TIM Participações S.A. (NYSE:TSU) is a Brazilian telecommunications company that is controlled by Telecom Italia S.p.A. (TI). Soon TIM Participações will be known as TIM S.A., and I will refer to it as just TIM throughout this article. I recently decided to analyze the Brazilian telecommunication sector because I feel that it is evolving and in ways that citizens of developed countries might not be able to understand. I also believe there could be some alpha available to those who can understand these changes.

The Market Transformation

The Brazilian mobile telecommunication market has been changing over the past years, and this change is even visible even to the average Brazilian. In TIM’s latest quarter report, it said the following: “which results from the continued phenomenon of SIM card consolidation.”

Table 1 – The SIM Card Consolidation Phenomenon

| SIM Card Consolidation | 2015 | 2016 | 2017 | 2018 | 2019 |

| Brazilian Wireless Subscriber Base “mn.” | 257.8 | 244.1 | 236.5 | 229.2 | 226.7 |

| subscriber growth % | -5.3% | -3.1% | -3.1% | -1.1% |

Source: TIM S.A. IR

From 2015 to 2019, the wireless subscriber base in Brazil decreased at a CAGR of 3.2%. The biggest drop in subscribers occurred in 2016 when the sector lost 13.7 million subscribers. From 2018 to 2019, the number of subscribers only decreased by 1.1%, which is the smallest decrease in subscribers since the phenomenon began.

So what is this phenomenon that TIM S.A. is talking about? Years ago, calls made between the same network were cheaper than calls outside the network (similar to the U.S.). Because of this policy, people in the lower-income bracket would have two or three pre-paid SIM cards. Each SIM card was with a different mobile network. One day, one of these companies decided that calls outside the network should be the same as calls within the network. That decision led to the SIM card consolidation, which consequently caused the subscriber base to decrease.

The wireless subscriber base is not shrinking because fewer people are using mobile phones, but because people are now using only one SIM card instead of two or three. The good news is that this trend seems to be slowing as the subscriber base is normalizing. I also feel that the subscriber base will increase over the next couple of years due to population growth and increased teen usage, like what occurred in the United States.

During its 2Q20 conference call, TIM informed investors that its prepaid segment lost 11 million users over the past 12 months. It also informed listeners that its postpaid segment added a net addition of 7.7 million during the same period. Though the postpaid segment added users, it wasn’t a one-to-one replacement (prepaid customer becomes a postpaid customer). This is due to the SIM card consolidation phenomenon.

The whole Brazilian telecommunications industry is experiencing this loss of customers on a per SIM card basis. All is not lost. The postpaid segment has a more predictable revenue, and customers commit to the company. The bad news is that an increase in the postpaid segment can increase bad debt expenses.

The Beginning Of The Valuation Process

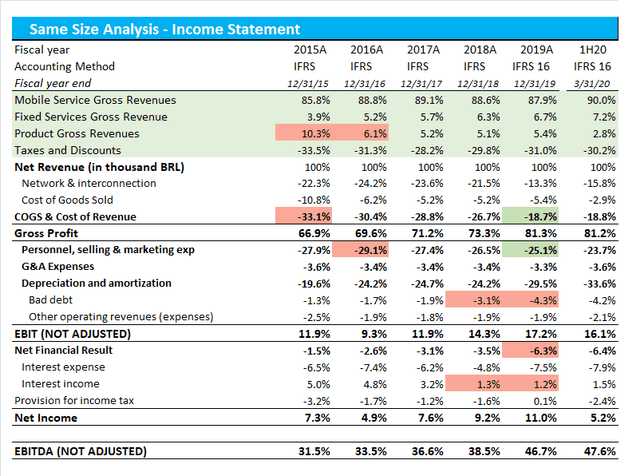

Figure 1 – Same Size Analysis

As seen in Figure 1, the mobile services segment is the company’s bread and butter. Almost 90% of the company’s gross revenue comes from prepaid and postpaid mobile services sales. The company changed its strategy in 2016, which caused a 9% decrease in sales y-o-y. The segment most affected by this change was the product segment (handsets and smartphones).

The company’s change in strategy resulted in a 1,440 bps increase in gross profit, from 66.9% in 2015 to 81.3% in 2019. With this increase in gross profit and better cost controls, its EBITDA margin and net profit margin also increased. The company’s EBITDA and net income grew at a CAGR of 10.7% and 11.2%, respectively (2015-2019).

From 2016 to 2019, the company’s personnel, selling, and marketing went from 29.1% of net revenue to only 25.1%. These expenses decreased at a CAGR of 2.3% during the same period, demonstrating that it focused on reducing expenses paid.

During the analysis period, the company’s net revenue increased at a CAGR of 0.3% while its net income increased by 11.2%. The company’s strategy was more focused on increasing profitability than increasing revenue. For this reason, I will focus more on bottom-line growth than revenue growth in my valuation model.

The company’s net financial expense is the only line item that didn’t improve during the analysis period. The company’s financial statements break down the net financial expenses into three sub-line items: financial expenses, financial income, and exchange rate variation. The FX rate variation is so small that it doesn’t even affect the net financial expenses, so I removed it from the same-size analysis. The company’s financial income as a percent of revenue decreased in 2018 and 2019. After further analysis, I noticed that its return on cash investments decreased during the period due to a decrease in Brazilian interest rates (“CDI”). Before 2018, financial income was large enough to offset financial expenses.

Table 2 – Market Share

| Brazilian Market Share % | 2017 | 2018 | 2019 | Aug-20 |

| Vivo | 31.69% | 31.92% | 32.90% | 33.32% |

| Claro w/Nextel | 26.14% | 26.05% | 25.59% | 26.13% |

| Claro w/o Nextel | 24.96% | 24.61% | 24.04% | 24.66% |

| Tim | 24.79% | 24.40% | 24.02% | 22.79% |

| Oi | 16.47% | 16.45% | 16.23% | 16.11% |

| Others | 0.91% | 1.18% | 1.26% | 1.65% |

Source: TELECO

TIM’s main competitors are Vivo (NYSE:VIV), Claro (parent company is AMX), and Oi (OTCPK:OIBRQ). Oi is in chapter 11 and will probably sell off its mobile services segment soon.

Up until August of this year, TIM has lost about 1.23% of its market share. Claro and Vivo are the likely beneficiaries of TIM’s loss in market share. The company’s mobile services revenue decreased from R$3,833 million in 2Q19 to R$3,671 million in 2Q20. The 4.2% decrease in mobile revenue was partially offset by a 10.8% increase in fixed service revenue. The fixed service segment is still small, but it is an area where I am the most bullish.

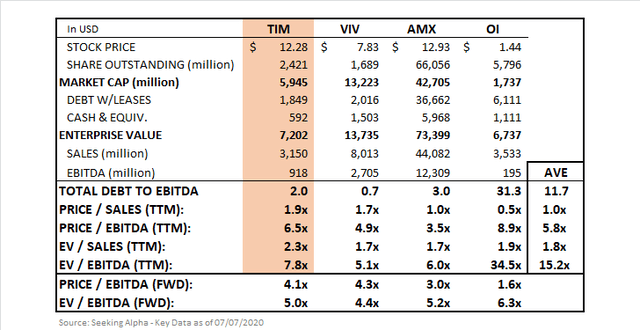

Figure 2 – Relative Value Comparison

Source: Seeking Alpha (VIV, AMX, and OIBRQ)

Source: Seeking Alpha (VIV, AMX, and OIBRQ)

Compared to its peers, TIM is trading at a slight premium. I believe the market is optimistic towards TIM as its profitability has improved greatly over the past couple of years. The company’s fixed services segment shows great progress as it continues to expand its broadband (referred to as TIM Live) coverage even during the pandemic. As I mentioned earlier, I am bullish on TIM Live because the company is building this network from the ground up.

Vivo owned a broadband company called NET that it later sold to Claro. TIM has an advantage over Claro in the broadband segment because they are building a network from the ground up. Claro will have to invest in NET to improve its infrastructure, while TIM will have to build an already state-of-the-art infrastructure.

Conclusion

I recommend that readers further analyze TIM because the company seems well-positioned to outperform its competition. I did not give TIM a bullish recommendation because the company lost almost 2% of its market share this year, and I need to understand why this dynamic occurred.

If you like what you read, please “Follow” me via Seeking Alpha. I typically only cover the Brazilian markets, the Robotics Industry, and the Food Industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.