Nordroden

Introduction

I’m a Scandinavian based main street investor and therefore have a natural interest for my own part of the world. Those following me, will also know that I’ve published what I call the “Scandinavian Shopping List” on more than one occasion, where I zoom in on the greatest companies available within each of the Nordic countries. Those stumbling upon this article and unfamiliar with this part of the world, I’d recommend taking a brief glimpse at the aforementioned article, as it highlights the strengths of the Scandinavian economies, some of the most developed and innovative economies in the world, combined with highly educated populations and stable democracies. Point being, companies from these countries, are surrounded by the required ingredients in order thrive locally as well as globally.

Within this article, I look closer at Atlas Copco (OTCPK:ATLKY), an industrial company with a global presence and one that I’ve praised in my previous installment of looking at what Scandinavia has to offer.

Atlas Copco From A Helicopter Perspective

The company was founded in 1873, a 149 years ago, and has grown to more than 43,000 employees allocated across 70 countries, securing sales in more than 180 countries. With a $43 billion market cap, it’s truly a global company despite its Swedish heritage. The presence in so many countries is due to a vast customer center network, while also maintaining production across all inhabited continents except for Australia, while mainly concentrated in Europe and North America when it comes to the production footprint. The current order distribution by region shows Asia/Oceania with 40% followed by Europe at 28% and North America at 24%.

The company follows a decentralized structure with four divisions focusing on their own product area.

- Compressor technique with 45% of total revenue and an operating margin for FY2021 of 23.9%

- Vacuum technique with 26% of total revenue and an operating margin for FY2021 of 24.2%

- Industrial technique with 17% of total revenue and an operating margin for FY2021 of 20.5%

- Power technique with 12% of total revenue and an operating margin for FY2021 of 16%

Within the three main drivers of revenue, Atlas Copco holds a leading market position, while it is considered more a challenger within power technique. Most of us have probably seen or already own for instance a compressor, and while Atlas Copco also provide those, it’s meaningful to understand they provide them on an industrial scale, meaning the required specifications are totally different than compared to one standing in your garage. Similarly for Vacuum pumps and industrial tools. Many of the industries to which Atlas Copco cater, are characterized by a need to provide ever more efficient and energy aware solutions while reaching a diverse customer landscape, and therefore, Atlas Copco has also increased its R&D spend by 60% over the past decade, ensuring the company maintains its leadership.

As is usual for companies from this part of the world, there is an emphasis on the bottom line, suggesting a need for balance between a profitable business with considerations for people and sustainability.

Atlas Copco Investor

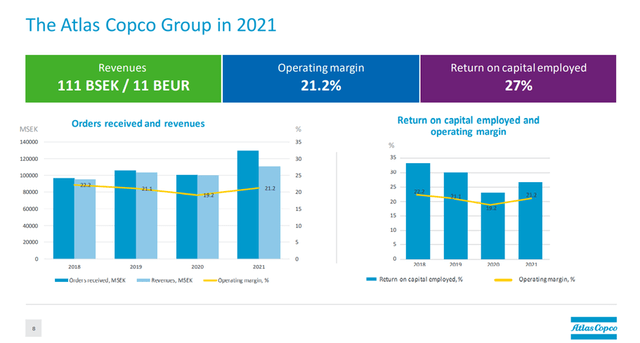

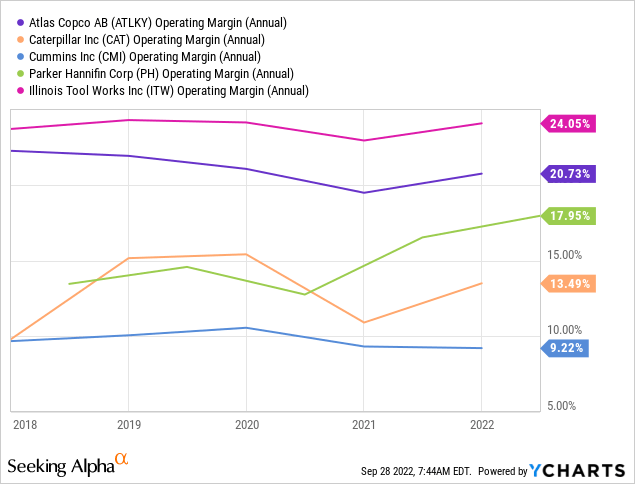

Seen from a headline perspective, Atlas Copco has a slowly growing revenue over time and a strong operating margin consistently north of 20%, rather satisfactory for an industrial company, as can also be seen from the small selection of industrial peers, though none of them are entirely similar as Atlas Copco operate across a number of industrial segments.

There is one last, but important thing to keep in mind when observing this company and its financial performance, and that is the decade long and continued weakness of the Swedish currency in comparison to the USD to the point where it today requires more than 11 SEK to obtain 1 USD, whereas five years ago it only took slightly above 8 SEK to obtain 1 USD and ten years ago, that number was 6.5 SEK for 1 USD.

The effect is very evident in a year such as this where investors crave USD due to its status as reserve currency combined with the safe harbor logic surrounding the USD. Being a freely floating currency, the SEK therefore gives way in a time such as the one we are in. It means that Swedish citizens will find it increasingly more expensive to visit countries who operate with the USD or purchase US based goods & services, while Swedish goods become cheaper in the eyes of those holding the USD. As an investor, it means that USD based investors today get more “bang” for the buck, but also that any given dividend will provide less in return due to it being paid in SEK and not USD. As with currencies, there is no certainty as to how they will develop as it’s also a reflection of how the underlying economy performs. As such, it doesn’t allow one to conclude the development seen below must reverse to its point of origin.

However, it’s important to keep in mind, that Atlas Copco is a global company and as such not primarily exposed to the SEK, but a basket of currencies.

www.xe.com

With Atlas Copco reporting its performance in local currency, it means that the actual development is very different from the one reported in USD, please observe the table below.

|

Year of reporting |

Revenue (SEK) Billion |

Revenue (USD) Billion |

|

Financial year 2012 |

90.5 |

13.9 |

|

Financial year 2018 |

95.4 |

10.7 |

|

Financial year 2021 |

110.9 (23% growth since 2012) |

12.2 (12% negative growth since 2012) |

Authors Own Creation: Financial Reports & Seeking Alpha Financials

While the company has managed to grow its revenue by 23% over the past decade in its own currency, when reported in USD it appears as if the company is in fact experiencing a declining revenue.

Recent Financial Performance

The numbers here will be presented in SEK unless specifically stated otherwise.

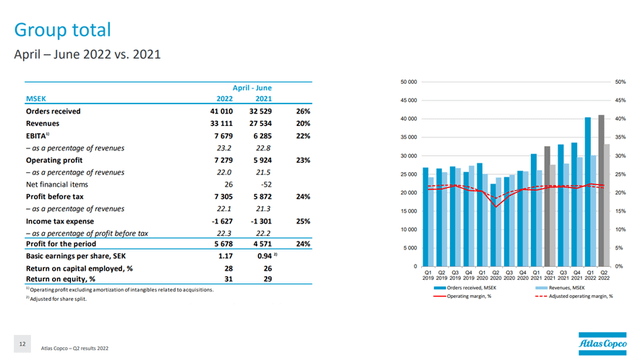

Atlas Copco reported its Q2-2022 performance on July 19th, showing a YoY growth in organic order intake of 13% and 26% in total. Organic revenue growth YoY of 8%, for total revenue growth of 20% YoY. Operating profit increased from SEK 5.9 billion to SEK 7.2 billion, a 23% increase YoY, therefore also showing a growing operating profit margin from 21.5% to 22%.

The company has provided a bridge explanation, detailing how the company benefitted from SEK 2.2 billion in volume growth for its revenue, while SEK 3.1 billion was provided by favorable currency developments. The growth in operating profit is primarily due to the favorable currency environment, securing SEK 1.3 billion of the operating profit growth. Although, this isn’t exactly a huge surprise given the currency fluctuations at play, and also something management didn’t consider outside of the normal given this effect has been at play for some quarters now. For US investors, primarily exposed to US based companies this can come off as strange, but it’s nothing different from how the machinery ticks for e.g. Coca-Cola (KO) who also is exposed to global currencies, but of course reports in the USD, therefore the currency development doesn’t appear as evident as is the case for a company reporting in a non-USD currency.

Atlas Copco Investor

The company experienced a strong order intake across all geographies and segments, but during the earnings call, management also noted that a slight decrease was observed sequentially in vacuum and power technique segments. Given how the order intake has spiked massively in the wake of Covid-19 and that consumer confidence numbers are declining, it’s not unexpected that we are seeing such a development.

What I take particular note of in the slide above, is the continued ability to maintain the profit margins despite the global supply chain constraints at play, showcasing the effectiveness of company operations, also supported by the strong order intake. Management has been able to maintain profit levels despite inflation, increased usage of air freight and other disrupting elements that could have caused erratic behavior in these headline numbers. Some of this, is of course a result of the favorable currency development, but doesn’t take away from the fact, that Atlas Copco is a well run company.

Atlas Copco Investor

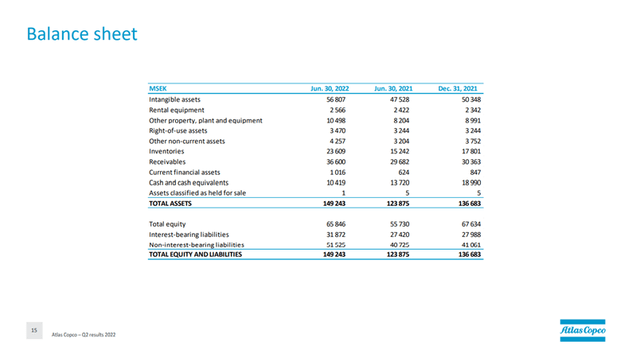

A brief glimpse at the balance sheet, and we observe a rather healthy company with a solid cash position but it’s also fair to note the significant intangible assets position. A result of Atlas Copco having been very active in the M&A market to add bolt-on acquisitions, within especially its power & vacuum technique segment. Going back to the headline slides, the company has completed a handful of acquisitions in recent times. In general, management is investing in the future, as also evident by the growing property, plant and equipment assets.

We see a spike in the inventory numbers, a result of management trying to be able to respond to customer demands without suffering from missing orders as a result of the global supply chain concerns. During the earnings call, management did note they are aware of striking the right balance between being able to respond to customer demands and not ending up with slow moving or depreciating inventory. For now, the company has been able to maintain profits, seeing a slightly reduced earnings picture from the volume and price mix, offset by currency effects.

However, seen from the outside, I could be slightly worried that the company will indeed end up with inventory it can’t get rid of, especially in a situation where we face a sudden recession, something rather likely in Europe due to the energy price shock currently ongoing pressuring the appetite for investments within businesses. Atlas Copco is rather diversified from a revenue base, but I’d monitor the inventory development for the next quarterly results coming up, as this is one of the weak spots in the balance sheet that could potentially require impairment charges down the road.

Atlas Copco Investor

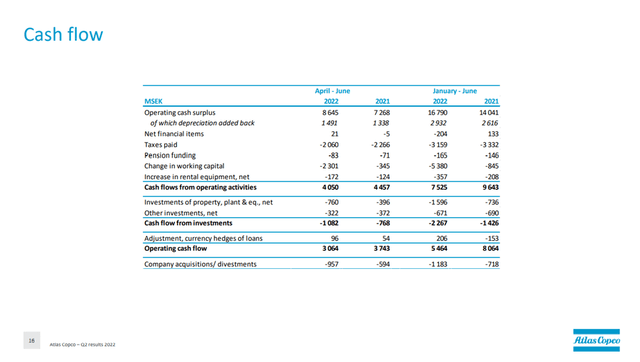

A natural next vantage point is of course the cash flow statement with strong operating cash flows despite being down YoY, primarily due to the significant change in working capital in conjunction with the investments. The strong operating cash flow is however a plus in comparison to what was just observed for the balance sheet, as it gives some cushion to absorb volatility over the coming quarters.

Management closed the call by simply stating they expect reduced customer activity in the coming quarter, but not giving a more detailed indication, while of course reiterating the strength of Atlas Copco.

I believe there are both strengths and weaknesses to be observed here as I don’t find the performance to be pristine, although positive given how the company operates with strong underlying profit across its segments.

Valuation

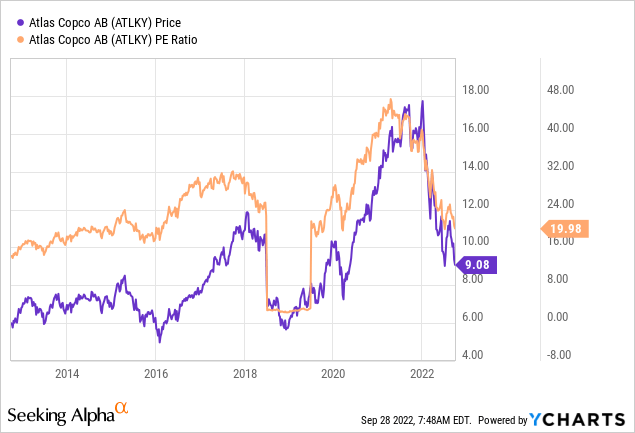

Despite having come down significantly year to date, Atlas Copco still doesn’t qualify as a cheap stock with a current P/E of just above 20. Equally on a forward basis, the stock is trading with a P/E of 20.6 for FY23 and 19.5 for FY24. Observing the graph below, and it’s actually more or less the cheapest the stock has been in the most recent decade except for a few occasions such as the Covid-19 market crash, but relativity doesn’t necessarily justify the current offer as a good entry, and I’m looking for more margin of safety in the current market.

Given the cyclicality of industrial companies, I don’t feel comfortable that Atlas Copco wouldn’t see its earnings impacted during the upcoming quarters given where one of its major markets, the EU, is currently at, with forward looking indicators suggesting a rough period for the European economy as a whole. If we look at another novel indicator, it could be the price to book value, where the company is still trading above 6, which suggests a premium for what is after all an industrial company, with strong margins, but an industrial and cyclical company in a situation where we don’t know how the macro picture will develop.

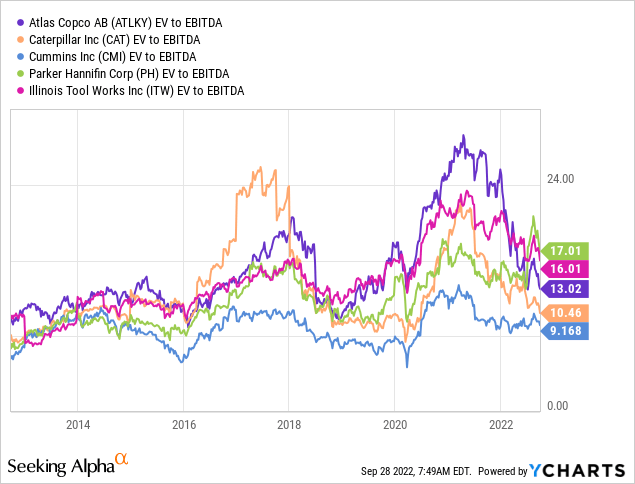

Lastly, I’ve inserted the EV/EBITDA levels, and despite the metric having come down substantially, I’d like for the multiple to get closer to 10, preferably below. However, that might only be achieved if the economy experiences a hard landing as Atlas Copco due to its strong financials, has always usually traded with a premium.

Atlas Copco is a company with a strong financial performance but belonging in a cyclical industry, where the economic impact might not be factored into the current outlook. According to marketscreener, consensus expectations are for Atlas Copco to experience growing revenues and operating profits over the coming two years with a sequentially growing top- and bottom-line for the coming four quarters. That may very well happen, but it’s an indication that the real economy might not be factored into the immediate future for the company in question.

At this point in time, I’d remain patient, but if one absolutely has to establish a position, I would argue in favor of dollar cost averaging as we’ll probably obtain a better understanding of how the real economy will develop over these coming months.

Wrapping Up

Atlas Copco is one of the finest companies based in Sweden. An industrial large cap company with sales and production throughout the world. A leader in its field of operations and consistently churning out strong financials, but also typically with a steep valuation. The vulnerabilities of its cyclicality may start to show itself over the coming quarters as the company has been investing in the future and building up inventory in order to circumvent supply chain issues and remain able to serve customers. Something that can turn from an advantage to a disadvantage should the economic conditions continue to worsen.

With a P/E around 20, also on a forward basis, and consensus estimates suggesting a continued expansion in earnings over the coming couple of years, I don’t perceive there is a margin of safety, even if the valuation relative to its recent valuation has come down substantially.

As such, Atlas Copco is neither attractive nor unattractive at the current valuation, but I’d remain patient at the current level and steer clear for now.