(Source: Exploration Insights)

Introduction

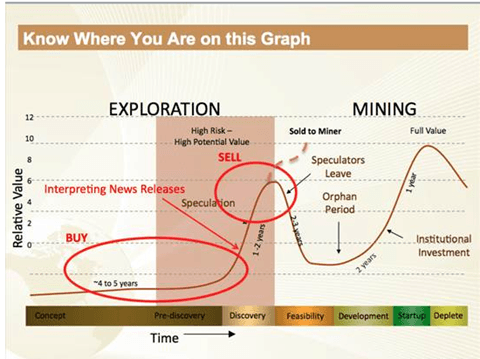

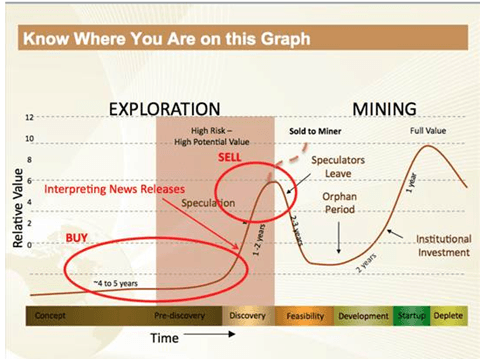

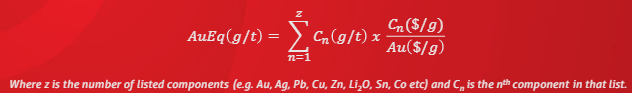

If you’re into investing in the mining sector, you should know the above chart very well. This series covers the three projects with the most significant drill interceptions over the past week as well as the prospects of the companies which own these projects. I will use data from the weekly bulletin of opaxe, which can be found on its website. Note that the drill interceptions are converted into grades of gold equivalents using the following formula:

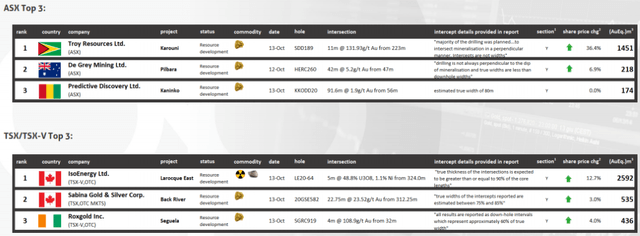

(Source: opaxe)

Where AuEq (g/t) is the gold-equivalent grade, z is the number of listed components (e.g. Au, Ag, Pb, Cu, Zn, Li2O, Sn, Co, etc.), ρn and Vn are the mass concentration and market value of the nth component in the list, respectively, and V Au is the market value of gold.

Gold has been chosen as the metal equivalent for all conversions as it is the most widely-used and best-understood benchmark to determine or appreciate the grade tenor of a drilling intercept. – opaxe

(Source: opaxe)

1) Larocque East uranium project Lake in Canada

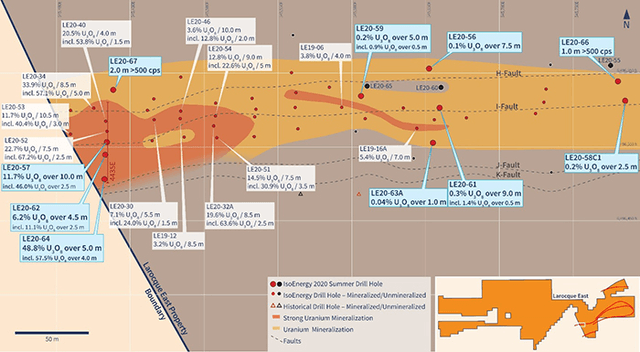

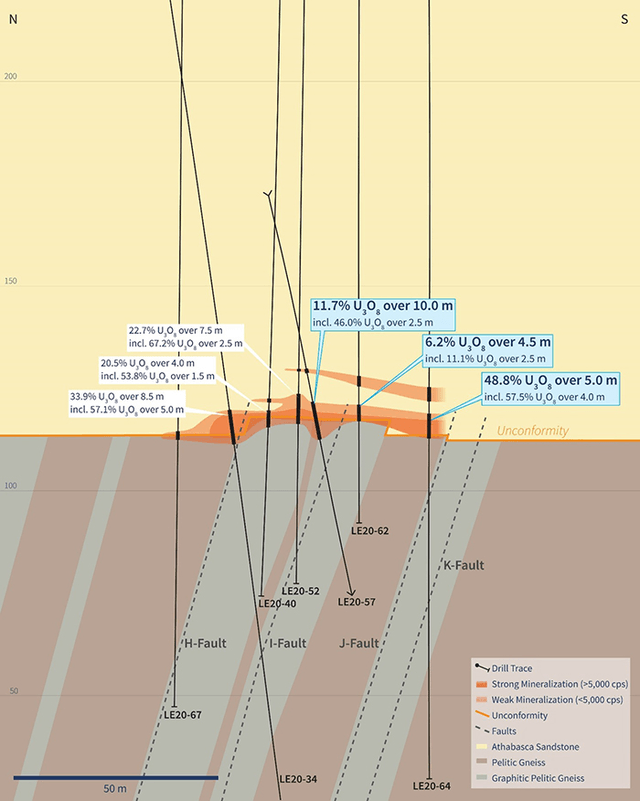

On October 13, IsoEnergy (OTCQX:ISENF) released a new batch of results from its summer drilling program at the Hurricane zone of its Larocque East project and the best interception was 5m @ @ 48.8% U3O8, and 1.1% Ni from 324m in hole LE20-64. This is equal to 2,592(AuEq.)m.

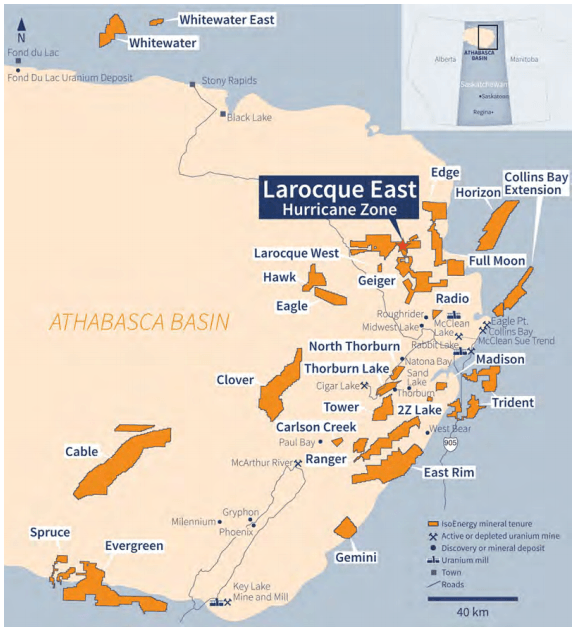

(Source: IsoEnergy)

Larocque East is situated in the eastern part of the Athabasca Basin in Saskatchewan, around 40km northwest of the McClean Lake mill. In May 2018, IsoEnergy acquired the project from Cameco (NYSE:CCJ) and its strategy includes snapping up a significant amount of land in the basin and drilling around mineralized intercepts that were found but never followed up properly.

(Source: IsoEnergy)

The 2020 summer drilling program at the property will include 20 holes for 8,000m.

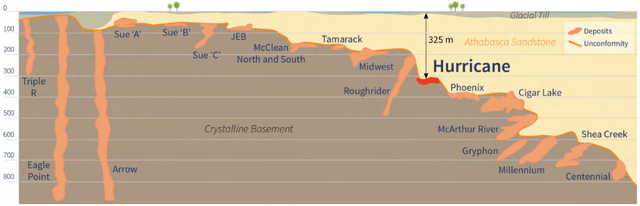

The sandstone cover on the property looks relatively thin and the Hurricane zone is relatively shallow as it’s some 330m below surface. At the moment, known uranium mineralization extends over a kilometer of strike length. I also like there’s no lake or water cover.

(Source: IsoEnergy)

2) Karouni gold mine in Guyana

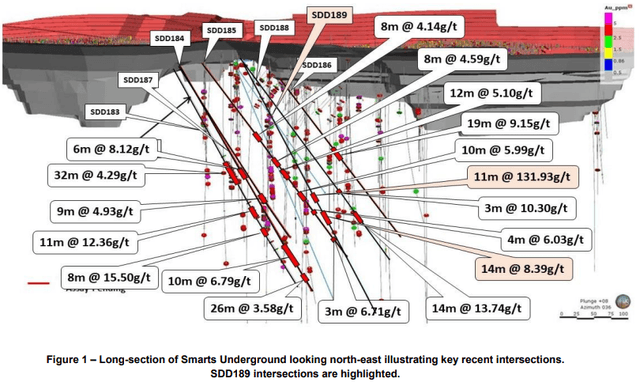

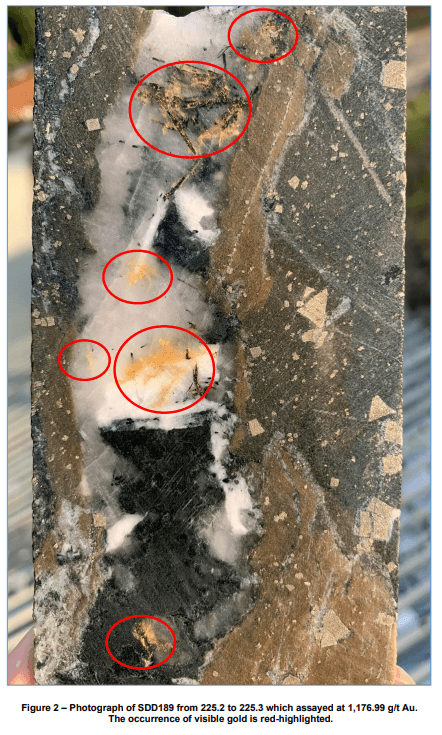

On October 13, Troy Resources (OTCPK:TRYRF) put out an exploration update for its Karouni mine, and the best interception was 11m @ 131.93 g/t Au from 223m in hole SDD189. This is equal to 1,451(AuEq.)m and formed part of a three-hole drill program aimed at defining a maiden reserve for the Smarts underground deposit. There was a lot of visible gold.

(Source: Troy Resources)

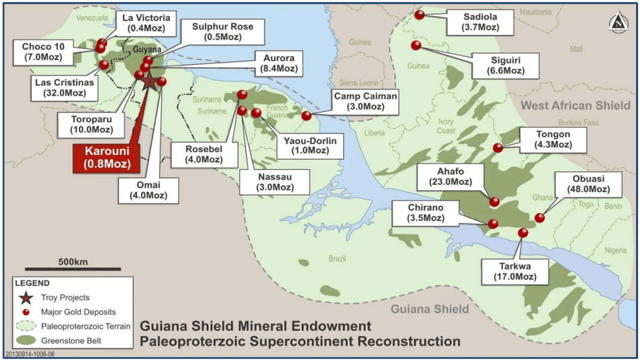

Karouni is located in one of the few underexplored greenstone terrains in the world:

(Source: Troy Resources)

It has a mill with a nominal capacity of 1Mtpa. In Q3 2020, it processed 201,812 tonnes at an average grade of 1.03 g/t and produced 6,334 ounces of gold.

In FY21, Troy expects the mine to produce 35,000-40,000 ounces at all-in-sustaining costs (AISC) of $1,450-1,550 per ounce.

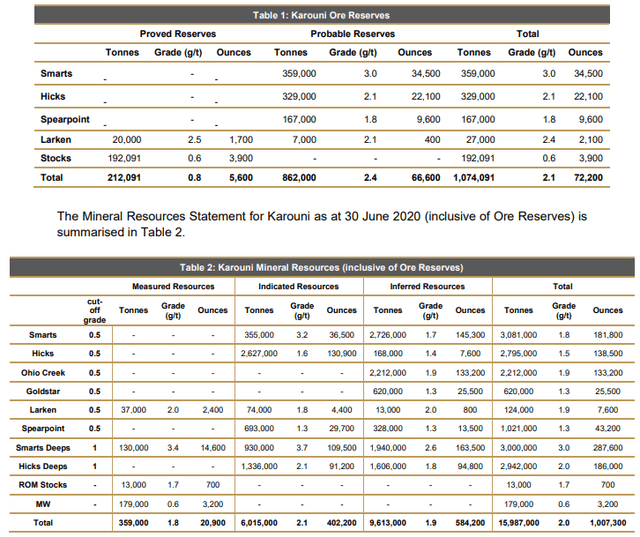

As of June 2020, Karouni had just 77,000 ounces of reserves but the exploration potential is there as resources are just over a million ounces.

(Source: Troy Resources)

3) Back River Gold Project in Canada

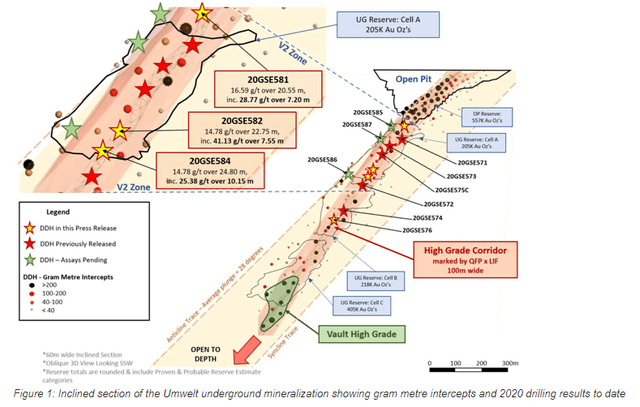

On October 13, Sabina Gold & Silver (OTCQX:SGSVF) announced more drill results from its Back River property and the best interception was 22.75m @ 23.52g/t Au from 312.25m in hole 20GSE582. This is equal to 535(AuEq.)m.

(Source: Sabina Gold & Silver)

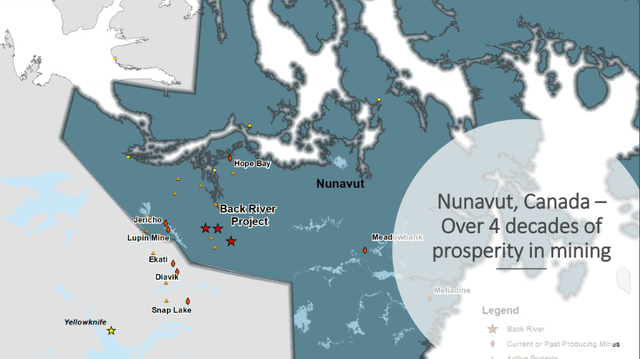

Back River is situated in the remote territory of Nunavut in northern Canada.

(Source: Sabina Gold & Silver)

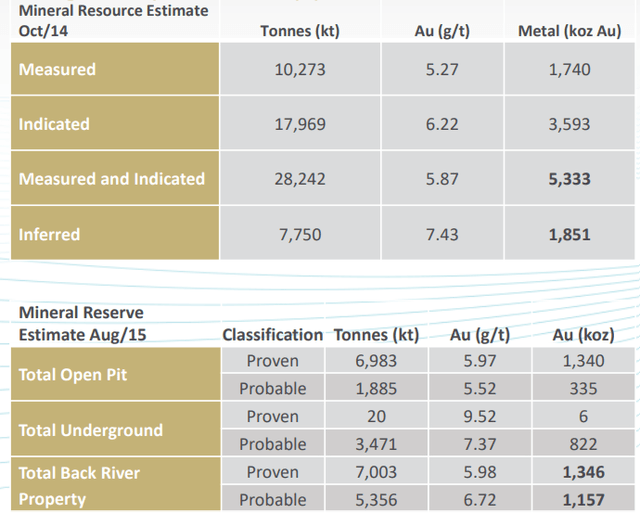

It’s an advanced high-grade gold project, there’s been very little progress over the past five years.

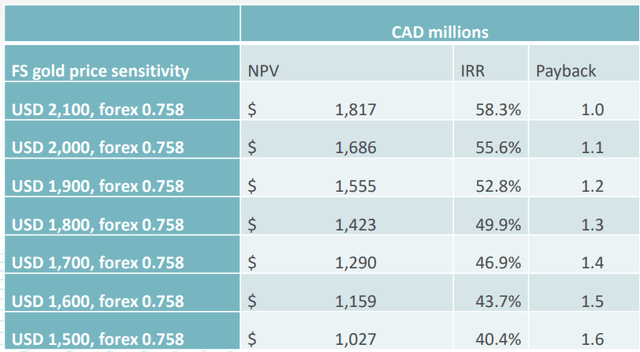

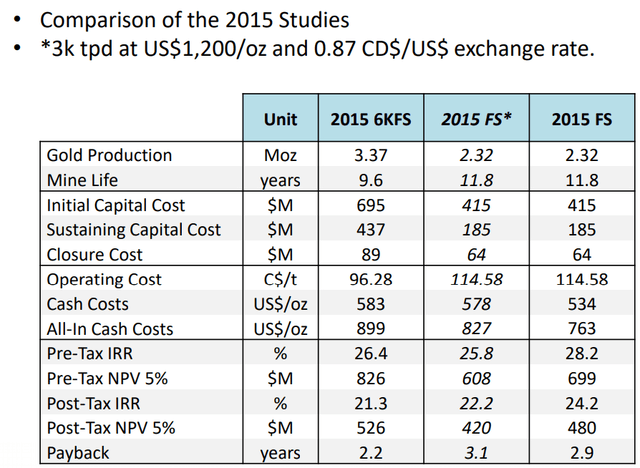

In 2015, Sabina announced the results of a feasibility study on Back River, which showed an impressive internal rate of return and a short payback period.

(Source: Sabina Gold & Silver)

Looking at the key financial figures from the feasibility study, I think the main issue for this project is the high initial capex.

(Source: Sabina Gold & Silver)

Sabina aims to release an updated resource and feasibility study in 2021, which will concentrate on high-grade production in the first years as well as a higher production profile. The key financial figures should be improved, especially in the first years of production.

Conclusion

I think IsoEnergy is among the few junior mining companies in the uranium sector with a high-grade discovery. Larocque East is located within trucking distance of the McClean Lake mill, which can potentially save a lot on initial capex. However, I think IsoEnergy looks overvalued at the moment as its market capitalization is almost $100 million.

Troy released good drill results from Karouni and this should help it significantly boost reserves in December when it releases a maiden reserve for the Smarts deposit. This deposit currently has a resource of 288,000 ounces of gold. However, Karouni will remain a small high-cost gold mine and I’m not optimistic it can be turned into a long-life profitable asset.

Sabina has a good advanced gold project in Canada but it’s hard to estimate how much it’s worth as the feasibility study is old. The company is working on fixing this and I think the recent drill results look compelling. The updated feasibility study should provide Sabina with some momentum, which is crucial for junior miners.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion – they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.