Sally Anscombe/DigitalVision via Getty Images

Investment Thesis

Since Chewy (NYSE:CHWY) launched its IPO in the June of 2019, its stock price has been on a roller-coaster. It started trading at $35 a share, then went all the way up to $120 when the whole stock market was at its peak and is now back at $40. This pullback of 66% has made a lot of investors wonder if it is finally time to buy the dip and wait for the stock to go back to its high levels.

However, the story now is not the same as it was a year and a half ago when the stock hit its all-time high, so investors should pump the brakes for a little and do a deeper dive into the company’s fundamentals in order to find if it is still worth investing.

How Does Chewy Make Money?

Chewy is an online retailer and distributor for pet owners that provides a simple and flexible platform for ordering pet food and other products for animals. These non-food things include medicines, toys, tools for training, and animal houses.

entrepreneur-360.com

Two (2) key revenue sources are included in the Chewy business model:

1. Autoship customer sales

Chewy’s Autoship program makes it simple for the company’s clients to arrange recurring deliveries and save money on the things they commonly buy.

Customers can schedule recurring product deliveries with Chewy’s auto-ship subscription service without having to pay a membership fee.

Chewy makes all of its money through online sales, but in the past 2 years, its Autoship subscription service generated more than half of the company’s total revenues.

This implies that most of the company’s clients have arranged the products that they wish to buy for their pets and are purchasing them every month on autopilot.

2. Connect with a vet

Chewy’s customers can use the Connect with a Vet service to contact a licensed veterinarian if they have a question about the health or behavior of their pet.

Recession-Proof Company

Most people envision businesses that provide items that are necessary for all people when they think about recession-proof businesses. But what they don’t envision is a company that sells pet food. Even when a recession hits, no pet owner is going to either abandon their pet or let it starve. Bearing that in mind, we can confidently assume that the company is not going to suffer dramatically even if things get tough in the general economy as its clients will keep buying its products at least to some extent.

Chewy Has A Growth Problem…

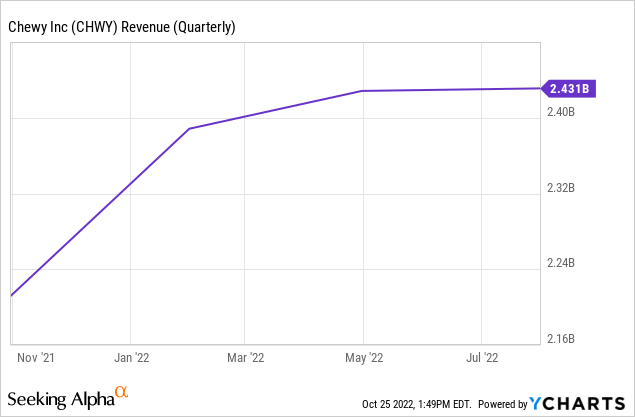

For the last few years, the company has managed to grow its top-line revenue at tremendous rates (24%-67%). This has helped this company make it to the high-growth businesses list, but does it still deserve a spot there?

In the last quarter, Chewy has barely managed to grow its revenue and even that was in low double digits. Although Chewy’s Total addressable market is estimated at $261 billion in 2022, the company struggles to find new customers and is thus growing its revenue almost solely from upsells to existing customers.

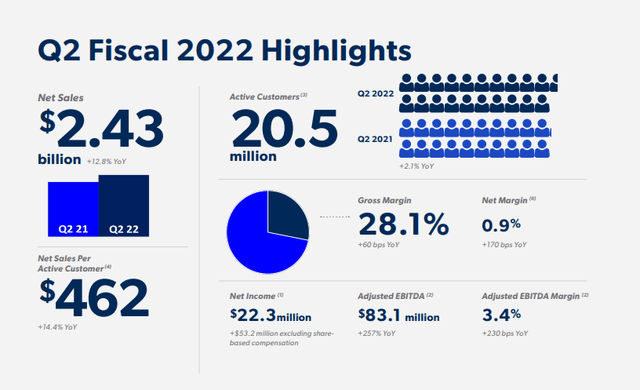

Chewy Shareholder Letter

More specifically, the business’s active customers grew by 2.1% quarter over quarter while its net sales per active customer grew by 14.4% in the same period of time.

This is both good and bad news as it means that the company has the ability to make more and more money from its existing customers but it is struggling in acquiring new ones.

Personally, I do not consider this a sustainable strategy as every customer has a limit on how much they are willing to pay for their pets and if the company can’t bring new customers, it is going to reach a point where it will find it extremely difficult to upsell the same customers even more.

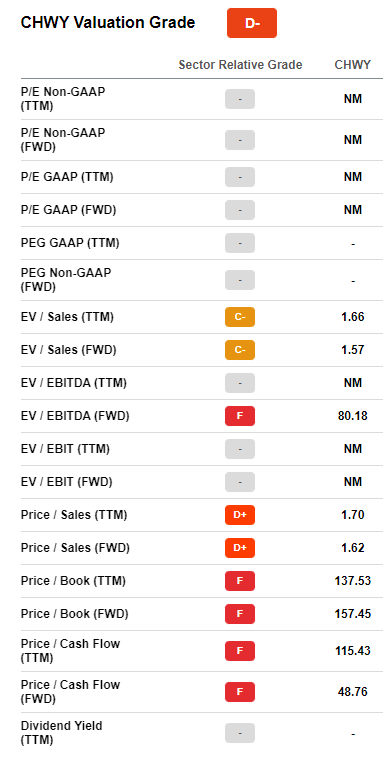

Chewy Valuation

SeekingAlpha

Chewy scored a D- in Seeking Alpha’s Valuation model. The company has a P/S ratio of 1.7, 115$ higher than that of its peers (0.79), and a P/B ratio of 137.53, which means that by buying this stock today you are paying 137.53 times its assets. The company is not profitable yet and thus, it does not have a P/E. That is why we are going to judge it by its P/FCF ratio which is 115.43. Most companies have such high P/FCF ratios when they first become FCF-positive as their FCF margin is pretty low. This should not be a problem as while the business keeps evolving, its FCF will grow with it too. Or should it?

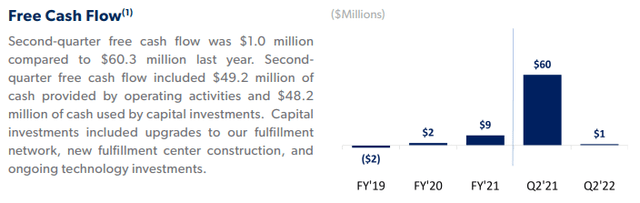

Chewy Shareholder Letter

As shown above, Chewy managed to firstly reach a breakeven point in 2020. It then grew its FCF in 2021 during the pandemic and is now again at almost 0. There may be multiple reasons why this is happening, but it is at least concerning and at most a red flag.

Taking all that into consideration, it is no wonder that Chewy scored a D- in the valuation model as it looks massively overvalued.

Valuation Forecast

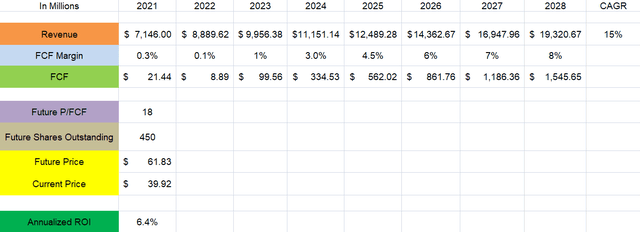

Author’s Calculations

By following what analysts believe about how Chewy’s revenue is going to grow, it seems that the company ends up with a turnover of a bit more than $19 billion, which implies a CAGR of 15% for the next 6 years. Now, trying to project an FCF margin for the company felt a bit like being in uncharted waters as the company has never been that profitable. However, I came up with an FCF margin of 8% for the company 6 years from now. This is based on the fact that its gross margins are at 26% and that at the end of the day it is a commodity good that it offers and these kinds of businesses are usually low margin. Lastly, I added a P/FCF of 18 as I believe that the company will still have some growth to offer even 6 years from now and that its moat will become even stronger. Put everything above together and you will end up with a future price of $61.83 per share. This means that if you buy this stock at $39.92 (the price that it is currently trading at), you are going to have an ROI of 6.4%. Not really good right?

Risks

Of all the risks that come with owning Chewy stock, the most important ones are competition and shareholder dilution.

- Competition

There are other huge e-commerce sites, like Walmart (WMT) and Amazon (AMZN) that offer many of the same things that Chewy does. And that is just a few of the company’s competitors; think about everywhere that you can go to get pet food and pet medicine. The pet sector is really competitive and I believe that the company is going to have a rough time differentiating itself from the competition.

Having said that, I should mention that Chewy has proved to have the ability to establish itself in the minds of its customers despite direct competition from the largest firms in the world. In my opinion, Chewy still has a ton of value in terms of its pharmacy and prescription food products compared to rival companies.

Throughout the past years, the company has been diluting its shareholders, giving them a smaller piece of the company as time goes on. If this keeps being the story for Chewy, eventually EPS is going to be lower when the company finally becomes profitable and is therefore going to drop the value of the stocks that you own.

Although this is a risk, by the time the company becomes profitable, the management could decide to stop diluting the company’s shareholders as they will be able to fund their expenses using the revenue generated from operations.

Lastly, if the company’s management finds a way to convert more pet owners into customers, for example by expanding in Europe, the revenue growth of the company could very well go back to its previous levels and drive the stock price up again.

Conclusion

I believe that Chewy is a great company with a great product. Chewy seems to be a bad wager; for it to succeed, managers must execute flawlessly over an extremely long period of time and that is quite uncommon for any company. Even though I believe that the company is going to grow at low levels from here and that it will find new customers, it is not going to be the high-growth stock that it used to be, and that will force shareholders to re-evaluate their decisions.

I would be interested if the price was half what it is now but at this valuation, I rate Chewy as a SELL.