When it rains it pours…while 2022 has been a tough year for investors, much of the recent ‘gloom and doom’ talk has centered around faulty narratives.

Ronald Martinez

As readers know, my career has given me an interesting perspective on markets and forced me to look at potential investments through a credit lens more often than not. Over the years I have read too many investment reports to keep count, but I always appreciated research (whether it was right or wrong) that forced me to revisit the investment thesis our trading desk was operating on because it forced us to attempt to poke holes in our own thesis while also sometimes giving us ideas for new trades or an item to watch out for in the future. Lately we have seen a few articles here on Seeking Alpha which we felt compelled to read because the titles not only disagreed with our research, but also seemed to go against the comments made by AT&T (NYSE:T) management on recent quarterly conference calls (including the most recent quarter’s).

While there are apparently some out there who think that AT&T’s dividend is currently in trouble of being cut AND that the company’s debt is a major problem due to higher interest rates, we actually believe the opposite and believe that the following will be compelling for most investors and readers.

Based on its capital structure and the supposed worries about the dividend, it is probably best to look at the company’s debt first as most of that research will feed right into the argument for why the dividend is not currently at risk of being cut.

The Debt Stack

Make no mistake, AT&T does have a ton of debt. They have had a ton of debt for a while now, and the acquisition of Time Warner only compounded their debt issues. While AT&T used to be the most indebted company in the world, now one can say that they are among the most indebted companies in the world… which does not sound like much of a difference, but it is progress.

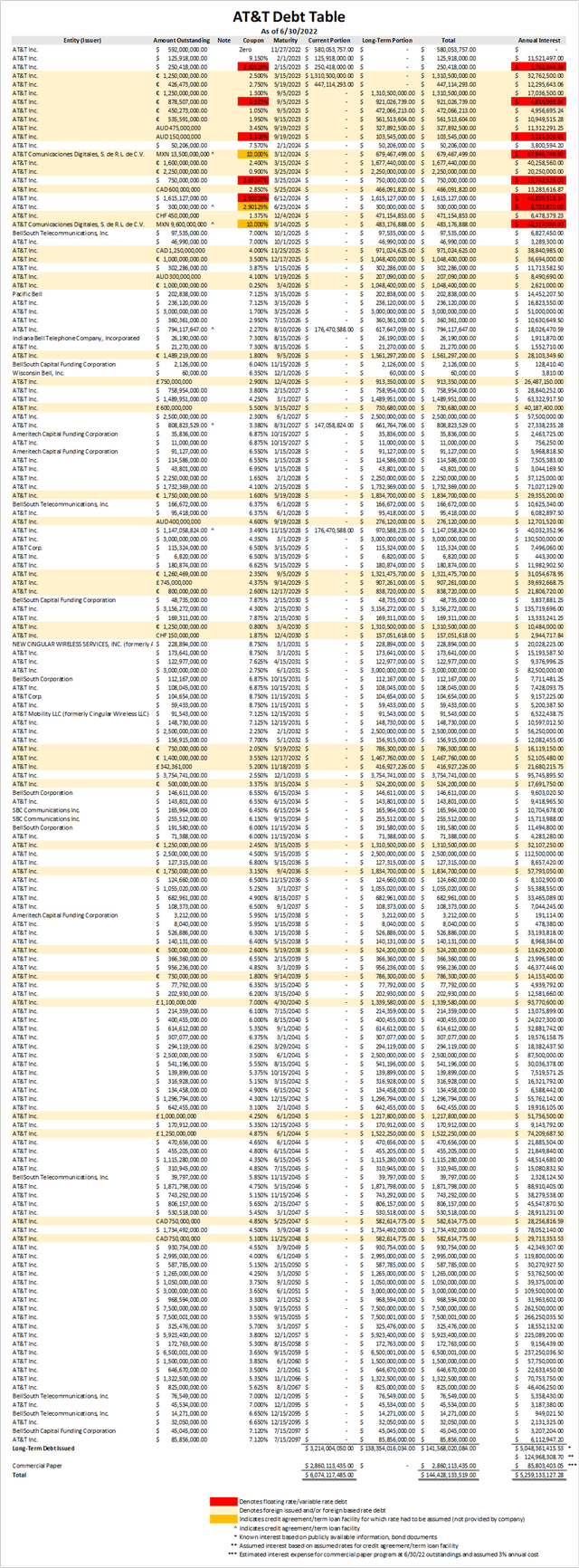

Since individual bonds are somewhat difficult for retail investors to do credit research on, and not everyone has access to platforms such as Bloomberg, we will attempt to utilize data from the company itself and its filings. Luckily, AT&T actually has a document on their website which lists all of their bonds, the amount outstanding, maturity date, coupon and other important information. It also has a reconciliation at the bottom to show what the company calls their total debt. Note that the company converts any foreign currency, as denoted in the issued column, to local currency (US Dollars), in the total outstanding column.

The takeaway from this document is that after AT&T’s tenders for certain debt issuances, the company has $141,568,020,084 in total long-term debt, including the current portion (which are those long-term bonds whose maturities are within the next 12 months) prior to adjustments. AT&T also has $2,860,113,435 outstanding in their commercial paper program, which is short-term debt. As someone who has purchased AT&T commercial paper, the company uses this program to finance the business in between billing cycles, for lumpy expenses which come in and to pay the dividend from time-to-time. Commercial paper debt (the volume of it issued by the company) can vary widely from quarter-to-quarter, especially around year-end, so we will ignore this from the analysis. However, if one wanted to be even more conservative, they could take the quarterly outstanding average and classify this as short-term variable rate debt in their calculation.

We have adjusted the debt table the company provides to highlight certain items we believe to be important. We also removed some items we think muddy the water a bit. The table is located below:

AT&T’s Debt Schedule (AT&T, Author’s Credit Research)

It is important to note that the company includes their credit facilities and term loans, which are indicated in the table. It is also important to note that these are classified by their final maturity, even though they may have minimum payments due each year. Since we do not have the covenants or structure of those liabilities, we include the total long-term amount in the year of the final maturity as it is not really material in each case.

An important note on methodology. It is our belief that some recent articles have looked at the balance sheet and picked up the Long-Term Lease Liabilities along with the Long-Term Borrowings by utilizing the balance sheet line item that they roll up into; Long-Term Debt. While accounting rules have moved to include lease liabilities in this section of the balance sheet, generally speaking Long-Term Lease Liabilities do not have an interest rate attached to them that might get you in trouble (yes, some have an inflation adjustment, but you would get that on the resigning of the lease as well and if it is factored in annually, then when resigning a long-term lease, your lease would remain relatively in the ball park of prior years). Basically, including the $20 billion in long-term lease obligations as a financial debt is bad practice in our book as we pick that liability up in the income statement as an annual expense (and it impacts estimated income and cash flows for future years). The item has nothing to do with interest rates, therefore we believe it just muddies the water and really provides no benefit when discussing the impact of interest rates on a company’s debt.

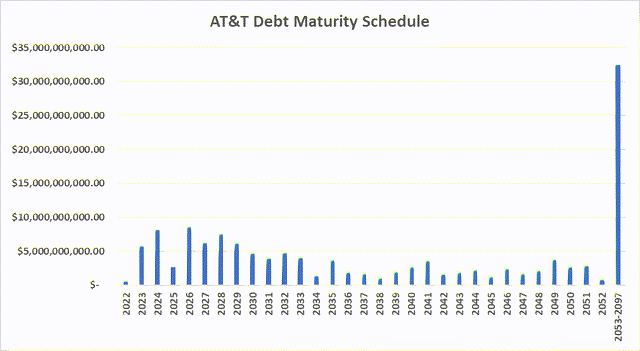

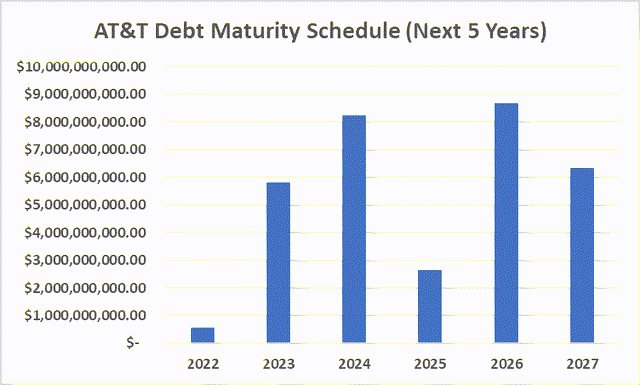

To make the debt schedule a bit easier for readers to consume, we put the debt into a graph to show the maturities. Due to the longer-dated maturities not necessarily being in subsequent years after 2053, we combined those issuances into a single item (yes, it does throw the graph out of whack, but it does allow for one to see the annual maturities that will be rolling down prior to that). The graph is below:

AT&T’s FCF will be mostly be utilized to fund the dividend and pay down maturing debt over the next few years, but nothing here looks scary to a fixed income investor. (AT&T, Author)

Will Higher Interest Rates Be A Problem?

One of the bearish arguments for AT&T recently has been that rising rates are going to create a cascading financial issue for the company as higher rates will drive up their borrowing costs and that their cost of debt will balloon along with the Fed Funds Rate. The problem with this thesis is that nearly all of AT&T’s debt is fixed, including their bank debt (term loans and credit facilities). In order to have a credit crisis and a cascading effect, the first domino has to fall and looking at AT&T’s maturity schedule and cash flows, we are hard pressed to see where this happens in the next few years – and to be clear, if it does not happen in the next few years, it is hard to see where it would create a problem. If the argument is that the floating rate issuances are going to cause this waterfall moment, we struggle to come up with a scenario where the pain inflicted would create that type of problem.

AT&T’s Floating Rate Bonds

Before getting too far into the floating rate bonds outstanding, it is first important to understand how floaters trade. When issued, investors buy these bonds at a spread to a short-term rate; when rates are low (as they previously were) spreads are wider to entice bond investors to buy these longer maturity bonds which trade with coupons based on short-term rates. Generally floaters are sold in 2-year, 3-year and 5-year maturities and are used by companies to keep interest expenses on their debt lower (which works in an environment when the Federal Reserve or other Central Banks are not raising rates). Why do investors buy these bonds? Simple, they are a great hedge and provide stability to fixed income portfolios because their rates reset (some daily, weekly, monthly, quarterly and annually – but mostly monthly or quarterly) and due to the rate reset function, the securities (as long as they have a respectable spread still) will trade around Par; meaning they will trade at close to the value they would be redeemed at.

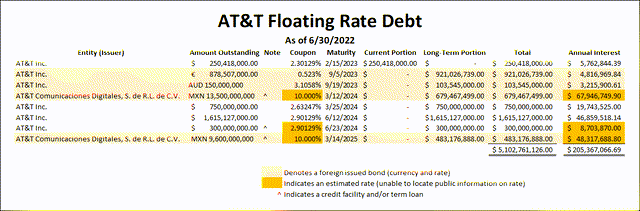

AT&T only has eight total issuances of floating rate debt, three of which are credit facilities and/or term loans. Out of the eight issues, four of them are foreign issues and two of those are for the company’s Mexican subsidiary. In total, AT&T has just over $5.1 billion (at currency prices as of 6/30/2022) in floating rate debt which at 6/30/2022 cost a little more than $200 million in interest payments (when annualized). (Note: Since these reset at different times, the annual interest column might never be correct for a given year, especially when the Fed is aggressively raising or cutting rates).

AT&T Floating Rate Debt (AT&T, Author’s Credit Research)

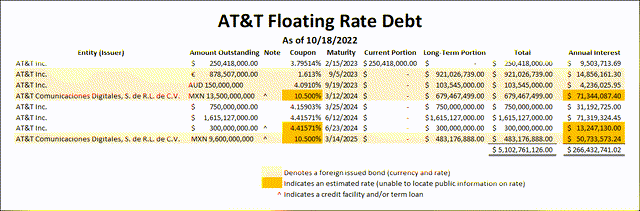

So how bad could it get? We think our estimated 10% variable rate on the debt for the Mexican subsidiary is extremely conservative and might be closer to the current rate rather than the rate at June 30, 2022 – so we will assume that the interest rate is around the central bank rate plus 125 basis points (or 10.50%). The other loan which we cannot find a rate for, the 6/23/2024 US Dollar denominated issue, we will estimate is roughly in line with the 6/12/2024 US Dollar denominated floaters. We will update the rates for all of the other bonds to the last reset as of today. The following table shows the results:

Even with all of the rate hikes since the end of June 2022, the annual interest projections only rise to just over $265 million after the recent rate resets on this debt. (AT&T, Author Credit Research)

While a $61 million increase in annual interest expense run rate is a significant jump that has occurred over the last 3+ months (and rates are only going higher so the actual interest expense figure will be greater), we think the good news is that the company can actually afford this inconvenience in the short-term. Why? Because the maturity schedule over the next 5 years is not all that daunting. Here is what the next 5 years (after 2022) looks like for AT&T:

AT&T has some flexibility in the next few years to retire debt, or even refinance some of it into 2025 where the company could accommodate a few billion more in that maturity window. (Author)

Looking at the fact that all of the floating rate debt matures prior to the end of Q1 2025 is also important. If rates to rocket higher, each year AT&T will see the pain recede a bit as many of the floaters mature in the next 1.5-1.75 years.

Can AT&T Afford To Pay Down Its Maturities?

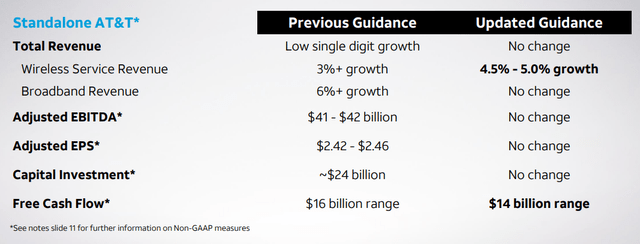

This is only part of the real question many are worried about. In reality, the question of whether AT&T can afford to pay down its debt maturities while also paying its dividend is the concern many have. While the stock got hit hard last quarter when the company revised its Free Cash Flow guidance for the full year downward by $2 billion, it is important to keep in mind that the company is still expected to generate around $14 billion in FCF for 2022.

AT&T raised guidance on wireless revenue growth but lowered full-year FCF estimates to around $14 billion. (AT&T Q2 Investor Presentation)

The dividend costs the company just under $2.1 billion per quarter now, and has a run-rate of roughly $8.4 billion per year. If AT&T is correct in their projections, that would leave about $5.6 billion in FCF that could be utilized in a number of ways; including to pay down or restructure the company’s debt.

While AT&T did not provide FCF guidance for 2023 during the latest quarter, management did hint at the potential for it to be higher than 2022 as a few key items come into play. First, the company will have a full year of their price hikes in place which equates to a higher ARPU figure; that, along with new customers should generate additional FCF. Secondly, the cost cutting measures (which range from interest expense to business operating expenses) will kick in for a full year in 2023. Back in March AT&T stated that the goal was to reduce expenses by $6 billion, and at the end of 2021 only half of those savings had been realized.

Also in March of 2022, AT&T announced that they expected to have $20 billion in FCF in 2023. Now, with the $2 billion FCF setback this year, is there a lot of confidence in achieving that $20 billion figure for 2023? Maybe not. But is it probably a decent bet that in 2023 AT&T will be able to generate $15 billion to $17 billion in FCF? We think so. If they are able to do so, the company would have at least $6.6 billion available for debt reduction in 2023 – and with $5.83 billion in maturities, AT&T could very well pay off all of those issuances. By paying off all of those issuances, the fixed and floating rate debt, at current coupons, the annual run-rate in savings for interest expense would be just under $130 million. For apples-to-apples comparisons, looking at just the fixed-rate issuances, interest savings would amount to about $101 million per year.

Previously AT&T used to spend between $20 billion and $22 billion in CapEx. If we assume that the company goes back down to $20 billion to $22 billion range after a major 2-year buildout, then the company could very well have $8.6 billion to $10.6 billion available for debt reduction starting in 2024. While investors are looking for AT&T to pay down their debt, and it certainly appears that the company will have the FCF to address debt reduction, we think that 2024 and 2026 might be years where the company looks to pay down some maturing debt while refinancing the rest. We believe that some of this debt is necessary for the company to actually operate, especially overseas, and 2023 and 2024 are heavy on maturities of foreign issuances.

For instance, of the ten maturities in 2023, eight of them are foreign (with six Euro denominated and two being Aussie Dollar bonds). Just over 93.5% of the 2023 maturities are foreign with over 86% being Euro-denominated. In 2024, AT&T faces nearly $8.3 billion in maturities, with just under a third being US Dollar debt and the rest being foreign. In 2024, the Euro-denominated debt will once again lead the way, with roughly 47.5% of the maturities but there will also be maturities for debt issued in Mexican Pesos, Canadian Dollars and Swiss Francs. Mexico is a locale where the vast majority (roughly 93%) of expenses are in local currency, so that might very well be a necessary roll for the company as that is one of two Peso denominated liabilities they have and it represents almost 60% of those liabilities (if those funds are used as working capital, then it is necessary debt). It is also worth noting that Europe’s rate are lower than those in the U.S., so if the company is rolling some debt, Europe might provide an opportunity to issue debt at lower rates than domestically.

Another important reason why we may not see 100% of maturities paid off is due to the need for investors to have new supply to replace their maturities and for AT&T to remain in the market. This is important for establishing and maintaining relationships, and could even see AT&T utilize a small portion of the 2023 maturities to issue 2-year debt into the 2025 maturity window as the company only has $2.65 billion in maturities that year. Another option could see AT&T utilize commercial paper to pay off some bonds in 2024 (a heavy maturity year) and then pay-off the commercial paper in 2025 with FCF in a year with light maturities.

As readers can see, AT&T has a lot of flexibility with their FCF to address their debt maturities and many levers which it can pull to achieve its goals. So long as the company is able to maintain at least $4 billion in FCF (after dividends) for debt retirement, we see no issues for the company moving forward. Even at $2 billion in FCF for debt retirement we still think that the company could navigate their current maturity schedule.

The Dividend

AT&T’s dividend is the holy grail for many of its investors, and while we have seen some articles on Seeking Alpha question its viability moving forward, we think that the dividend, at its current rate, is pretty safe. The payout ratio is a bit out of range for what management is targeting, sure, but we suspect that it will gradually come down as the company begins to put in operation its new assets from the major CapEx outflows for the current year and in 2023, addresses the debt, and works on profitability moving forward.

Depending on how management addresses the maturities, and how quickly they can get their leverage in line with targets, we think that management could look to return cash to shareholders as soon as 2025. As of right now they would certainly have the flexibility to do something sizable in 2025. For instance, if the stock is still yielding 7%+ in 2025, the company could announce say a $5 billion stock buyback plan, repurchase $1 billion worth of shares (depending on the timing of the announcement, weighted average) prior to any dividends being paid out in the year and the dividend cost savings from that $1 billion in repurchased shares (just over $70 million) would pay to increase the dividend by about $0.01/share for the year while also retiring almost 1% of the company’s shares.

It does not matter how you look at the FCF, dividend or debt maturities, because AT&T’s dividend looks pretty solid at current levels when looking at the facts. The payout ratio may be a concern for some, but cash flow is what pays the dividend and in the short-term there does not appear to be anything that could seriously imperil the company’s current path other than a serious recession which saw AT&T’s FCF get cut in half – or more. As long as FCF remains at the levels we have highlighted, the company will be able to address maturities, its floating rate liabilities and continue to tap into fixed-income markets to issue new debt (to roll portions of its maturities).

Final Thoughts

We suspect that management will focus on debt reduction and try not to deviate from the plan this time around, but eventually the company will need to reward shareholders. While the debt needs to get paid down, readers might be surprised to find out that many of the company’s bonds actually have a lower coupon than the company’s stock yields. If rates level off or even pull back a bit, management might find it attractive to buy back shares.

Some have stated that the debt refinancing is going to take AT&T shares lower; that is most certainly not the case. The ample FCF can not only handle the floaters resetting at rates double current levels, it is also robust enough to enable the company to go in and address some of the floating rate liabilities prior to maturity. Outside of a major recession or depression, a new competitor emerging or some unforeseen black swan event, both the dividend and the company appear to be on solid footing.

AT&T might not be the growth story that it once was, but it does offer a compelling path forward for investors. This is a deleveraging story for sure, but it offers investors an opportunity (so long as management does not screw it up) to benefit from strong, stable FCF that should not only be able to support the dividend and pay down the considerable debt load, but also support dividend growth and share buybacks in the next few years.

While large debt stacks always look troubling when rates are rising, we think it is important to look at the maturity schedule and recognize that AT&T has very addressable maturities and is not in trouble of being unable to pay off, roll, or exchange its upcoming maturities.