Quick Take

Midwest Holding (OTCQB:MDWT) has filed to raise $50 million in a Nasdaq uplisting IPO of its common stock, according to an S-1 registration statement.

The firm provides annuity insurance products to consumers in 20 states in the United States mainly through distributors.

MDWT is growing quickly and now producing earnings and positive cash flow from operations.

I’ll provide a final opinion when we learn more about the IPO’s pricing and valuation assumptions.

Company & Technology

Lincoln, Nebraska-based Midwest was founded to provide annuity products through independent marketing organizations (IMOs) that in turn offer such products to independent insurance agents.

Management is headed by A. Michael Salem, who has been with the firm since 2019 and was previously Chairman of American Life, one of Midwest’s subsidiaries.

Below is a brief overview video of the multi-year guaranteed annuity:

Source: SafeMoneyPlaces

The company’s primary offerings include:

Below is a chart that shows the firm’s four subsidiaries and related functions:

Midwest has received at least $67 million from investors, including Vespoint and Crestline Assurance Holdings.

Customer Acquisition

The firm primarily sells its services through independent marketing organizations, of which it currently has agreements with eight.

Midwest provides support to its distribution partners through training, compliance, and new product introduction.

Salaries & Benefits expenses as a percentage of total revenue have been dropping sharply as revenues have increased, as the figures below indicate:

|

Salaries & Benefits |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2020 |

18.3% |

|

2019 |

79.5% |

|

2018 |

246.7% |

Source: Company registration statement

The Salaries & Benefits efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Salaries & Benefits spend, rose to 4.3x in the most recent reporting period, as shown in the table below:

|

Salaries & Benefits |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2020 |

4.3 |

|

2019 |

0.9 |

Source: Company registration statement

Market & Competition

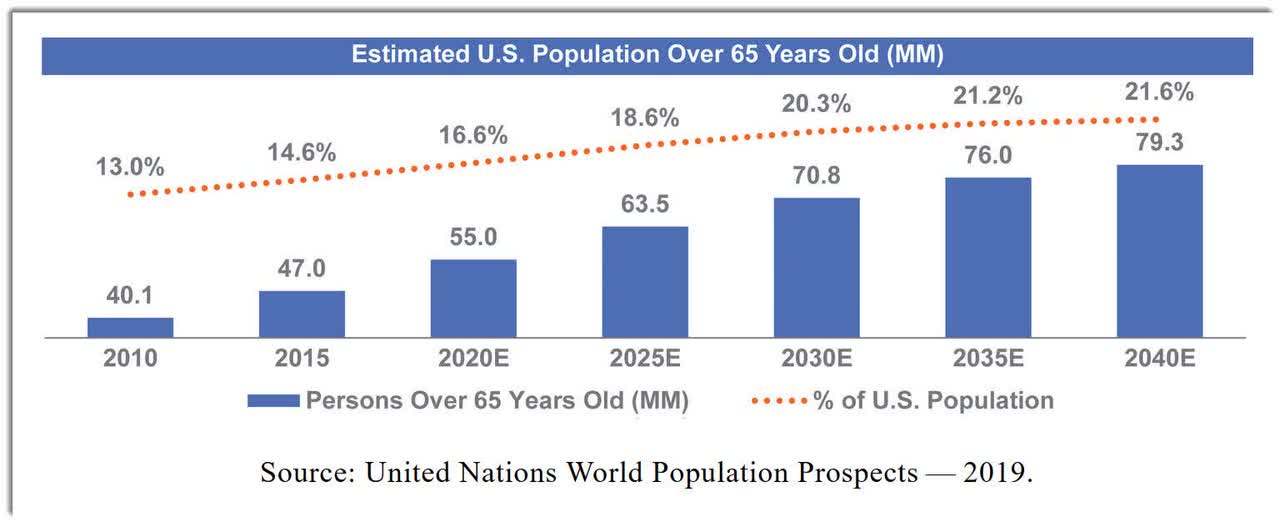

According to a 2019 market research report by United Nations World Population Prospects, the estimated U.S. population over 65 years of age is expected to grow markedly in the decades ahead as the ‘baby boomer’ generation retires, as shown in the chart below:

Annual annuity premiums reached $296 billion in 2019, or about 32% of all accident, life, annuity and health insurance premiums.

Management believes its model provides for several sources of revenue, including ceding fees, recurring policy administration and asset management fees.

Also, the firm seeks to expand its market presence to additional U.S. states and increase its product offering while developing additional distribution capacity and growing relationships with reinsurance intermediaries.

Major competitive or other industry participants include:

Financial Performance

Midwest’s recent financial results can be summarized as follows:

-

Strong growth in topline revenue

-

A swing to operating profit and positive margin

-

A swing to net income and cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2020 |

$ 11,930,000 |

364.6% |

|

2019 |

$ 3,400,000 |

288.1% |

|

2018 |

$ 876,000 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2020 |

$ 5,898,000 |

49.4% |

|

2019 |

$ (5,375,000) |

-158.1% |

|

2018 |

$ (5,037,000) |

-575.0% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

|

|

Six Mos. Ended June 30, 2020 |

$ 5,011,000 |

|

|

2019 |

$ (5,609,000) |

|

|

2018 |

$ (5,066,000) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2020 |

$ 2,480,934 |

|

|

2019 |

$ (2,457,176) |

|

|

2018 |

$ (20,369,748) |

|

Source: Company registration statement

As of June 30, 2020, Midwest had $75 million in cash and $369.8 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2020, was negative ($5 million).

IPO Details

Midwest intends to raise $50 million in gross proceeds from an IPO of its common stock, although the final figure will likely differ.

The firm’s common stock is quoted on the OTCQB as MDWT, and the last trade was on September 28, 2020, at $40.00 per share.

Management says it will use the net proceeds from the IPO as follows:

to contribute capital to American Life to support additional growth, including possible product expansion; and

for general corporate purposes, which may include acquisitions of insurance companies with state licenses of interest to us.

Management’s presentation of the company roadshow isn’t available.

The sole listed bookrunner of the IPO is Piper Sandler.

Commentary

Midwest is seeking public market capital to fund its expansion plans, both geographically and with new insurance products.

The firm’s financials indicate sharp revenue growth as a result of growth in Annuity direct written premiums.

MDWT is now producing earnings and positive cash flow from operations.

Salaries & Benefits expenses as a percentage of total revenue have dropped markedly; its Salaries & Benefits efficiency rate has swung positive; both metrics signal increasing efficiencies as the firm grows its business operations.

The market opportunity for providing annuity and related insurance products in the U.S. over the coming years and decades is significant, as the number of retirees grows owing to the baby boomer generation.

Increasing health costs along with longer life spans will put pressure on public sources of support. This, combined with boomers’ large retirement assets, will provide annuity insurers with a major source of growth potential.

However, Midwest competes with hundreds of insurers, so will need to capitalize on its technology and other offerings to differentiate itself in the market.

When we learn more about the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Consider becoming a member of IPO Edge.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.