DNY59

Supply chain disruptions why did it start

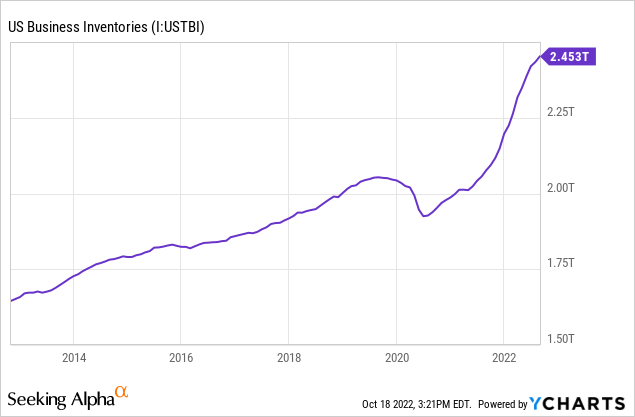

The last few years have been very challenging for global supply chains, with a sudden shift in consumer demand at the start of the pandemic with an equally sudden return of this demand just a few months later, followed by global ocean freight delays. As a result, US Business inventory levels saw a rapid decline in early 2020, followed by a sharp increase in the last 2021 up until now. Yesterday I talked about why Stanley Black & Decker (SWK) suffered greatly under these inventory changes, but today I want to talk about a beneficiary of this trend: Zebra Technologies (NASDAQ:ZBRA).

How the disruption is transforming industries

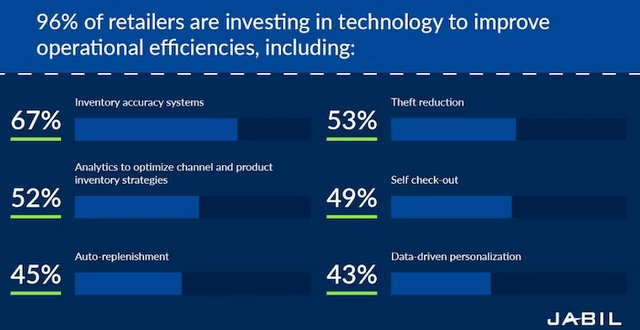

According to a recent study from Jabil, 96% of retailers are investing in technology to improve operational efficiencies. The most significant focus lies on inventory accuracy systems, an area where Zebra is a leader and heavily invests in its portfolio. Zebra also has solutions for fraud detection, as described in this blog post about fraud reduction in self-check-out (another high priority for retailers. Hiring employees is also challenging for many companies, especially labor-intensive ones like retail and supply chains. Here, employers have to battle high employee turnover and low tenures. One way to solve this issue is to increase the efficiency of each employee through hardware devices and software solutions or outright replace the worker with robotics. Zebra is a player in all these areas.

Retail survey about technology investments (Jabil)

Zebra seizing the opportunity

Zebra has been building a portfolio of market-leading solutions for many years, emerging as the leader in many automation categories like mobile computing devices, Scanners and printers. I want to highlight especially the RFID market, still a tiny segment for Zebra but growing “well in the double digits, according to CEO Anders Gustafsson in the Q2 earnings call. According to Markets and Markets, RFID is expected to grow at a 12% CAGR through 2030 to reach a market size of $35.6 billion. In my last article on Zebra, I mentioned my personal experience about how RFID changes the way Heavy Metal festivals are run.

Zebra as the industry leader (Zebra IR)

The company innovates in two ways:

- 10% of sales are reinvested in R&D to increase customer value and develop new devices and services. Zebra invests a lot in software and has more software engineers than hardware engineers. I see great potential here for value-added services leveraged through its vast hardware portfolio in the future.

- Zebra acquires companies in adjacent industries to add solutions and services to its portfolio. So far, the company has been a disciplined capital allocator, and I especially like their angel investments to build relationships with potential acquisition targets at a later date. This vastly improves the odds of successful integration because the two companies already know each other and can find better ways to leverage each other’s capabilities. A recent example of these angel investments is its acquisition of Fetch Robotics.

Zebra as an AI company

In the last years, Zebra acquired three SaaS companies:

- Profitect Inc. (2019) for $100 million, a leading provider of prescriptive analytics for retail and consumer packaged goods industries.

- Reflexis Systems (2020) for $575 million, an AI-powered workforce management, task management, execution and communications solutions business with over 275 customers in retail, restaurants, hotels, banks and healthcare.

- Antuit.ai (2021) for $145 million, a SaaS company focused on retail analytics and inventory management to enable people to make better decisions.

In this podcast, Zebra talks about its integration of Antuit.ai a year after its acquisition. Over the last years, primarily fueled by the pandemic, inventory cycles are speeding up: What used to take 4-5 years now happens within 18 months. Companies are catching on to the fact that they can leverage software solutions to handle the increasing input variables that humans can’t compute themselves anymore. Zebra and Antuit want to demystify Artificial Intelligence for what it really is: A tool to enable humans for better decision-making. Zebra aims to implement AI decision-making into its hardware solutions to make it a seamless part of the product.

Valuation

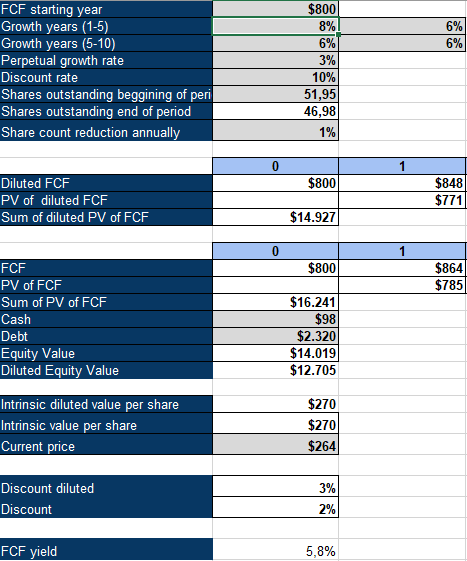

To value Zebra Technologies, I use an Inverse DCF analysis. I used FY 22 FCF guidance from management in Q2, adjusted for $150 million in settlement and related payments that are non-recurring in nature. Furthermore, I use a 10% discount rate (my required rate of return), a 3% perpetual growth rate and I assume a 1% of annual share count reduction. This is realistic, in my opinion, based on past performance and the great use of buybacks by management to only buy back shares while they are trading below their intrinsic value (they are buying back heavily right now).

Using these assumptions, my model calculates an expected FCF growth rate of 6% for Zebra Technologies, a very fair growth rate, considering that the company expects its markets to grow at 5-7% annually, and we can assume market share gains and operating leverage through a shift in sales mix towards data analytics and software.

ZBRA inverse DCF model (Authors Model)

I am a buyer

Zebra Technologies is a well-run company benefiting from global supply chain disruptions as it raises awareness and is a call to action for companies to invest in automation. The company has a lot of things going for it and keeps innovating and adding to its portfolio, increasing its moat. The stock is my 8th largest position at almost 6% portfolio weighting, and I keep DCAing monthly.