Joe Raedle

Devon Energy’s (NYSE:DVN) total oil equivalent production increased from 575 MBoe/d in 1Q 2022 to 616 MBoe/d in 2Q 2022, driven by increased production in the Delaware Basin. Also, DVN’s total oil equivalent realized price (including cash settlements) increased from $54.75 per Boe in 1Q 2022 to $64.70 per Boe in 2Q 2022. Thus, the company reported strong 2Q 2022 financial results. I expect DVN to report strong quarterly results in 3Q 2022 as oil and gas prices and oil and gas production levels were high during the third quarter. Also, as oil and gas prices and production levels will remain high, the company’s recent significant profitability will continue for the next three quarters.

Quarterly results

In its 2Q 2022 financial results, DVN reported total revenues of $5626 million, compared with 1Q 2022 total revenues of $3812 million, driven by increased oil, gas, and NGL sales. The company’s production expenses increased from $618 million in 1Q 2022 to $729 million in 2Q 2022. Also, its marketing and midstream expenses increased from $1324 million in 1Q 2022 to $1700 million in 2Q 2022. The company reported an income tax expense of $557 million in 2Q 2022, compared with $267 million in the previous quarter. DVN reported 2Q 2022 net earnings (attributable to Devon) of $1932 million, up 95% QoQ. Its net earnings per diluted share increased from $1.48 in 1Q 2022 to $2.93 in 2Q 2022. The company’s total cash, cash equivalents, and restricted cash increased from $2625 million in 1Q 2022 to $3457 million in 2Q 2022, up 32% QoQ.

The company’s oil realized price (including cash settlements) increased from $81.62 per Bbl in 1Q 2022 to $95.50 per Bbl in 2Q 2022. Devon’s NGL realized price (including cash settlements) increased from $37.76 per Bbl in 1Q 2022 to $40.28 in 2Q 2022 (It is worth noting that in 1Q 2022 and 2Q 2022, cash settlements were zero). DVN’s gas realized price (including cash settlements) increased from $3.15 per Mcf in 1Q 2022 to $5.06 in 2Q 2022.

In the second quarter of 2022, DVN’s fixed-plus-variable dividend increased by 22 percent to a record high of $1.55 per share. “The second quarter saw our business continue to strengthen and build momentum as we delivered systematic execution across the financial, operational, and strategic tenets of our cash-return business model,” the CEO commented. “This success was showcased by production from our Delaware-focused program that exceeded guidance expectations, our streamlined cost structure captured the full benefit of higher commodity prices and we returned record-setting amounts of cash to shareholders,” he continued.

The market outlook

According to International Energy Agency (IEA), World oil demand is projected to increase by 2.1 million barrels per day in 2023. World oil production rose to 101.3 mb/d in August 2022 and is expected to increase to 101.8 mb/d in 2023. European Union and United Kingdom’s oil import from Russia decreased by 880 kb/d since the start of the year to 1.7 mb/d. On the other hand, their oil import from the United States increased by 400 kb/d to 1.6 mb/d. The EU embargo on Russian crude oil imports that comes into effect in December 2022, means that European countries will need to increase their oil reallocations from other countries.

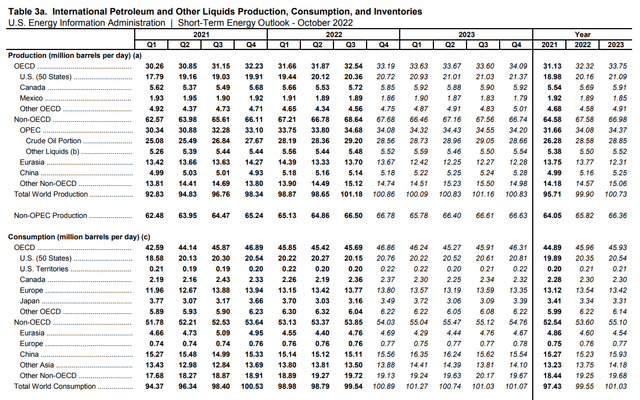

Furthermore, Energy Information Administration (EIA) expects that world petroleum and other liquids production and consumption to increase in 2023 (see Figure 1). Total world petroleum and other liquids production and consumption in all of the quarters of 2023 are expected to exceed 100 million barrels per day. U.S. oil production was 20.12 mb/d in 2Q 2022 and 20.36 mb/d in 3Q 2023. It is expected to increase to 20.72 mb/d in 4Q 2022, 20.93 mb/d in 1Q 2023, and more than 21 mb/d in 2Q-4Q 2023. U.S. petroleum and other liquids consumption is expected to increase from 20.35 mb/d in 2022 to 20.54 mb/d in 2023.

Figure 1 – International petroleum and other liquids production and consumption

eia

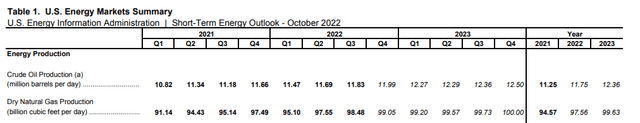

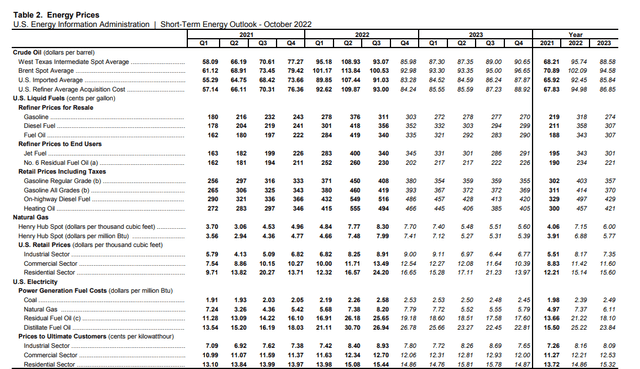

In 3Q22, U.S. dry natural gas production was 98.48 Bcf/d, compared with 97.55 Bcf/d in 2Q 2022 and 95.10 Bcf/d in 1Q 2022. EIA expects U.S. dry natural gas production to increase to 99.05 Bcf/d in 4Q 2022 and to 99.20 Bcf/d in 1Q 2023. EIA expects U.S. dry natural gas production reaches 100 Bcf/d in 4Q 2023 (see Figure 2).

Furthermore, due to higher household energy consumption as a result of colder temperatures, OPEC+ production cut, the continuing war in Ukraine, and continuing sanctions on Iranian oil and gas, crude oil and natural gas prices will remain high for the rest of 2022. EIA expects Brent crude oil spot price averages $93 per barrel in 4Q 2022 and $95 per barrel in 2023. Also, EIA forecasts Henry Hub’s natural gas spot price to average $7.40 per MMBtu in 4Q 2022 and then fall below $6.00 per MMBtu in 2023 as U.S. natural gas production rises. Figure 3 shows that crude oil prices in the United States in 3Q 2022 were lower than in 2Q 2022 and are expected to decrease further in 4Q 2022. On the other hand, natural gas prices in the United States in 3Q 2022 were higher than in 2Q 2022. U.S. natural gas prices in 4Q 2022 are expected to be close to their levels in 2Q 2022.

Figure 2 – U.S. crude oil and natural gas production

eia

Figure 3 – Energy pieces in the United States

eia

DVN expected its 3Q 2022 oil production to be between 287 to 295 MBbls/d. The company expected its NGL production to be between 151 to 156 MBbls/d. Finally, Devon expected its 3Q 2022 gas production to be between 930 to 970 MMcf/d. Also, the company expected its 4Q 2022oil, NGL, and gas production to increase by 4% QoQ due to timing of activity and higher working interest. The company brought online about 100 new wells in 3Q 2022, driving higher production in the fourth quarter of 2022.

DVN’s total oil production increased from 300 MBbls/d in 2Q 2022, compared with 288 MBbls/d in 1Q 2022, driven by increased production in Delaware Basin, partially offset by decreased production in Williston Basin and Eagle Ford Basin. The company’s NGL production increased from 136 MBbls/d in 1Q 2022 to 156 MBbls/d in 2Q 2022, driven by increased production in Delaware Basin. Finally, DVN’s gas production increased from 906 MMcf/d in 1Q 2022 to 961 MMcf/d in 2Q 2022, driven by higher gas production in Delaware Basin. Devon’s capital expenditure in the Delaware Basin decreased from $413 million in 1Q 2022 to $374 million in 2Q 2022. However, its capital expenditure in Anadarko Basin, Williston Basin, Eagle Ford, and Power River Basin increased to $42 million (up 163% QoQ), $21 million (up 24% QoQ), $37 million, (up37% QoQ) and $37 million (up 37% QoQ), respectively.

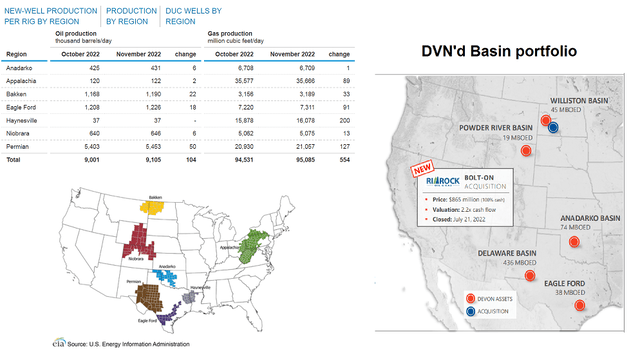

According to Figure 4, oil production in the Permian region (the Delaware Basin lies within the Permian region) is estimated to be 5403 MBbl/d in October 2022 and is expected to increase by 50 MBbl/s in November 2022. Gas production in the Permian region is estimated to be 20930 Mcf/d in October 2022 and is expected to increase by 127 Mcf/d in November 2022. Moreover, oil and natural gas production levels In Anadarko, Eagle Ford, Bakken, and Niobrara are expected to increase in November 2022.

Figure 4 – U.S. oil and gas production by region and DVN’s Basin portfolio

eia and DVN’s 2Q 2022 presentation

DVN performance outlook

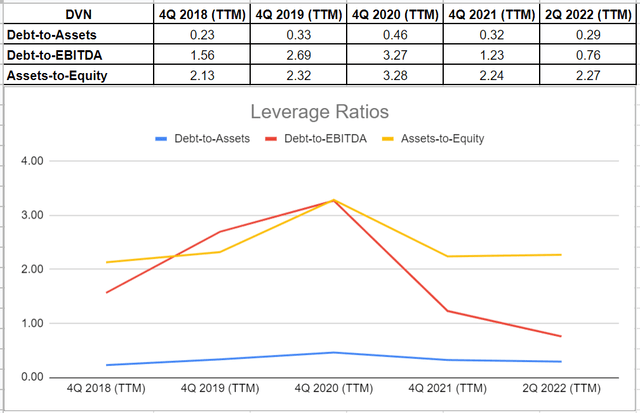

The debt-to-assets ratio is one of the significant calculations that measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. Thereby, the higher the ratio, the greater the degree of leverage and financial risks. The debt-to-asset ratio of DVN has decreased from 0.32 at the end of 2021 to 0.29 on 30 June 2022. Moreover, DVN’s debt-to-EBITDA ratio, which determines the probability of defaulting on debt, decreased from 1.23 at the end of 2021 to 0.76 on 30 June 2022. Finally, DVN’s assets-to-equity ratio increased slightly from 2.24 at the end of 2021 to 2.27 on 3. June 2022. However, compared to its assets-to-equity ratio of 3.28 at the end of 2020, the company’s current assets-to-equity ratio is promising. Altogether, the leverage ratios of DVN depict the company’s solvency and its ability to meet its current and future obligations (see Figure 5).

Figure 5 – DVT’s leverage ratios

Author (based on SA data)

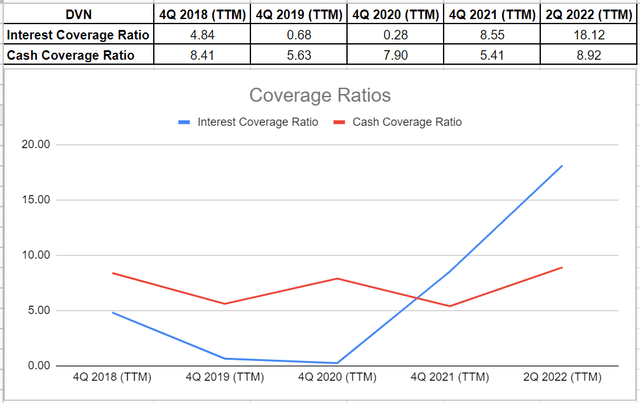

Besides the mentioned ratios, I investigated coverage ratios of DVN to measure the company’s ability to pay its financial obligations. Generally, it is observable that the coverage ratios of DVN have improved during recent years. DVN’s ICR increased from 8.55 at the end of 2021 to 18.12 on 30 June 2022. This ratio indicates the number of times a company is able to pay its interest expenses on its debt with its operating income. Furthermore, as a conservative metric, the cash coverage ratio compares the company’s cash generation with its interest expenses. DVN’s cash coverage ratio increased from 5.41 at the end of 2021 to 8.92 on 30 June 2022. Devon’s coverage ratios prove its capability of meeting its financial obligations and providing returns for its investors (see Figure 6).

Figure 6 – DVT’s coverage ratios

Author (based on SA data)

Summary

Due to increased oil and natural gas prices and production levels in the United States, and the global demand for U.S. oil and natural gas (as a result of the war in Ukraine, energy crisis in Europe, and OPEC+ production cut), I expect Devon’s revenue’s to be strong in 2H 2022 and 1H 2023. The stock is a buy. The company is well-positioned to benefit from the market condition.