Latest Updates:

Stocks Open Higher Friday as TikTok Takes Center Stage

[Friday, September 18, 9:31 am]

Contributed by Sarah Smith

President Donald Trump must not have learned the newest dance moves. That would explain why he has decided to ban downloads of TikTok and WeChat, a messaging app from Tencent (OTCMKTS:TCEHY), starting Sunday. His recent move also includes other measures that block all U.S. business transactions with the two mobile apps.

Wait what? I thought we saw a resolution to this saga earlier this week. Oracle (NYSE:ORCL) received the green light from ByteDance, the Chinese company behind TikTok, to be its partner. Yesterday rumors even began to swirl that through Oracle, TikTok could launch a global initial public offering. Plus, Oracle has long been supported by Trump thanks to CEO Larry Ellison.

Investors likely initially cheered the news, but the celebration may have been too soon.

Trump is set to weigh in on the Oracle deal sometime today, and now the future looks unclear. The president had originally called for a full acquisition of TikTok. In the recently announced arrangement, Oracle would take a minority stake in TikTok and be its technology partner in the United States. Reports have also emerged that Walmart (NYSE:WMT) would like to be another minority investor. However, minority stake does not equal takeover.

If the ban goes through, new users would not be allowed to download the apps from the likes of Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL). Existing users would not be able to receive app updates, and users would be prohibited from making payments through WeChat.

It is safe to say investors should keep a close eye on TikTok — and not just the funny videos — ahead of any news from Trump today. The decision will have an implication for Oracle, Walmart and the future of U.S.-China relations, especially on tech. Remember, national security has been invoked as a key concern in the TikTok deal.

- The S&P 500 opened higher by 0.08%

- The Dow Jones Industrial Average opened lower by 0.03%

- The Nasdaq Composite opened higher by 0.53%

Stocks Close Lower Thursday on Fed Outlook, Jobless Claims

[Thursday, September 17, 4:09 pm]

Contributed by Sarah Smith

The stock market needs to embrace a little bit of Taylor Swift’s energy and learn to “shake it off.” Investors are still reeling after processing a negative outlook from the Federal Reserve and this morning’s look at initial jobless claims. There is simply no sunshine to be found on Wall Street today.

Tech stocks could have provided some optimism.

Oracle (NYSE:ORCL) sealed the deal with TikTok, and a global initial public offering for the short-form video platform could be on the way. Facebook (NASDAQ:FB) just unveiled a new headset. Apple (NASDAQ:AAPL) made waves with new smartwatches, new tablets and new bundles of its red-hot services. But still, Silicon Valley and its tech inhabitants are dragging the market lower on Thursday. Facebook and Amazon (NASDAQ:AMZN) closed lower by more than 2%. Apple and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) closed down by slightly less than 2%.

What gives? Why are our market-leading tech companies not gaining? Consider that as these stalwart names slump, Wall Street is also welcoming a whole new cast of characters. This week has brought Snowflake (NYSE:SNOW), JFrog (NASDAQ:FROG) and Sumo Logic (NASDAQ:SUMO) to the public markets. Each of these red-hot companies has made waves with their initial public offerings. Plus, investors are still eyeing updates from industries like electric vehicles and battery suppliers.

Put on some comfy shoes, do a little dance and get ready to stay on your toes. Who knows what tomorrow will bring.

- The S&P 500 closed lower by 0.84%

- The Dow Jones Industrial Average closed lower by 0.47%

- The Nasdaq Composite closed lower by 1.27%

Amazon Stock Is a Buy on Its Suburban Plans

[Thursday, September 17, 3:42 pm]

Contributed by Sarah Smith

Could Amazon (NASDAQ:AMZN) become even more a part of daily life?

Since the start of the novel coronavirus pandemic, consumers and investors continue to embrace it. Amazon supplies essential goods like toilet paper and pet food, provides streaming entertainment like music and movies, and it has even ventured into the video game space through its Twitch acquisition. Plus, the e-commerce leader is behind Amazon Web Services and the Whole Foods grocery chain.

But one area that Amazon is not a winner in is one-day shipping. Investors initially dragged the company when it rolled out that option for Prime customers, worried that it would eat away at profitability. During the pandemic, consumers have also complained about shipment delays and slower-than-average deliveries. Some analysts even concluded that logistics hurdles could be the one way to sink AMZN.

At the same time we have seen Walmart (NYSE:WMT) and even Target (NYSE:TGT) pivot more seriously into one-day shipping and store pickup. They each have networks of retail locations across the United States, helping them get goods from shelves to porches.

Amazon is not one to take a back seat. According to Bloomberg, the company is now looking to open more than 1,000 warehouses in suburban neighborhoods to speed up the delivery process. Instead of waiting for your package to make its way from a rural — or at least non-urban — area, your package may be coming to you from just down the street. As the team behind Robinhood Snacks put it, Amazon is looking to move in right next to your neighborhood coffee shop.

For investors, know that this move is likely to solidify its leadership position against Walmart and Target. However, it also solidifies its dominance over the likes of United Parcel Service (NYSE:UPS), especially as it builds out a fleet of delivery vehicles and looks to take over mall retail space with its warehouses.

Keep a close eye on Amazon stock. CEO Jeff Bezos is not done winning just yet.

Moderna Stock Races Higher on Updated Vaccine Timeline

[Thursday, September 17, 10:24 am]

Contributed by Sarah Smith

Moderna (NASDAQ:MRNA) remains neck and neck with vaccine rivals AstraZeneca (NYSE:AZN) and Pfizer (NYSE:PFE). Boosting that reality was an update Thursday morning from CEO Stephane Bancel, who shared the company was targeting final novel coronavirus vaccine results by December. Here is everything investors need to know.

- The best-case scenario would have Moderna deliver results by October. The worst-case scenario would bring results by the end of December.

- Moderna is ready to deliver 100 million doses of its coronavirus vaccine by the end of the year.

- It is developing an experimental vaccine that uses messenger RNA, or mRNA.

- For more, read the InvestorPlace.com brief on MRNA stock here.

Sorrento Therapeutics Stock Rallies on FDA Trial Approval

[Thursday, September 17, 9:44 am]

Contributed by Sarah Smith

Fan-favorite Sorrento Therapeutics (NASDAQ:SRNE) is delivering on Thursday. SRNE stock is higher by 20% in early morning trading thanks to good news from the U.S. Food and Drug Administration. Here is what investors need to know:

- Sorrento received permission from the FDA to launch Phase 1 trials of its antibody drug.

- The antibody drug is known as STI-1499 and COVI-GUARD.

- Importantly, the company thinks it can target emergency-use authorization as early as the end of 2020. This timeline makes it very competitive in the antibody drug space.

- For more, read the InvestorPlace.com brief on SRNE stock here.

Stocks Slump Thursday on Gloomy Jobless Claims Report

[Thursday, September 17, 9:30 am]

Contributed by Sarah Smith

Predictions from the Federal Reserve are ringing a little too true on Thursday. After the central bank called for the novel coronavirus to continue weighing heavily on the economy, investors are seeing that up close and personal. Another 860,000 Americans filed for initial jobless claims.

Since the start of the pandemic, these weekly claims have been coming in at historic highs. Week after week the figure held high above 1 million. Now we are finally seeing the report come in below that psychological threshold, but it is still very high.

Plus, economists were only calling for 850,000 Americans to file for those benefits, so this morning saw a worse-than-expected number.

Beyond the ominous warnings from the Federal Reserve, it is likely that investors are driving the major indices lower on Thursday because of a lack of action from Congress. Wall Street has long been waiting for lawmakers to pass a second stimulus package, but one has not come.

Clearly there is a lot of gloom in the stock market Thursday, but there is also some reason for positivity. Vaccine makers like Moderna (NASDAQ:MRNA), iBio (NYSEMKT:IBIO) and Sorrento Therapeutics (NASDAQ:SRNE) are all rallying thanks to positive updates. In a week that has been marked with bullish reports from AstraZeneca (NYSE:AZN) and Pfizer (NYSE:PFE), it certainly seems that a safe and effective vaccine is closer than ever before.

What will come first — a vaccine or a stimulus package?

- The S&P 500 opened lower by 1.49%

- The Dow Jones Industrial Average opened lower by 1.03%

- The Nasdaq Composite opened lower by 1.25%

5 Online Education Stocks to Buy Ahead of the iHuman IPO

[Wednesday, September 16, 4:44 pm]

Contributed by Sarah Smith

Students are back to school and online education companies are booming.

Although some campuses are filled — at least partially — with students and teachers, much of the 2020 back-to-school season has revolved around virtual classrooms and a whole lot of creativity. It is the first time that many households considered online education as a viable alternative.

This reality has been a major catalyst for a number of online education stocks — and especially for a handful of Chinese companies in the space. Just last week, investors learned that iHuman had filed for an initial public offering on the New York Stock Exchange. According to its paperwork with the U.S. Securities and Exchange Commission, it will begin trading under the symbol IH.

iHuman is all about the blend of education and entertainment that parents are likely craving. It bills itself as an “edutainment” company, touting a series of apps and games. The company not only targets parents, but educational institutions that want to round out their offerings. Importantly for investors, the company says its revenue has doubled in the last year, from 131.9 million yuan in 2018 to 218.7 million yuan in 2019.

Also important for investors to note is the fact iHuman plans to use proceeds from its IPO to expand, including out of the Chinese market.

This sudden interest in new online education stocks is no doubt a boon for those companies already existing in the space. If you are excited about the upcoming iHuman IPO and what it represents, take a look at these five stocks to buy from InvestorPlace contributor Gregg Early.

- Chegg (NYSE:CHGG)

- Arco Platform (NASDAQ:ARCE)

- K12 Inc (NYSE:LRN)

- Universal Technical Institute (NYSE:UTI)

- New Oriental Education & Technology Group (NYSE:EDU)

Stocks Struggle Wednesday Following Fed Announcement

[Wednesday, September 16, 4:02 pm]

Contributed by Sarah Smith

Well, the Federal Reserve sure does know how to rain on a parade. After its Federal Open Market Committee shared its forecast, the major stock indices all dipped lower.

So what exactly happened? The Federal Reserve shared that it plans to keep interest rates near zero at least through 2023. That should not be entirely surprising, as the central bank has been consistent in its commitment to near-zero rates. However, it previously was targeting those levels through the end of 2021. This expansion likely has investors worried about the broader economy.

Building on this, in its official policy statement, the Federal Reserve said the novel coronavirus would continue to “weigh” on economic activity. That has been its stance for months, and as investors have seen that, as through weak consumer spending, it is not pleasant to hear so explicitly. Wall Street was probably looking for a show of confidence from the bank.

There were a few positive updates from the two-day meeting, however. The Fed has improved its update on gross domestic product (GDP). It initially forecast a contraction of 6.5% in real GDP and an overall unemployment rate above 9% for 2020. Now, it is calling for real GDP to contract just 3.7% and for the unemployment rate to be at 7.6% by the end of the year. What a nice holiday present!

As we reported this morning, any commitment from the Fed would be much better matched by a fiscal stimulus package. Although there have been various proposals for a second package, such as the one we reviewed from the Problem Solvers Caucus, it remains unclear if or when Congress could strike such a deal. That reality, combined with caution from the Fed, no doubt explains weakness in the stock market on Wednesday afternoon.

Keep an eye out for the initial jobless claims report in the morning, as well as share-price movement in Big Tech. Those market leaders are once again under pressure.

- The S&P 500 closed lower by 0.46%

- The Dow Jones Industrial Average closed higher by 0.14%

- The Nasdaq Composite closed higher by 1.25%

Eli Lilly Stock Looks Like a Buy on Antibody Drug Results

[Wednesday, September 16, 1:51 pm]

Contributed by Sarah Smith

Pharmaceutical leader Eli Lilly (NYSE:LLY) hit a record Wednesday when it became the first company to share results from human trials of an antibody drug for the novel coronavirus. According to the release, at least one dose level may be effective in fighting the virus. Here’s why that matters:

- Vaccine stocks are definitely hot, but there are many issues facing widespread vaccination. In the interim, antibody drugs may be necessary.

- Eli Lilly shared that its antibody drug helped reduce viral load and the need for hospitalization.

- Interim data will be available in a peer-reviewed study soon.

- For more, read the InvestorPlace.com brief on Eli Lilly stock here.

Did Mr. Trump Just Open the 5G Floodgates?

[Wednesday, September 16, 12:47 pm]

Contributed by Andrew Taylor

You can’t blame him.

He’s just trying to keep the USA on top.

So with China nipping at our heels when it comes to the massive 5G rollout…

President Donald Trump just issued a revolutionary new 5G infrastructure bill to Congress.

It’s a decisive blow for the USA.

But he did something else, too.

Our commander in chief may have inadvertently tipped us off to the “Biggest Tech Breakout of the 21st Century.”

It has the potential to be bigger than Apple (NASDAQ:AAPL)… bigger than Amazon (NASDAQ:AMZN)… bigger than anything that came before.

Stop what you’re doing now, and use this special link I’ve set up for readers like you to learn more details about Louis Navellier’s top 5G investment recommendation for 2020.

P.S. There may never be a better time to get invested in 5G. And there may never be a more lucrative stock-buying opportunity on his radar. Click here for the full story.

Inovio Stock Pops on Plans to Launch Later-Stage Trials

[Wednesday, September 16, 10:37 am]

Contributed by Sarah Smith

Inovio Pharmaceuticals (NASDAQ:INO) has been rallying since CEO Joseph Kim gave an investor presentation Monday afternoon. The company is wrapping up its first human novel coronavirus vaccine trials, and it has big plans for the future. Here is everything you need to know:

- CEO Joseph Kim shared the company is planning to release peer-reviewed findings from its Phase 1 coronavirus vaccine trials in the coming weeks. It previously shared results from trials in small animals and non-human primates.

- The next step is to recruit participants and launch Phase 2 and Phase 3 trials.

- Inovio Pharmaceuticals is also studying its INO-4800 in South Korea and China.

- For more, read the InvestorPlace.com brief on INO stock here.

Eastman Kodak Rebounds on Committee Findings

[Wednesday, September 16, 10:19 am]

Contributed by Sarah Smith

Not too long ago it seemed that Eastman Kodak (NYSE:KODK) was the perfect novel coronavirus play. The U.S. government loaned Kodak $765 million to renovate its factories and produce generic drugs. Things changed quickly though, as investigators shared concerns over insider trading, among other things. Here’s why KODK stock is rallying in the market today:

- Eastman Kodak initially received the $765 million to renovate its factories and begin producing generic drugs including hydroxychloroquine.

- The timing of a company announcement, and the timing of the surge in KODK stock, sparked concerns. Investigators also questioned the timing of option grants given to Executive Chairman Jim Continenza.

- Today an independent committee found that Eastman Kodak had committed no crime. Investors are bidding up KODK stock — likely feeling very relieved.

- Now there is the potential for Kodak to resume its rebranding.

- For more, read the InvestorPlace.com brief on KODK stock here.

Stocks Open Higher Ahead of Federal Reserve Meeting

[Wednesday, September 16, 9:31 am]

Contributed by Sarah Smith

It is the middle of the week but there is no shortage of news.

Investors are closely watching the Federal Reserve, and are waiting for updates from its Federal Open Market Committee and Board Chair Jerome Powell. Many market experts have already declared that a lack of further fiscal stimulus from Congress is weighing on the Fed, perhaps souring sentiment ahead of any announcement later today.

However, a group of lawmakers known as the Problem Solvers Caucus has just proposed a $2 trillion stimulus package to stir up conversation. After weeks of negotiations failed in August, many on Wall Street appear to have given up on such a package. Any surprise from Congress, or positive news from the Fed, could send the major indices higher.

Also in the news Wednesday morning is a disappointing update on core retail sales. It appears that a decrease in consumer spending — it all really comes back to the stimulus package — has hurt retail sales. Core sales, which experts consider the closest aligned with consumer spending, fell 0.1% in August. Overall retail sales, which include things like gasoline purchases, increased 0.6%.

Beyond potential progress from Congress, the other positive in the news is that there is a new at-home test for the novel coronavirus. Produced by startups Gauss and Cellex, the rapid test can be completely done at home. Individuals can use nasal swabs, placing them then in a glass vial. Then, they snap a picture. Using artificial intelligence, the Gauss app will examine the uploaded picture and give results in less than 15 minutes. Talk about convenience.

Right now, consumers and investors are worried. A desire to solidify the economy through reopening and an embrace of normalcy has been hindered by steady levels of Covid-19 cases and a lack of testing. Making testing so easy and accessible could be a way to have the best of both worlds.

Look out for more details on testing and expect any FOMC updates to be key drivers in the market later today.

- The S&P 500 opened higher by 0.36%

- The Dow Jones Industrial Average opened higher by 0.29%

- The Nasdaq Composite opened higher by 0.3%

Stocks Cut Gains to Close Out Tuesday Trading

[Tuesday, September 15, 4:03 pm]

Contributed by Sarah Smith

Stocks held their positive edge on Tuesday, but they sure cut back gains. Here is a look at what all happened in the stock market today.

Apple unveiled a handful of new products including new iterations of its iPad tablets and smartwatch. The highly anticipated event also included a look at bundled services — featuring its Apple Music and Apple TV+ — and a new fitness subscription. Missing from the event, although not unsurprisingly, was the release of its 5G iPhone. Although enthusiasts have long predicted the new iPhone models would be absent from the Tuesday event, no doubt are investors disappointed.

Also on Tuesday we continued to see waves in the vaccine world, with Novavax (NASDAQ:NVAX) popping higher on a supply deal. We are getting increasingly close to Election Day, and therefore the deadline set by President Donald Trump to grant early approval to a novel coronavirus vaccine. Investors are optimistic, but still hesitant about the chances.

Yesterday brought clear signs of recovery to the market after tech stocks led it lower. After watching the major indices trim their gains in trading, it is hard to predict Wednesday. Will we see the back half of the week hurt the market? Or are investors just cooling down after a series of impressive updates from AstraZeneca (NYSE:AZN) and Pfizer (NYSE:PFE)? It may be soon to tell.

Ahead this week one of the most important catalysts may be a look at the weekly initial jobless claims figure. This report has been a key driver each week since March, and unfortunately, continues to bear bad news.

- The S&P 500 closed higher by 0.52%

- The Dow Jones Industrial Average closed flat

- The Nasdaq Composite closed higher by 1.21%

Bristol-Myers Squibb and Pfizer Offer New Coronavirus Potential

[Tuesday, September 15, 3:21 pm]

Contributed by Sarah Smith

The race to fight the novel coronavirus is heating up even more. Amid accelerating vaccine trials and drug studies, National Institutes of Health researchers are studying another type of drug. This new study will examine a handful of existing blood-thinning medications to see if they can improve outcomes for patients with Covid-19.

For investors, Bristol-Myers Squibb (NYSE:BMY) and Pfizer (NYSE:PFE) are part of this trial.

This trial is part of the Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV) initiative, which is a collaboration between the NIH and various drugmakers. Behind the study is the fact that several individuals who have died as a result of the coronavirus had unusual blood clots, even in their smallest blood vessels. According to the NIH, this particular effect of the virus is particularly damaging.

ACTIV researchers are not the first to dive into the potentially beneficial role of blood thinners in helping Covid-19 patients. Back in July, a team at Rensselaer Polytechnic Institute discovered that the blood thinner heparin helped prevent the spike protein of the coronavirus from infecting more cells. Just a few weeks ago, another team from Mount Sinai reported that blood thinners appeared to reduce the risk of death by as much as 50% in seriously ill patients.

Now, ACTIV is examining blood thinners like Eliquis and Aspirin from Bristol-Myers Squibb and Pfizer to see if they can help Covid-19 patients at various stages of illness. As both companies have other interests in the broad fight against the coronavirus, including a leading vaccine candidate from Pfizer, this is just the cherry on top.

Investors should know that the new trial from ACTIV should answer more questions than previous studies. Researchers want to isolate who benefits most, and when doctors should tread Covid-19 patients with blood thinners. While much remains to be seen, the market has definitely reacted to other positive treatment news.

Even the knowledge that blood thinners could significantly improve patient outcome — thus making the coronavirus less deadly — could be enough to trigger a rally in stocks like BMY and PFE.

At the end of the day these blood thinners may just be the cherry on top of the sundae, but they still are sweet.

Novavax Looks Hot on New Manufacturing Vaccine Deal

[Tuesday, September 15, 2:03 pm]

Contributed by Sarah Smith

Underdog vaccine maker Novavax (NASDAQ:NVAX) is popping in the market today on news it would be able to significantly increase its manufacturing capabilities. Here is why that matters:

- Novavax is a small, Maryland-based company developing a novel coronavirus vaccine.

- The company just signed a deal with the Serum Institute of India, where the Serum Institute will now make the key ingredient in its vaccine candidate.

- This deal will allow Novavax to produce 2 billion doses of its vaccine candidate in 2021.

- For more, read the InvestorPlace.com brief on NVAX stock here.

5 Pet-Friendly Stocks to Buy on Petco IPO Rumors

[Tuesday, September 15, 10:41 am]

Contributed by Sarah Smith

Have you rescued a dog during the pandemic? What about a cat? My pet fish and I keep scrolling through local adoption sites, wishing we could join in on the fun.

Americans really love their pets. The novel coronavirus, which has decimated other areas of consumer spending, has not changed that. Consumers are rescuing new pets to make working from home more enjoyable, and spending on pet products and care should hit $99 billion this year. That is up from just under $95 billion in 2019.

Riding this pet-crazy tailwind is Petco Animal Services, a privately held company known for selling small animals, food and other pet supplies. According to Bloomberg, the company is thinking about coming public as early as the first half of 2021. Another alternative would be a sale.

Petco has a market value of $6 billion — including debt — meaning any such move would create a big wave in the pet products niche.

Why does it matter? Well, amid the pandemic, online pet products retailers like Chewy (NYSE:CHWY) and Freshpet (NASDAQ:FRPT) have been hot. All of the new furry friends joining households need food, treats, toys and accessories. Stay-at-home orders meant e-commerce options were just better.

But there are a variety of other growth stocks to buy that are pet friendly. If the investor enthusiasm for Chewy and Freshpet, and even for the potential Petco IPO, is indicative of anything, it is clear that investors like to fill their portfolio with stocks that support their furry peers.

Ahead of the potential Petco IPO, consider these five pet-friendly growth stocks to buy from InvestorPlace analyst Neil George:

- Nestle (OTCMKTS:NSRGY)

- Zoetis (NYSE:ZTS)

- Merck (NYSE:MRK)

- Amazon (NASDAQ:AMZN)

- Covetrus (NASDAQ:CVET)

Opendoor SPAC Looks to Ride the Housing Market Boom

[Tuesday, September 15, 10:39 am]

Contributed by Sarah Smith

Chamath Palihapitiya, an icon in the special purpose acquisition company niche, is bringing yet another bold idea to the public markets. Palihapitiya is making waves Tuesday after announcing the Opendoor SPAC merger. Here is everything you need to know:

Stocks Look Set to Continue Gains on Tuesday

[Tuesday, September 15, 9:31 am]

Contributed by Sarah Smith

The weather may be getting cooler on the East Coast, but the stock market is just heating up again. Yesterday we wrote that it looks like the September curse has been shattered, and Tuesday has done nothing so far to detract from that thesis.

Many of the same catalysts are driving the market. Investors are celebrating merger news from Oracle (NYSE:ORCL) and Nvidia (NASDAQ:NVDA). Yesterday there was a general sense of cheer over the resolution to the ongoing TikTok scandal. Plus, investors liked the idea that U.S. chip giant Nvidia had just solidified its leadership position through acquiring Arm Holdings from SoftBank (OTCMKTS:SFTBY).

The other big catalyst on Monday came from the vaccine makers. It seems that once again a cure for the novel coronavirus could be right around the corner. AstraZeneca (NYSE:AZN), Pfizer (NYSE:PFE), BioNTech (NASDAQ:BNTX) and Vaxart (NASDAQ:VXRT) each reported favorable news. Particularly bullish was an update from Pfizer CEO Albert Bourla who said his company could be ready to vaccinate the U.S. as soon as the end of the year.

It is still unclear that the major news items on Tuesday will be. Tesla (NASDAQ:TSLA) continues to head higher thanks to a tweet from CEO Elon Musk, and Verizon (NYSE:VZ) also looks hot thanks to its acquisition of TracFone.

Keep a close eye on the market today. Things are looking up.

- The S&P 500 opened higher by 0.79%

- The Dow Jones Industrial Average opened higher by 0.67%

- The Nasdaq Composite opened higher by 1.16%

Tesla Stock Is Still Climbing on Battery Day Tweet

[Tuesday, September 15, 9:03 am]

Contributed by Sarah Smith

CEO Elon Musk has Tesla (NASDAQ:TSLA) rallying once again in the market. A Friday tweet teasing the upcoming Battery Day event has had investors obsessed. Here’s why:

- Tesla Battery Day is an annual event for shareholders.

- This year, the event will take place on Sept. 22 in Fremont, California.

- Musk tweeted on Friday that “many exciting things” will be revealed during the event.

- Electric vehicle stocks like TSLA have been red hot amid the novel coronavirus as investors look for innovative ways to drive the stock market higher.

- For more, read the InvestorPlace.com brief on Tesla stock.

The GoodRx IPO Should Benefit From Coronavirus Catalysts

[Monday, September 14, 4:19 pm]

Contributed by Sarah Smith

GoodRx, a California-based startup that helps consumers find the best deals on their prescription drugs, is about to come public. This is what you should know ahead of the GoodRx IPO:

- GoodRx will trade on the Nasdaq Exchange under the ticker GDRX.

- The IPO should raise more than $900 million if shares price between $24 and $28.

- GoodRx is a play on the novel coronavirus in that many healthcare stocks have been successful amid the pandemic. Importantly, it offers telemedicine services.

- For more, read the full InvestorPlace.com brief on GoodRx here.

Did Vaccine Stocks Break the September Curse?

[Monday, September 14, 4:02 pm]

Contributed by Sarah Smith

It sure looks like it.

Monday saw an absolutely impressive turnaround in the stock market. The major indices all launched into the green in pre-market trading, and remained there to close out the day. Even the Nasdaq Composite, which has suffered in recent weeks, added on almost 2%.

As we reported this morning, there were two big catalysts behind the news. The first was that, finally, investors got some closure to the TikTok drama. ByteDance, the Chinese company behind the short-form video platform that is increasingly popular, chose Oracle (NYSE:ORCL) to be its U.S. partner. Investors should note that Oracle is not necessarily fully acquiring TikTok, but will partner with its U.S. business to satisfy demands from President Donald Trump.

Twitter (NYSE:TWTR), another TikTok contender, saw its shares close down on Monday.

The other big catalyst in the market remained vaccine makers. Vaxart (NASDAQ:VXRT) got approval for human trials. AstraZeneca (NYSE:AZN) at least partially resumed its human trials. Pfizer (NYSE:PFE) and BioNTech (NYSE:PFE) just simply continue to dominate. The duo plans to have results ready by the end of October from their Phase 3 trials.

Will this impressive start to the week last? It is Virgo season, so the stars should be aligning in the market’s favor.

- The S&P 500 closed higher by 1.27%

- The Dow Jones Industrial Average closed higher by 1.18%

- The Nasdaq Composite closed higher by 1.87%

6 Restaurant Stocks to Buy as Fall Draws Near

[Monday, September 14, 3:13 pm]

Contributed by Sarah Smith

Hot summer months have been a lifeline for restaurants. Consumers packed into outdoor seating arrangements, eager to embrace a little slice of normalcy and a delicious meal. At least in the United States, that lifeline is about to run out.

The reason is simple. The weather is getting colder, and in many parts of the U.S. it will soon be too chilly to sit outdoors. Restaurants — and especially chain restaurants — that have not embraced digital friendly features will suffer the most. Because of social distancing protocols, the return of indoor dining will likely not be enough on its own.

So what should investors do? Start by finding restaurant stocks that did well at the start of the novel coronavirus pandemic. These are restaurants that either already had strong digital operations, or that quickly pivoted. Perhaps some of these restaurants even died down in popularity as diners opted for more diverse options with outdoor seating. Now, a return of stay-at-home culture, driven by colder weather and an ongoing pandemic, could bring about a second rally.

Think about Starbucks (NASDAQ:SBUX) and Dunkin’ Brands (NASDAQ:DNKN), two coffee chains that managed to innovate their menus, lean into online ordering and expand drive-thru pickup. As we recently reported in this blog, DNKN stock has particularly thrived thanks to new menu options that cater to the lunch crowd. Plus, coupons and other weekly incentives have helped increase foot traffic as the world returns to office work.

What works here is the mixture of familiar brands and innovations. You know what you get when you order at a Starbucks, and you can rely on corporate releases to learn about what precautions each location is taking. The products are reliable — and super easy to order.

If you like the sound of that business model, here are six of the best restaurant stocks to buy now:

- Starbucks (NASDAQ:SBUX)

- Chipotle (NYSE:CMG)

- Domino’s Pizza (NYSE:DPZ)

- Wingstop (NASDAQ:WING)

- Dunkin’ Brands (NASDAQ:DNKN)

- Papa John’s (NASDAQ:PZZA)

Vaxart Stock Shoots Higher on Human Trial News

[Monday, September 14, 2:05 pm]

Contributed by Sarah Smith

Underdog vaccine maker Vaxart (NASDAQ:VXRT) is shooting higher today — to the tune of 55%. Beyond being an incredible day for companies participating in the novel coronavirus race, here’s what is behind the VXRT stock rally:

- The U.S. Food and Drug Administration completed its review of the Investigational New Drug (IND) application from Vaxart.

- This means Vaxart can begin enrolling participants in a Phase 1 human trial.

- Many investors appreciate Vaxart because the company specializes in so-called oral vaccines, tablets that administer the sterilizing effect.

- For more, read the InvestorPlace.com brief on VXRT stock here.

This Is My No. 1 ‘Buy’ Signal for 1,000% Upside Right Now

[Monday, September 14, 10:46 am]

Contributed by Eric Fry and the InvestorPlace Research Staff

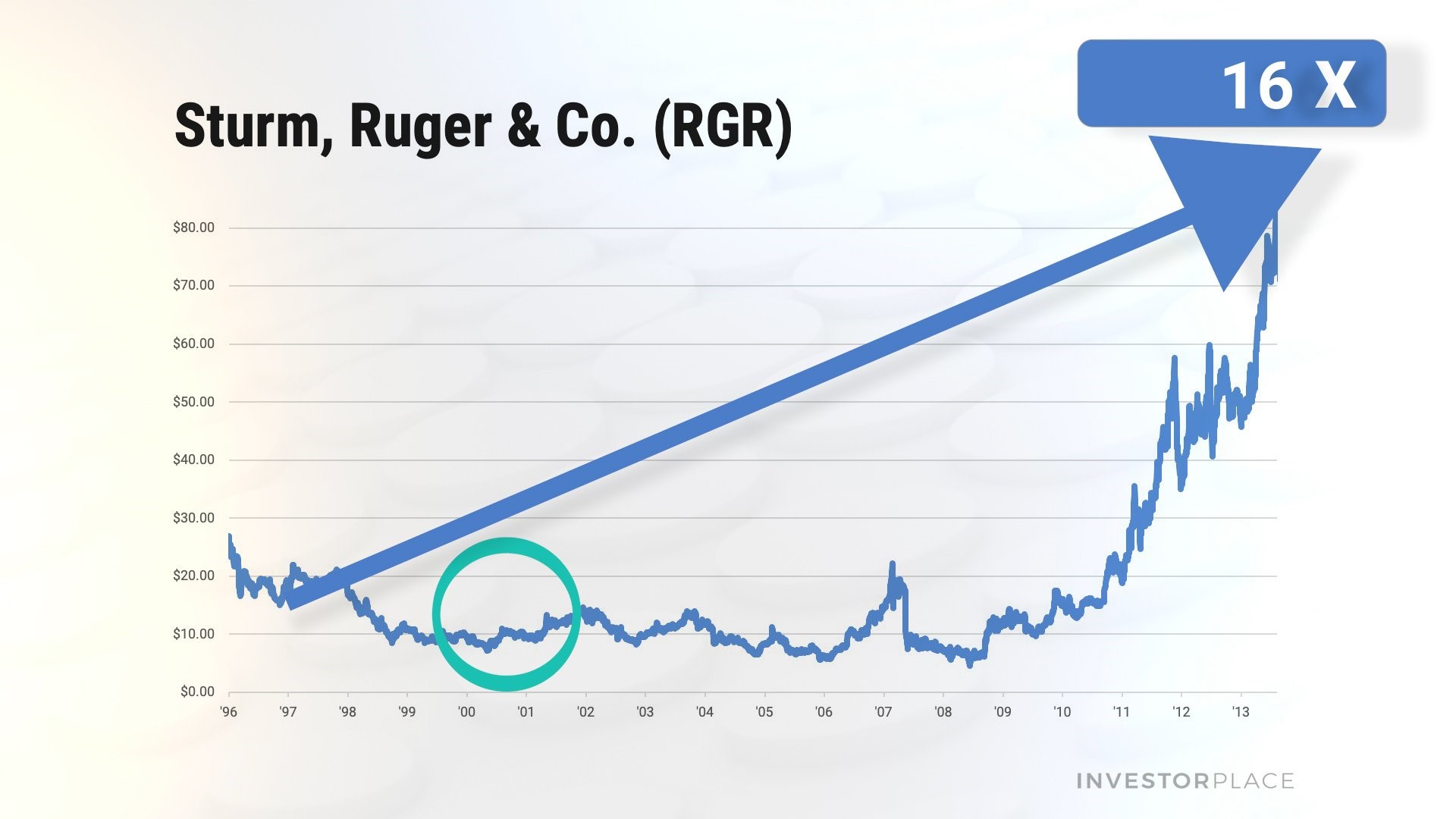

Back in the 1990s, Sturm, Ruger & Company (NYSE:RGR) was under a full-on assault.

The Clinton Administration was trying to put gun manufacturers out of business…

Helped by an army of trial lawyers…

And politically correct investors were tripping over themselves shorting these companies.

But I saw something no one else could…

Sure enough, the stock almost immediately began to turnaround… and soared to 16 TIMES the price at which I called it a buy…

I see situations like this over and over…

When the smartest people in this country are all leaning hard in the same direction, it creates an extreme kind of situation…

And money is made at the extremes.

I followed the same playbook betting against radical environmentalists with my uranium play.

While celebrities were busy getting arrested at protests, uranium miner Cameco (NYSE:CCJ) soared 1,737%.

Then there was Bayer (OTCMKTS:BAYRY), which went up exactly 1,000%…

But the recent “crisis” has created one of the greatest opportunities I’ve seen in well over a decade.

There’s a little-known sector way out at the extremes of the stock market…

America’s money managers are so short that sector… they’re practically doing all the work for us.

But I think this small group of stocks is about to stage a sudden, powerful turnaround…

I think it’s going to be THE success story of 2020. If you look forward to January 2021, this is what you’re going to be hearing about the financial media.

That’s because every single major trend developing in this country relies on these little-known companies…

Electric cars, Alternative energy, Healthcare…

In fact, some of these stocks are already soaring…

And according to my research that’s just the beginning.

Nvidia Stock Looks Hot on Arm Holdings Acquisition

[Monday, September 14, 10:24 am]

Contributed by Sarah Smith

Nvidia (NASDAQ:NVDA) is climbing seriously higher in the market Monday thanks to its acquisition of Arm Holdings. Here is why the $40 billion deal matters:

- SoftBank (OTCMKTS:SFTBY) first purchased chip designer Arm Holdings back in 2016 for its valuable intellectual property.

- In order to raise some cash, SoftBank agreed to sell Arm Holdings to Nvidia for upwards of $40 billion. Investors like the news.

- Arm Holdings gives Nvidia access to the chip design space as well as innovative tech like self-driving cars.

- For more, read the InvestorPlace.com brief here.

Stocks Open Higher Monday on Vaccine, Merger News

[Monday, September 14, 9:31 am]

Contributed by Sarah Smith

There is no reason to fret this Monday morning. You may be tired, but the major indices are getting off to an impressive start.

The first reason for the early rally is that novel coronavirus vaccine makers are soaring higher. AstraZeneca (NYSE:AZN) has resumed its late-stage trial, which it is running in partnership with the University of Oxford. AZN recently sunk after pausing the trial to investigate a participant who developed an unexplained illness.

Pfizer (NYSE:PFE), BioNTech (NASDAQ:BNTX) and Moderna (NASDAQ:MRNA) are also causing excitement on Monday. Pfizer and BioNTech are getting ready to potentially vaccine Americans before the end of the year, and Pfizer has also applied to expand its late-stage trial. As Moderna has pulled forward as a third leader, investors are rewarding its innovative approach. Like Pfizer, Moderna is researching an mRNA-based vaccine. If either candidate receives approval, it would be the first mRNA vaccine to do so.

Elsewhere in the investing world, a little bit of M&A activity is stoking enthusiasm. In the closely followed TikTok saga, it looks like we finally have an answer. Oracle (NYSE:ORCL), notable for its relationship with President Donald Trump, has shared that it struck a deal with ByteDance, the Chinese company behind the popular social media platform.

According to Oracle, ByteDance has chosen it to become the U.S. partner. Thanks to the high-stakes nature of the deal, as well as the wild popularity of TikTok, ORCL stock is soaring Monday morning. Shares opened higher by almost 7%.

Don’t be fooled. This is surely not the last you will hear about either vaccine makers or TikTok, but at least investors are finally getting an update. Keep a close eye on the major indices as the day progresses.

- The S&P 500 opened higher by 0.97%

- The Dow Jones Industrial Average opened higher by 0.7%

- The Nasdaq Composite opened higher by 1.5%

Pfizer and BioNTech Pop on Coronavirus Vaccine Updates

[Monday, September 14, 9:15 am]

Contributed by Sarah Smith

Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) are giving investors something to cheer Monday morning. Here’s why:

- Pfizer CEO Albert Bourla said the two companies could know whether or not their novel coronavirus vaccine candidate works as soon as October.

- From there, Pfizer and BioNTech could begin deploying vaccines — including to Americans — by December 2020.

- Pfizer also is seeking approval from the U.S. Food and Drug Administration to expand its Phase 3 trial to 44,000 participants.

- For more, read the InvestorPlace.com brief here.

Positive Early Trading Turns to Pain

[Friday, September 11, 4:17 pm]

Contributed by Jessica Loder

What an up-and-down day. At first it looked like the markets might break free of the malaise, as all the major indices started the day looking up. But things turned around midday, with all three heading into the red.

The Nasdaq bore the brunt of the pain, as tech stocks led the way down. Nikola (NASDAQ:NKLA) had a particularly rough day, closing down 14.5%. Short-seller Hindenburg Research has called the company a fraud, saying it has evidence of “dozens of false statements by Nikola Founder Trevor Milton.” Nikola fought back, releasing a statement calling the report “replete with misleading information and salacious accusations directed at our founder and executive chairman.” But nervous investors fled.

Nikola wasn’t the only tech stock tripping up at the finish line of this short week. Apple (NASDAQ:AAPL) fell 1.3%. Amazon (NASDAQ:AMZN) lost 1.9%. Nvidia (NASDAQ:NVDA) dropped 1.2%.

It wasn’t pretty.

At least two of the three indices managed to pull back into the green by the end of trading. And we’ve also made it to the weekend, which will give investors a chance to take a deep breath and calm down. Then we can see what the new week will bring.

- The S&P 500 closed up by o.o5%

- The Dow Jones Industrial Average closed higher by 0.48%

- The Nasdaq Composite closed lower by 0.6%

3 Cargo Stocks to Buy for Worldwide Vaccine Shipment

[Friday, September 11, 12:44 pm]

Contributed by Sarah Smith

Do you hear that? From the depths of the pandemic, Boeing (NYSE:BA) was just given a lifeline.

The last few weeks have brought intense scrutiny to the vaccine makers. Everyone wants a vaccine soon, and some like President Donald Trump have a deadline. That is why the decision by AstraZeneca (NYSE:AZN) to pause its late-stage trials was so painful, and why it was such an upside catalyst for rivals Moderna (NASDAQ:MRNA) and Novavax (NASDAQ:NVAX).

But as Trump continues to flirt with vaccine approval and deployment as early as October, other industries need to get ready.

According to the International Air Transport Association, we need 8,000 cargo jets to deliver a vaccine for the novel coronavirus around the world. Boeing, thanks to its 747 cargo aircraft, looks rather lucky. Passenger planes are idling, but Boeing has found its cargo aircraft to be a lifeline. Some, like CNN’s Karla Cripps, have even called them “pandemic heroes.” Now, having been singled out for its 747 cargo models, Boeing could save the day in an even bigger way.

There are two other publicly traded companies that are benefiting from this Covid-19 catalyst. Just think: Which companies will be operating the cargo flights? Which companies will coordinate all of the logistical puzzle pieces and ensure the vaccine doses are transported safely and promptly?

Atlas Air (NASDAQ:AAWW) and Air Transport Services Group (NASDAQ:ATSG) stand out. Not only did these companies shine earlier in the pandemic as they raced to fulfill growing demand for e-commerce orders, these companies are playing a role in coordinating vaccine delivery.

With October in mind, investors should remember that the first company to receive approval for its vaccine will pop. But as picks-and-shovels plays, the companies that will actually transport and deliver these vaccines could soar even more.

Walmart Looks Hot on Drone Delivery Pilot Program

[Friday, September 11, 11:14 am]

Contributed by Sarah Smith

Another day, another way Walmart (NYSE:WMT) is stepping it up against rival Amazon (NASDAQ:AMZN). This time, the retailer is leaping into the world of drone delivery thanks to an exciting partnership with Israeli startup Flytrex.

Through a pilot program in Fayetteville, North Carolina, Walmart will work with Flytrex to test deliveries of essential grocery items. Why does this matter? Drone delivery comes straight from the world of science fiction, but consumers are increasingly ready. Hopes are that soon, days of spending hours at the grocery store will be a thing of the past. It promises quicker delivery — without the hindrances of roadway traffic.

And importantly, the novel coronavirus has escalated consumer and industry interest in contactless delivery. We have seen retailers invest in self-driving delivery, such as through the startup Nuro, to get customers essential groceries and prescriptions without the dangers of human contact. Drone delivery takes that to the next level.

But for Walmart and Flytrex, this pilot program is a baby step. An exciting baby step, but still small.

Acknowledging this, Tom Ward, senior vice president for customer products at Walmart, said that the company understands it will be “some time” before millions of packages hit the skies. Right now, drones from Flytrex can carry packages no heavier than 6.6 pounds, and they are limited to round-trip distances of 6.2 miles. Flytrex has long worked with the Federal Aviation Administration, and has received approval for this pilot program, but with caveats. It can only fly during the day, on predetermined routes, over unpopulated areas and in pleasant weather.

What matters for investors here is that Walmart has some skin in the game. Rival Amazon has been pushing forward with drone delivery through its Amazon Prime Air. Although the e-commerce giant previously said deliveries would begin in 2019, the drones also just received approval from the FAA.

The race is close. Amazon drones carry less than those from Flytrex, and are limited to 30-minute flights. Walmart has made its competitive intentions known, putting it further into the race with the likes of Amazon, Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) and the United Parcel Service (NYSE:UPS).

Pick up WMT stock here to fly into the future.

Stocks Turn Higher Friday on Earnings, Tech Rebound

[Friday, September 11, 9:32 am]

Contributed by Sarah Smith

Do tech stocks love us or not?

This has been a week worthy of plucking flower petals as tech leaders move back and forth. Yesterday, the likes of Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) betrayed the market. The major indices closed lower just as investors started to believe a recovery was on its way. On Friday morning, as tech stocks once again creep higher, investors must be careful not to be too optimistic.

But even without diving too much into that saga, there are plenty of reasons for hope in the stock market this morning. Peloton (NASDAQ:PTON), an at-home fitness leader, soared on earnings Thursday afternoon. The company — largely considered a stay-at-home winner thanks to its connected fitness devices — beat analyst estimates for revenue and earnings and posted impressive guidance for the fourth quarter. Just earlier this week, Peloton announced it would reduce its product prices and also unveil a premium bike with more features.

Earnings from Oracle (NYSE:ORCL) also have the market excited on Friday. The company beat on revenue expectations thanks to increased demand for its cloud-computing services. Remember, many Americans are still working from home, and with back-to-school season in full swing, there are more individuals tapping into devices from home than perhaps ever before.

One last reason for optimism comes from Bank of America. As tech stocks lagged this week and the major indices saw red, fears of a September curse and continued volatility raged. But analysts do not see any reason for alarm here, simply considering the last few days a “normal” and “tactical” correction in the markets (subscription required). Sure, this month has done nothing to erase September’s bad reputation, but it is also nothing out of the ordinary — and at least to Bank of America, not a sign that the market rallied too far after the novel coronavirus selloff.

Heading into the weekend, it is nice to have that perspective. Just don’t count on tech to get us through today.

- The S&P 500 opened higher by 0.6%

- The Dow Jones Industrial Average opened higher by 0.41%

- The Nasdaq Composite opened higher by 0.89%

Tech Stocks Send Market Lower in Betraying Move

[Thursday, September 10, 4:02 pm]

Contributed by Sarah Smith

What a disappointment.

Just for a day, tech stocks had us fooled. It made sense that they would swoop in and lead a rally in the wake of bad news from AstraZeneca (NYSE:AZN) and the University of Oxford. But just as we entered that thought into the atmosphere, stocks came crashing back down.

In fact, according to one estimate, the six largest tech stocks on Wall Street have shaved off a cumulative $1 trillion in just the last three trading days. Experts are quick to point out that after a market-leading rally, the likes of Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) are far from being in a bad spot.

However, without Silicon Valley headed higher, it is still unclear just what can take its place.

Beyond the tech betrayal, investors are still likely weighing news that AstraZeneca had paused its novel coronavirus vaccine candidate trial after a participant developed an unexplained illness. Plus, news this morning that another 884,000 Americans had filed for initial jobless benefits is not helping matters. What we need right now is a distinct sign of recovery. Will we get that next Thursday?

Bottom line: While there is no reason to feel bad for Jeff Bezos any time soon, it sure stinks to see so much red in the market. Cross your fingers and stay optimistic for better trading days ahead.

- The S&P 500 closed lower by 1.77%

- The Dow Jones Industrial Average closed lower by 1.45%

- The Nasdaq Composite closed lower by 1.99%

3 Retail Stocks to Buy That Are Winning Right Now

[Thursday, September 10, 2:42 pm]

Contributed by Sarah Smith

Wall Street is on a home improvement kick.

This is not something new. We have previously reported on this trend, noting the obvious catalysts from the novel coronavirus pandemic. Americans are spending more time at home than ever before, and are using their homes for more endeavors. Bedrooms are now offices and kitchens are now classrooms. Consumers are adapting, working to outfit their spaces for new uses.

Beyond the practical catalyst, many consumers have also been motivated by a desire for increased comfort and aesthetic appeal. This reality is why mattress sales have boomed — if your bed is also going to serve as a couch and a desk, it better be comfortable.

The newest manifestation of this DIY streak has come as school starts around the country. With many classrooms closed, families are turning to home improvement retailers for desks and anything else reminiscent of a traditional learning environment. Parents are turning to social media for inspiration, and the results are both beautiful and costly.

What is most impressive is that this trend has not died down. Months into working and learning from home, consumers are still modifying their living spaces. In fact, when popular retailer At Home (NYSE:HOME) dropped after earnings last week, InvestorPlace Markets Analyst Luke Lango wrote that investors should ignore the selloff. He still sees the home goods chain as a long-term leader.

Industry data backs Lango up. In fact, Caroline Jansen just wrote for Retail Dive that At home, along with Wayfair (NYSE:W) and Overstock (NASDAQ:OSTK), have become unlikely winners. Why unlikely? Home goods purchases are traditionally considered discretionary, and the economic impacts of the pandemic have broadly hit discretionary spending. When you live and work at home, home goods no longer are discretionary.

At Home, Wayfair and Overstock may have rallied far this year, and they may even need some time to cool down. However, as the trend holds up, investors should stay enthused. Whether you need to deck out an at-home classroom or make your studio apartment a little more professional, these retail winners remain stocks to buy.

I Did the Unthinkable… For You

[Thursday, September 10, 1:16 pm]

Contributed by Andrew Taylor

Andrew Taylor here…

As the General Manager of InvestorPlace.com…

I have to admit…

I have access to resources most investors can only dream of.

I mean, just think about it…

My research firm spends millions of dollars in market research each and every year…

And…

I have a modern-day “Dream Team” of stock-picking titans at my side each and every trading day.

True Wall Street legends… like Louis Navellier, Matt McCall and Eric Fry… to name a few.

In other words, to me…

It’s like having a crystal ball… creating an almost unfair advantage for our readers…

For example…

Our firm discovered Netflix (NASDAQ:NFLX) at just a measly $1.37 a share…

Today… that stock trades at over $446.

That’s an extraordinary 32,454% return over the years…

A rate of return that transforms $1,000 into $325,540.

Or…

When our firm introduced Apple Computer to our readers…

It was just $1.49 a share…

Today, those same shares… are worth over $355.

A return on investment that can turn $2,000 into a once-in-a-lifetime $476,500 over the years.

Or just consider for a moment…

Microsoft (NASDAQ:MSFT)… and how we told readers to grab up shares…

Back when they were just 38 cents… literally just 38 pennies.

Today, those shares are worth over $195 a share!

A single trade that could have turned $5,000 into a once-in-a-lifetime $2,565,750 over the years.

Any one of these trades could have changed your financial future forever.

Like I said before…

I have a massive amount of firepower available at my fingertips.

And it almost seems unfair…

While most folks struggle to make ends meet…

My team has a four-decade-long track record of delivering amazing gains.

Frankly…

I just couldn’t take it anymore.

Which is why, just a few short weeks ago, I did the unthinkable…

Something we have NEVER done before in our firm’s 40-plus-year history…

A brand-new project that could very well change your life… forever.

With more investment ideas…

More research…

And more potentially money-multiplying opportunities…

In other words…

I’m pulling out all the stops…

I am practically giving away the keys to my virtual war chest of hard-hitting investment insight.

It is bold.

It is ambitious…

And you need to get all the details today.

But please be warned…

This historical opportunity will not last long, for reasons you’ll soon understand.

Take action now — before it is too late.

Stocks Open Higher as Jobless Claims Hold Steady

[Thursday, September 10, 9:30 am]

Contributed by Sarah Smith

There are two competing forces in the stock market today.

The first is that tech stocks are making a rebound after days of lagging the broader market. We saw the first signs of that yesterday, when the Nasdaq Composite closed higher by almost 3%. After AstraZeneca (NYSE:AZN) halted trials of its novel coronavirus vaccine candidate and reopening plays cooled, tech stocks got their time again in the spotlight.

Thursday morning was no different. Amazon (NASDAQ:AMZN) continued to climb higher. Electric vehicle leader Tesla (NASDAQ:TSLA) also turned around, after shares slumped last week on news of a secondary offering. Tech stocks have done more than their fair share to drive a recovery, and that outperformance looks to be back on track.

The other catalyst is that, unfortunately, initial jobless claims continue to hold steady. Economists were calling for 850,000 Americans to file for unemployment benefits for the week ending Sept. 5. Instead, 884,000 Americans filed. This figure is identical to the revised one for the previous week, indicating no recovery occurred. Now, investors must ask themselves, what will it take for employment to right itself?

- The S&P 500 opened higher by 0.48%

- The Dow Jones Industrial Average opened higher by 0.44%

- The Nasdaq Composite opened higher by 0.79%

Tech Stocks Rebound, Reopening Plays Cool Wednesday

[Wednesday, September 9, 4:01 pm]

Contributed by Sarah Smith

Tech stocks answered the call to action on Wednesday, driving the Nasdaq Composite higher by 3%.

As we have previously reported in this blog, the last few days have seen a selloff in tech stocks that sank the Nasdaq and the rest of the market. These leading companies, like Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN), needed a break after powering several months of gains. We questioned — along with the rest of Wall Street — just how long this slump would last.

AstraZeneca (NYSE:AZN) set things in motion, opening the door for at least a short-term rebound in tech stocks. After the pharmaceutical company paused its late-stage trials of is novel coronavirus vaccine candidate, investors began to fear. Wednesday saw reopening plays like airlines, cruise ships and movie theaters falter. American Airlines (NASDAQ:AAL) closed down by about 4%. AMC Entertainment (NYSE:AMC), which just recently opened its theaters, closed down by 2%.

Without a vaccine, it is hard to have any confidence in hard-hit sectors like travel and leisure.

But tech stocks did not just sit around and watch chaos unfold. They turned around, taking the entire market higher despite the vaccine blow. Apple (NASDAQ:AAPL) closed up by almost 4%, and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) gained roughly 2% on the day.

Also helping the performance were rival vaccine makers. Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) offered a reason for optimism with news of a European vaccine supply deal, and Moderna (NASDAQ:MRNA) and Novavax (NASDAQ:NVAX) also popped. While investors cool on AstraZeneca, they now have an opportunity to choose a new vaccine bet. Keep a close eye on this space.

- The S&P 500 closed higher by 2.02%

- The Dow Jones Industrial Average closed higher by 1.6%

- The Nasdaq Composite closed higher by 2.71%

Pfizer and BioNTech Pop on European Vaccine Deal

[Wednesday, September 9, 3:36 pm]

Contributed by Sarah Smith

Now that AstraZeneca (NYSE:AZN) and the University of Oxford have paused their novel coronavirus vaccine trials, a major opportunity is present in the stock market. Vaccine duo Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) raced to claim that spot Wednesday.

Today the big news is that the two companies have reached a preliminary supply deal with the European Union — the largest such deal Pfizer and BioNTech have secured. Under the agreement, the duo will supply the EU with 200 million doses of their vaccine, and potentially will supply another 100 million. Investors love this governmental commitment. Many likely see it as a sign that a ready vaccine is coming sooner rather than later.

On that note, the companies sparked enthusiasm yesterday as well, confirming their candidate could be ready for regulatory approval as early as October. BioNTech CEO Ugur Sahin said Tuesday that the candidate has a “near perfect” profile, and it has performed well in terms of safety. Very few late-stage trial participants have reported any adverse side effects.

AstraZeneca had been eyeing a similar timeline, and President Donald Trump was on board, touting he could grant emergency-use authorization to its vaccine sometime in October. Although his move has prompted many to express concerns over a politically motivated vaccine, investors were excited. Regardless of whether Trump saw early approval as a way to boost his reelection chances, broad deployment of a coronavirus vaccine would usher in a return to normal.

Now that AstraZeneca has hit the brakes, news Pfizer and BioNTech can potentially match its timeline is reason for optimism. Plus, CEOs from the partner companies signed a letter earlier this week promising they would respect the scientific process and would not seek unjustified approval.

Pfizer and BioNTech are signing supply deals, catering to public health worries and pushing their vaccine candidate along. It is the perfect recipe for investing success.

5 Stocks Set to Soar after the Coronavirus Selloff

[Wednesday, September 9, 1:06 pm]

Contributed by Andrew Taylor

Buy these 5 tech stocks immediately.

Eric Fry, one of America’s top investment strategists, provides his latest report titled, “5 Tech Stocks Set for 1,000% Gains After the Recent Coronavirus Sell-off.”

Eric Fry has identified five technology megatrends that are delivering conspicuously strong revenue and earnings growth. These five megatrends — and Eric’s five hot tech stock picks — will be booming for a very long time. You can’t afford to miss out on the once-in-a-decade chance to buy after the recent dip in the markets. Click here to download this hot-off-the-presses research report now. It’s yours free.

Stocks Open Higher Despite AstraZeneca Blow

[Wednesday, September 9, 9:31 am]

Contributed by Sarah Smith

It looks like the sun is peeking through the clouds on Wall Street, as the major indices press higher.

For the first day in what feels like a long time, we are seeing green before the opening bell. Yesterday brought about the ugliest market close in over a month, as investors watched tech stocks sink lower and lower. At a time when bulls are rooting for a recovery, it has felt rather ominous. But on Wednesday, things appear to be turning themselves around.

Why? There may be no one clear reason.

In fact, investors were dealt some rather unfortunate news this morning. AstraZeneca (NYSE:AZN), one of the leading companies in the race to develop a novel coronavirus vaccine, has paused trials of its candidate. Running its late-stage trials in conjunction with the University of Oxford, AstraZeneca reported that one trial participant in the United Kingdom had fallen ill with an unexplained illness. According to the company, this is standard practice. Halting the trial will allow investigators to find out what happened — and whether the illness is an adverse reaction to the vaccine.

Remember, AstraZeneca has been ramping up its late-stage trials around the world, recently launching a large trial in the United States with the intent to enroll 30,000 participants. It also has trials in Brazil and South Africa.

Standard practice or no, it comes at a bad time. Investors have been bidding up the market on rumors that President Donald Trump would grant early vaccine approval — likely to AstraZeneca — as early as October. Such approval would allow for vaccine deployment across the U.S. to begin, and it would usher in the normalcy so many individuals are waiting for.

- The S&P 500 opened higher by 1.31%

- The Dow Jones Industrial Average opened higher by 0.91%

- The Nasdaq Composite opened higher by 1.94%

Market Closes Lower as Tech Woes Continue

[Tuesday, September 8, 4:02 pm]

Contributed by Sarah Smith

You know the story.

Tech stocks were leading the rally, and now they are not. The stars of Silicon Valley — like Amazon (NASDAQ:AMZN) an Apple (NASDAQ:AAPL) — have cooled down and they are dragging the rest of the stock market into the red. Pessimists think a big correction is coming. Optimists are viewing the last few days as a healthy breather, and perhaps an opportunity for some much-needed sector rotation. Regardless of your approach, the major indices closed down on Tuesday.

But bulls should find some joy in little victories of the day. Peloton (NASDAQ:PTON), the at-home fitness play that has wildly benefitted from the novel coronavirus, is continuing to run higher. The company is cutting the price of its popular bike and is launching new products, including a more upscale bike model that comes with a larger screen and better speaker system. This should give investors some confidence that other coronavirus winners are still looking strong.

The other big piece of news comes from Nikola (NASDAQ:NKLA) and General Motors (NYSE:GM). General Motors, a traditional automaker, and Nikola, an up-and-coming electric vehicle company, are forming a strategic partnership. GM will take an 11% stake in Nikola and aid it in the development of the Badger pickup truck. Nikola will get access to industry knowledge and all sorts of vehicle parts and components.

Just like at-home fitness, electric vehicle stocks have been a bright spot in the market throughout the pandemic. Investors are likely happy to see the success continue, especially as NKLA stock has been generating buzz since its very first days as a public company.

Although the bright side on Tuesday may be rather dim compared to the drops in the major indices, who knows what the rest of the week will bring. Keep your chin up, and keep a close eye on the market.

- The S&P 500 closed lower by 2.78%

- The Dow Jones Industrial Average closed lower by 2.25%

- The Nasdaq Composite closed lower by 4.11%

The Best 5G Stock to Buy Right Now

[Tuesday, September 8, 10:56 am]

Contributed by Andrew Taylor

There’s a lot of hype surrounding 5G these days…

And for good reason. It’s a breakthrough technology that’s going to change the world and make early investors a fortune.

But investing legend Louis Navellier says there’s only one 5G stock you should be paying attention to right now.

This is coming from the analyst who…

- Found Microsoft (NASDAQ:MSFT) when it was trading for 39 cents.

- Cisco (NASDAQ:CSCO) at 50 cents.

- Qualcomm (NASDAQ:QCOM) at $2.45.

- Adobe (NASDAQ:ADBE) at $1.91.

- Apple (NASDAQ:AAPL) when the legendary software company was trading for $1.38.

- Amazon (NASDAQ:AMZN) when it was just a $46 stock.

And MarketWatch said he was “the advisor who recommended Google before anyone else.”

Now Louis’s pounding the table on a 5G stock he recently uncovered.

He’s put together a presentation with the full details which you can view right here.

Tech Stocks Lead the Market Lower on Tuesday

[Tuesday, September 8, 9:32 am]

Contributed by Sarah Smith

It looks like Big Tech names did not get the break they needed over the long weekend. Companies like Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) continue to drag the market down as investors prep themselves for a potential correction.

As we discussed last week, Big Tech stocks have pulled more than their weight since the start of the novel coronavirus. Now, it is unclear if they are just pausing for a few days after leading the rally higher, or whether the weakness in the Nasdaq Composite is indicative of something bigger. Last week, some experts predicted that we would see rotation out of tech stocks and into another sector, creating an opportunity for investors to profit from another rally.

Sometimes it really does help to look for the silver lining.

Elsewhere in the investing world, vaccine makers are looking to keep public sentiment rosy on their endeavors. Tuesday morning saw the release of an open letter signed by CEOs from Johnson & Johnson (NYSE:JNJ), AstraZeneca (NYSE:AZN), GlaxoSmithKline (NYSE:GSK), Pfizer (NYSE:PFE), BioNTech (NASDAQ:BNTX), Moderna (NASDAQ:MRNA), Novavax (NASDAQ:NVAX), Sanofi (NYSE:SNY) and Merck (NYSE:MRK).

Why does this matter? Well, Wall Street and Main Street appear a little split. Everyone broadly wants a vaccine for the novel coronavirus, but the timing and delivery matter a whole lot. President Donald Trump continues to say a vaccine could be ready as early as October, but many public health experts are skeptical. Dr. Anthony Fauci, the nation’s leading infectious disease expert, has said such an early success is not impossible, but it is also not highly likely.

Because Trump is currently driving the vaccine charge, many Americans are worried about the political motivations. Some have already expressed they are not interested in receiving the vaccine.

The open letter on Tuesday aims to address exactly that, with the CEOs promising there are no corners being cut in their initiatives. They promised to uphold the integrity of the scientific process, and to comply with regulatory bodies like the U.S. Food and Drug Administration. This letter could be just enough to excite vaccine bulls while also giving some peace of mind to worried consumers.

Here is hoping you had a good weekend, and that you are ready for this week of trading ahead!

- The S&P 500 opened lower by 1.99%

- The Dow Jones Industrial Average opened lower by 1.36%

- The Nasdaq Composite opened lower by 3.52%

Stocks Close Lower Heading Into a Long Weekend

[Friday, September 4, 4:01 pm]

Contributed by Sarah Smith

We have reached yet another holiday weekend marred by the novel coronavirus.

The major indices reflect how I feel — they are lagging in the red as I kick myself for not booking a remote Airbnb sooner. After we saw the worst market selloff since June, the S&P 500, Dow Jones Industrial Average and the Nasdaq Composite just kept falling. It appears a bad combination of the September curse, rotation out of red-hot tech names and what could be a standard correction are afflicting the market this week.

Will next week see a reversal and a return to big gains? Some analysts think that the breather in the Nasdaq is a good thing. We have long been relying on Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) to drive the market higher. If this is just a case of some run-of-the-mill sector rotation, we could see another major opportunity in different stocks.

While there is certainly a lot of uncertainty in the market, there are two reasons for optimism here. Labor Day weekend could give retail investors the chance to digest recent price action and ready themselves to buy the dip on Tuesday. Labor Day weekend also gives the economy a chance to prove that it has recovered — will see things like air traffic and consumer spending improve over the weekend?

As you enjoy a socially distanced long weekend, start thinking about the rest of the month. And remember, the stock market is closed on Monday. We’ll see you back here bright and early in just a few days.

- The S&P 500 closed lower by 0.82%

- The Dow Jones Industrial Average closed lower by 0.56%

- The Nasdaq Composite closed lower by 1.27%

3 Dating App Stocks to Buy on the Bumble IPO Buzz

[Friday, September 4, 2:08 pm]

Contributed by Sarah Smith

Not too long ago, I felt myself preparing to lie whenever someone asked me how I met my husband. Tinder just felt … wrong. Now, with the world immersed in a deadly pandemic, dating apps are the only way to go. As many columnists have highlighted, it is much more controversial now to be mingling with strangers at a party or bar than it is to spend socially distanced time swiping on a dating app.

With that backdrop, Robinhood Snacks just reported that Bumble is considering an initial public offering in early 2020. Estimates put the value of such a deal between $6 billion and $8 billion.

For those unfamiliar with the dating app space, what sets Bumble apart is the idea that women have to drive the process. Women must message first, and CEO Whitney Wolfe Herd says it makes dating safer.

During the pandemic, Bumble has buzzed along with its dating app peers. Global online dating was up 82% in March. Bumble saw use of its video dating feature soar 93%. It now has over 100 million users, and revenue is climbing, largely thanks to its subscription service Bumble Boost.

This coronavirus-driven success could very well mean that it is the perfect time for Bumble to hit the public markets. Sure, a coronavirus vaccine would certainly send people back out to bars, restaurants and all other spots for awkward first dates, but the pandemic has still done a great job of boosting the visibility of dating apps. Adoption of digital dating is simply higher. The stigma is gone.

Bumble is not alone in this reality. Since the start of the pandemic, other dating app stocks have seen similar performances, and the future still looks bright. If you want to swipe right on profits, here are three great investing ideas:

How to Change Your Life With Cryptocurrencies

[Friday, September 4, 10:32 am]

Contributed by Matt McCall and the InvestorPlace Research Staff

Less than one decade ago…

Bitcoin was helping even the most beginner investors, including high school dropouts and teenagers, amass millions of dollars in wealth.

And yet many of the world’s successful hedge fund managers completely missed out on it.

But now this situation is beginning to change.

Billionaire super-investor Paul Tudor Jones bet as much as $100 million on cryptocurrencies.

Just before that, billionaire tech wiz Peter Thiel placed a $50 million bet on cryptocurrencies.

Now 80% of institutional investors — typically the richest Americans — say they find crypto investing appealing.

Why are all these billionaires suddenly placing huge positions in the crypto market?

I believe it’s all tied to one recent event.

If you missed out on the incredible wealth creation force of bitcoin in 2012, don’t worry…

A new bull market is forming in cryptocurrencies right now. This is NOT just my opinion… the numbers prove it…

Bitcoin has soared 154% from March to August of this year.

But this time around, the biggest gains will NOT be from ordinary bitcoin tokens.

One of my open crypto recommendations soared as much as 666%.

… Another has soared as much as 193%…

… And another crypto soared as much as 242%.

The best chance at enormous gains comes from a small group of little-known altcoins.

Discover the full details by clicking here.

Stocks Open Slightly Lower as Unemployment Falls

[Friday, September 4, 9:32 am]

Contributed by Sarah Smith

Friday is seeing a nervous start to trading, as investors scramble to figure out exactly what the August jobs report will mean. Will it be a good sign of recovery? Or is it a warning that sluggish growth is ahead?

Depending on who you ask, either sounds like the correct answer. On Friday morning, Wall Street learned that the United States economy added 1.4 million jobs. This gain also brought the unemployment rate down to 8.4% from 10.2% in July. Broadly, these are both good updates. But as Axios’ Courtenay Brown highlights, everything since the surprise 4.8 million jump in June has come with a hint of disappointment.

Plus, the labor situation is still so uncertain in the U.S. States are gradually signing onto the $300 per week in enhanced unemployment benefits rolled out via executive order. But many are hoping that lawmakers will return to the negotiating table to bring pack $600-per-week payments, or at least revisit drafting a broader stimulus bill.

The novel coronavirus has been making its impact since early March, and the weeks of pandemic living are continuing to drag on. One big catalyst on the horizon is the potential for the U.S. Food and Drug Administration to grant AstraZeneca (NYSE:AZN) or one of its peers early approval for a coronavirus vaccine in October, with plans to deploy vaccines by November.

Pending such a vaccine success, many Americans await more help and more answers. Daily headlines highlight the issues of unemployment — such as mass evictions around the country. Between the lines then, the report on Friday just does not do enough to ease these concerns.

- The S&P 500 opened lower by 0.02%

- The Dow Jones Industrial Average opened higher by 0.6%

- The Nasdaq Composite opened higher by 0.54%

Kensington Capital Pops on EV Battery Merger

[Thursday, September 3, 4:14 pm]

Contributed by Sarah Smith

In a day otherwise filled with doom and gloom, Kensington Capital Acquisition (NYSE:KCAC), a special purpose acquisition company (SPAC), is having a beautiful day in the market. Shares of KCAC are up more than 65% in intraday trading.

Why? Kensington Capital just announced the private business it plans to acquire, and investors are incredibly excited. That is because the blank-check company is making moves for QuantumScape, a solid-state battery maker with a ton of institutional support. The combined company will continue to trade on the New York Stock Exchange with the ticker QS, and has an implied pro-forma enterprise value of $3.3 billion.

Simply put, the battery business is really hot. Electric vehicles have been all the rage in 2020, as leader Tesla (NASDAQ:TSLA) has continued to climb higher, and smaller plays like Nikola (NASDAQ:NKLA), Xpeng Motors (NYSE:XPEV) and Li Auto (NASDAQ:LI) came onto the scene. Consumers want electric cars in their driveways, and investors want electric car stocks in their portfolio.

QuantumScape is a business that could heat things up even more for these EV makers. According to Kirsten Korosec from TechCrunch, EV companies currently rely on lithium-ion batteries to power their vehicles. What QuantumScape is offering is a solid-state battery — a type of battery developers say has greater energy density. For these car companies, this means they can get more range out of smaller and lighter batteries. Particularly as companies like Nikola start aiming for the electric truck space, range of batteries matters more than ever.

Do you still need more convincing? Consider that the novel coronavirus has made consumers more interested in supporting sustainable and eco-friendly businesses. The EV space is just starting to boom, and interest and money should keep flowing its way for years to come. Plus, QuantumScape has a lot of support. The company is backed by Bill Gates, Volkswagen (OTCMKTS:VWAGY) and a number of other big institutional investors.

Don’t let QuantumScape drive off without you.

Dow Drops 800+ Points as September Selling Starts

[Thursday, September 3, 4:03 pm]

Contributed by Sarah Smith

What an ugly day in the stock market.

After watching the S&P 500 and the Nasdaq Composite hit record highs earlier this week, it is brutal to see the major indices fall so sharply into the red. Particularly painful is the 800-point drop in the Dow Jones Industrial Average. Investors are racing to sell their stocks just a few days into a historically weak month.