FilippoBacci/E+ via Getty Images

Introduction

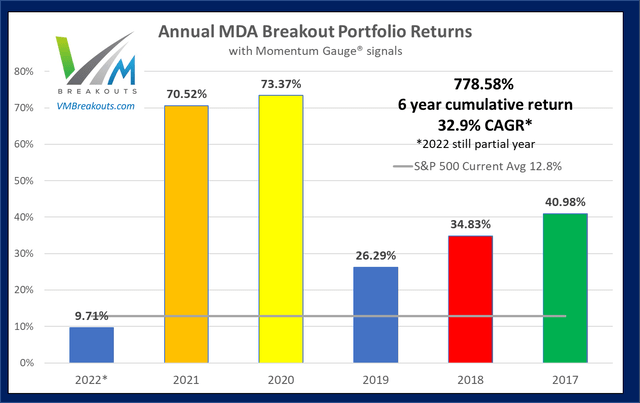

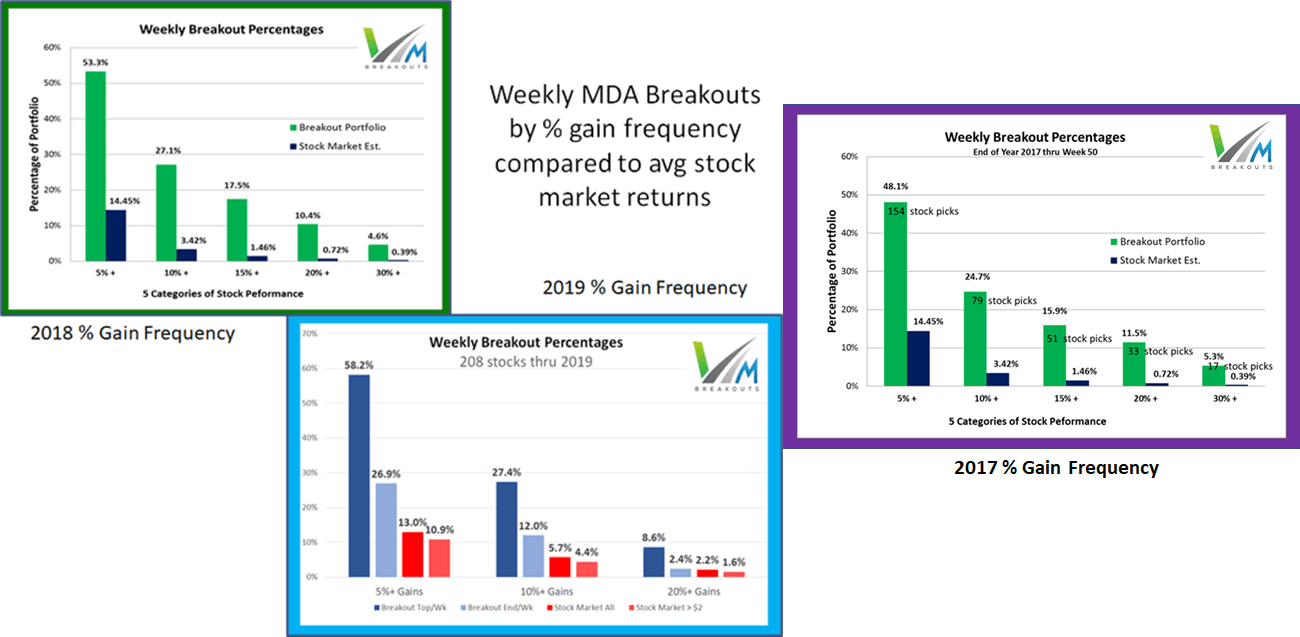

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now exceeded 280 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages in the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate only 4 selections each week. In addition, 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading studies were made public.

Market Outlook

The Momentum Gauges®, economic events, and weekly market outlook are now separated into a weekly articles here which also includes my new weekly Technical Market update videos. As I cautioned all year about September being the worst month of the year on average since 1927 not including the scheduled 2x Fed quantitative tightening, October is likely to have strong similarities to a very negative October 2018 with prior QT. We are finally leaving September that delivered, as expected, the worst month of the year AND the worst month since March 2020.

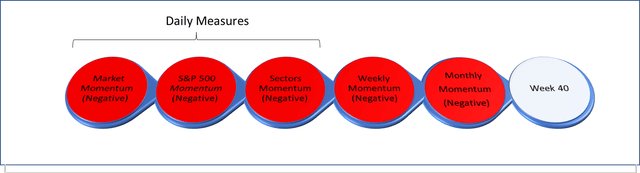

Momentum Gauges® Stoplight signals for Week 40 continue with all the gauges extremely negative ahead of Week 40. Sector Gauges show several sectors at Max Low levels and historically this low level is rarely sustained for more than a few days without a bounce off the lows. During the Covid correction, the sector gauges remained at max lows for several weeks. See more discussion in the chat rooms and on the charts.

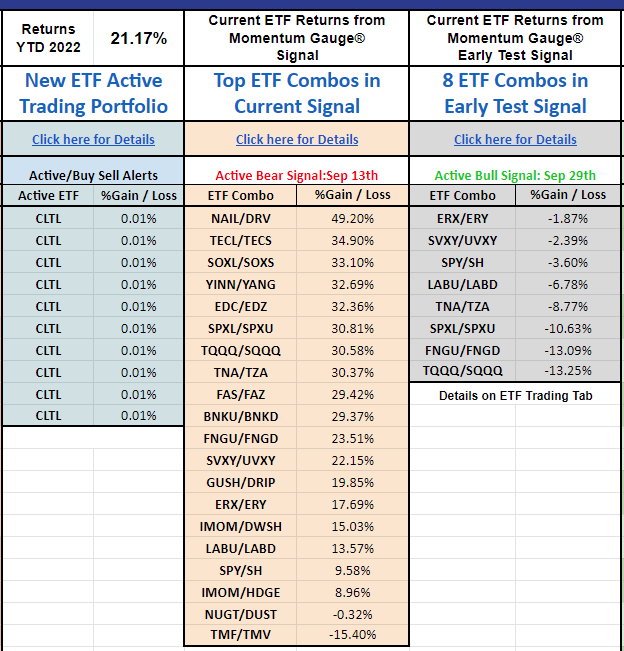

VMBreakouts.com

As a reminder, much greater detail is covered live every day with current charts and signals. If you are not reviewing the latest charts and updates you could be missing out. With the signals predictably bearish for September and very negative in the worst month on average since 1927 the ETF models have been very active in bear funds with the current returns by model. The Active ETF portfolio frequently moves to cash (CLTL) over the weekend to minimize risk in these 3x leveraged funds:

VMBreakouts.com

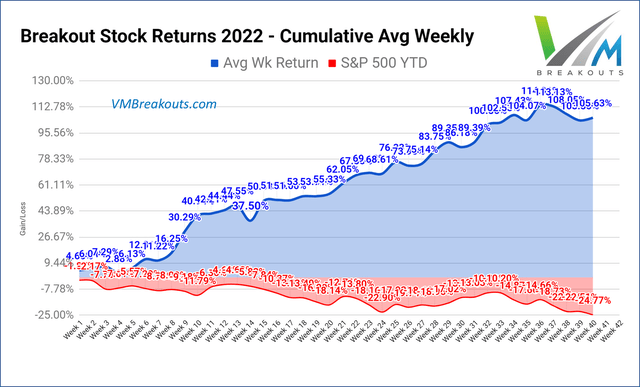

Current MDA Breakout Returns

So far YTD 2022 there are 102 picks in 39 weeks beating the S&P 500. 64 picks are beating the S&P 500 by over 10%+ in double digits. Leading MDA gainers include WVE +19.1%, RES +51.97%, TDW +84.7%, CLFD +68.9%, VRDN +59.2%, TA +45.4%. Despite such high negative momentum conditions all year, 39 picks in 39 weeks have gained over 10% in less than a week. Additionally, 87 picks in 39 weeks have gained over 5% in less than a week in these high frequency breakout selections. These are highly significant statistical results that are further improved by following the Momentum Gauge signals.

VMBreakouts.com

Additional background, measurements, and high frequency breakout records on the Weekly MDA Breakout model is here.

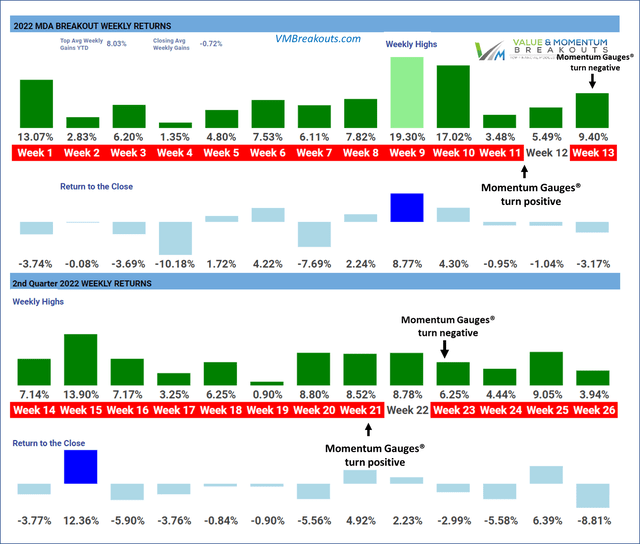

2022 First-half weekly return results

First half returns with all the weekly returns available on the V&M Dashboard

VMBreakouts.com

Red weekly color indicates negative Market Momentum Gauge signals. MDA breakout selections outperform when the market signal is positive and daily negative values are below 40 level.

Historical Performance Measurements

Historical MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

VMBreakouts.com

Longer term many of these selections join the V&M Multibagger list now at 99 weekly picks with over 100%+ gains, 39 picks over 200%+, 18 picks over 500%+ and 11 picks with over 1000%+ gains since January 2019 such as:

- Enphase Energy (ENPH) +1,906.29%

- Celsius Holdings (CELH) +1,829.36%

- Intrepid Potash (IPI) +1,060.41%

- Trillium Therapeutics (TRIL) +1008.7%

More than 300 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation

The Week 40 – 2022 Breakout Stocks for next week are:

The picks for next week consist of 3 Healthcare, and 1 Energy sector stocks. These stocks are measured from release to members in advance every Friday morning near the open for the best gains. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals — but readers are cautioned to follow the Momentum Gauges® for the best results.

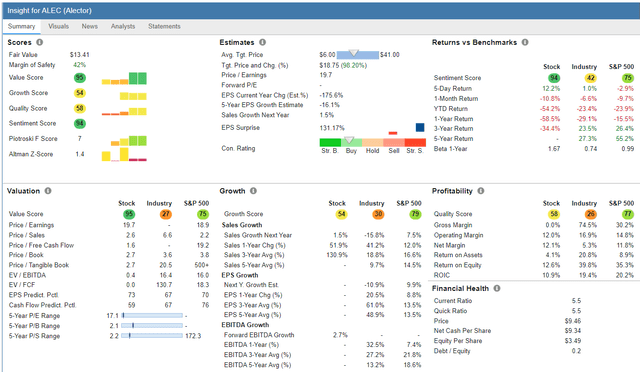

Alector Inc. – Healthcare / Biotechnology

FinViz.com

Price Target: $12.00/share (See my FAQ #20 on price targets)

Alector, Inc., a clinical stage biopharmaceutical company, develops therapies for the treatment of neurodegeneration diseases. Its products include AL001, a humanized recombinant monoclonal antibody, which is in Phase III clinical trial for the treatment of frontotemporal dementia, Alzheimer’s, Parkinson’s, and amyotrophic lateral sclerosis diseases; and AL101 that is in Phase I clinical trial for the treatment of neurodegenerative diseases, including Alzheimer’s and Parkinson’s diseases.

(Source: Company Resources)

StockRover.com

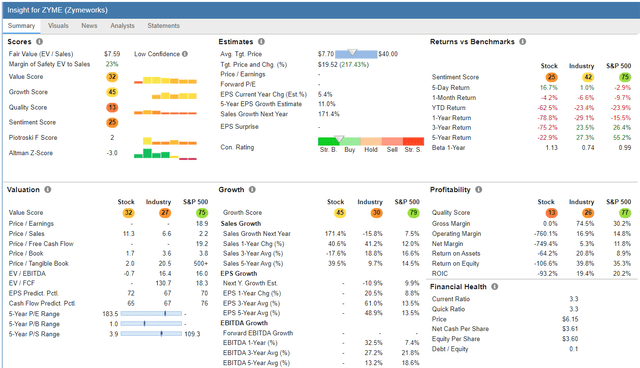

Zymeworks – Healthcare / Biotechnology

FinViz.com

Price Target: $8.00/share (See my FAQ #20 on price targets)

Zymeworks Inc., a clinical-stage biopharmaceutical company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer. The company’s lead product candidates include zanidatamab, a novel bispecific antibody that is in Phase 1 and Phase 2 clinical trials for the treatment of biliary tract, gastroesophageal adenocarcinomas, breast, and colorectal cancer; and ZW49, a biparatopic anti-human epidermal growth factor receptor 2 (HER2) antibody-drug conjugate that is in Phase 1 clinical trial for the treatment of advanced or metastatic HER2-expressing tumors.

(Source: Company Resources)

StockRover.com

Top Dow 30 Stocks to Watch for Week 40

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Conditions have delivered the worst first half to the stock market since 1970. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks.

The Dow index is in technical breakdown condition with 12 out of 30 stocks hitting new 52 week lows. The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (MMM) | 3M Company | -2.20% |

| MCD | McDonald’s Corp. | -6.18% |

| (JNJ) | Johnson & Johnson | -1.38% |

| (MCD) | McDonald’s Corp. | -8.59% |

| (MSFT) | Microsoft Corp. | -11.93% |

| (CAT) | Caterpillar Inc. | -13.41% |

| (AAPL) | Apple, Inc. | -13.20% |

| (CVX) | Chevron Corp. | -8.51% |

| (JPM) | JPMorgan Chase & Co. | -8.87% |

| (DOW) | Dow Inc. | -19.34% |

If you are looking for a much broader selection of large cap breakout stocks, I recommend these long term portfolios. The new mid-year selections were released to members to start July:

Piotroski-Graham enhanced value –

- July midyear down -8.55%

- January portfolio beating S&P 500 by +28.21% YTD.

- July midyear down -10.21%

- January Positive Forensic beating S&P 500 by +6.45% YTD.

- July up +14.87%

- January Negative Forensic beating S&P 500 by +18.70% YTD

Growth & Dividend Mega cap breakouts –

- July midyear down -9.28%

- January portfolio beating S&P 500 by +10.32% YTD

- The October dividend stocks have just been released.

These long term selections are significantly outperforming many major hedge funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -60.01% YTD, Tiger Global Management -52% YTD.

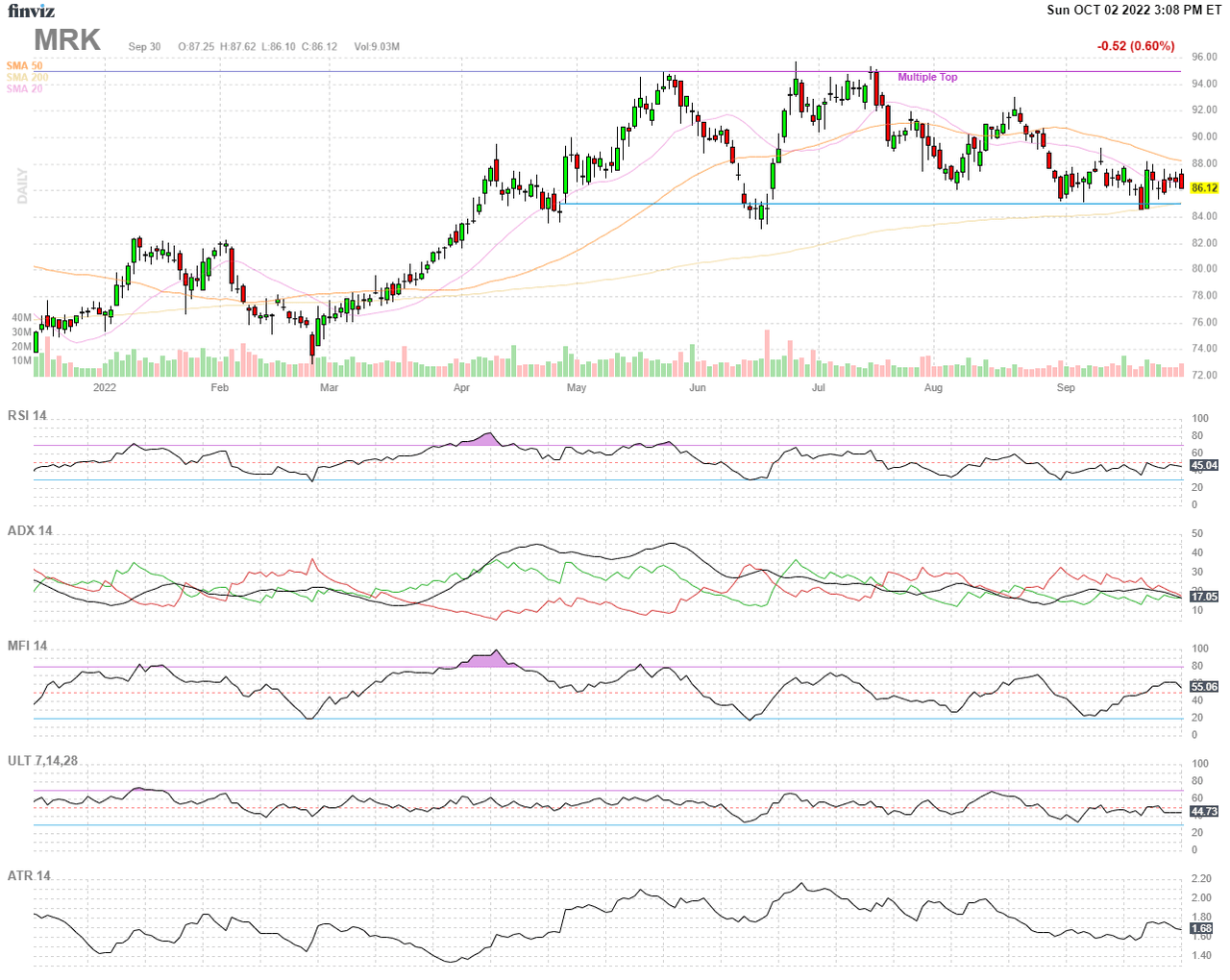

The Dow pick for next week is:

Merck & Co., Inc. (MRK)

Merck & Co. is still holding key support at $85/share back to April and remains one of the stronger Dow stocks. Net MFI inflows are still positive and if market conditions can improve in October, Merck could retest $95/share resistance in the trading channel following strong July earnings.

FinViz.com

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

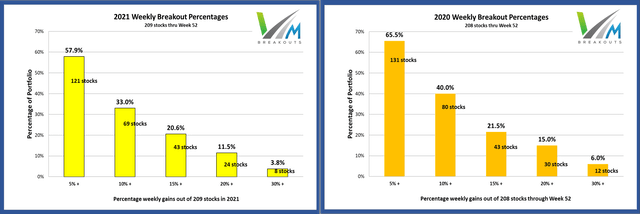

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

(Value & Momentum Breakouts)

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

VMBreakouts.com

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

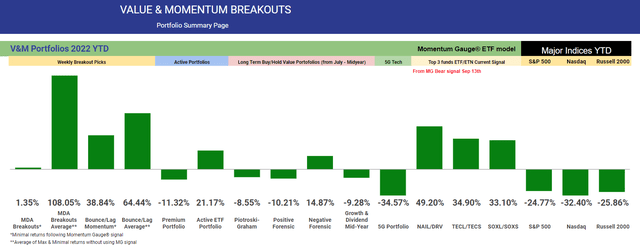

All the V&M portfolio models are beating the market indices through the worst 6 month start since 1970. New mid-year value portfolios are up sharply to start the next long term buy/hold period.

VMBreakouts.com

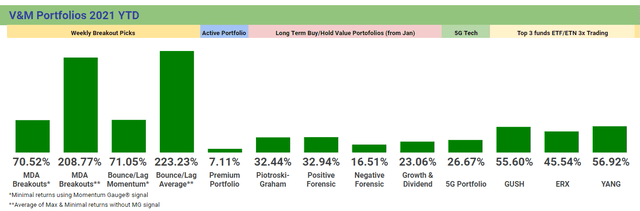

The final 2021 returns for the different portfolio models from January of last year are shown below.

VMBreakouts.com

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS