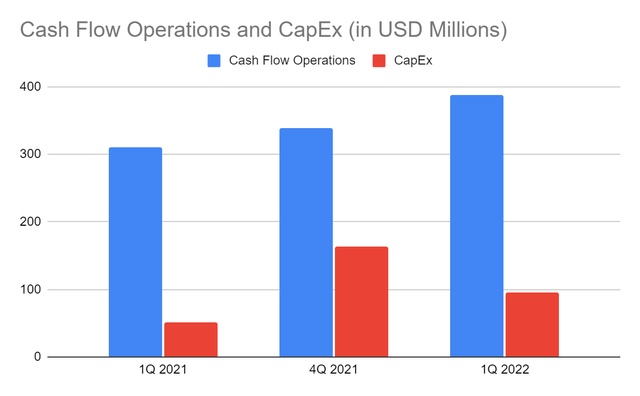

If we check its Cash Flow Statement, the same thing is evident. The cash inflows from the operations are more than enough to cover its CapEx. Only 24% of cash inflows are used for CapEx. As such, FCF continues to increase. Even if we check the five-year average, cash inflows are in an uptrend. It allows ODFL to sustain its operations, invest in more PPEs, and expand. This year, it plans to increase its CapEx by 50%. The amount will be used to expand its service centers, buy more trucks, and enhance its digital capabilities. This move appears expensive, but economies of scale are possible. As it adapts to the newest trends in technology, dispatch monitoring will be more efficient. In the trucking industry, service dispatch software is now a vital tool. It monitors the field of service employees, such as drivers and dispatchers. It also finds easier routes, especially during heavy traffic and other unforeseen circumstances. Other features are feedback from customers and data analytics to know which aspect to improve further.

Cash Flow Operations and CapEx (MarketWatch)

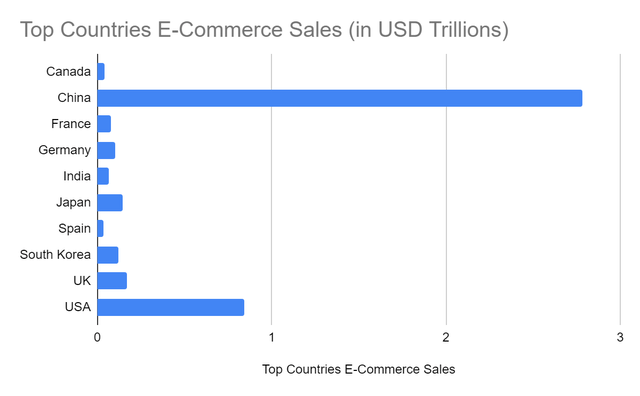

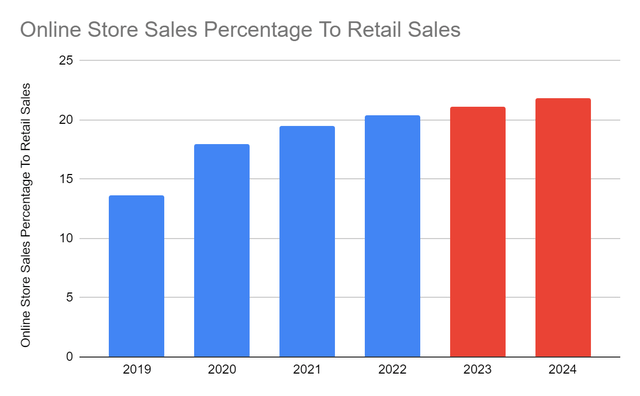

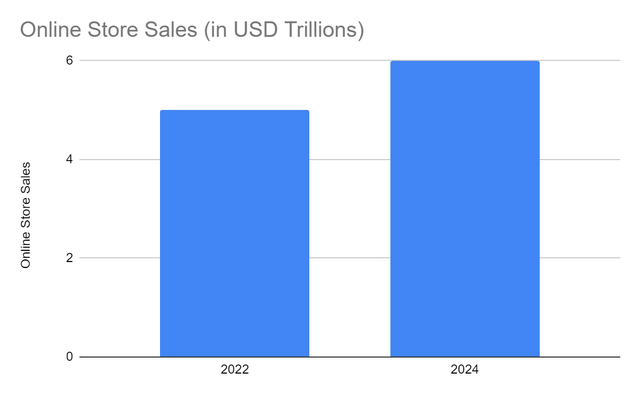

The continued expansion and innovation of the company are timely and relevant. E-commerce is at its peak, which provides more demand in the market. It is indeed a good thing that ODFL continues to strengthen its domestic presence. Many small-to-medium-sized stores are entering the market. They have less responsive supply chains, which are more favorable for LTLs. As such, they cannot just retract orders due to a lack of access to distribution networks. Unlike big box retailers and large e-commerce companies, smaller ones prefer a third-party transportation service provider. As such, their value is more on the demand part. Currently, the US accounts for over $800 billion of global e-commerce sales. Canada accounts for $44 billion. ODFL is working to get into e-commerce distribution networks, which may be a giant leap. Today, e-commerce is expanding with 20.4% of the total retail sales. It is expected to reach 24% with e-commerce sales of $5-6 trillion in 2022-2024.

Top Countries E-Commerce Sales (business.com)

Online Store Sales Percentage To Retail Sales (Statista)

Online Store Sales (shopifyplus)

Stock Price Analysis

The stock price appears to be in an uptrend in the last two weeks. But, the bearish pattern remains strong and evident. At $257.72, it has already been cut by 25% from the starting price. It is an 11% upside from the most recent dip. With its PE Ratio of 25.29, it is trading higher than the peer average and the S&P 500. It may still appear overvalued with an earnings multiple of 25-30x. Its EV/EBITDA of above 10 also conveys overvaluation.

Meanwhile, it appears to be an ideal dividend stock with consistent dividend payments. Since its first payment, it has had an average dividend growth rate of 19%. Given the quarterly payments of $0.30 per share, it may amount to $1.2. But, its dividend yield is only 0.44%, which is way lower than the S&P 500 and NASDAQ at 1.37% and 1.51%, respectively. It may suggest that while its dividends are enticing, the price is still too high. To assess the price better, we may check it using the DCF Model and the Dividend Discount Model.

DCF Model

FCFF $988,000,000

Cash and Cash Equivalents $541,310,000

Outstanding Borrowings $24,080

Perpetual Growth Rate 4.2%

WACC 8.4%

Common Shares Outstanding 113,761,115

Stock Price $257.72

Derived Value $233.48

Dividend Discount Model

Stock Price $257.72

Average Dividend Growth 0.196040724

Estimated Dividends Per Share $1.2

Cost of Capital Equity 0.10069694

Derived Value $238.44

Both models adhere to the potential overvaluation of the stock price. There may be an 8-10% downside in the next 12-24 months. As such, the company has strong fundamentals, but the price is still high.

Bottom line

Old Dominion Freight Line, Inc. is a solid stock with its robust performance and strong market positioning. Its stable cash levels and low financial leverage make its fundamentals sound. So, it may sustain its expansion and cover its borrowings and dividends. I would like to mention and thank kaluu0003 for asking why ODFL is a worse investment than Knight-Swift (KNX). ODFL is an excellent stock for me. It has a lot of promising growth prospects. I am bullish on this. But, the stock is still high. It is better to find a better entry point before making a position. The recommendation, for now, is that Old Dominion Freight Line, Inc. is a hold.