imaginima

As U.S. natural gas price hiked in the first five months of the year, Energy Transfer LP (NYSE:NYSE:ET) stock price increased from $9 to $12 per share. Since June 2022, natural gas prices in the United States experienced high levels of volatility. Natural gas prices are expected to be high, and I predict ET’s financial results in the second quarter of the year to be better than in 1H 2022.

It is worth noting that since January 2021, Energy Transfer insiders and independent board managers purchased more than 23 million units of ET stock. Just in September 2022, the Executive Chairman purchased 3 million Units. With insider ownership of more than 13%, which is significantly higher than the peers, combined with high natural gas prices in the fourth quarter of 2022, Energy Transfer is a buy.

Quarterly highlights

In its 2Q 2022 financial result, ET reported 2Q 2022 net income attributable to partners of $1.33 billion, up $700 million YoY. The company reported revenues of $25.9 billion, compared with 2Q 2021 revenues of $15.1 billion, up 72%. Energy Transfer achieved record processing volumes in the Permian Basin in the second quarter of the year. Also, the company reported record total NGL transportation and fractionation volumes in 2Q 2022. Energy Transfer increased its expected adjusted EBITDA for 2022 to $12.6 to 12.8 billion, up from the previous guide of $12.2 to $12.6 billion. In 2Q 2022, the company’s distributable cash flow increased by 35% YoY to $1.88 billion.

“As a result of increasing demand for fractionation capacity, Energy Transfer recently resumed construction of its eighth fractionator at its Mont Belvieu, Texas facility. Frac VIII, which was more than half funded when construction was paused in 2020, is now expected to be in service in the third quarter of 2023 and will bring the Partnership’s total fractionation capacity at Mont Belvieu to over 1.1 million barrels per day,” the company announced. “The Partnership has entered into five long-term LNG Sale and Purchase Agreements. Under these SPAs, Energy Transfer LNG Export, LLC is expected to supply a total of 5.8 million tonnes of LNG per annum, with first deliveries expected to commence as early as 2026 under SPA terms ranging from 18 to 25 years,” the company explained.

The market outlook

According to Figure 1, in the second quarter of 2022, natural gas prices in the United States increased from $5.7/MMBtu to $9.3/MMBtu and then dropped to $5.4/MMBtu. In the third quarter of 2022, natural gas prices in the United States increased from $5.4/MMBtu to $9.7/MMBtu and then declined to $6.8/MMBtu. U.S. natural gas prices decreased during the past month due to weakening global economic sentiment and the threat of a recession. On the other hand, in Europe, two lines of the North Stream 1 pipeline and one line of the North Stream 2 pipeline were damaged, making the European natural gas prices increase. According to EIA’s latest short-term energy outlook, Henry Hub price will be about $9/MMBtu in the fourth quarter of 2022. However, EIA expects Henry Hub natural gas price to be about $6/MMBtu in 2023 as U.S. natural gas production increases. Thus, I expect ET to report strong 3Q 2022 financial results. Also, I expect the company’s financial results in 1H 2022 to be better than in 1H 2022.

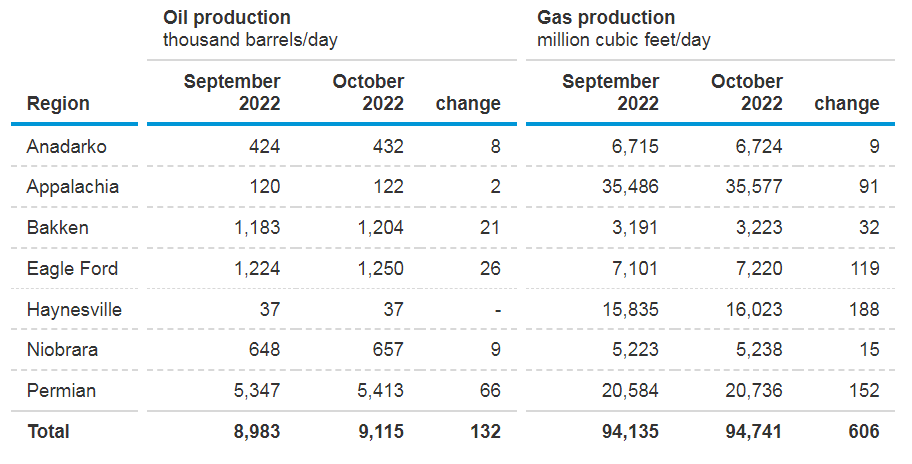

17% of ET’s adjusted EBITDA belongs to the crude oil segment, which has significant connectivity to the Permian, Bakken, and Midcon Basins. Also, 28% of ET’s adjusted EBITDA belongs to the midstream (natural gas) segment, which has strong connectivity to the company’s operations in Permian, Eagle Ford, Anadarko, and Marcellus/Utica Basins. Figure 2 shows that oil production in Permian Basin is expected to increase from 5347 thousand barrels per day in September 2022 to 5413 thousand barrels per day in October 2022. Also, oil production in the Bakken Basin is expected to increase from 1183 thousand barrels per day in September 2022 to 1204 thousand barrels per day in October 2022. Moreover, natural gas production in Permian Basin is expected to increase by 152 million cubic feet per day in October 2022. In October 2022, Natural gas production in Eagle Ford and Anadarko is expected to increase by 119 and 9 million cubic feet per day, respectively. Thus, the market condition is in favor of ET to make a high profit in the crude oil and midstream segments.

Figure 1 – Natural gas price in the United States

tradingeconomics.com

Figure 2 – Oil and gas production by region in September and October 2022

EIA

Energy Transfer performance outlook

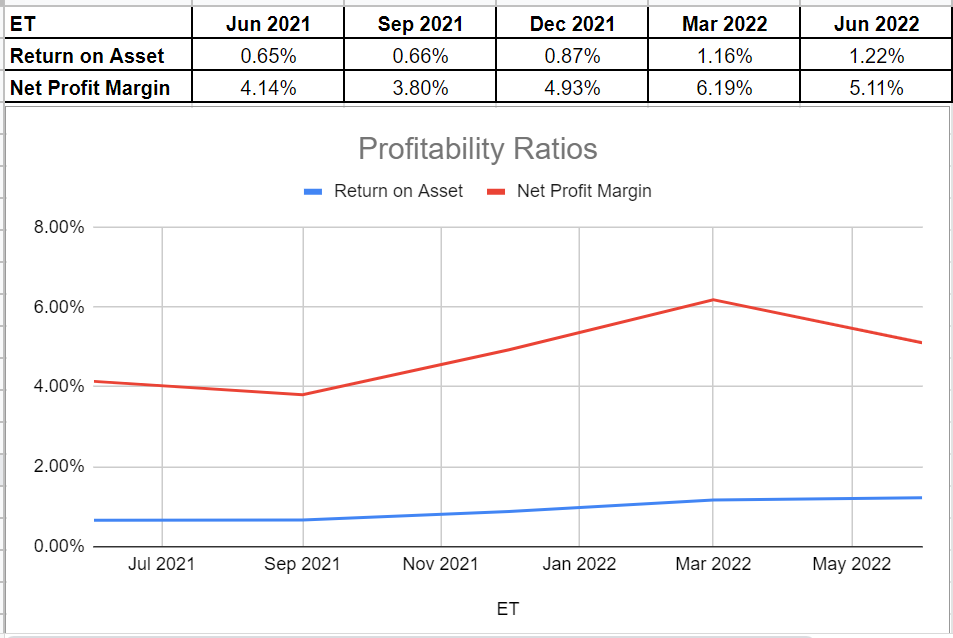

In the case of ET’s profitability ratios, I have analyzed its net profit margin and return on assets. During H12022, the company improved its net profit margin. The net profit margin sat at 5.1% in the second quarter of 2022 year-over-year compared with its amount of 4.14% at the same time in 2021. Meanwhile, it declined slightly versus its amount of 6.19% at the end of 1Q2022.

Moreover, across the board of return on assets, the ROA ratio in Q2 2022 shows that 1.22% of the company’s net earnings is related to its total assets. Energy Transform’s return on assets improved slightly during the previous quarter and sat at 1.22% in 2Q2022 versus its level of 1.16% at the end of the first quarter of 2022. However, the company has increased its ROA by 57 bps year-over-year compared to its previous level of 0.65% at the same time last year. We all know that oil and gas profit margins are so volatile due to the volatility of energy prices. Thus, considering this reality, Energy Transfer’s profitability ratios cater a good capture of its ability to generate income relative to its revenue and assets (see Figure 3).

Figure 3- ET’s profitability ratios

Author (based on SA data)

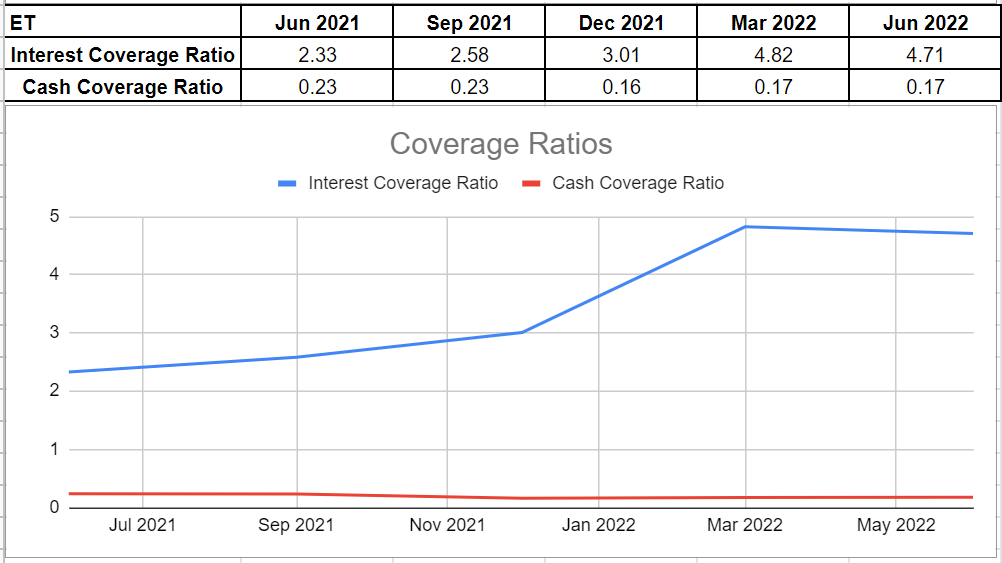

Furthermore, we can analyze ET’s coverage ability across the board of its interest coverage and cash-coverage ratios. Its ICR in Q2 2022 indicates that 4.7 times the company can pay its interest expenses on its debt with its operating income. Notwithstanding a decline in its interest coverage ratio of 4.71 in the second quarter versus the previous level of 4.82 in 1Q2022, ET’s ICR is more than twofold compared with the same time in 2021.

Meanwhile, as a conservative metric to compare the company’s cash balance to its annual interest expense, ET’s cash coverage ratio in Q2 2022 was 0.17, which was unchanged versus the first quarter of 2022, for, both the operating cash flow and current liabilities were almost constant. In sum, there may not be concerns about Energy Transfer’s ability to cover its obligations (see Figure 4).

Figure 4 – ET’s coverage ratios

Author (based on SA data)

Energy Transfer stock valuation

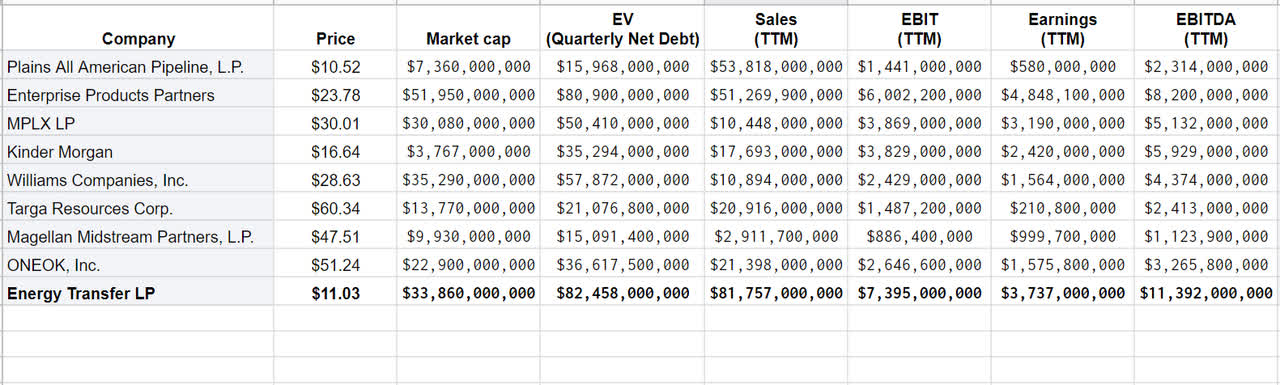

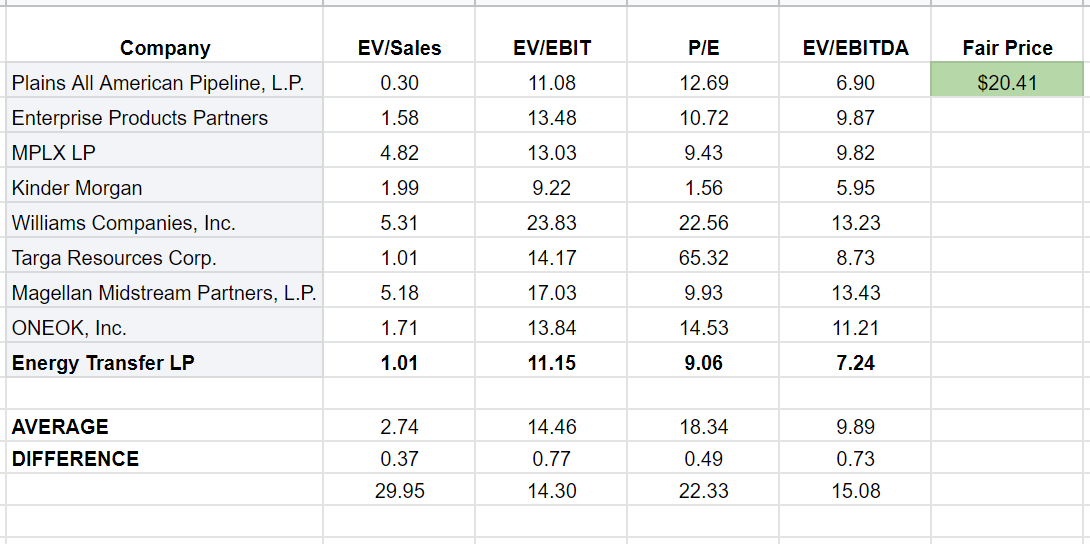

I used Competitive Companies Analysis (CCA) to evaluate Energy Transfer stock. I have updated my peer group, compared ET with other competitors, and used the CCA method to estimate the stock’s fair value. In my opinion, Energy Transfer is undervalued and has an upside potential to reach around $20. I have selected the peers and used common key ratios in a CCA method to illustrate the value of similar companies. Data was gathered from the most recent quarterly and TTM data (see Table 1).

Table 1- ET’s financial data vs. its peers

Author (based on SA data)

Comparing ET’s ratios with other peer companies, I observe that the stock is undervalued – ET’s EV/sales ratio is 1.01x, which is far lower than the peers’ average of 2.74x. Moreover, Energy Transfer’s EV/EBITDA ratio equals 7.24x, which is about 26% lower than the average of 9.89x. Shortly, ET’s financial ratios versus its competitors indicate that the company is attractive as a potential investment (see Table 2).

Table 2- ET stock valuation

Author (based on SA data)

Summary

Due to the acquisition of the Enable Oklahoma Intrastate Transmission system, combined with expanded NGL pipeline and export activities, I expect ET to report strong financial results in the second half of the year as it did in the first half. ET’s market share of worldwide NGL exports has doubled over the last 24 months to approximately 20%, and Natural gas price in the European Union is expected to remain high as long as the war in Ukraine continues. Also, Crude oil and natural gas production in the Permian Basin is increasing.

My valuation shows that ET is worth more than $20 per share. I am bullish on the stock.