Leonid Ikan

Investment Thesis

Marathon Oil (NYSE:MRO) has been a volatile stock in the past 6 months. But unlike other pockets of the equity market where volatility has been commensurate with negative returns, in the case of Marathon Oil, volatility means that the stock has gone up and down, yet remains unchanged in the past 6 months.

The bear thesis is widely known and priced in, in a slowing economic environment, there’s likely to be demand destruction, that could crumble oil prices.

In this analysis, I add some nuance to the investment thesis and wish to explain why investors will be positively rewarded for staying long this name.

Also, I lay out the math to Marathon Oil’s +10% combined returns.

Demand Destruction?

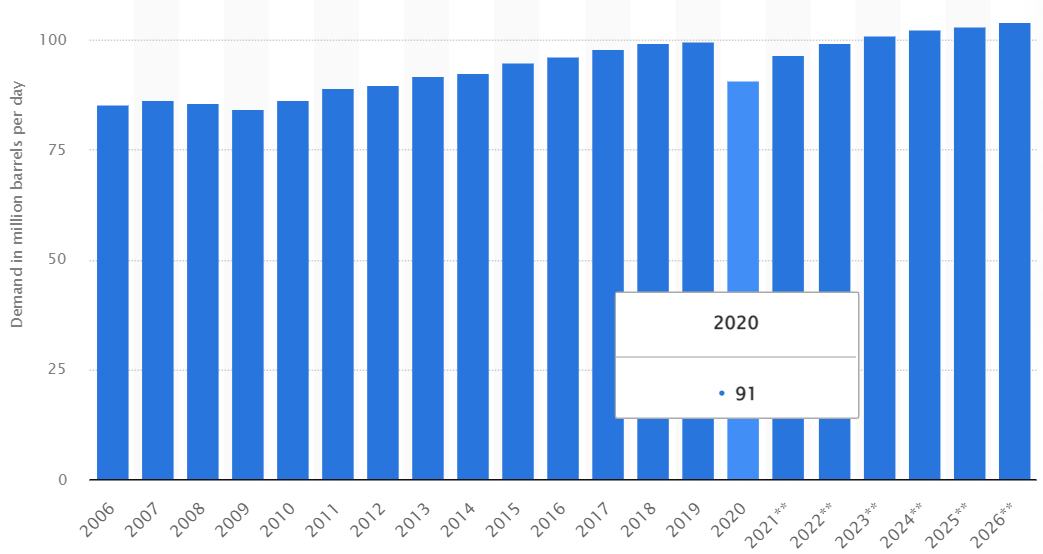

Here’s a graphic of oil demand in the past 16 years:

statista.com

Oil demand only marginally dipped lower in 2008 and 2009. Before substantially bouncing back in 2010.

Also, when the world economies shut down in 2020, oil demand dropped lower, only to increase the following year as world economies started to reopen.

The point that I’m making is that oil demand is a lot more sticky than the equity prices from oil companies would lead you to believe.

We need oil for everything we do (e.g. travel), what we make (e.g. plastics), and even what we eat (e.g. fertilizer)!

The idea that in a slowing economy, oil demand is going to substantially be curbed is unrealistic. Not to mention the idea that there is no realistic viable alternative. There simply isn’t anything available at an affordable and feasible scale, either today, tomorrow, next year, or 5 years out.

Consequently, the point I’m making is that even if investors believe that oil companies today are over-earning, and bears turn out to be right, the slowdown from these peak earnings is very likely to be marked by a slow topline deceleration.

Capital Return Program: You Above Capex!

This is how Marathon Oil describes its capital return framework during its Q2 earnings call,

Our return of capital framework is uniquely calibrated to operating cash flow, not free cash flow, prioritizing our shareholders as the first call on capital instead of the drill bit.

Marathon oil has been very consistent with its messaging to shareholders, that its capital return framework is based on cash flows from operations. That shareholders will be prioritized before capex projects.

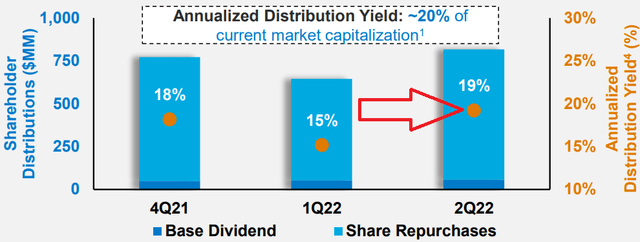

MRO Q2 2022 presentation

As you can see above, Marathon Oil states that with WTI above $60, they’ll return at least $1 billion to shareholders.

MRO Q2 2022 presentation

In fact, what you see in the graphic above is that in Q2 2022, Marathon Oil’s total annualized distribution reached 19%.

On the other hand, we know that during Q2 WTI prices during Q2 were higher than $100, and Henry Hub prices were around $8 mmbtu. While today prices are hovering around the mid-80s for WTI and falling to $6.3 on Henry Hub.

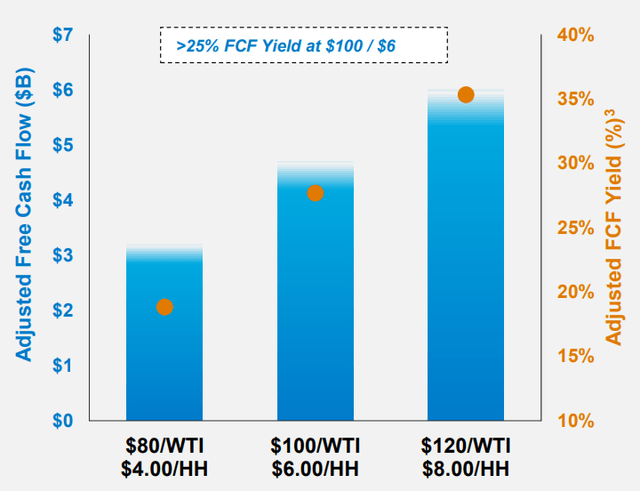

MRO Q2 2022 presentation

Consequently, I believe that investors should expect to see Marathon Oil’s run rate free cash flow at somewhere close to $3.5 billion.

Now, keep in mind that Marathon Oil’s full-year 2022 capex figure is expected to reach around $1.3 billion.

That means that Marathon Oil’s full-year cash flows from operations would reach around $4.8 billion. And if as much as 50% of its cash flows from operations were to return to shareholders as a run rate in Q3, that would mean around 10.6% annualized return to shareholders.

MRO Stock Valuation: 5x Free Cash Flow

The point that I’m making is that MRO is valued at approximately 5x this year’s free cash flows. Even if the business ends up reporting slightly less free cash flow in 2023, and less still in 2024, an investment today largely pays for itself over the next 5 or 6 years.

That means that anything Marathon Oil makes in free cash flows after year 5 or year 6, will nearly all be ”free” upside to shareholders getting involved today.

The Bottom Line

As investors, we frequently overestimate the near-term pace of change. We are incredibly reliant upon fossil fuels. And even if we hold high hopes for EVs and greener energy sources in the future, for too long we’ve fallen prey to promising stories of the future, without paying attention to the present. More common sense is required.

As the coming months progress and investors come to the realization that 2022 was not an abnormal year for energy markets, but emblematic of what the next few years will look like, I believe that even without any multiple re-rating higher, Marathon Oil could be a very attractive investment.

The bull case here is driven by its continued increase in earnings per share plus its robust capital return program. Altogether, paying 5x this year’s free cash flows is seriously compelling.

Also, keep in mind that Marathon Oil’s combined total returns to shareholders are likely to be +10% in Q3.

In sum, there’s a lot to like from this investment.