We Are

Investment Thesis

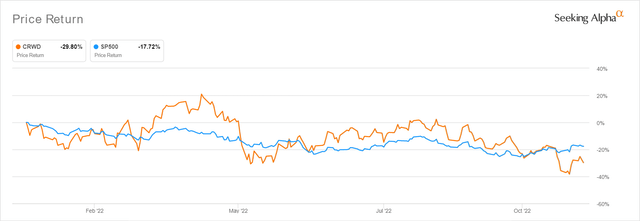

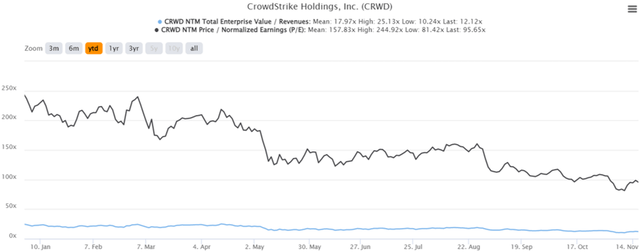

CRWD YTD Stock Price

Seeking Alpha

CrowdStrike (NASDAQ:NASDAQ:NASDAQ:CRWD) has plunged by -51.07%, since its hyper-pandemic peak of $284.58 in November 2021. However, there is obviously a massive baked-in premium, despite the tragic correction thus far. The stock is still trading at a hyper-inflated NTM P/E of 95.65x, against its YTD mean of 157.83x and the all-time high of 1,572.02x, respectively.

Thereby, pointing to CRWD’s precarious situation since most of its cloud/software/security peers, such as Microsoft (MSFT), VMware (VMW), and Oracle (ORCL) are trading at moderate P/E valuations between 10s and 20x. These companies will also similarly report sustained top and bottom-line growth ahead at single to mid-digits CAGR through 2025, though notably not as impressive at CRWD at revenue CAGR of 41.2% and EPS CAGR of 60.9%.

Perhaps CRWD’s premium is well justified, though we also would like to highlight that the stock would inadvertently plunge at the slightest whisper of slowing growth. Investors, take note of this risk.

CRWD Continues To Execute Brilliantly, While Growing Its ARR & Subscription Base

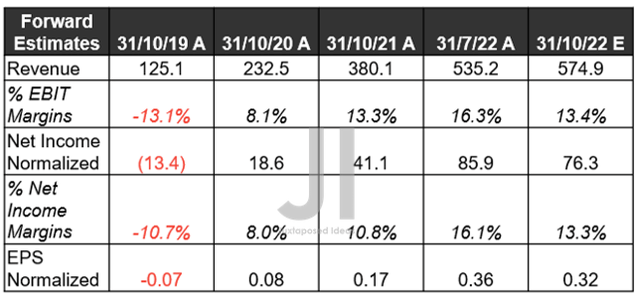

CRWD Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

S&P Capital IQ

In its upcoming FQ4’23 earnings call, CRWD is expected to report another excellent quarter with revenues of $574.9M, indicating an increase of 7.41% QoQ and 51.24% YoY. Due to the unusually robust growth in the past three quarters and seasonal deceleration in Q4, investors need not worry about the perceived QoQ normalization and YoY deceleration in profitability and margins then. Its YoY EPS growth of 88.23% remains impressive, especially given the impact of two large deals in FQ4’22 and ongoing Stock-Based Compensation of $413.35M over the last twelve months, increasing 88.77% sequentially.

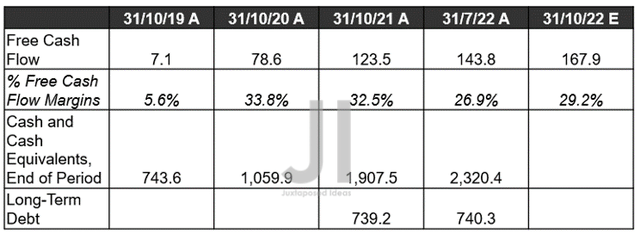

CRWD Cash/ Equivalents, FCF ( in million $ ) %, and Debts

S&P Capital IQ

Analysts also expect CRWD to execute brilliantly with the projected $167.9M in Free Cash Flow ((or FCF)) generation for the next quarter, with a QoQ expansion in its margins by 2.3 percentage points. The company remains well-positioned through the worsening macroeconomics as well, given its minimal long-term debts and growing liquidity on the balance sheet to $2.32B by the last quarter.

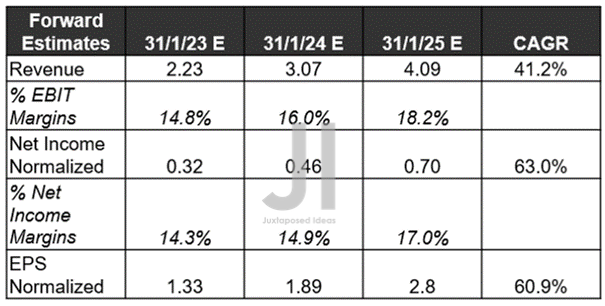

CRWD Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

CRWD’s top and bottom line growth have also been upgraded by 4.33% and 10.3% since our previous analysis in June 2022, despite the supposed destruction in corporate spending thus far. It is evident that Mr. Market is extremely impressed with its growing ARR, at a CAGR of 79.10% between FY2019 and FY2022, significantly aided by the sticky consumer base with an excellent net retention rate of 123.9% by FQ4’22. Thereby, rapidly growing the company’s subscription numbers, with 59% of its consumers signed up for five or more modules by FQ2’23, compared to 53% in FQ2’22 and 39% in FQ2’21.

As a result, it is not surprising to see CRWD’s stellar projected growth during these uncertain economic conditions, with the company expected to record YoY revenue growth of 37.66%, net income growth of 43.75%, and EPS growth of 42.1% in FY2024. It is apparent that cyber-security spending remains robust, despite the tightened discretionary corporate expenses and job cuts thus far.

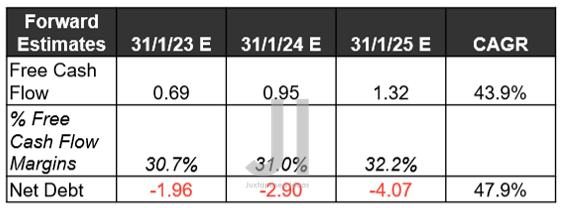

CRWD Projected FCF ( in billion $ ) % and Net Debts

S&P Capital IQ

Furthermore, CRWD is expected to continue expanding its EBIT/ net income/ FCF margins tremendously from -13.6%/-13%/4.1% in FY2020, 13.5%/11.1%/30.4% in FY2022, and finally to 18.2%/17%/32.2% by FY2025. Impressive indeed despite the staged low-friction selling, since analysts expect the company to grow its liquidity ahead, with the massive reduction in its net debts from -$1.25B in FY2022 to -$4.07 by FY2025. The same, unfortunately, cannot be said about another software company, Palantir (PLTR), which continues to report cash burn and GAAP unprofitability through FY2025 despite a similar sales strategy.

In the meantime, we encourage you to read our previous article on CRWD, which would help you better understand its position and market opportunities.

- CrowdStrike: What You Need To Know From Its Investor Briefing

- CrowdStrike: A Bargain, But This Is Not The Bottom

So, Is CRWD Stock A Buy, Sell, or Hold?

CRWD YTD EV/Revenue and P/E Valuations

S&P Capital IQ

CRWD is currently trading at an EV/NTM Revenue of 12.12x, lower than its YTD mean of 17.97x. The stock has also bounced from its 52 weeks low of $120.50 to $139.23, though normalized by -49.36% from its 52 weeks high of $274.98. Assuming that the company is able to live up to Mr. Market’s superbly rosy expectations, there is indeed no doubt, that we will see the stock record a sustainable long-term rally through the next few years. Thereby, explaining the consensus estimate’s bullish price target of $230.31 and a 65.42% upside from current prices.

As a result, we are re-rating the CRWD stock as a speculative Buy, due to the relatively attractive risk/reward ratio. Naturally, investors should also size their portfolios accordingly, since the Feds may not pivot this early. The recent 13.78% stock recovery from November rock-bottom levels is attributed to the growing confidence that the Feds will pivot early by the December meeting, due to the upbeat October CPI report. 80.6% of analysts are already projecting a 50 basis points hike, mirroring the Bank of Canada’s recent moderation. Assuming a soft landing through 2023 despite the raised terminal rate to 6%, it is likely that the stock market will maintain its optimism, providing an excellent runway for a massive recovery from these peak recessionary fears.

Otherwise, another bottom test by 14 December. Only time will tell.