hapabapa/iStock Editorial via Getty Images

FedEx’s (NYSE:FDX) above-expectations earnings print on December 20th has boosted its share value from $164.35 then to $177.05 at Tuesday’s close. That’s an impressive 7.7% return in just one week, so FDX traders did well.

But will investors who buy into FDX for exposure to the Transport Sector do as well? I tend to think not. UPS is the better long-term bet.

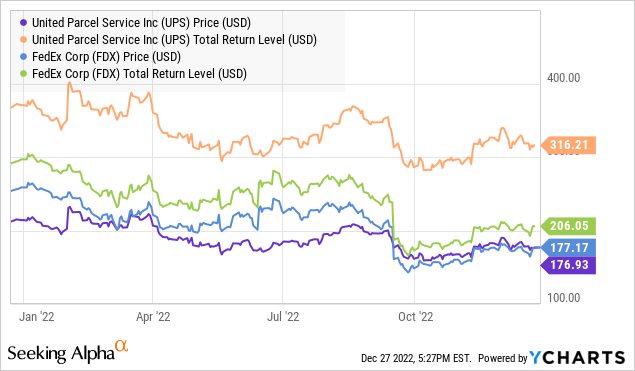

Overall, for investors, United Parcel Service (NYSE:UPS) is far and away the superior investment for a number of reasons, not least of which is its total return over the last year, as this chart shows.

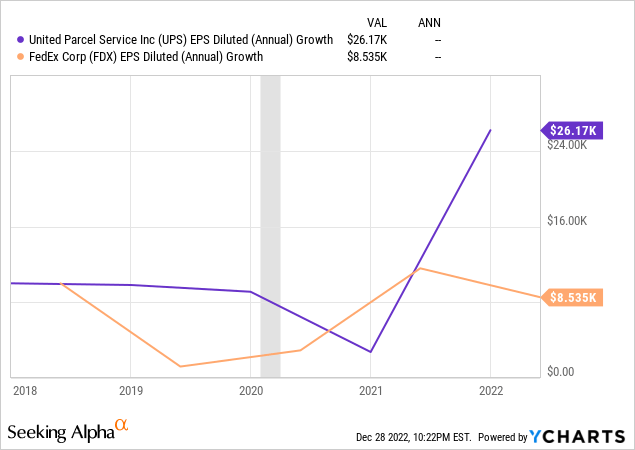

But that should not come as a surprise. According to their most recent earnings releases, FDX’s margin is just over 5% whereas UPS’ margin was over 10% domestically; over 20% internationally.

My investment thesis is that these two logistics companies are competing, in most instances, for the same business and that UPS has a competitive advantage in the following respects. Ultimately, I think these advantages could cause FDX to significantly reduce its operational capabilities.

Some Background

I wrote about UPS and FDX earlier this year in articles here and here, respectively. I recommended a long position on UPS and a short position on FDX. Those positions are reiterated here.

UPS New Operational Opportunities

FDX service cuts and higher rates, which I discussed in some detail in my last coverage of the logistics company, create longer-term opportunities for a UPS, upon which “Brown” is set to capitalize. FDX, on the other hand, has – for now – only a defined and limited ability to cut costs and raise rates. But UPS has a number of competitive alternatives.

Consider:

1. Rates. As FedEx rates are increased, UPS will obviously have greater latitude in its pricing to increase its rates. (But Delivery Density, discussed below, allows another, more aggressive, competitive, choice.)

2. Delivery Density, a technique that allows packages with the same delivery day commitment to the same customer to be consolidated. Moreover, UPS has joined with drop-shipping company CommerceHub to effect delivery from multiple separate retailers and create similar efficiencies in the B2B delivery chain.

These efficiencies, just recently started, might eventually cause UPS to be able to reduce its rates, and thereby take volume and customers from FDX. Longer term, that UPS advantage could snowball further, causing further excess FDX capacity that must be cut to fit FDX reduced demand.

3. Macro Environment. Practically every well-run business is looking to reduce costs and increase efficiencies. So expenses for “When it absolutely, positively, has to be there overnight” will be reduced by substantially by proactive managers who will back-load projects to move deadlines on projects or shipments to several days ahead of the promised delivery. As with Delivery Density, this trend will also reduce demand for FDX, create more excess capacity, and force FDX to further reduce service. (FDX has already grounded 5 of its aircraft; it anticipates grounding 11 more.)

Other Analysis

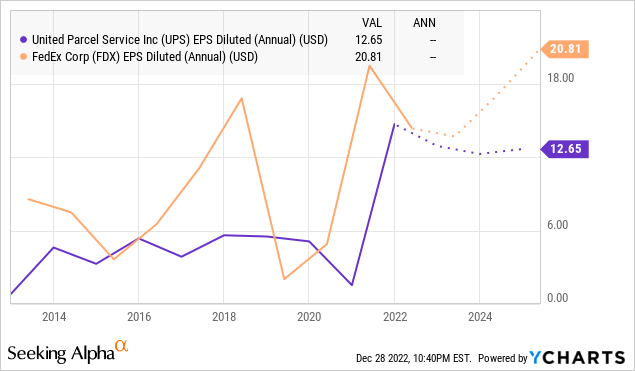

As of the close of markets today, both FDX and UPS had nearly an identical price per share, $173, +/- a few cents. Forward earnings would anticipate a higher share price for FDX, but I am circumspect. After all, it was just last September that FDX revised its forward earnings guidance and suffered a 16.5% collapse in its share price. UPS, by comparison, has a less optimistic forward EPS which, to us, makes quite a bit more sense preceding a widely anticipated recession in 2023.

Summary

One could easily imagine the aforementioned circumstances resulting, ultimately, in a severe downward spiral for FDX over time; one that results in a far smaller boutique/concierge logistics service company for package delivery for customers willing to pay a huge premium or for mission-critical, time-sensitive, parts logistics. (Imagine something akin to NetJets versus Delta Air Lines.) A more price-competitive UPS, excess capacity, a reduction in service, and reductions in demand for premium-priced logistics are a sure path to decline for FDX over time.

____________________________

Note: Our comments are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. You should seek out competent advisors in those areas to provide advice appropriate to your individual circumstances. Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be underperforming and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).