They are ill discoverers that think there is no land, when they can see nothing but sea.”― Francis Bacon

We are going to use the recent weakness in the markets as an opportunity to add a new position to our model portfolio. It is from a sector that has sold off hard as Covid-19 has impacted that part of the economy hard. Our new recommendation is seeing much lesser impacts than most, but still is being punished like about every entity in the group. We may be a tad early, but long term this firm is well-positioned to weather the storm. It is a good name to accumulate during dips in the overall market and will be added to our model portfolio at market close today.

Company Overview:

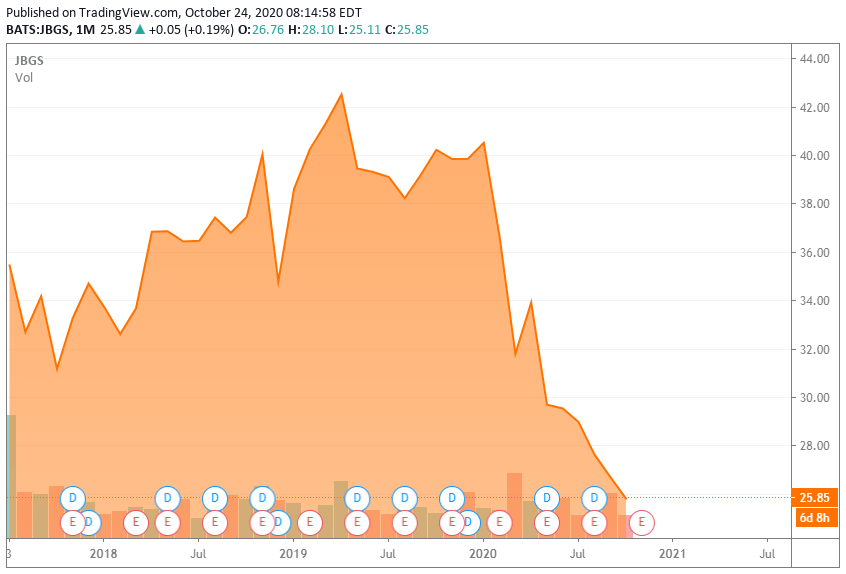

JBG SMITH Properties (JBGS) is a Bethesda, Maryland-based real estate investment trust [REIT] with office, multi-family, and retail properties concentrated in urban infill submarkets in and around Washington DC. Its portfolio is comprised of 63 operating assets, of which 43 are commercial – totaling 13.3 million sq. ft. (11.2 million sq. ft. at its share) – and 20 multifamily comprising 7,367 units (5,583 at its share). With roots dating back to 1957, JBG SMITH was formed when Vornado Realty Trust (VNO) spun off its Washington, D.C., portfolio and merged it with The JBG Companies in 2017. Its first regular way trade was executed at $36.59 a share. Owing to the belief that demand for office space has entered a secular decline as a result of teleworking spawned by the Covid-19 pandemic, JBG SMITH now trades in busted IPO territory at around $26.00 a unit, translating to a market cap of ~$3.8 billion.

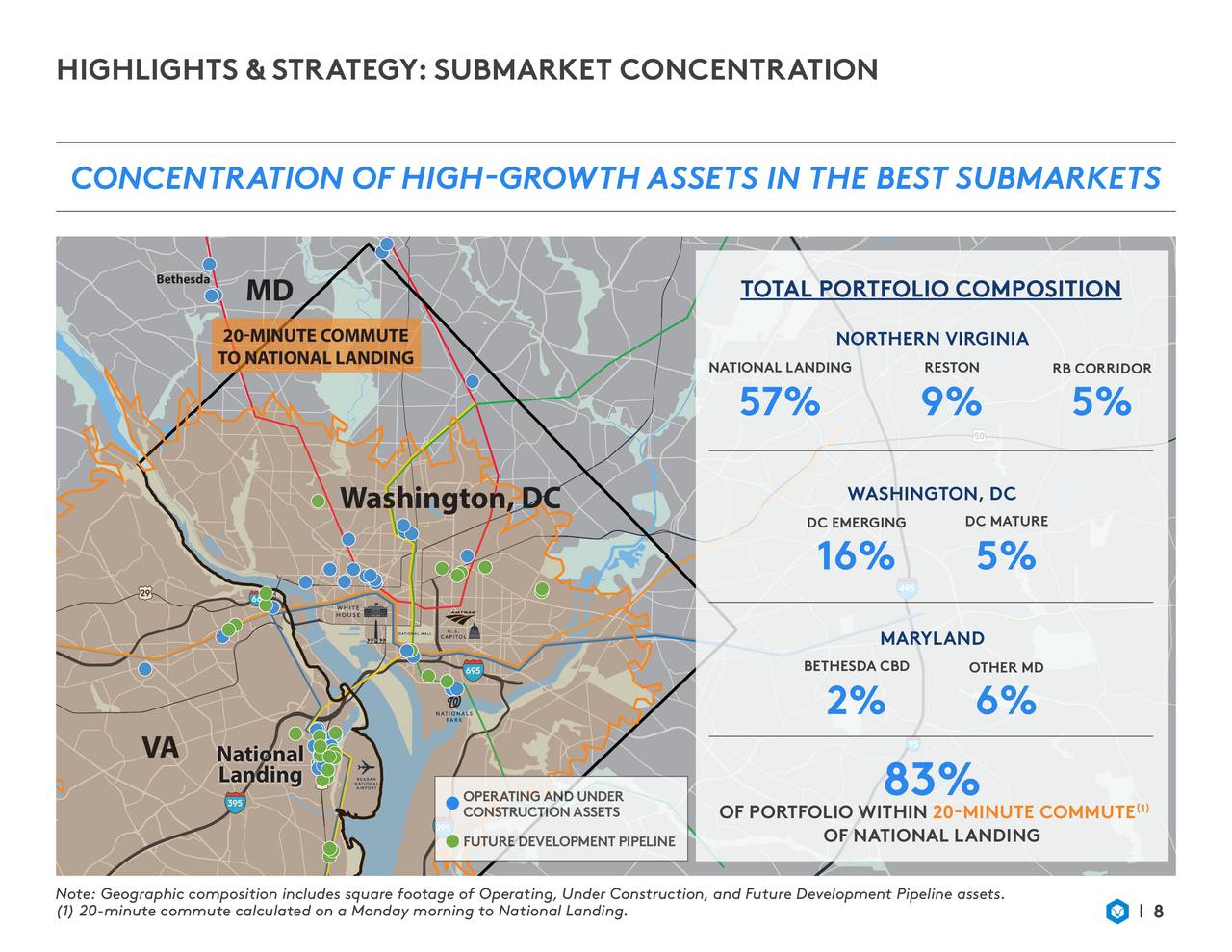

The company’s approach to value creation entails a concept it refers to as “placemaking”, which mixes high-quality multifamily and commercial buildings with anchor, specialty, and neighborhood retail in a walkable community with access to Metro DC transportation. The company has extensive land and building holdings in National Landing (just west of Reagan International Airport in Northern Virginia), Crystal City, eastern Pentagon City, and the northern portion of Potomac Yard, in which it has created these mixed-use communities. In normal operating environments it generates ~70% of its revenue from office rent; ~24% from multifamily dwellings; and ~6% from retail. Geographically, Virginia is responsible for ~67% of revenues; Washington DC ~27%; and Maryland ~6%.

Operational Tailwinds

Operating in the DC market is a solid advantage for JBG SMITH with the average household annual income ~73% above the national average and a vibrant economy that has created ~300,000 jobs in the past decade. Additionally, the nation’s capital has one of the greatest concentrations of Millennials in the country, is ranked the number two market in America for tech talent, and delivers the company’s largest tenant: the U.S. federal government, which was responsible for 16.7% of its 2019 revenue.

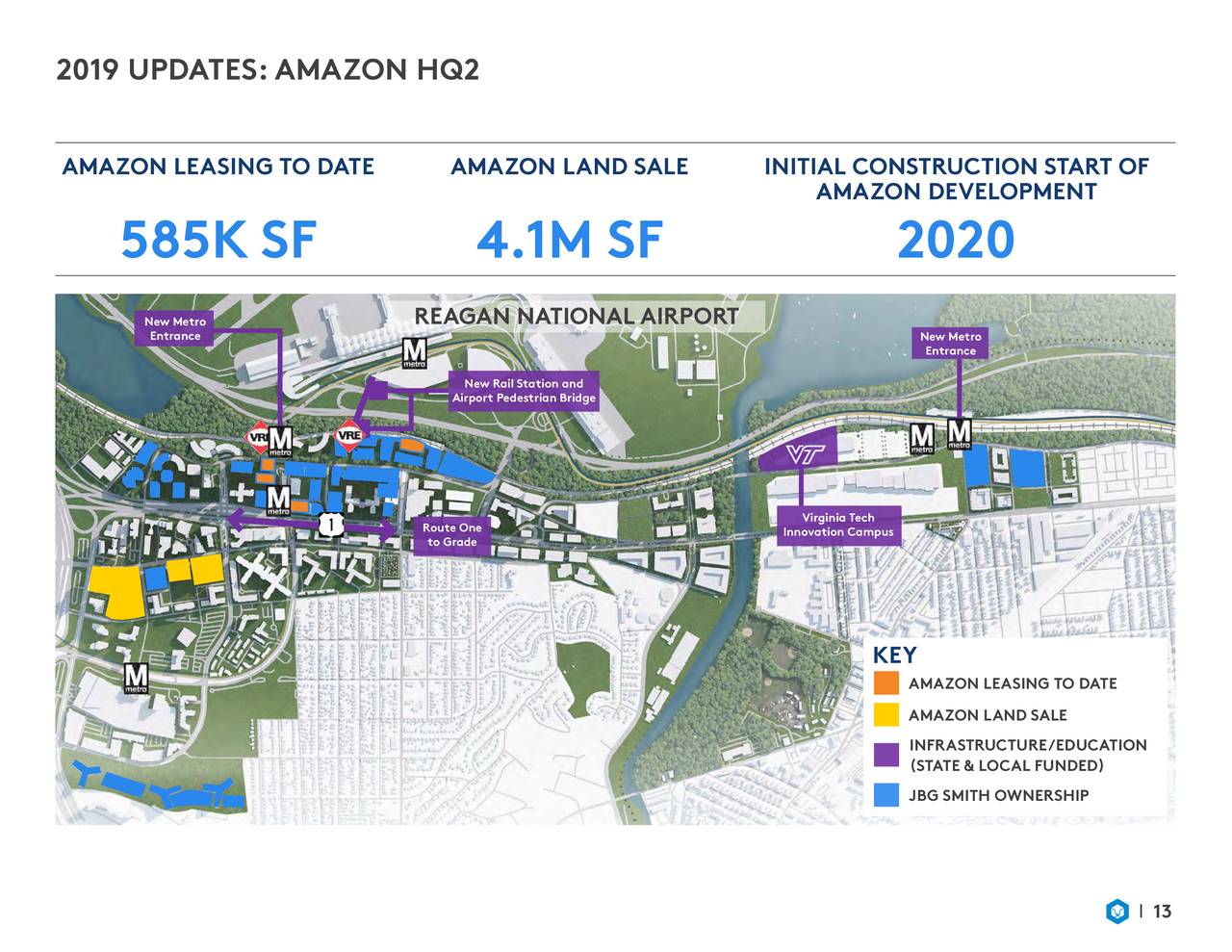

JBG SMITH was also buoyed by Amazon’s (AMZN) announcement that its HQ2 plans for Northern Virginia would include sites it owned. To date, Amazon has executed leases totaling ~857,000 sq. ft. at five office buildings in JBG SMITH’s National Landing portfolio. It has also purchased one land site from the REIT for $155.0 million and expects to close on another in 2021 for ~$150 million. With Amazon essentially guaranteeing 37,850 full-time jobs at average salaries of $150,000 or higher – it has hired ~1,000 to date – the Commonwealth of Virginia has pledged to kick in $1.8 billion for infrastructure and education improvements at National Landing. As the developer, property manager, and retail leasing agent for Amazon’s new headquarters at National Landing with three assets under construction (a 274,000 sq. ft. office building 97.8% pre-leased and two multifamily assets totaling 755 units – 577 units at its share), and a future development pipeline consisting of 35 assets totaling ~19.4 million sq. ft. of estimated development density, this Metro DC REIT was in an enviable position at the onset of 2020.

Impact of Covid-19

At the close of 2019, JBG SMITH had its operating commercial portfolio 91.4% leased and its in-service operating multifamily assets 95.1% leased. Its operating portfolio generated core funds from operations (FFO) of $1.61 in 2019 and investors received four quarterly distributions totaling $0.90. With these events as a backdrop, units of JBG were trading in the low $40s before coronavirus laid waste.

With demand for new office space disappearing during the height of the pandemic and many businesses operating successfully with their employees working remotely, this office-centric REIT was taken to the woodshed, losing nearly half its market cap in the span of a month, trading (intraday) to $21.66 in late March. Factor in the perception that many renters may not renew their leases when they come due – a belief driven by a bump in subleasing activity – and a significant amount of supply in the DC Metro market coming on line and it is easy to see why shares of JBG SMITH have continued to languish. Currently, there is more than 3 million sq. ft. of office space being built, of which 1.3 million sq. ft. is still available for lease.

With that said, the hit to JBG Smith’s operating performance to date has been relatively mild, as it was able to collect 98.6% of office rents in 2Q20 totaling $92.7 million (versus 99.7% in FY19) and 98.5% of residential rents totaling $30.9 million (versus 99.9% in FY19). The only revenue stream severely impacted was its less significant retail property portfolio, which saw rent collection plunge from 98.4% in FY19 to 58.0%, or $4.7 million in 2Q20. JBG Smith has entered negotiations for or completed retail rent deferrals of $3.9 million, deciding that it’s much easier to keep current tenants in place than dealing with filling a vacant store front in this operating environment. Management indicated that rent collections in July were in line with 2Q20 results. Also, the operating commercial portfolio was 90.4% leased (down 1.0% from YE19) while the in-service operating multifamily portfolio was 93.3% leased (down 1.8% from YE19).

However, these ‘paper cuts’ had an impact on the bottom line. Overall, the company generated 2Q20 Core FFO of $0.26 per diluted share and annualized net operating income (NOI) of $307.0 million versus $0.38 per diluted share and annualized NOI of $334.6 million in 1Q20. JBG SMITH generated 2Q20 Adj. EBITDA of $58.1 million on revenue of $145.0 million versus 1Q20 Adj. EBITDA of $73.6 million on revenue of $158.1 million as $8.1 million of reserves and rent deferrals and a $4.1 million decline in parking revenue were the chief culprits.

Balance Sheet and Analyst Commentary

As a precaution, the REIT drew down a total of $400 million from its revolver and the last tranche of a term loan in 2Q20. After the close of the quarter, management paid down the $500 million outstanding on its revolver, leaving it with ~$224.2 million in cash and ~$2.1 billion of debt at an average interest rate of ~3%. It has access to an additional $1 billion on its revolver. No meaningful debt is due in 2020 with $202.0 million and $228.1 million due in 2021 and 2022, respectively. Owing to the slide in 2Q20 Adj. EBITDA, leverage as measured by net debt to current quarter annualized Adj. EBITDA has risen to 8.1x (from 5.8x at YE19). On a trailing twelve-month basis, it is 6.5x. Although these metrics appear worrisome, with its business in a high growth phase, management targets 6x to 7x leverage and mid-8xs in periods of active development.

The REIT’s quarterly dividend of $0.225 appears safe. Although its yield of 3.4% may not be that appealing to some, this is a mixed-use REIT with Amazon providing nearly guaranteed high growth over the next half decade.

JBG SMITH has scant sponsorship from the Street, and what there is is tepid. The only two firms to make commentary in the past twelve months are Nicholas Stifel, which lowered its price target from $40 to $32 while maintaining a hold rating in April; and Evercore ISI who initiated coverage with a hold rating in December 2019.

Three board members are decidedly bullish based on their purchases during mid-August and mid-September, totaling 66,500 units between $26.65 and $27.87 per share.

Verdict

The bear case for office REITs is well-known. Businesses have discovered during the pandemic that the need for big office space is not essential. This dynamic will put pressure on occupancy rates and rents. And for many office REITs this scenario may play out. However, JBG SMITH is concentrated in very affluent and demographically appealing markets in the DC area with a high percentage of demand driven by the federal government, government contractors, and Amazon-related activity. With federal government spending skyrocketing in response to the pandemic, contractors and lobbyists are certainly not moving away; and with Amazon pledging 37,850 jobs with an average salary north of $150,000 in Northern Virginia – 12,000 of those by 2025 – JBG SMITH’s market is on extremely sound footing relative to others. If a V-shaped recovery is not in the offing, the potential for construction cost reductions and a likely decline in the supply pipeline should bolster the economics for the REIT’s development activities in National Landing and the balance of the DC Metro market.

How the exodus from the major cities and the trend towards teleworking evolve is unknown, although it would appear that employers will likely move out to infill urban markets to attract talent that desires the convenience of walkable amenities in vibrant communities as opposed to the current deteriorating conditions we are seeing in New York City and other large cities. This dynamic is JBG Smith’s business model. Still down nearly 40% from its 2020 highs and with recent insider buying, this name is a long term buy.

Farming is a profession of hope“― Brian Brett

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Author’s note: I present and update my best small-cap Busted IPO stock ideas only to subscribers of my exclusive marketplace, The Busted IPO Forum. Our model portfolio has crushed the return of the Russell 2000 since its launch in the summer of 2017. To join the Busted IPO Forum community, just click on the logo below.

Disclosure: I am/we are long JBGS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.