Investment Thesis

I am at a “buy” on Anglo American due to its diverse portfolio of mines and commodities, coupled with a good growth outlook and a fair balance sheet. It is a company that will provide resilience in your portfolio for many years.

Company Summary

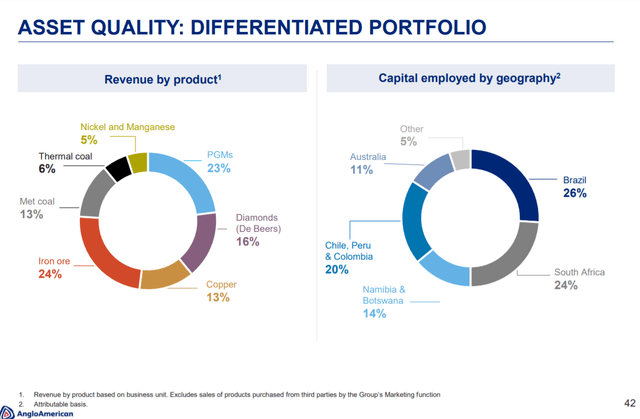

Anglo American (AAL.LSE)(OTCQX:AAUKF)(OTCPK:AAUKY)(OTCQX:NGLOY) is a mining company with over 100 years of history. It operates in four main segments: Diamond, Copper, PGMs and Bulks.

Figure 1 – 2020 Interim Results

De Beers is a dominant player in the worlds diamond industry supplying approximately 35% of the world’s supply. It is 85% owned by Anglo American and 15% owned by the government of Botswana. It is one of the largest copper producers and is expanding this position. It is the largest producer of Platinum globally and has a leading position in all PGMs (Platinum Group Metals). Bulk products contain materials such as Iron, Coal and Nickle.

The stock has recovered well from its march lows and approximately flat for the years and down about 10% YTD.

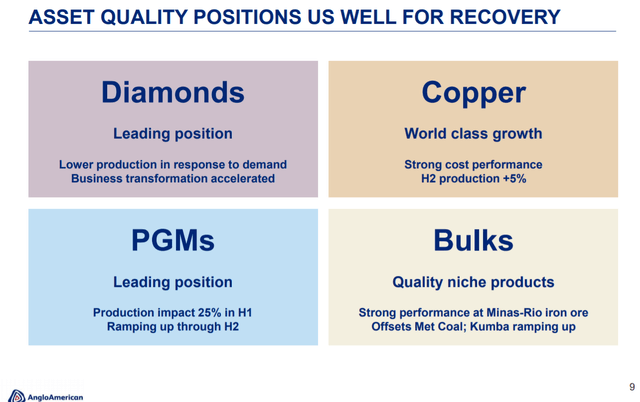

Commodity outlook

Copper is vital in most of modern technology. The long-term outlook is hazy as reserves have been increasing for some years, and as such the level of production is also expected to increase. However, its usefulness in electrical devices and power systems will make it continue to play a vital role in modern life. Between 40-50% of copper consumption takes place in China, however Indian demand is expected to rise quickly. Copper is sensitive to macro-economic trends and its price is heavily dependent on these industrial economies. For further reading, I advise looking at Statistica.

Each year the De Beers group conduct a diamond insight report. Whilst we can expect obvious bias, I have found it to be a useful resource, especially as an insight into Anglo American. From the 2019 diamond insight report:

Global consumer demand continued to grow in 2018 driven by sustained positive macro-economic fundamentals. US and Chinese consumers were largely responsible, while weakness in the US dollar relative to currencies in most other leading diamond-consuming countries supported further growth.

Currently, the US dollar is weak however COVID-19 will slow demand as global GDP has fallen. However, the diamond market is resilient and diamonds “are forever” will lead there to be a constant level of demand.

Platinum Group Metals are mainly used as catalysts. Platinum’s main use according to the Royal Society of Chemistry is in catalytic converters (50%), converting emissions into less harmful waste products. It also used in hard disks, thermocouples, optical fibres, LCD, turbine blades and pacemakers. A wide range of uses that seems to only be growing. I do not expect to see any slowdown in demand. The group is actually expected to see an increase in demand of 4% CAGR between 2020-2025. They are also considered to be one of the “35 Minerals Deemed Critical to U.S. National Security and the Economy”

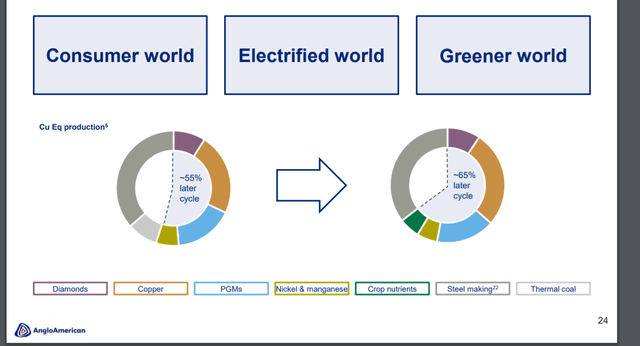

The Bulks section contains Iron and Coal. Iron demand is expected to remain strong however coal is a dying industry. Whilst the company believes that coal demand will shift from China to India, I believe that renewable energy generations rapid commercialisation, decreased cost and the political will of people globally will see coal become obsolete very quickly.

Figure 2 – Companies Commodity outlook from BoA Mining conference

Qualitative Analysis

Strengths

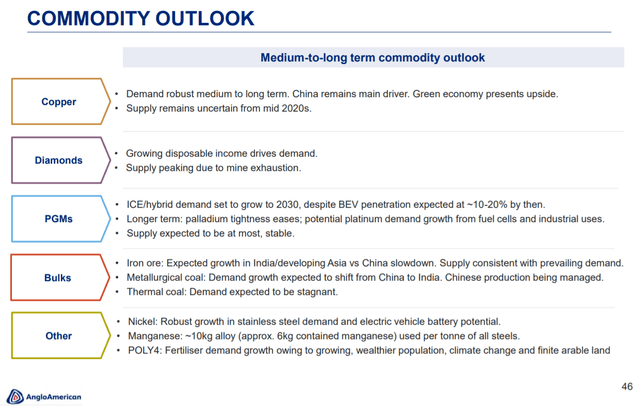

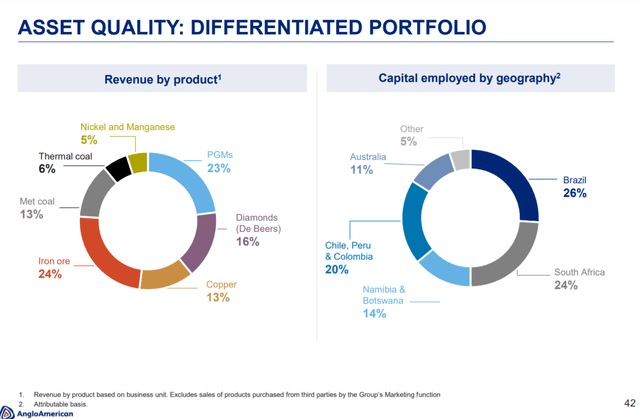

Anglo American has diversity across countries and commodities. This increases its resilience as it is neither dependant on a single country’s politics and regulations or the demand of a single commodity. Its commodities are either vital for modern technologies and materials or they are highly sought after for their perceived value.

Figure 3 – Revenue and Capital Allocation by product and geography from the BoA mining conference

De Beers is one of the most respected diamond brands globally. The value that diamonds hold has caused terrible crimes and violence to be committed to control their mining. This led to the term “blood diamonds”. De Beers is committed to an ethical code of practice to ensure the provenance of their products. This commitment to provenance and tracing allows them to ensure the ethical production of their products.

Our stringent sourcing procedures, selection processes and certification requirements mean that the diamonds in every piece of De Beers jewellery are guaranteed to be ethically produced and 100 per cent conflict-free.

In an ideal world, this would not be a discriminating factor, however, De Beers reputation creates peace of mind for customers.

Like most mining companies Anglo American is investing in automation and digitisation of its mines. However, its scale allows for greater efficiencies in the implementation and purchase of these products. The P101 programme has been to improve processes and equipment efficiencies throughout the company and has already caused savings of approximately $500m. The FutureSmart programme seeks to revolutionise the company using technology digitisation and sustainability. Anglo American target up to $1b of efficiencies and cost reduction by 2022.

The company is investment-grade rated with a Moody’s rating of Baa2 and BBB stable rating from Fitch.

Weaknesses

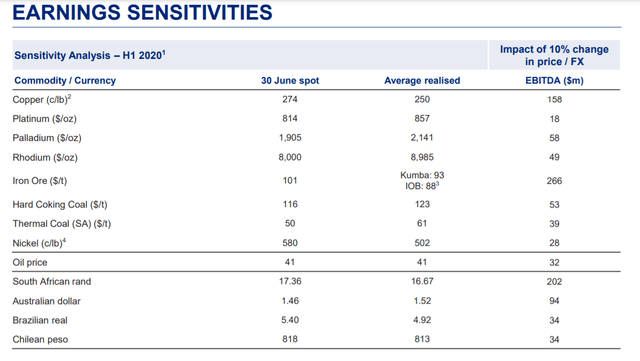

Anglo American main weaknesses are around constant exposure to risk. They are sensitive to many different things: geopolitics, the global economy, currency fluctuations and commodity demand. They conduct their own sensitivity analysis as shown below.

Figure 4 – Sensitivity Analysis from 2020 Interim Results

Anglo American would be severely affected by volatility in the iron ore and copper markets and by changes in the value of the South African Rand or the Australian Dollar. All of these would affect EBITDA by greater than $190m. Considering that TTM EBITDA is $7.58b, iron could cause an EBITDA decrease of 3.5% while the Australian Dollar would move the needle by 1.3%. Personally, I see this as a cost of doing business, some years in your favour other years against you.

Opportunities

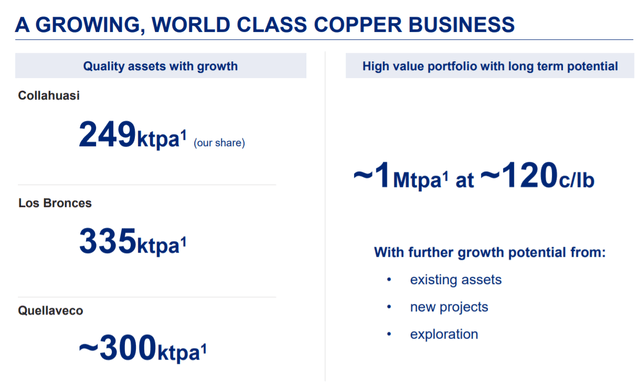

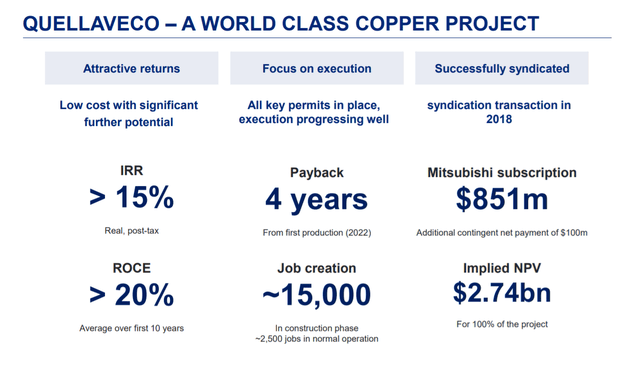

Anglo American has three copper mining developments. These are Quellaveco, Los Bronces and Collahuasi.

Figure 5 – Copper Assets 2020 Interim Report

Los Bronces has been in operation for years and is one of the workhorses at Anglo Americans disposal. It has some issues with water however once this is solved it will be back to producing copper at a brilliant rate. Collahuasi is set to begin production in 2024 and still requires some permits to be passed. Quellaveco is the real development star.

Figure 6 – Quellaveco project returns -2020 Interim

Quellaveco will become operational in 2022 and will catapult Anglo American to the 6th largest global producer of copper. Given the strong medium-term outlook of copper, this should lead to some healthy profits,

Anglo American has also diversified into crop nutrients through the purchase of Sirius. It is believed that the North-Yorkshire mine that Sirius owned is the largest deposit of Potash in the world.

Figure 7 – Target production – 2020 Interim

Figure 7 – Target production – 2020 Interim

They plan to phase out coal products and replace the income stream using crop nutrients. A smart play as the world population expands rapidly.

Threats

Short term demand for Anglo American’s products will heavily depend on COVID-19 and the economic recovery of industrial nations. Apart from diamonds, which are predominantly a luxury product, all the commodities main demand comes to form these countries. If the recovery is staggered or interrupted by a second wave, then demand will fall, and prices will slip. Similarly, an outbreak could cause production to fall if restrictions are implemented further.

Long-term, however, a decrease in globalisation/ an increase in nationalism or regulations will cause profit to diminish.

Quantitative

The balance sheet is strong, it is not spectacular, but it is strong. With investment-grade rating and debt to EBITDA ratio of 1.1 after a very tough quarter to the company looks well-positioned to ride this turbulence out. With liquidity of $15.5b, the company is also flexible.

As I said, we entered the start of the period in a very, very strong position – net debt: EBITDA of 0.5 times at the start of the period. And there were two primary factors across the six months that saw net debt increase.

This jump has been caused by a fall in EBITDA of approximately 30% due to COVID-19 (both directly and indirectly) from H1 2019 and an increase in debt due to growth and a build-up of working capital of 65%. This must lead to the company project a net debt to EBITDA of 1.1x.

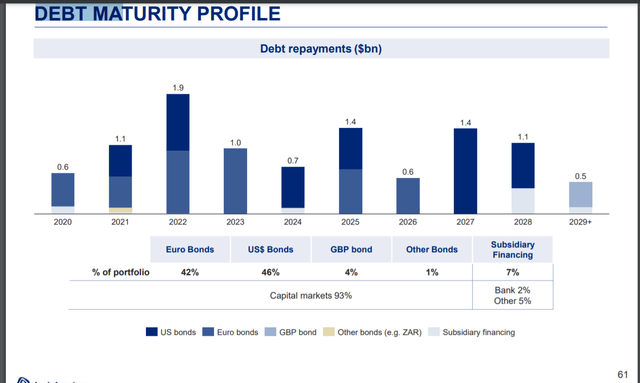

Debt maturity is well spread out however caution must be taken when approaching 2022.

Figure 8 – Debt Maturity 2019 Annual Report

The Dividend pay-out ratio is always targeted at 40% of earnings. Current EPS estimates for full-year 2020 are at about $2.5 per share. Therefore approximately $1 per share should be paid out over the year. That is a dividend yield at a share price of $25 of 4%.

The company prefers to return value to shareholders through dividends with $0.6b in dividends paid (in H1 2020) and $0.2b in share buybacks. Personally, I prefer this method.

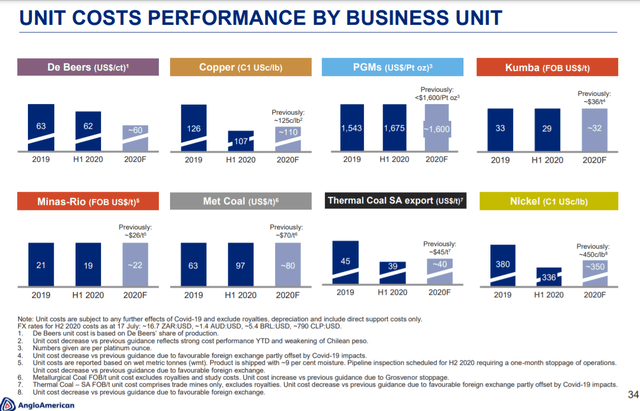

Currently, all commodities are operating at low costs compared to their sales prices. These costs are projected to remain relatively steady.

Figure 9 – Commodity Costs – 2020 Interim.

Valuation

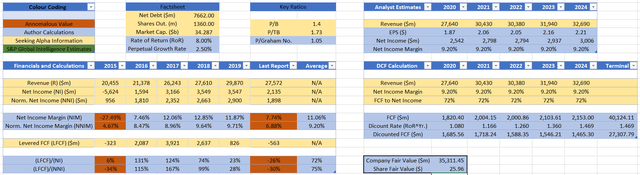

Usually, when creating these DCF models I use Seeking Alpha estimates of revenue (and EPS if available) and use 5-year average margins to determine future EPS. However, these margins were expected to expand as they have been artificially suppressed by growth CPEX which is expected to cease.

Figure 10 – Seeking Alpha DCF made by the author

This finds a fair value at a required RoR of 8% of $25.96.

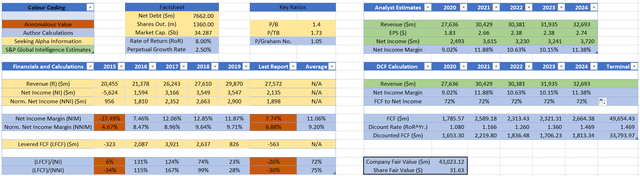

As such, I decided to use the S&P global intelligence analyst reports.

Figure 10 – S&P Global DCF made by the author

This finds a fair value at a required RoR of 8% of $31.63.

At current values, an expected rate of return would be approximately 9.5%.

Merging the two to provide a conservative estimation gives a fair value of approximately $28.80.

Considering a 20% margin of safety on my valuation finds a value of $23, which also below the calculated graham number of $23.5. I will likely open a position at $24 and average into the position at no higher than $24.5.

Conclusion

I believe that Anglo American is fairly valued at its current price. However, I want to increase the diversity across my mining portfolio and as such will be taken any weakness as a buying opportunity. I believe that it has long term potential to produce strong dividends and free cash flows going forward.

I would really appreciate it if you would take some time and post in the comments any suggestions that you have for improving this article so that I can improve in the future. Stay safe – Tom

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AAUKF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.