ArtistGNDphotography

Leading Swiss specialty chemicals company Sika’s (OTCPK:SXYAY) recent investor day event outlined a clear path to achieving its near to mid-term targets, comprising an annual sales increase of 6-8%, 15-18% EBIT margin, >25% ROCE, and an >10% cash flow margin. In addition, the company has doubled down on net zero, aiming to reduce scope 1 and 2 emissions by 42% in 2032 and an impressive 90% by 2050. Similarly, scope 3 emissions are targeted to see a 25% reduction by 2032 and a 90% reduction by 2050. Given the inflationary backdrop, Sika’s innovation track record also sets it apart, supporting its industry-leading pricing power and through-cycle growth potential.

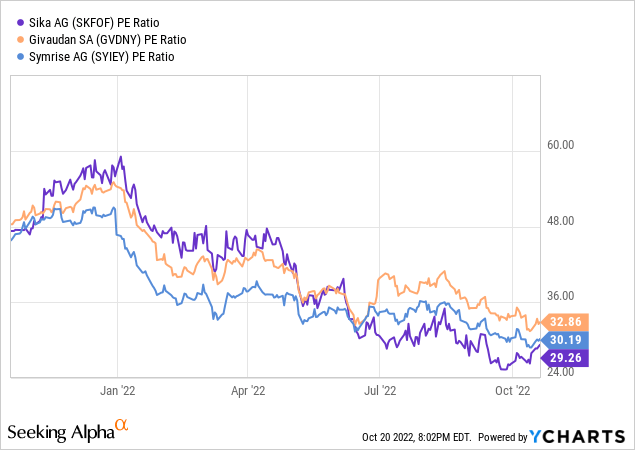

All in all, Sika deserves a relative valuation premium (vs the current discount) to peers like Symrise (OTCPK:SYIEF) and Givaudan (OTCPK:GVDBF), given its ability to not only sustain revenue growth but also margin expansion through the cycles, offering valuable defensiveness through an upcoming macro downturn. Long-term, successful execution of its net zero roadmap should catalyze more ESG flows as well, paving the way for further multiple expansion.

Capitalizing on Secular Growth Tailwinds

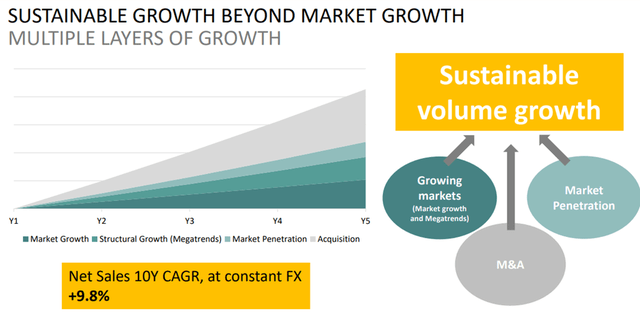

Over the mid to long term, Sika sees three key secular tailwinds for the construction industry – digitalization, automation, and sustainability. With ample investment flows into the space as well (~$14bn of investment in tech start-ups post-2020 vs. ~$8bn prior to 2020), the company sees ample room for its penetration of the construction chemicals market to increase 2.5-4x through 2050. This not only represents an acceleration relative to the ~2x penetration increase historically, but it also implies an impressive 3-5%pts outperformance above the market CAGR over the period. Geographically, growth in North America is expected to be solid, while China will drive a significant portion of growth on the back of its rapid retail network expansion (>170k points of sales).

Sika

While these targets seem a tad ambitious at first blush, they do tally with the rapid middle-class expansion in many developing countries, as well as the rise in GDP per capita globally. With more global growth and economic development comes the need for more sophisticated construction solutions, providing a nice tailwind for Sika. The addition of MBCC Group (formerly BASF (OTCQX:BASFY) Construction Chemicals) to the Sika portfolio offers incremental upside potential as well – in particular, the superior sustainability benefits from its complementary solutions should prove invaluable in accelerating Sika’s growth potential over time.

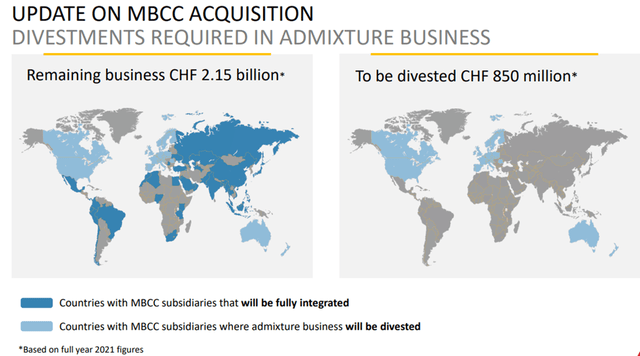

MBCC Acquisition On Track

Management also reassured investors on the progress of the MBCC transaction – recall that Sika will need to divest ~CHF850m of admixtures sales (out of ~CHF3bn of sales in FY21) to gain approvals from the US, Canada, EU, UK, Australia, and New Zealand. As the assets on offer are attractive, the elevated interest level for the assets comes as no surprise, with demand firmly intact despite the adverse macro changes over the last few months. Post-divestments, MBCC is guided to contribute ~CHF2.15bn of incremental margin accretive sales, driving significant margin expansion for the combined entity. Of note, the synergies target has been pegged at CHF160-180m by 2025/2026, implying a higher post-synergies margin than initially guided.

Sika

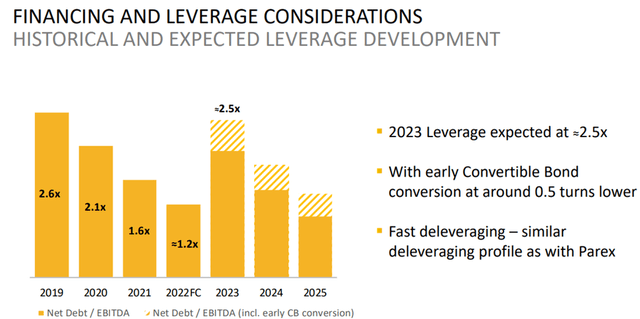

In the meantime, Sika has maintained a pro-forma leverage target of 2.5x net debt/EBITDA on 0.5 turns of deleverage per year. The headline metric does not, however, account for its convertible bond (soft call option exercisable in 2023), which upon conversion, would result in leverage coming down to ~2x. This leaves ample room for the MBCC deal funding, with a bridge loan facility already fully committed, along with long-term funding comprising cash-on-hand, bank loans, and bonds. As things stand, the annual interest cost is projected at a manageable CHF90m, subject to FX fluctuations. Assuming execution goes as planned, the MBCC deal is set to close in H1 2023.

Sika

Financial Targets Intact Despite Inflationary Pressures

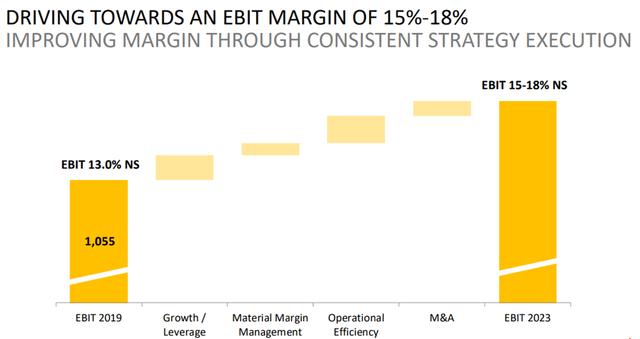

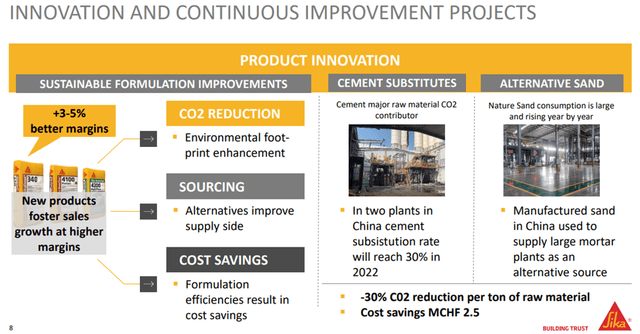

Despite the ongoing macro challenges, Sika confirmed its targeted annual sales growth of 6-8%, EBIT margin of 15-18%, and cash flow margin of >10%, as well as an industry-leading >25% ROCE. For this fiscal year, the sales growth guidance has been raised to an impressive >15% (vs.>10% previously), signaling underlying strength across key end markets. Similarly, Sika’s EBIT margin guidance now stands at >15% for the year, as the planned price hikes in H2 2022 (YTD +15%) are set to more than offset any headwinds from raw material cost inflation. Given that H1 inflation had a negative impact of ~4%pts at the EBIT level, the latest update points toward a positive reversal in the materials margin trend (management noted the limited impact of energy costs).

Sika

At the heart of Sika’s pricing power is the superior margin profile of its new products, which have risen in contribution in recent years (now ~25% of overall sales). In addition, the company’s progress on unlocking cost savings has been good, with operational efficiency gains contributing +0.5%pts thus far (mainly due to digitization initiatives such as automation and process control). As management beds down acquisitions and unlocks cost synergies as well, expect profitability to further improve over time – note Sika’s track record of post-acquisition has been good, with Parex, for example, yielding ~CHF100m in synergies.

Sika

Through-Cycle Growth Potential Intact

On balance, this was a positive event for Sika. The confirmation of its financial targets was a key positive, with annual sales on track for a 6-8% increase, alongside EBIT margins of 15-18% and an operating FCF margin of >10%, culminating in a best-in-class ROCE of >25%. The emphasis on net zero should also broaden the institutional appeal (particularly ESG mandates), with CO2 emissions set to undergo a 12% reduction per ton sold.

Importantly, the company’s pricing power is holding through the demand weakness, supporting the case for continued growth through the cycles. Given Sika has grown sales by an impressive +10%/year on an FX-neutral basis and also expanded EBIT by ~15%/year through the COVID headwinds over the last three years, I’d agree with this view. Coupled with Sika’s attractive internal and M&A-led growth opportunities, the stock offers good value at the current relative valuation discount.