simpson33

Shares of streaming platform fuboTV (NYSE:FUBO) have declined 76% in 2022 despite the company making significant progress regarding subscriber and revenue growth. Streaming companies have fallen a bit out of favor lately, but the fuboTV platform benefits from long term trends such as cord-cutting and it has potential in the advertising business. Shares of fuboTV sell for less than 1 X FY 2023 revenue — which is low for a streaming company — and I believe the risk profile is skewed upwards in the long term!

fuboTV is growing rapidly

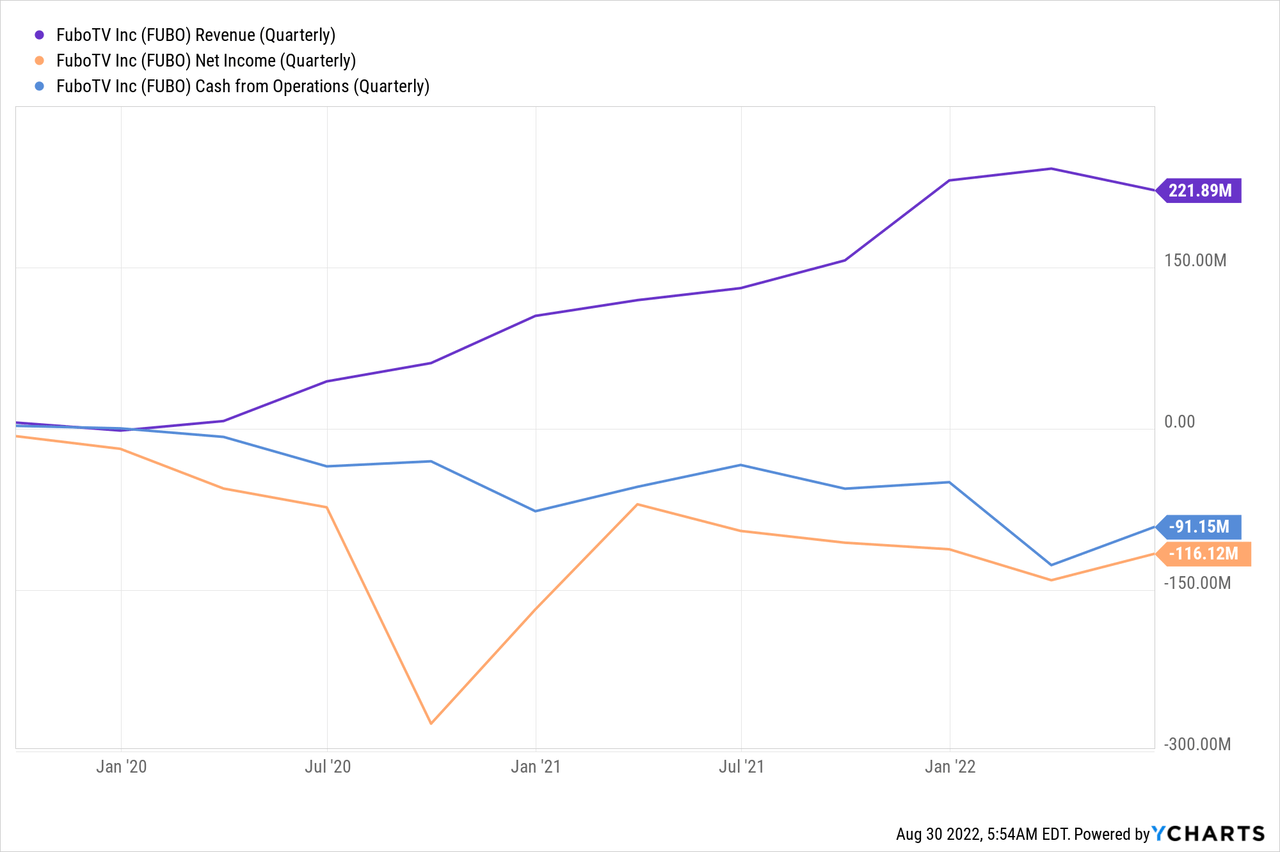

fuboTV reported a 70% increase in revenues to $221.9M in the second quarter due chiefly to growth in subscribers in North America. While fuboTV also has subscribers in other countries, the North America region remains the driver for the platform’s revenue and subscriber growth. Subscribers in North America generate about 97% of the firm’s revenues, largely because the US is the most attractive marketing region for advertisers.

In Q2’22, fuboTV’s North American subscribers totaled 947 thousand, showing 41% growth year over year, but growth is slowing and the company did not meet its guidance of 965-975 thousand subscribers.

Subscriber growth was stronger in the “rest of the world” than in North America: the international business had 347 thousand subscribers at the end of the quarter, showing 130% growth year over year. However, these subscribers generated a relatively small amount of revenues of $5.8M.

fuboTV is also seeing a slowdown in the advertising business which I believe is only temporary. The fuboTV platform, I believe, has a lot of long term potential as the subscriber base continues to grow and more customer data can be monetized. Many streaming companies are exploring alternative monetization paths, such as the introduction of ad-supported tiers.

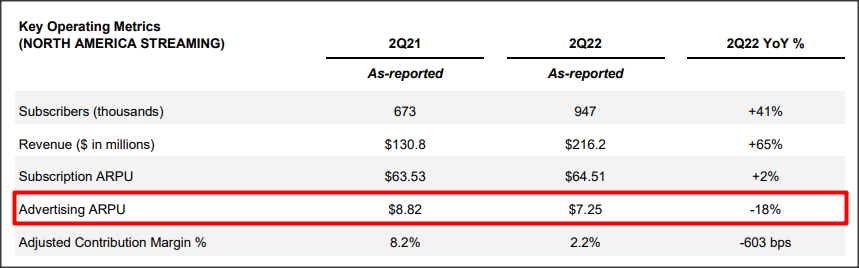

While the segment’s total ad revenues increased 32% year over year to $21.7M, fuboTV’s advertising average revenue per user/ARPU declined 18% year over year to $7.25 in Q2’22 due to macro factors.

fuboTV: Q2’22 Key Metrics

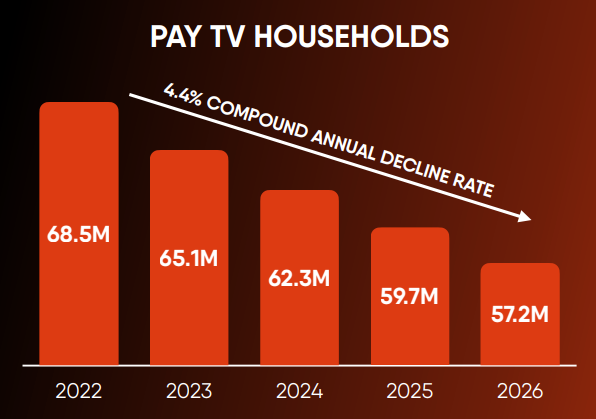

Long term trends in the streaming industry are favorable to fuboTV, however, and support the company’s expansion and platform growth. Consumers are endorsing streaming platforms and it comes at the expense of traditional pay-TV subscriptions. Cord-cutting trends are working heavily in favor of fuboTV as projections imply a continual decline in traditional pay-TV viewership until FY 2026. According to eMarketer, US pay-TV penetration is declining rapidly and expected to drop below 50% next year.

fuboTV: Pay TV Penetration

New guidance for FY 2022

fuboTV is seeing a post-pandemic slowdown in its subscriber growth and the sports live streaming company reduced its FY 2022 subscriber forecast from 1,465,000-1,475,000 to 1,330,000-1,350,000 subscribers in the second quarter. Based off of the new guidance, fuboTV expects to grow its subscriber base 19% year over year.

No profits in sight (for now)

fuboTV is not profitable and it will take years before investors are going to see profits show up on the company’s profit and loss statement. The lack of profits as well as the lowered subscriber guidance have weighed on fuboTV’s valuation lately. In Q2’22, fuboTV made a loss of $116.1M and the company is not expected to be profitable until FY 2026.

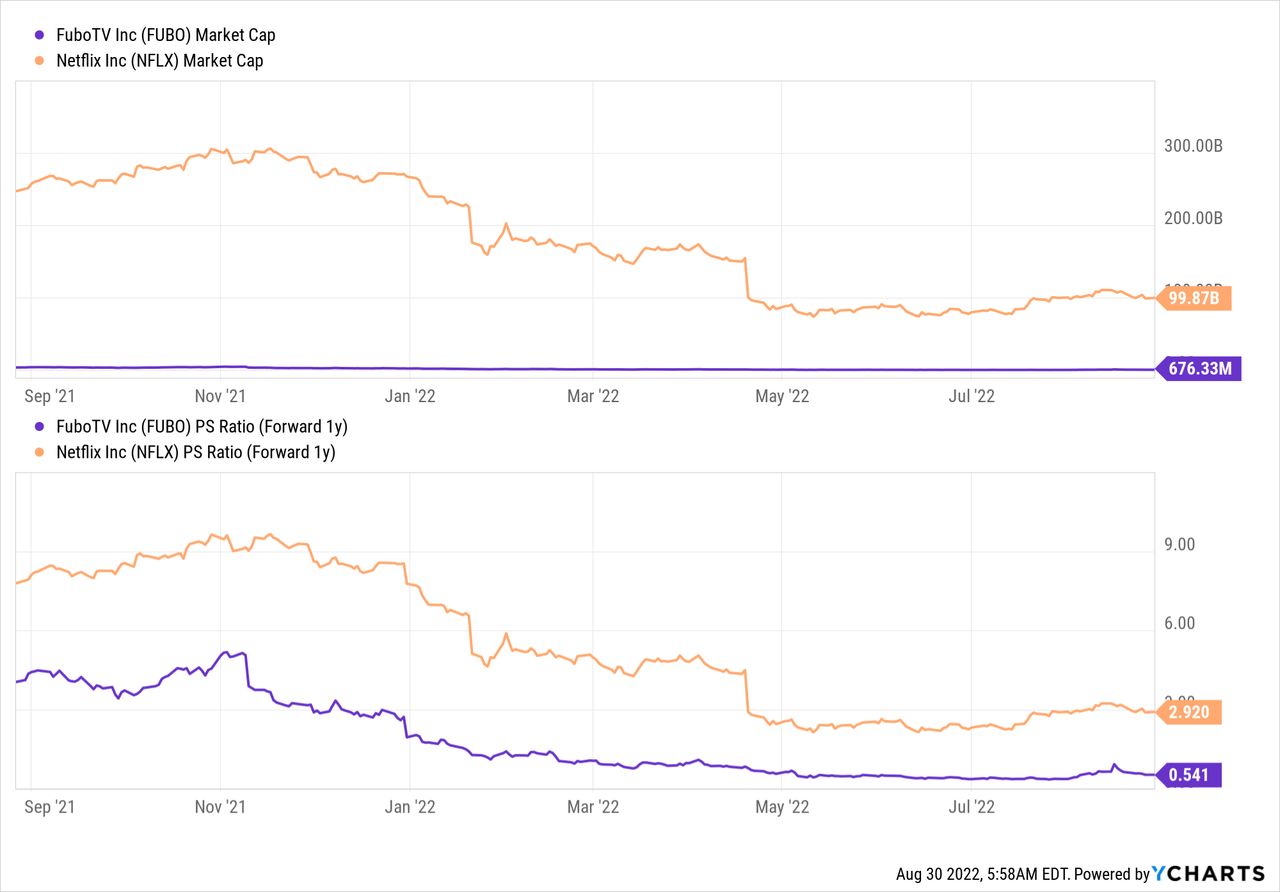

fuboTV is undervalued

I have said it before that fuboTV was undervalued and I was clearly wrong about that. However, compared against other streaming platforms, fuboTV has an attractive revenue-based valuation. fuboTV is expected to see revenues of $1.25B in FY 2023. Since the streaming platform — after a 78% decline in pricing this year — only has a market cap of $676M, fuboTV’s shares are selling for 0.5 X estimated FY 2023 revenues. Netflix (NFLX), as an example, is trading at more than five times this valuation factor.

Risks with fuboTV

In the short term, I see risks for fuboTV’s advertising business as well as subscriber growth. As advertisers pull back on advertising due to growing macroeconomic risks, fuboTV may see continual weakness in ad-spend on its platform as well as declining average revenue per user. At the same time, moderating subscriber growth is a problem for fuboTV and its stock, especially if the company was forced to reduce its outlook for full-year subscribers yet again in the second half of the year. Lower top line and subscriber growth may delay fuboTV’s profitability timeline as well.

Final thoughts

fuboTV is a loss-making streaming platform which is not something that investors value right now. However, the platform is still growing subscribers rapidly (just not as rapidly as guided for) and benefits from cord-cutting trends that are expected to last for years to come. fuboTV could be a winner in the streaming business as people continue to ditch pay-TV subscriptions, but investors must know that the streaming platform is unlikely to turn a profit for at least the next three years. Going forward, the market may turn further against streaming companies that are losing money, but it may reward them with a higher valuation factor if they sustain subscriber momentum and profits start to show up!