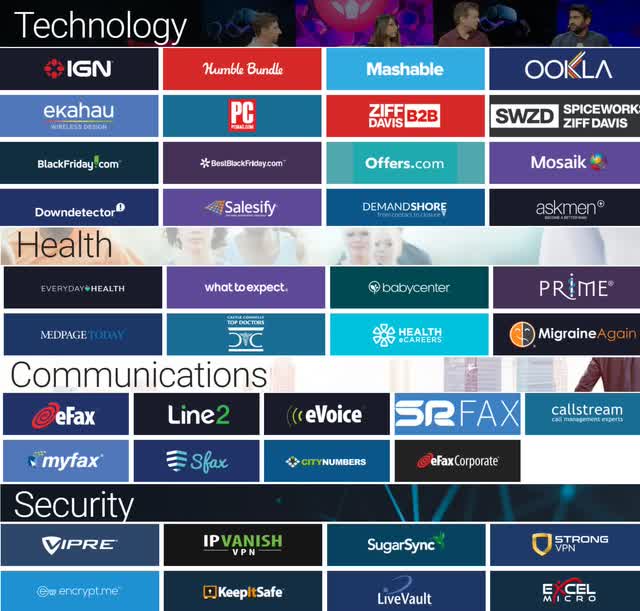

J2 Global Inc. (JCOM) is an internet services provider with an extensive portfolio of digital media and cloud-based service companies. Website brands like IGN, PCMag, and Mashable, among others, are recognized as market leaders with a global audience. The services and subscription business includes tools like online fax services, VPN, and e-mail security applications used by both consumers and commercial customers. While certain parts of the business have seen disruptions due to the pandemic this year, the overall financial profile remains solid with steady growth and strong cash flows. We are bullish on shares that offer attractive value heading into the upcoming Q3 earnings release scheduled for November 2nd. This is a high-quality stock with a positive long-term outlook.

(Source: Finviz)

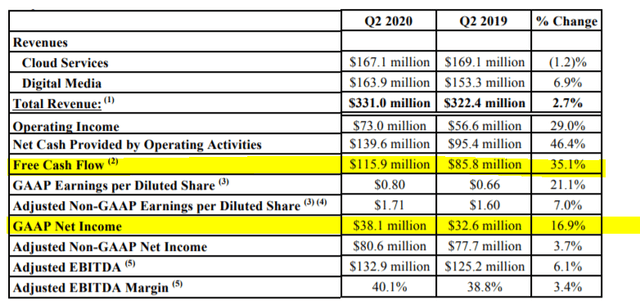

JCOM Financials Recap

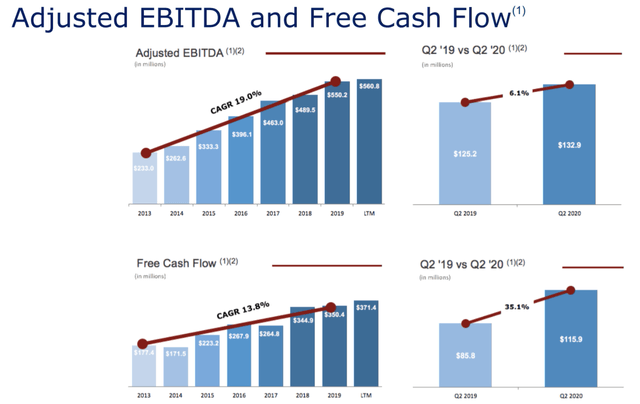

In line with broader trends in technology companies, J2 Global’s operating environment has been relatively resilient despite the pandemic. In the last-reported quarter, total revenues climbed by 2.7%, while adjusted EPS was 7.0% higher compared to the period in 2019. Notably, the adjusted EBITDA margin was up 340 basis points to 40.1%, driven by some cost-saving initiatives and the revenue mix. The positive earnings environment generated $116 million in free cash flow, up 35% y/y, a quarterly record for the company.

(Source: Company IR)

In terms of the operating segments, 6.9% y/y growth in digital media revenue was supported by strength in online advertising, which surprised management, as they had expected more weakness due to the pandemic. On the other hand, cloud services, which include various subscription-based businesses, saw revenues decline by 1.2%. The average monthly revenue per customer at $13.66 fell 2.5% y/y.

J2 Global sees opportunities to drive growth through initiatives like bundling, along with ongoing investments to expand offerings. Management notes that the retention rate has remained steady, reflecting customer loyalty.

J2 Global Brand Select Portfolio

(Source: Company IR / image composite)

During the conference call, management noted that excluding the divestment of jBlast in 2019, the cloud services segment revenue was flat on a year-over-year basis. Some products like the cloud fax services which have exposure to the healthcare and medical industry were pressured with lower volumes considering hospital facilities limited elective surgery procedures during the period, which typically use faxing services to send documents. The company expects this business to improve gradually going forward.

The Cloud services segment also weathered the Q2 storm very nicely. Revenues were down 1.2% on a year-over-year basis. However if you adjust for forex and jBlast, which is a broadcast fax business we sold in October 2019, revenues were flat. Cloud fax is essentially flat in the quarter, notwithstanding the decline in medical record volumes. The significant reduction in elective procedures in the US directly impacted our page volumes, but we’re starting to see page volumes return to the cloud fax business as elective procedures are coming back.

Finally, J2 ended the quarter with approximately $711 million in cash and equivalents against $1.1 billion in long-term debt. Considering adjusted EBITDA of $561 million over the trailing twelve months, we calculate the net-debt to leverage ratio at 0.7x, highlighting a solid balance sheet.

(Source: Company IR)

While J2 Global does not pay a dividend, the company is using that higher free cash flow to support a new share repurchasing program that was authorized by the board of directors announced with the last quarterly results. It may buy back up to 10 million shares of the common stock through 2025. What’s impressive is that considering the 47 million shares currently outstanding, the program can generate upwards of 20% value for shareholders over the period. This implied yield supports our bullish view of the stock.

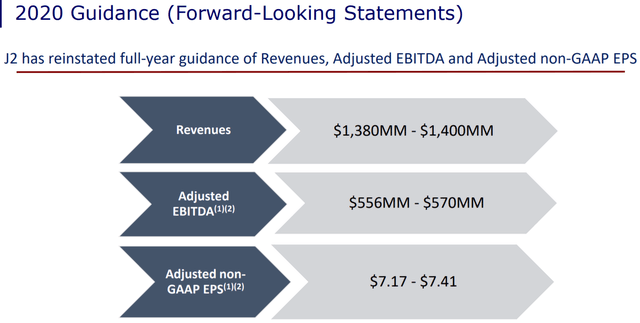

Management Guidance and Consensus Estimates

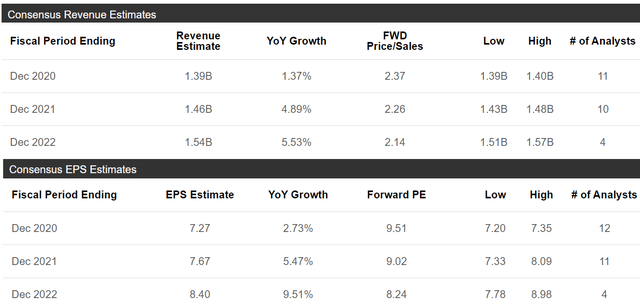

Another positive development last quarter was a reinstatement of full-year guidance. Management is targeting revenues between $1.38 billion and $1.4 billion this year, and expects positive adjusted EPS in a range between $7.17 and $7.41.

(Source: Company IR)

The current consensus estimates for 2020 for both revenue and EPS are within the management’s guidance range. Looking ahead, the market sees revenues and earnings climbing by about 5% in 2021. Overall, the outlook is for steady and moderate growth over the next couple of years.

(Source: Seeking Alpha)

Analysis and Forward-Looking Commentary

What we like about J2 Global’s business is the relative diversification across the online properties. Even if one particular site of cloud service is seeing weaker trends, there is a good chance that another property may be presenting greater market share gains. As an example, one of the themes in the broader market this year was the growth of online gaming as consumers spent more time at home looking for entertainment options. J2 Global’s gaming- and PC-focused websites like IGN.com and PCMag.com likely saw a surge of users with renewed interest, which helps add to the intrinsic value of the asset. Regardless of near-term volatility in the advertising sales or cost pressures, we believe the digital portfolio has a long-term positive outlook.

Similarly, cloud services products on their own may be seen as a niche segment. We argue that there should be an optionality value with the possibility that one particular tool sort of takes off with accelerating user growth. Data shows that VPN (“Virtual Private Network”) usage surged during the pandemic for a variety of reasons, including the need for enhanced security for work-from-home arrangements. With several differentiated products targeting different users, J2 Global was likely well-positioned to capture these trends.

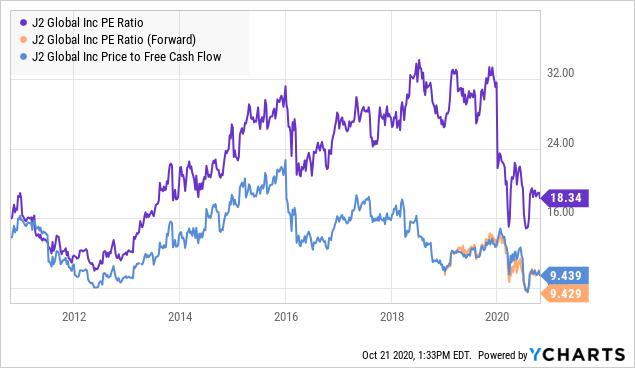

The challenge for JCOM is that despite the overall strong fundamentals, the outlook for firm-wide sales and earnings growth in the mid-single digits over the next couple of years is hardly at a level to get excited about. By this measure, the company valuation currently trading at 9.4x consensus 2020 EPS represents a cautious outlook by the market. Still, we think the value here is attractive, and there is an upside to the consensus estimates.

Data by YCharts

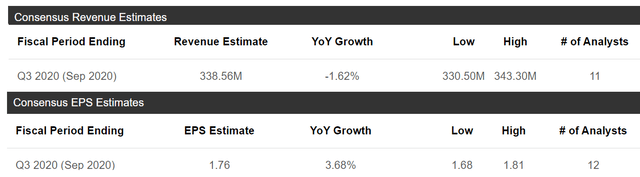

Data by YChartsQ3 Earnings Outlook

J2 Global is set to report its Q3 earnings on November 2nd. Current estimates are for revenue at $339 million, representing a 1.6% y/y decline, while a forecast for EPS of $1.76, if confirmed, would be 3.7% higher compared to the period in 2019. The expectation is that continued cost saving measures and efforts towards efficiencies drive margins higher. We believe there is an upside to the revenue estimate that could be supported through strength in the ads business related to the election.

(Source: Seeking Alpha)

Final Thoughts

The big takeaway here is that despite the recent share price weakness for JCOM, the fundamentals remain strong with consistent profitability and a rock-solid balance sheet. Overall, we rate shares of JCOM as a Buy, with a price target of $80.00 for the year ahead representing about 17% upside from the current level. The expectations for only modest growth in the coming year sets a low bar we believe the company can exceed.

The risk here beyond a broader deterioration of the macro outlook is that it will be important for J2 Global to stabilize the recent trends in the cloud services business. Weaker-than-expected results could force a reset of earnings expectations and further pressure the stock lower. Monitoring points for the upcoming quarters include the evolution of financial margins and continued free cash flow generation.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JCOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.