Galapagos NV (GLPG) is best known for filgotinib, an anti-inflammatory agent approved in the EU and Japan for RA (Rheumatoid Arthritis). Its approval in the U.S. is pending, which will be discussed at greater length below. It is also in clinical trials for other immunology related diseases. While the rest of the clinical pipeline is not particularly broad, Galapagos has a small molecule and target discovery platform in the process of producing a much broader pipeline.

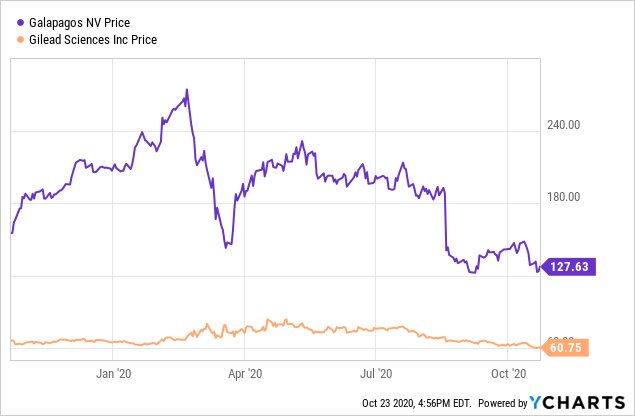

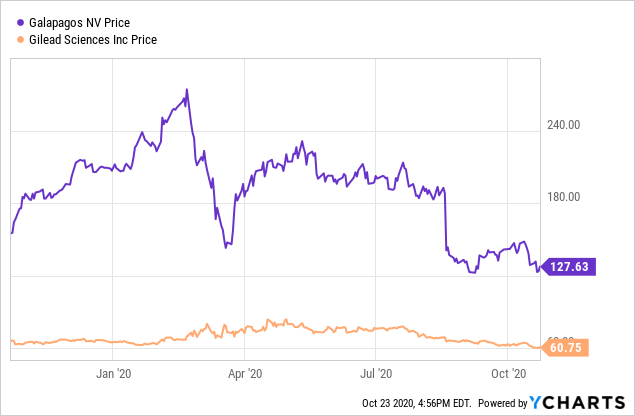

As of the close on October 22, 2020, Galapagos stock, at $123.68, was near a 52-week low of $121.42. This followed a peak of excitement back in February when it hit a 52-week high of $274.03. I believe investors became overexcited about the Gilead (GILD) deal, which I will summarize below. Then. the delay in the U.S. for filgotinib for RA hit the stock hard. I believe the price is now attractive for accumulation, despite the filgotinib delay and the recent failure of the osteoarthritis trial.

Data by YCharts

Data by YChartsGilead and Galapagos

In 2015, Galapagos signed a collaboration agreement with Gilead for the development and commercialization of filgotinib. In August 2019, Galapagos entered into a 10-year global research and development collaboration with Gilead. The terms of the agreement included an upfront license fee of $3.95 billion by Gilead to Galapagos. Gilead also made an equity investment in Galapagos of approximately $1.1 billion by subscribing for new shares at a price of €140.59 per share. As a result, Gilead then owned 13,589,686 ordinary shares of Galapagos, representing approximately 22 percent of its outstanding shares. In November 2019, Galapagos issued notification that Gilead owned 25.1% of its shares. The agreement covered six molecules in clinical trials, over 20 preclinical molecules, and the Galapagos drug discovery platform. In return for the cash and investment, Gilead received an exclusive product license and option rights to develop and commercialize current and future Galapagos programs in all countries outside Europe.

Filgotinib (Jyseleca) potential

Filgotinib, now with tradename Jyseleca in Europe and Japan, is a small molecule, oral JAK1 inhibitor. It was approved in the EU for adults with moderate to severe RA in late September. Unlike the United States, there is not usually a quick revenue ramp in Europe because each nation’s insurer must approve reimbursement for a new drug. Also, the RA therapy market is crowded, so new patients will most likely be those who are not getting good results with their older therapy.

On the downside, in August 2020, Gilead received a complete response letter from the FDA for this indication. It is now hard to predict when, or possibly if, filgotinib might get U.S. approval. The data from further studies requested by the FDA may become available in the first half of 2021.

Under the terms of the 2015 filgotinib collaboration with Gilead, Galapagos will receive tiered royalties starting at 20% from sales by Gilead while the companies will split profits in co-promotion territories. That is in addition to the $30 million license fee and a $425 million equity investment by Gilead, plus up to $1.35 billion in potential milestone payments. Clearly, Gilead bet heavily on the success of filgotinib. Galapagos has the option to co-promote in Europe, but Gilead will book the sales. The royalties apply to the rest of the world. That means the delay in the U.S. will likely hurt Gilead more than Galapagos.

Filgotinib is being tested in several other disease indications. Most recently, a Phase 3 trial generated positive results in moderate and severe ulcerative colitis. However, even these results, at the highest dose, gave just a 34.7% remission rate for this difficult-to-treat disease. Filgotinib is also in Phase 3 trials for Crohn’s disease and psoriatic arthritis. It is in Phase 2 trials for ankylosing spondylitis and uveitis.

GLPG1972 failure for osteoarthritis

Galapagos had partnered with Servier on a potential osteoarthritis therapy, GLPG1972. I wrote about how exciting a success would be in Galapagos NV Osteoarthritis Drug Candidate Has Vast Potential Value in August 2019. Unfortunately, the results of the GLPG1972 Phase 2 trial were not statistically significant. That certainly knocked down my estimate of the value of the company. But the results did show some improvement, so perhaps a tweak to the molecule could do better. Gilead and Galapagos have begun a Phase 1 trial for GLPG-0555, an alternative molecule for osteoarthritis.

Idiopathic Pulmonary Fibrosis program

Ziritaxestat ATX inhibitor (GLPG1690) is in a Phase 3 trial for IPF (idiopathic pulmonary fibrosis) and completed a Phase 2 trial for systemic sclerosis. GLPG1205 is in a Phase 2 trial for idiopathic pulmonary fibrosis. So far, the prognosis is good. The FLORA Phase 2 study of ziritaxestat in IPF patients reported a halt in disease progression, target engagement, and a favorable safety and tolerability. Ziritaxestat has been granted orphan status in IPF and systemic sclerosis in Europe and the US. In September 2020, the collaboration reported achievement of the primary endpoint in the Phase 2 trial of ziritaxestat for systemic sclerosis.

Platform

Small molecules have not generated the excitement lately of newer classes of drugs like antibodies, RNA therapies, and gene therapies. But they can still be quite effective. Galapagos has a competitive advantage in its target discovery platform, finding proteins that cause diseases. Then, small molecule inhibitors of those targets are engineered.

Galapagos’ Toledo program is a code name for a novel target class. There appears to be a dual mode of action, both stimulating anti-inflammatory cytokines and inhibiting pro-inflammatory cytokines. The first clinical candidate is GLPG3970 which started a Phase 1 trial in 2019. Multiple proof of concept trials are expected in the near future. Gilead has options to in-license the ex-European commercial rights to Toledo molecules following the Phase 2 trials.

1H Results

Galapagos reported first half 2020 results on August 6. Its revenue was $267 million, most of it recognized from the Gilead collaboration for option rights. Expenses were $423 million, which included R&D expense of $316 million. Net loss was $197 million. Clearly, the company is a long way from profitability. However, cash and equivalents were over $6.6 billion. If filgotinib has a good ramp, cash should not be a problem before cash flow breakeven is reached.

Conclusion

Given how closely the two companies are tied together, one way to invest in Galapagos is to hold Gilead Science stock [which I do]. Gilead pays a dividend and has a large array of commercial therapies as well as an extensive pipeline. On the other hand, Gilead’s stock price has been going mostly down for years. Since Galapagos will just begin to see commercial revenue this quarter, it is difficult to predict how filgotinib will fare in the competitive RA market. At the stock price of $123.68, Galapagos had a market capitalization of about $8.1 billion. Some revenue growth going forward is assumed in that market cap. I believe that would be justified if filgotinib eventually captures even 5% of the global RA market, which was near $58 billion in 2019, keeping in mind that Galapagos gets either royalties or a profit split.

The key for long-term investors is that filgotinib is just the start. In addition to the other potential drugs described in this article, Galapagos claims to be able to generate many more from its platform, and I find the claim credible. As always when enough clinical trials are involved, there will be some successes and failures, causing the stock price to dive or rise quickly at times. I have added Galapagos to the list of pharmaceutical companies I am considering buying, but it also has to compete with companies that are already in my portfolio that I think are undervalued and would like to own more of. Whether it is right for other investors depends on their individual investment strategies and assessments of the value of the pipeline.

Disclosure: I am/we are long GILD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.