Tim Boyle/Getty Images News

My first experience with Twinkies, as my parents keep reminding me every so often, was when I was two years old and we were visiting my uncle who was pursuing graduate studies in upstate New York (this was in the 1980s). We had arrived at our motel late at night and the only food my parents could find were some Twinkies and Coca-Cola at a local convenience store. To this day, I still enjoy an occasional twinkie treat.

The company behind Twinkies, Hostess Brands Inc. (NASDAQ:TWNK), is a defensive food staples company currently firing on all cylinders as it has been able to grow both volumes and price/mix despite a challenging macro environment. Although the stock trades at a premium multiple, I think this is justified due to the GARP characteristics of the company’s business.

Company Overview

Hostess Brands, Inc. (TWNK) is a snacking pure-play that manufactures and sells iconic treats such as Twinkies, Donettes, CupCakes, and Ding Dongs. The current iteration of the company was formed in 2013, when private equity firm Apollo Global Management partnered with consumer food and beverage billionaire Dean Metropolous to acquire the Hostess Brands snack cake assets out of Chapter 11 bankruptcy. Hostess Brands, Inc. came to the public markets in 2016 via a merger with a SPAC sponsored by The Gores Group, another private equity firm.

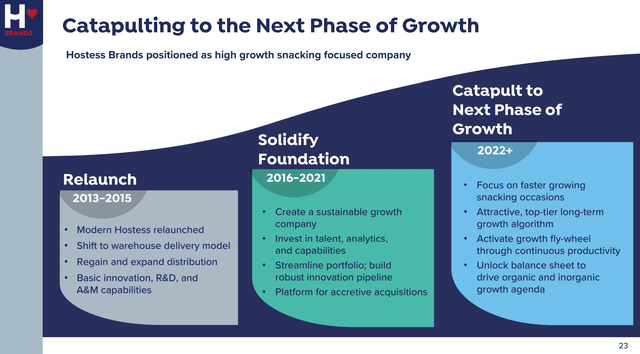

According to the company’s marketing materials, the first few years of the new Hostess Brands was all about relaunching the products and shifting to a warehouse delivery model. Post the de-SPAC in 2016, the company focused on creating the foundations for sustainable growth. Finally, in the last few quarters, the company has begun focusing on increasing growth through both organic and inorganic channels (Figure 1).

Figure 1 – TWNK Launching Next Phase Of Growth (TWNK investor day presentation)

Impressive Financial Performance

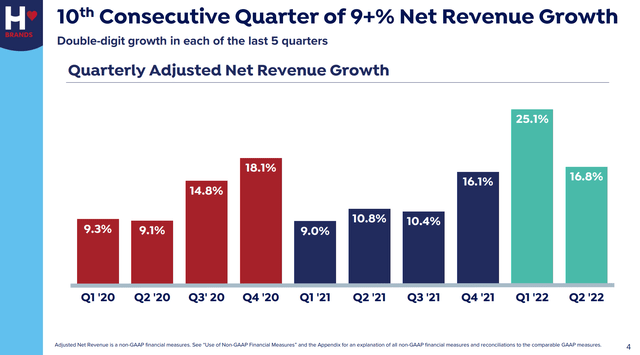

Undeniably, Hostess Brands has delivered extraordinary financial performance in recent quarters. The recent Q2/2022 was the 10th consecutive quarter where TWNK had reported greater than 9% net revenue growth (Figure 2).

Figure 2 – TWNK has 10 consecutive quarters of 9%+ revenue growth (TWNK Q2/2022 Presentation)

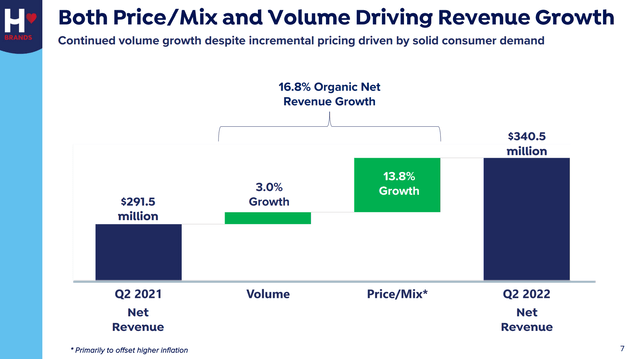

Impressively, Hostess Brands’ growth is coming from a combination of volume and price/mix, which has allowed the company to maintain its industry-leading margins (Figure 3).

Figure 3 – TWNK Q2/2022 YoY Growth Breakdown (TWNK Q2/2022 Presentation)

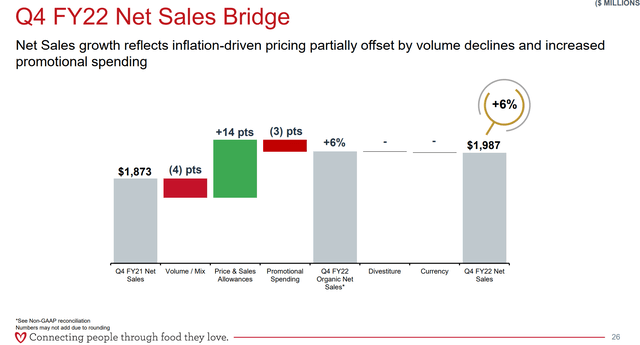

Across the consumer foods industry, it is hard to find another company delivering this level of financial outperformance in the current challenging macro environment. For example, if we look at Campbell Soup Company’s (CPB) latest quarter, we can see CPB was able to take price actions, but at the expense of volumes (Figure 4). This is a common theme across the consumer food space, with companies trading off volumes to raise prices and maintain margins.

Figure 4 – CPB Q4/2022 Revenue Bridge (CPB Q4/2022 Presentation)

Hostess Outperforms By Focusing On Core Snacking Occasions

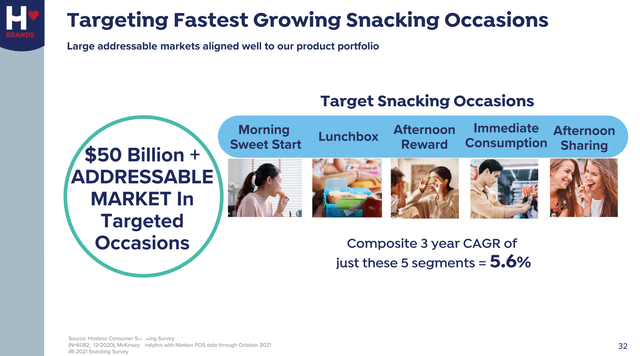

Hostess Brands has been able to achieve its peer-leading growth rates by focusing on the fastest growing snacking occasions that have a composite 3-yr CAGR growth rate of 5.6%. For example, to target the immediate consumption occasion (i.e. convenience stores), Hostess Brands launched a caffeine-infused ‘Boost’ Donette. For afternoon sharing, Hostess Brands offers ‘Crispy Minis’ creme wafers.

Figure 5 – TWNK Targets Key Snacking Occasions (TWNK investor day presentation)

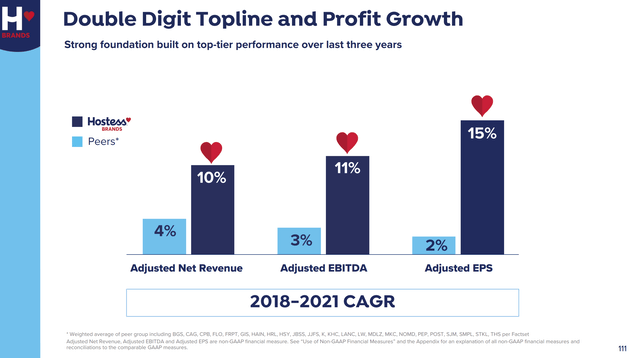

Altogether, Hostess Brands’ focused product innovations and positioning has allowed it to grow revenues at a 9% CAGR, almost double the category growth rate. Strong revenue growth plus operating leverage means a ~10% growth in revenues can translate into 15% growth in EPS (Figure 6).

Figure 6 – TWNK Operating Leverage (TWNK investor day presentation)

Longer Shelf-Life An Underrated Advantage

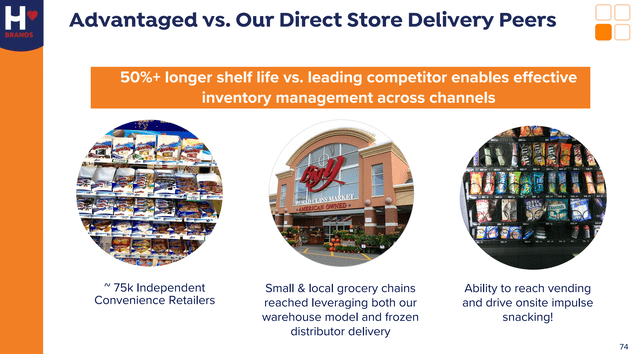

An underrated advantage of Hostess Brands products are their 50%+ longer shelf-life vs. peers (urban legend has it Twinkies can survive a nuclear war!). When Hostess Brands relaunched their products in 2013, they made key changes to the recipes that stretched the shelf-life of a Twinkie from 26 days to 45 days (Figure 7).

Figure 7 – TWNK products have longer shelf life (TWNK investor day presentation)

Longer shelf-life allows Hostess Brands to manage its inventory levels more effectively than peers and reduce wastage, a large cost in the packaged foods industry.

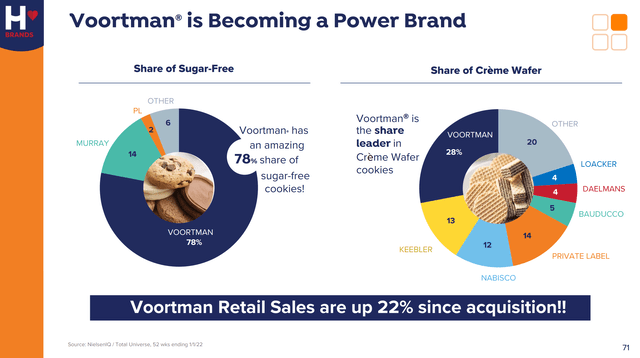

Voortman Is A Growth Platform

In December 2019, Hostess Brands acquired Voortman Cookies Limited for $320 milion. Voortman is known for making creme wafers and sugar-free cookies. Since the acquisition, Voortmans sales have increased 22% under the Hostess management (Figure 8).

Figure 8 – Acquired Voortman cookie business showing strong growth (TWNK investor day presentation)

TWNK Trades At A Premium Valuation

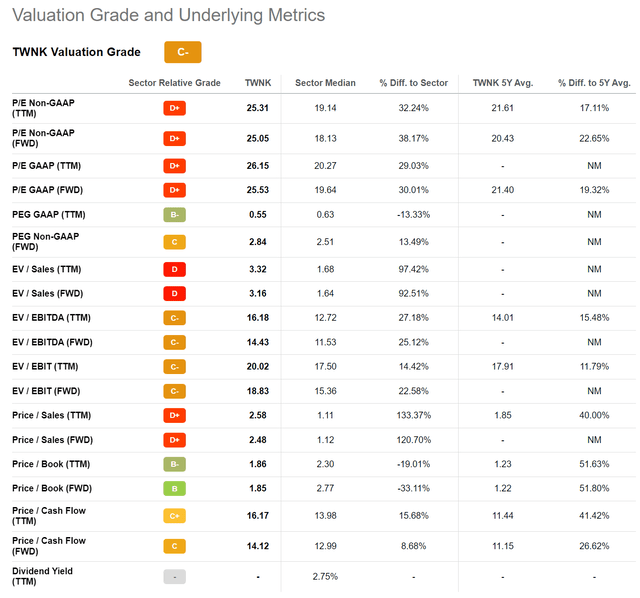

In terms of valuation, Hostess Brands is currently trading at a Fwd P/E of 25.1x, a premium multiple vs. its consumer staple peers at 18.1x (Figure 9).

Figure 9 – TWNK Valuation vs. Sector (Seeking Alpha)

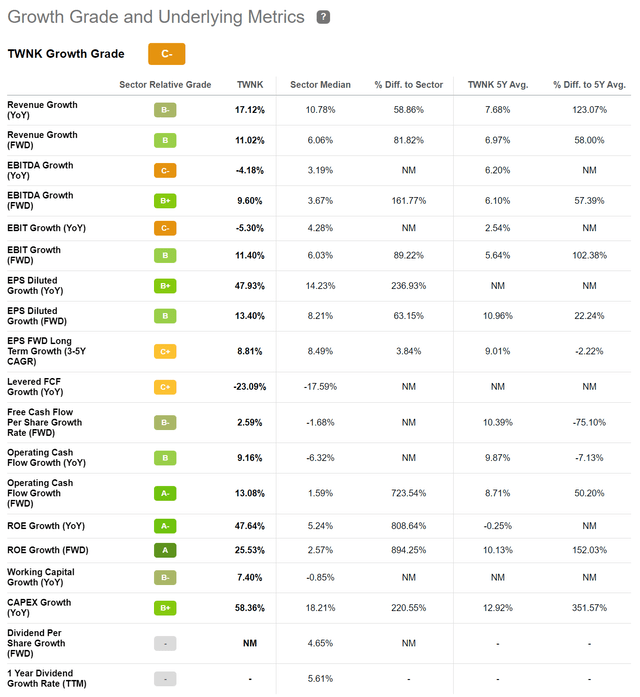

I believe TWNK’s premium multiple can be justified as the company has Fwd Revenues and EPS growth rates of 11.0% and 13.4%, significantly above the sector’s 6.1% and 8.2% respectively (Figure 10).

Figure 10 – TWNK Growth vs. Sector (Seeking Alpha)

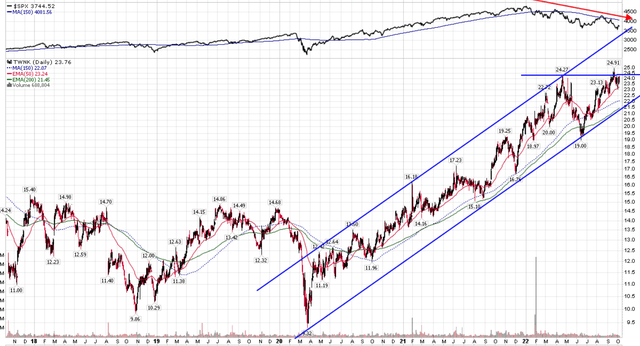

Technicals Show Strong Momentum

Technically, TWNK shows strong relative momentum as the stock is near all-time highs while the S&P is down over 20% YTD (Figure 11). If TWNK can clear resistance around $24.25, there is a lot of upside in the rising uptrend.

Figure 11 – TWNK stock shows strong relative momentum (Author created with price charts from stockcharts.com)

Risk

The biggest risk to Hostess Brands is a slowdown in consumer spending impacting sales of the company’s cakes and snacks. To date, that has not shown up in the data. As shown in Figure 3, TWNK continues to grow volumes and price/mix. One possible explanation is that while inflation is soaring for all consumer products, they may be less noticeable at the typical low price point of Hostess Brands’ products, or they have been hidden via shrinkflation. Furthermore, with inflation negatively impacting consumer shopping habits, perhaps consumers are switching down from purchasing a dozen Krispy Kreme donuts for $7.99 to buying a 10 oz bag of Hostess Donettes for $2.50.

Another risk to Hostess Brands is their relatively high levels of debt. As of June 30, 2022, TWNK has $1.1 billion in term loans at a 3.6% interest cost, or 3.3x Net Debt / LTM EBITDA. High levels of debt may hinder management’s ability to react to economic conditions. Furthermore, when the term loan comes up for renewal in 2025, TWNK many not be able to refinance the loan at the same rock-bottom rates, since interest rates have increased significantly in the past few months.

Conclusion

Hostess Brands Inc. is a defensive food staples company currently firing on all cylinders as it has been able to grow both volumes and price/mix despite a challenging macro environment. Although the stock trades at a premium multiple, the multiple may be sustainable as long as the company continues to execute operationally. I would rate the company a buy based on its growth-at-a-reasonable-price (“GARP”) characteristics.