Khaosai Wongnatthakan/iStock via Getty Images

Flywire (NASDAQ:FLYW), a leading global payments enablement and software provider focused on high-value payments, could be one to watch for the long term, given its unique value proposition in solving various payment friction points across key verticals like education, healthcare, and travel. In the near term, the stock could benefit from a cyclical recovery as well, with foreign student enrolment and experiential travel likely to tick up post-COVID. FLYW’s defensive exposure to non-discretionary cross-border flows could also provide some insulation from any potential macro headwinds ahead.

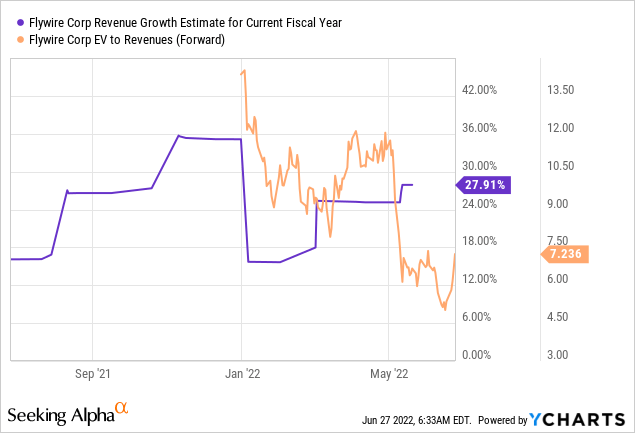

The valuation is a hurdle, though, at ~25x mid-term EBITDA (~7x fwd EV/Sales) in a rising interest rate environment. That said, if management can deliver on its ~30% growth target and unlock operating leverage benefits from its scaling efforts, FLYW could still deliver upside – particularly with Street estimates well below its mid-term targets.

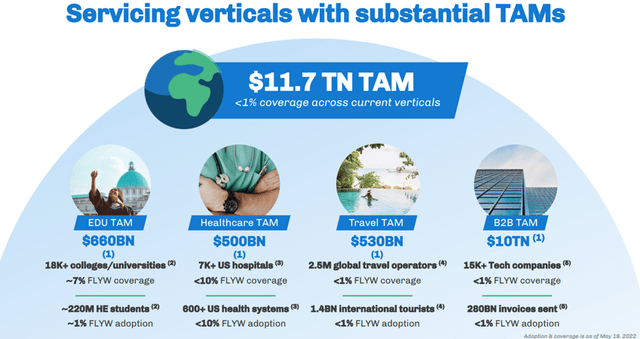

Growth Runway Underpinned by Underpenetrated TAM Opportunities

Broadly speaking, FLYW targets unique verticals accepting high-value payments –in aggregate, this entails a combined addressable market opportunity of ~$11.7tn, of which FLYW’s penetration amounts to <1%. The breakdown by vertical is as follows – B2B Payments at ~$10tn, followed by Education at ~$660bn, Travel at ~$530bn, and Healthcare at ~$500bn. Within the Healthcare, Travel, and B2B verticals, FLYW’s penetration rates stand at <1%, while in Education (its most mature vertical), the penetration is still relatively low at ~7% – despite having >2k institutions globally.

Flywire

Plus, Flywire has only just crossed the >400 client milestone in its emerging travel and B2B verticals, so there remains ample room to grow from here. Another key positive for the FLYW investment case is the resilience of its end markets, many of which have maintained strong secular growth trends through the cycles. For instance, the ~7% growth in the international student market, ~5% growth for out-of-pocket healthcare expenses, ~8% growth in the luxury travel market, and ~20% growth in global e-invoicing.

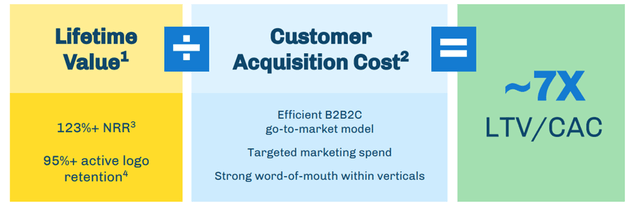

Unlocking Growth Through a “Land and Expand” Strategy

FLYW has had a demonstrated track record of leveraging a “land and expand” strategy to retain and grow within the existing customer base while also accelerating the onboarding of new customers. As of 2021, its customer count has not only grown to >2.7k (up from ~50 in 2011) but has also been highly diversified – no single client represents more than 3% of revenue. Retention is another key highlight, with FLYW sustaining a >120% average net retention rate over the last three years (>95% logo retention of active customers), driving an impressive ~7x LTV-to-CAC ratio (i.e., the lifetime value of a customer vs. the marketing costs of acquiring that customer).

Flywire

From here, there is still ample room for the company to grow within its existing base, with management citing a 5-7x multiplier opportunity within existing customers and products. This likely excludes pricing given FLYW typically prices competitively, so using pricing as a growth lever could be a source of incremental upside going forward.

Outside of its existing revenue base, management has also guided to an even larger opportunity from new client wins. Given these estimates exclude other long-term drivers such as additional verticals and M&A, expect upside to the external growth targets as well. FLYW’s track record on acquisitions bodes well for the cross-sell opportunity – for instance, WPM, a recently acquired software and payment solutions provider for UK-based universities and colleges, screens favorably on strategic and financial fronts. Thus, there are ample opportunities for the company to add capabilities to support existing verticals or bring it into new verticals while targets (e.g., WPM) benefit from FLYW’s expertise in payments as well as its global payments reach.

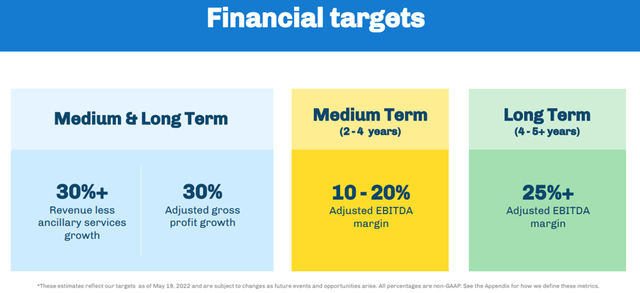

A Relatively Conservative Financial Outlook

While corporates have been conservatively reluctant to move numbers up/down following recent investor days, this year’s FLYW investor event was an exception. Management pegged its mid to long-term targets for revenue growth (less ancillary services) at a >30% rate, with adjusted gross margins guided within the 65%-70% range. The latter is subject to the revenue mix by vertical, payment method, and type, but if achieved, FLYW could deliver gross profit growth of 30% over the mid to long term.

Achieving its EBITDA targets could prove more complex, though – the company will need to balance investing in growth initiatives with projected margin expansion of ~ 3-6%pts/year. This would imply reaching 10%-20% in the mid-term and ~25%+ beyond the five-year mark, with incremental P&L upside dependent on a more efficient cost structure and ability to unlock operating leverage gains. Given that ~65% of its employee base has high scaling capability, FLYW could tap into this expense line for margin upside down the line.

Flywire

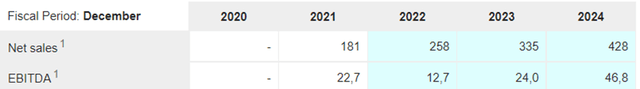

Yet, the Street remains skeptical – relative to the >$100m of adj 2025 EBITDA implied by achieving these targets, current estimates remain significantly lower, leaving ample room for upside should management execute as planned.

MarketScreener

A Growth Asset with Upside Potential – Despite the Valuation

Amid the rising interest rate backdrop, the market has become increasingly discerning, as investors demand a clear path to profitability and hold management teams accountable to their financial targets. FLYW ticked all the boxes at its investor day, outlining a clear message on the outlook for the next five years while maintaining the balance sheet flexibility to reinvest in the business as needed.

Still, the stock has underperformed the broader indices YTD – a seemingly unjustified sell-down given FLYW’s high-quality business model, management team, and growth opportunities. Net, FLYW offers one of the best combinations of counter-cyclicality, growth, and profitability in the universe of growth stocks with a track record of >30% growth and thus, could still see upside from here despite the valuation.