designer491/iStock via Getty Images

Thesis

Soligenix (NASDAQ:SNGX) is an underfollowed small biotech company with two business segments. The first business segment essentially develops drug candidate HyBryte or synthetic hypericin for cutaneous T-cell lymphoma, psoriasis and possibly other indications. The second business segment develops vaccines for some of the world’s top-listed pandemic, outbreak and biowarfare threats. The company had last been covered on Seeking Alpha in October 2020 and seems to be very much under-the-radar.

The Phase 3 trial for HyBryte in cutaneous T-cell lymphoma showed a statistically significant treatment response after 6 weeks, with deepening responses over 12 and 18 weeks of treatment. In case of approval, HyBryte would fill an unmet medical need as a potential first-line treatment. I see a very large divergence between its current market price and its growth and revenue potential upon approval in the US and beyond. The company itself estimates its peak sales for the US alone at $90 million, and I believe that estimates are actually fairly moderate in view of the size of the total addressable market and sales of earlier treatments. A moderate 6x sales multiple for the US alone, merely for HyBryte, holds the potential of a +$500 million valuation in the years to come.

The company’s second segment, funded so far by government grants and contracts in a non-dilutive manner, is built around ThermoVax, a platform for the development of up to 40° C. heat-stable vaccines. There are obvious advantages related to the making of such vaccines, and this did not go unnoticed by the government and defense authorities, which basically funded this segment up to this point. The vaccine candidates in development comprise a ricin toxin vaccine, a Marburg and Ebola filovirus vaccine, and a Covid-19 vaccine. All three vaccine candidates in development have at this point generated strong and consistent results in four indications. They are all top-listed biowarfare threats and drug candidates for a future possible outbreak.

The company had about $20 million in cash at the end of the last quarter, with a low cash burn and seemingly constant public funding. There appears to be quite some room for growth with approval and commercialization starting in the next years.

Company

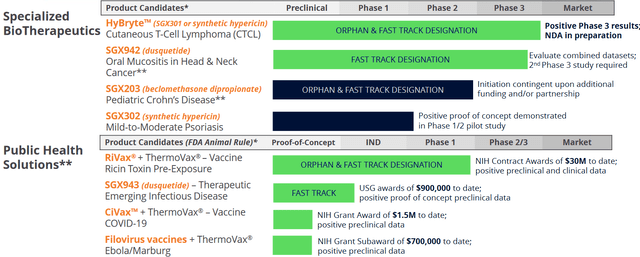

Soligenix, Inc. is a late-stage biopharmaceutical with the following pipeline.

Company Pipeline (Corporate Presentation)

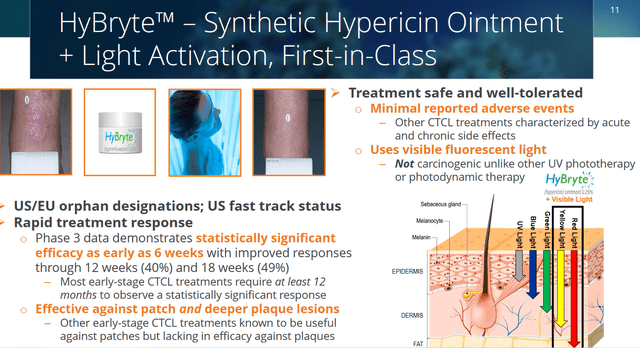

HyBryte, SGX302 or synthetic hypericin, is the company’s main drug candidate. It is expected to be a first-in-class treatment for first line cutaneous T-cell lymphoma, with efficacy in all lesions in a relatively short period of time, that does not come with the acute and chronic side effects seen from the current treatment options.

HyBryte has been shown to have strong antiviral effects, and has been shown to inhibit growth of a variety of cell types. It has shown strong efficacy in a Phase 3 trial in cutaneous T-cell lymphoma, as well as in earlier trials against psoriasis.

Soligenix’s Public Health Solutions segment focuses on heat-stable vaccine development against some of the larger military and civilian threats of the modern world, namely ricin exposure, Ebola, Marburg and COVID-19.

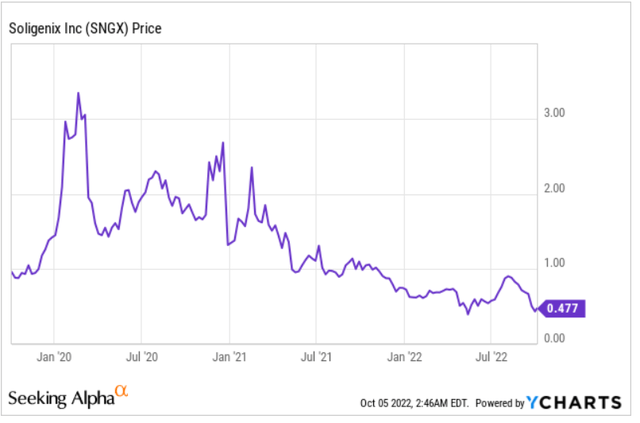

This is the company’s three-year price chart. The 52-week low was at $0.38, which was also the three-year low. The current share price is not all too far from that low. The first big drop from $2.99 to $1.65 occurred from March 6, 2020 to March 20, 2020, coinciding with the S&P 500’s heavy drop over that period. I believe that to be pandemic-related. The company’s positive topline data release for HyBryte on March 19, 2020, in the midst of the pandemic’s panic, has been able to stabilize negative sentiment but not more than that. The second drop around December 2020 was related to the market’s perception of the topline data readout of oral mucositis in head and neck cancer patients, not showing statistical significance despite showing clear biological effects. I see the 56% sell-off over the past twelve months as presumably biotech bear market-related. That leads the company to now have a de-risked and approval-ready main asset, with some pretty interesting additional vaccine developments in the pipeline.

Three-year price chart (Ycharts)

The past three years have basically erased any value-potential, and meanwhile, the company has been successful in several reportings. Given the positive results the company has published coming from HyBryte and its vaccine platform over the past two years, that price seems almost too good to be true.

With potential value-driving catalysts and future commercialization ahead, I believe that the company may see a strong upward revision of its share price in the coming years. Investors may need to weather out the bad investing climate, though.

HyBryte for cutaneous T-cell lymphoma

Introduction

Cutaneous T-cell lymphoma is a denominator for various cancers caused by malignant T-cells, the most common ones being mycosis fungoidis and Sezary syndrome. The disease affects about 40,000 patients worldwide, without there being a cure. In the initial stages, the disease often gets mistaken for skin rash or eczema. The mortality risk depends on the stage of the disease. Median survival generally ranges from 12 years in the early stages to only 2.5 years when the disease has advanced. Treatment in the early stages is often steroidal, and not efficacious. There are some therapies for advanced to late-stage patients, which represent about 5% of the total patient population. Patients often cycle through therapies, none of which leaves them satisfied. Some of them come with risk of secondary cancer, such as narrow band ultraviolet B therapy or mechlorethamine. There is an unmet medical need for the other 95% of patients, with no approved therapy for early-stage cutaneous T-cell lymphoma.

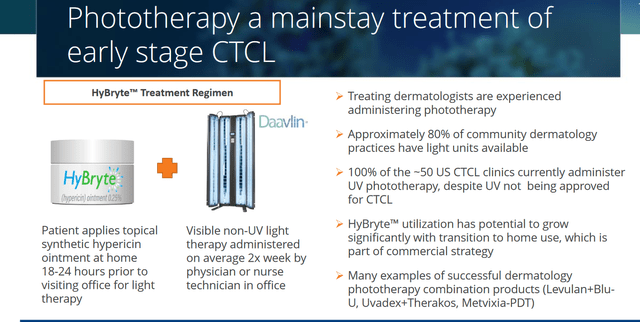

HyBryte is an ointment to be applied on skin lesions, with synthetic hypericin as its active ingredient. HyBryte’s active ingredient is first being taken up by malignant T-cells, and later activated utilizing safe light therapy in the red-yellow spectrum. That combination triggers mitochondrial-driven cell death, as hypericin creates oxygen radicals which cause cellular toxicity, killing the targeted T-cells. The use of red-yellow spectrum light allows deep penetration in the skin, without being mutagenic. HyBryte is non-carcinogenic and does not lead to DNA-damage or secondary malignancies. Soligenix’s proprietary set up would involve the use of exclusive calibrated light devices with special bulbs. Treatment, by light exposure of about 10 minutes on average, would occur 2x/week for 6 weeks. HyBryte has received Orphan Drug designation in the US and in Europe. For the US, that orphan drug designation has been extended to hypericin for the treatment of T-cell lymphoma, for treatments extending beyond cutaneous T-cell lymphoma.

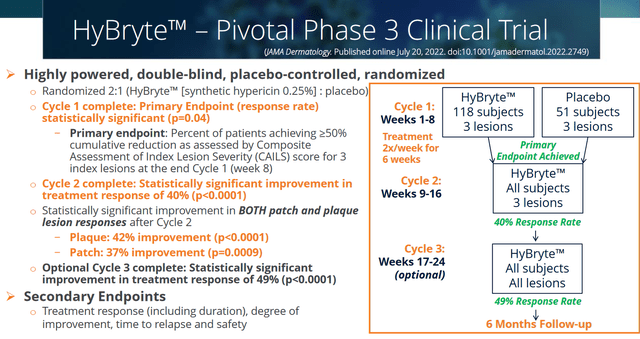

After a positive topline Phase 3 ‘FLASH’ trial readout in March 2020, Soligenix is preparing a new drug application (NDA) for HyBryte in cutaneous T-cell lymphoma. The FLASH trial was a randomized placebo-controlled trial that enrolled 169 stage IA, IB or IIA mycosis fungoides patients who each had at least 3 target lesions. Treatment consisted of three treatment cycles of 8 weeks. The first treatment cycle randomized patients on either HyBryte or placebo, the second cycle had all patients on HyBryte, and the third cycle was for those who chose to continue the trial.

Phase 3 trial design (Corporate presentation)

Cycle 1 results showed a statistically significant treatment response with 16% treated patients responding versus 4% on placebo. Second cycle results showed significantly increased efficacy with a 40% response rate (of note: P<0.0001). Third cycle results confirmed the gradually increasing response rate, with 49% of patients demonstrating a 50% or greater reduction in the relevant lesion rating scale (CAILS) (of note: P<0.0001). The entire trial results were published in Jama Dermatology.

For a treatment that only lasted 18 weeks, I must say those results come across as very powerful, and worthwhile for patients. Given the typical duration of the disease, a possible 50% reduction in lesions over the course of four and a half months is impressive.

Additionally, contrary to other treatments that only affect patch lesions, the trial results showed efficacy both in patch lesions as in deeper plaque lesions.

HyBryte slide (Corporate Presentation)

On April 26, 2021, Soligenix followed up with expanded efficacy and safety data, showing the rate of serious adverse events to be only 2.4%, and unrelated to the use of HyBryte. HyBryte’s response rate was shown to be as good or better than other second-line approved drugs, with significantly less safety concerns.

Commercialization plans fur cutaneous T-cell lymphoma

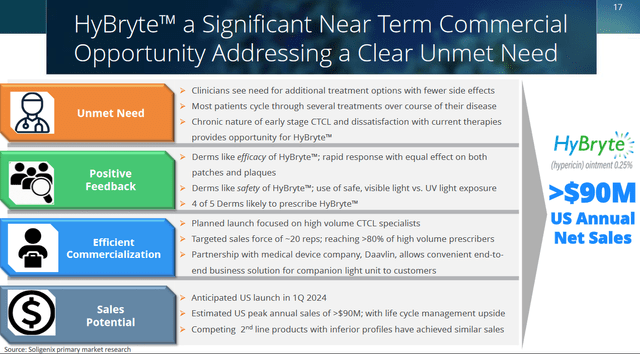

The company is planning to commercialize HyBryte in the US itself in light of a highly specific and specialized market, with only about 50 specialized clinics in the US currently administering UV phototherapy even if this treatment is not approved for the indication. It expects the launch to come at a cost of less than $10 million. Utilization can start in specialized dermatology centers, but could eventually be expanded to home use.

Phototherapy mainstay slide (Corporate Presentation)

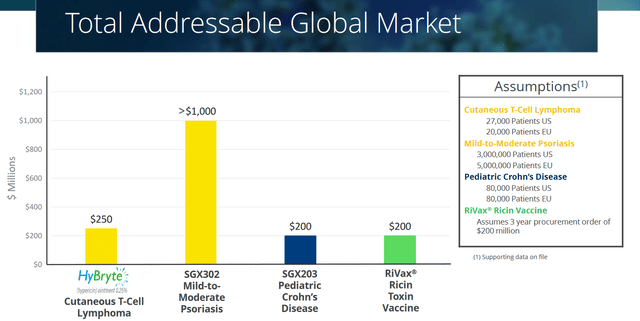

Soligenix itself estimates its global market potential for this indication at $250 million, $90 million of which is related to the U.S., the market it wants to target in first instance. Soligenix sees advantage in starting commercialization in the US due to the high level of specialists with a good referral base, a sales force need of about 20 representatives that could reach more than 80% of high-volume prescribers, low barriers to access, and a high likelihood of reimbursement.

Commercial Opportunity for HyBryte (Corporate Presentation)

Dermatologist key opinion leaders would play a pivotal role in treatment here, as most patients go to these specialists for diagnosis and treatment, or follow-up with the referring physician. Many of these key opinion leaders participated in the execution and success of HyBryte’s Phase 3 trial.

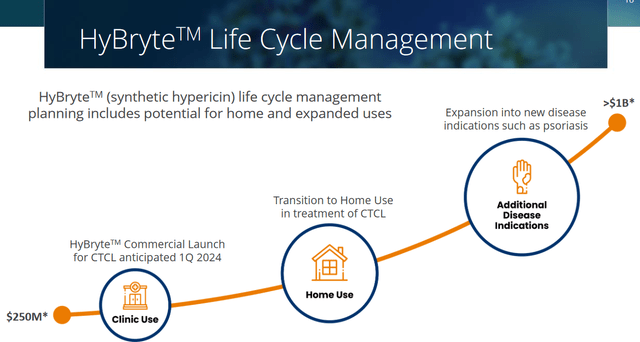

In case of approval, Soligenix should exclusively be entitled to commercialize HyBryte for the foreseeable future, on the basis of a method of synthesis patent to expire in 2030 and a method of use patent in psoriasis to expire in 2031. Orphan drug designation for cutaneous T-cell lymphoma both in the US and the EU should allow market exclusivity for 7 years and 10 years respectively. An additional patent for methods of synthesis and formulation for synthetic hypericin has been filed, with its expiry being anticipated in 2034 in case of grant. The extension of the orphan drug designation in the US to other lymphomas may extend the field of exclusivity. This is how Soligenix sees HyBryte’s life cycle.

HyBryte life cycle (Corporate Presentation)

The above global market potential of $$250 million and expected US peak sale numbers of $90 million strike me as fairly conservative. In his August 17, 2022 coverage, AllianceGlobalPartners’ J. Molloy projects a launch in 2024, $75 million revenue in the US by 2026, and sales in the rest of the world of $37 million. That again seems a fairly moderate estimate that still leads to $112 million of revenues some three years from now, more than five times its current market cap, merely accounting for HyBryte in cutaneous T-cell lymphoma. With the EU market being as big as that of the US, I believe Soligenix can aim much higher. Soligenix itself adds that competing second line products with inferior profiles have achieved similar sales as the $90 million in peak sales it indicates.

The value of the global T-cell lymphoma market was estimated at $ 1.6 billion in 2021, with the expectation of the cutaneous T-cell lymphoma to be worth $3.5 billion by 2030, grow at a compounded annual growth rate of 9.8%.

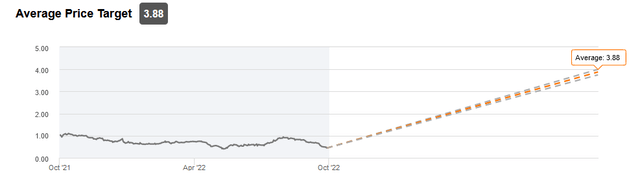

With approval possible in 2023 or 2024 and commercialization soon after in a highly specialized market, it may not take too long to fully penetrate the market and reach peak sales. If successful, and they reach their stated forecast of greater than $90mm in sales, a very moderate 6x sales multiple for US sales alone could lead to a market valuation of $540 million in the next few years. Analysts at this time still see a more moderate evolution, with little divergence on a 12-month price target average of $3.88.

Analyst average price target (Seeking Alpha)

The US and the EU are the biggest markets here. The extension to the EU, where HyBryte also has orphan drug designation, may boost sales further.

Interestingly here, upon approval, it is not excluded that there may also be off-target prescription for psoriasis, in the same centers of care serviced by the same key opinion leaders. The market for mild-to-moderate psoriasis is much larger with the same key opinion leaders and specialized dermatologists.

HyBryte TAM slide (Corporate Presentation)

HyBryte for psoriasis

Soligenix has on June 28, 2022, received FDA clearance to initiate a phase 2 clinical trial in psoriasis.

Psoriasis is a non-life-threatening, chronic, noncontagious inflammatory condition. Plaque psoriasis is the most common type and occurs in 80-90% of all cases. There is no known cure, and some patients are on therapy for life.

A small phase 1/2 trial had shown 6 out of 11 evaluable patients responding to treatment, with only mild adverse events.

The upcoming Phase 2 trial will be randomized and placebo-controlled and will enroll 32 patients who have mild to moderate stable psoriasis covering 2% to 30% of their body for a twice weekly treatment of up to 18 weeks. Patient enrollment is scheduled to start in Q4 2022.

Dusquetide for Oral Mucositis in Head And Neck Cancer Patients

Dusquetide is a synthetic peptide that had shown efficacy in preclinical work and a Phase 2 study. It binds to scaffold protein p62, which is implicated in tumor cell survival.

In December 2020, Soligenix has announced topline results of a Phase 3 trial for its drug candidate dusquetide for severe oral mucositis in head and neck cancer patients. Although dusquetide showed a meaningful improvement in its primary endpoint by reducing the median duration of several oral mucositis by 56%, it failed to show statistical significance. Secondary endpoints additionally supported biological activity, and were consistent with an earlier Phase 2 study.

Further studies confirmed dusquetide’s anti-tumor efficacy both as a standalone and combination therapy. The above-mentioned Phase 3 trial could serve as the first of two Phase 3 studies to support a request for marketing authorization. At this point, Soligenix is looking for a partner for dusquetide.

The Public Health Solutions segment

Introduction

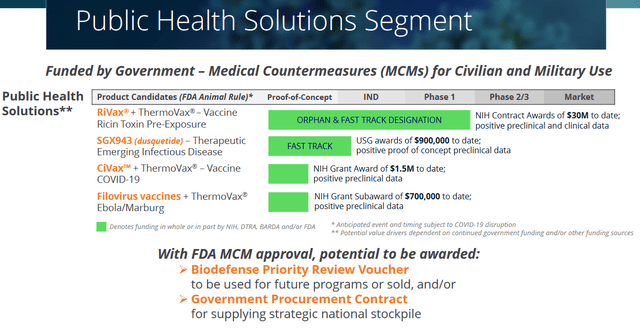

The second part of Soligenix’s pipeline is a next generation vaccine platform that combines high-quality vaccine proteins with an adjuvant, in a thermostabilization-enabling formulation. It has so far been funded solely with non-dilutive funding, and interest from government and defense authorities is high.

Public Health Segment (Corporate Presentation)

Soligenix has three vaccine candidates in the making, with its RiVax as the furthest-advanced at this point, and the filovirus vaccines being equally promising in my opinion.

Heat-stabilization formulation conditions should allow antigens to remain for at least 12 weeks at 40 degrees Celsius, and only require the addition of water immediately prior to use. The effects of this formulation have been published in the Journal of Pharmaceutical Sciences. I believe that, for practical purposes, the heat-stabilizing characteristic may make a big difference to existing vaccines or many vaccine candidates which may require cold-chain storage of −60 °C or less.

These vaccine candidates fit in well in president Biden’s $82 billion pandemic-preparedness plan, as the toxin and viruses targeted by these vaccine candidates are mentioned in different lists of priority pathogens or potential toxic threats. As an example, the NIH ranks the Ebola and Marburg filoviruses as category A priority pathogens. And the USDA puts Ebola, Marburg, ricin and Covid respectively on places 10, 14, 17 and 19 of its list of biological agents and toxins have been determined to have the potential to pose a severe threat to both human and animal health. Monkeypox virus features on number 15 of that list.

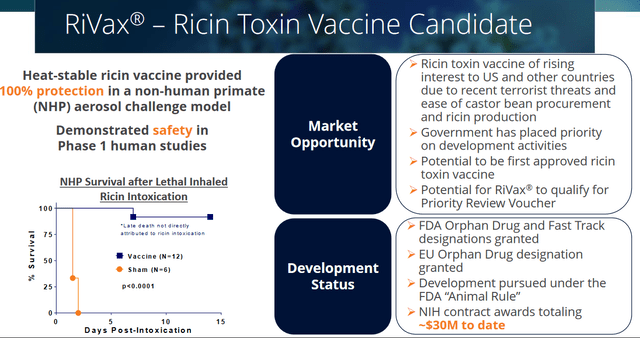

The ricin vaccine candidate

Ricin is one of the most toxic known substances and may lead to death within 36-72 hours after exposure. There is currently no antidote. It has been used and is feared for its use as a terrorist and biowarfare weapon. The lethal dose is about the same as a grain of salt.

RiVax is Soligenix’s ricin vaccine candidate, which has demonstrated safety and 100% antibody protection in a non-human primate model. Those results have been published in mSphere. RiVax has FDA and EU Orphan Drug Designation, has received Fast Track Designation in the US, and has the potential to qualify for a Priority Review Voucher.

Ricin vaccine slide (Corporate Presentation)

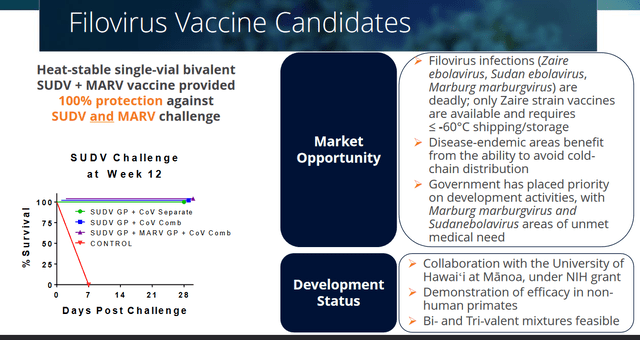

The Marburg and Ebolavirus vaccine candidates

The Marburg and Ebola virus are known for their outbreaks and high mortality rates. There is no vaccine available against either Marburg or Sudan Ebola filoviruses. A vaccine does exist against the Zaire ebolavirus strain, but that vaccine requires shipping and storage conditions at -60° C, which make it difficult for use in warm or less developed countries.

Soligenix’s heat-stable filovirus vaccine candidate basically packages two vaccine candidates in one. In non-human primates, they led to a 100% antibody protection as shown in two studies. The results have been published in Frontiers in Immunology and Vaccine.

Filovirus vaccine slide (Corporate Presentation)

CiVax for Covid-19

CiVax is the company’s heat-stable vaccine candidate against Covid-19 infection, which needs no introduction. It combines the adjuvant with the SARS-CoV-2 spike protein. Soligenix has reported that CiVax vaccination led to neutralizing antibodies against the Alpha, Beta, Gamma, and Delta Covid variants, with ongoing protection, lower peak viral titers and faster resolution of viral shedding. On March 17, 2022, Soligenix reported that CiVax could be used as a booster vaccine as well, with neutralizing antibodies against the original and Delta variant having increased up to 27-fold within one week and up to 243-fold within three weeks, and Omicron protection levels up from undetectable to presumed protective levels within a week.

Financials and external funding

Soligenix’s market cap at the time of writing was about $20 million.

On August 12, 2022, the company reported having ended Q2 2022 with $20.2 million in cash, offset by a $10 million debt facility the company has with biotech fund Pontifax. That debt is convertible at $4.10 at either party’s option after a 2-year interest period running until the end of 2022. The company’s average quarterly cash burn is about 2.9 million, which should give it a cash runway until at least the end of Q2 2023.

At some point, the company may need to raise cash. Judging from the CEO’s statement during the last quarterly results announcement that the company has capital required to achieve its near-term milestones, including NDA filing and initiation of the Phase 2a psoriasis study, I would assume an equity raise should not occur until sometime in 2023. The January 10, 2022 letter to shareholders also mentions the existence of an at-the-market sales issuance agreement with B. Riley Securities. Inc., with approximately $27 million remaining available at that time. I have not seen filings showing that facility has been used so far.

Remarkably also is the fact that to date, its entire second business segment has been supported by all sorts of non-dilutive public grants and funding. That bodes well both for the quality of this business segment as many of these grants will need to pass review first, and for the risk of dilution going forward. The most recent grants and funding include $2.07 million from New Jersey’s Technology Business Tax Certificate Transfer Program and $1.5 million from the NIH for the Covid vaccine development. In June 2022, the FDA also awarded $2.6 million in the framework of HyBryte’s development.

Risks

The above article is largely based on the premise that, after a successful Phase 3 trial in an indication with an unmet medical need, the company’s chances for approval of HyBryte here are high. Although a drug candidate that has shown success after a Phase 3 trial could be seen as quite de-risked compared to many others, approval in the end depends on the regulators’ discretion.

Once a drug is approved, the stage of commercialization is another chapter where Soligenix will have to prove itself. If its costs run higher than its expected revenues, which could be the case in the first year, the road to profitability could be slower than expected.

The company’s vaccine drug candidates have shown good results so far, but these are early stage, and may face competitive threats at any given point. The company will need to invest in further trials to establish further meaningful results that could lead to approval. These trials may take some years.

Conclusion

In the coming quarter, Soligenix will file a new drug application for HyBryte in cutaneous T-cell lymphoma. In a Phase 3 trial, HyBryte had shown a quick and deepening statistically significant response in skin surface and deeper lesions in this indication, after having also shown efficacy in an earlier trial in psoriasis as well. According to company estimates, HyBryte could bring in $90 million in US peak sales. To me that estimate appears moderate. The current company valuation in any case gives all of this little credit.

Soligenix may have had the bad luck of having presented its most favorable data for HyBryte in during the early days of the Covid pandemic. The overall biotech bearishness over the past year will neither have helped to support its share price. That leads to the market now giving little valuation to an approval-ready drug candidate that can fill an unmet medical need that comes with significant value potential.

Key opinion leaders in dermatology are located in about 50 highly specialized centers in the US, and several of them have participated in the company’s Phase 3 trial. The company estimates that it can get commercialization underway with a small set of representatives and a less than $10 million start-up cost. I believe there is a significant upward opportunity for long investors here.

The second business segment is earlier stage, but the results the vaccine platform has generated so far are impressive from an efficacy and commercial potential viewpoint. Equally impressive are the indications it targets. These three vaccine candidates also generate a clear potential of the company’s platform for the development of future vaccines.

For all the above, I am rating the company as a Strong Buy.