Thesis Summary

We believe that clinical stage biopharma company CymaBay Therapeutics (NASDAQ:CBAY) holds a unique hypothesis for treatment of complex liver conditions, that insulates the company and provides grounds for additional, unexplored treatment avenues from their labels. The company has managed to secure several pipeline advancements this year, which has regained investor attention and market confidence. Consequently, we firmly believe that CBAY has begun clawing its way back to its 2019 position. On that basis, further upside is likely, on the back of positive top-line data in their Seladelpar studies in primary biliary cholangitis, or PBC, which is a chronic bile duct disease that erodes the liver’s function of producing bile. We also see the potential expansion of the label into underexploited segments, including primary sclerosing cholangitis, or PSC, and non-alcoholic steatohepatitis, or NASH.

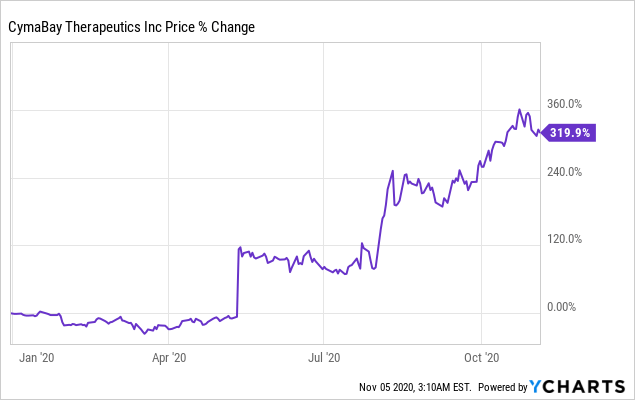

Data by YCharts

Data by YChartsShareholders have enjoyed +319% upside YTD on the back of the FDA lifting its clinical holds across all three of CBAY’s liver disease studies back in July, thereby exhibiting a reversal of fortunes and creating immense value for investor. With top-line data from the ENHANCE study meeting its primary endpoint and showing no adverse safety concerns, the company is set to create additional shareholder value within its Seladelpar segment. We advocate investors consider the points raised in this report, alongside the risks that pertain to clinical-stage companies, also highlighted.

Catalysts For Long-Term Price Change

The PBC market was valued at US$526.4 million in 2017, with expected growth of CAGR of 36.3% to $717.5 million by 2026. The current standard of treatment for PBC is ursodiol, however, this has been shown to be ineffective in over 40% of patients. Moreover, the incidence of intolerance is unacceptably high. Therefore, we believe that Seladelpar has the potential to create a remedial breakthrough for PBC patients in this market segment. Firstly, as a new standard and frontline treatment for PBC, but particularly considering its application as a second-line treatment to non-responders or intolerance to ursodiol. Therefore, the potential market size is over $287 million as a second line treatment alone, notwithstanding the potential to capture market share as a primary therapy. On this basis, we firmly believe that CBAY has a high probability percentage of capturing market share in this segment, providing they convert with Seladelpar. We see further upside in share price as more positive news is released, especially as the company has the potential to fly underneath larger players like GlaxoSmithKlien (GSK) and Johnson & Johnson (JNJ), who are also active in this market.

Top-line data from the ENHANCE study was released at the beginning of August. This was no more than 2 weeks after the FDA lifted all clinical holds attached to Seladelpar, which is now also being investigated for additional applications in PSC and NASH. ENHANCE has progressed through its phase 3 stage, and was conducted at around 100 centres in around 20 countries. Therefore, these results signal CBAY’s effectiveness in converting high quality studies to meeting primary objectives in their research. Although the ENHANCE trial was terminated early, all adjusted primary and secondary endpoints were met with statistical significance. The news has come as an elation for investors backing the company, as the FDA had placed a hold on all 3 of CBAY’s phase 2 liver disease studies back in 2019, citing adverse histological concerns. However, since the decision was lifted, shares rallied over +100% in a matter of weeks, and investors will continue to see the upside potential as this story progresses.

On this basis, we are confident in the company’s ability to convert from its pipeline, alongside the value in creating a remedial breakthrough for the PBC segment alone. With potential applications to PSC and NASH, then Seladelpar has the potential to become a superior label, that will drive revenue volumes northwards at light-speed. There are currently no approved treatments for PSC, therefore management believe the carry over shown via effectiveness in PBC, warrants exploring its safety here. Additionally, management have indicated their commercialisation strategy will involve license and potential royalty structuring. This would enable larger players to conduct most of the heavy lifting, reduce the execution risk and create long-tailed asset returns that will create shareholder value for many years to come.

Valuation

As a clinical-stage biopharmaceutical company, there are 2 ways to value CBAY. First, is to factor in the market size and potential market share, plus the probability that the company will capture a percentage of this through whatever commercial strategy. Management have guided licensing and royalty structures, which we feel the company will adhere to, as it will allow them to prioritise on R&D. Then, we need to factor in the potential of what cash flows these arrangements will yield the company. Analysing other royalty & licensing agreements in companies similar to CBAY’s position, plus the value of a potential remedial breakthrough in PBC, a yield in the range of 10%-13% is reasonable in our view. Management have also hinted at making Seladelpar non-exclusive, which will enhance the commercial reach for CBAY.

Therefore, we are confident to assume that CBAY can capture a large portion of the second-line treatment market, where ~40% of PBC patients are non-responders or intolerant to ursodiol. In our blue-sky case, we see assume a 60% probability that CBAY will capture this segment by 2022, and that they can realise a ~10% royalty or licensing yield of total net sales in this segment, via collaborative agreements. We therefore view total Seladelpar revenues of around $172.2 million by 2026, with these assumptions. We view the company reinvesting heavily back into the pipeline over this time. Assuming a FCF margin of 5%, a terminal growth rate at a 2x premium to the long-term US GDP growth, or 3.98%, and discounting back from 2026 to today at 11.55%, we see a fair value of $14.01. The 11.55% hurdle rate in the upside case is simply the opportunity cost of holding a risk-free treasury security and the S&P 500 index. Changing these figures to reflect the base case, we assume 40% probability to capture the market on sales of $114 million, 2% FCF margin, same terminal growth rate but discount at 20% back to 2020. The base case factors in the additional risks to the sales and market outcomes. With these inputs, we see a fair value of $7.70 on today’s trading. These very broad assumptions are one attempt to provide a fair value on the company from a DCF perspective, although investors should realise the inputs are based on many potentials.

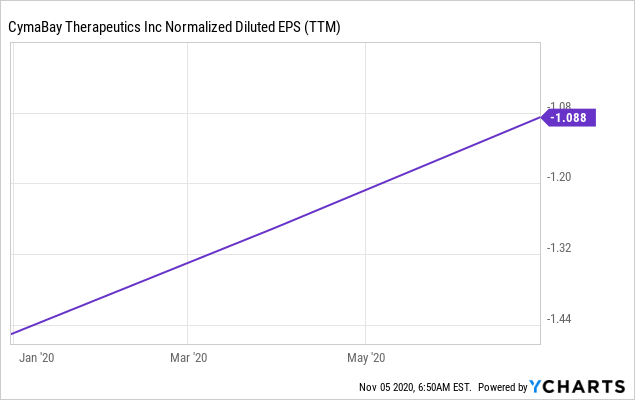

On a multiples basis, the company is trading at 3.4x book value, and around 86x gross sales. They have -$0.11 in free cash per share on a FCF yield of -30%. CBAY does have around $2.45 in cash per share, and with a market cap of ~$566 million, $168 million in cash and only $2 million in debt, we value the company on an enterprise level at $400 million. Therefore, they have $1.07 in EV/Share. We therefore feel the company is trading at a premium to peers, especially without a predictable path to profitability. These are risks that must be priced into the valuation, and the lack of a transparent valuation are risks that investors must factor to their own investment reasoning.

Data by YCharts

Data by YChartsConsidering our DCF analysis in the blue-sky case, we are confident that the company can convert at this level, therefore we assign a price target of $14.01 over the coming 12 months. Should the company release more positive data from its Seladelpar segment, we feel the market will value the shares at this level. Investors can see the potential in pricing outcomes over the coming quarters should shares continue along their current trajectory, on the chart below. This provides investors a gauge into price direction, which is essential for decisions on entry and rebalancing effects if holding CBAY in portfolios.

Data Source: Author’s Bloomberg Terminal

Further Considerations

On the charts, shares broke away in July as the FDA lifted the hold on Seladelpar. We can see investors have regained confidence since, as shares have trended in an ascending channel from this period. Shares have bounced away from the support line nicely 5x since July, and are currently being tested at the channel floor. The stock hasn’t managed to break resistance, and has been held tightly in the ranges shown on the chart below, from the red resistance line to the floor of the channel at today’s trading. Further positive news will contribute to another uptick away from current support, in our view. This would ensure that investors begin to realise the fundamental value of the company, more so than as a speculative play for short-term gains. We believe longer-term investors are candidates for CBAY, because the company has evidenced it can deliver on Seladelpar outcomes, and the potential market size is large and growing. Therefore, long-term investors should keep a close eye on the price trajectory over the coming periods. Investors can see the recent pricing activity from July, on the chart below.

Data Source: Author’s Bloomberg Terminal

In October, shares breached the RSI 70 line, entering into overbought territory. We saw a small pullback to today’s trading as a consequence, in our view. Shares are now trending within healthy RSI ranges, where they have maintained for the majority of the YTD. Back in July, shares also breached into overbought territory, and we can see the effects on market pricing from this. Therefore, longer-term investors should pay close attention to the RSI ranges for CBAY, for their own investment reasoning on entry and reallocation scale. Should shares remain away from the RSI 70 line, and the current longer-term trend continue, we believe that further upside is likely on the charts, especially as the company continues to deliver from its pipeline. Blending the fundamental picture with these indicators will provide investors with the best possible investment reasoning, in our view. Therefore, longer-term investors can pay close attention the the correlation in RSI, fundamental outlook, pipeline developments and price direction, as seen on the chart below.

Data Source: Author’s Bloomberg Terminal

Credit Summary

Management have been active in reducing the FDA overhang since the end of 2019, where they intervened on trial progression. Cash burn for the second quarter was ~$7.3 million, which was above guidance provided earlier in the year. The increase in spend was due to costs associated with close out of contracts with clinical studies, severance payments with headcount reductions, and costs associated with regulatory efforts to lift the clinical hold on Seladelpar. The company left the quarter well capitalised with ~$170 million in cash and equivalents, and the runaway on this should extend over the coming 2-year period. Therefore, the development plan for Seladelpar looks feasible into 2022 from an economics perspective. There is strength on the balance sheet, as the company hasn’t required additional capital since 2019, and equity capital has been efficiently put to work in our view. Equity to assets is at 94%, whilst total debt to capital is 1.17x, which we feel is excellent considering the capital intensive requirements of a company in clinical-stages. On a short-term solvency basis, short-term obligations are covered over 18x from liquid assets, and the debt ratio is at 1.11x from the 2nd quarter. With a strong cash position, adequate solvency coverage, no meaningful debt maturities and Altman Z-score of 7.54, this fits our thesis that cash runaway is over 2 years. Therefore, the company has strength from the balance sheet, and can leverage its cash position to fund additional essential trials coming out of 2020.

Data Source: CBAY SEC Filings; Author’s Calculations

Risks and Conclusion

CBAY has begun to claw back its position to where it was pre-2019. Since the FDA has lifted all holds on Seladelpar studies in July, shares have rocketed north as investors have regained confidence that the company will convert from its pipeline. Seladelpar has the potential to make a remedial breakthrough in the PBC segment, which is tipped for growth at CAGR of 36% to over $700 million by 2026. Seladelpar’s application as a second-line alternative to the non-responders of the current treatment standard in PBC, enables the company to extend reach to at least 40% of that figure, notwithstanding its potential as a front-line treatment as well. As the company has demonstrated sound cash management and hasn’t required additional capital over the recent periods, we see strength on the balance sheet, and adequate cash to fund the developmental portfolio over the coming 2-year period. Therefore, long-term investors who want exposure to the chronic liver disease segment, are candidates for a CBAY holding. There are risks that must be priced into the valuation, including risks that pertain to all clinical-stage biopharmaceutical companies. These include pipeline risks, where CBAY may fail to successfully convert Seladelpar, alongside other therapies. This also extends to any adverse safety data that may arise from further studies. We’ve seen the effects this has had on the company over the last year. Further, there are risks that if Seladelpar is approved, it will fail to capture market share and perform poorly in the commercialisation strategy. This is included into the executional risk profile of the company and the product. To offset these risks, management have guided at license and royalty structures in their commercial strategy for the drug. Furthermore, there are competition risks from larger players, like GSK and JNJ, however they would also be contenders in any strategic collaboration. Furthermore, there are risks on identifying the correct valuation of the company. We have postulated a few scenarios to assist, however the company does seem to be trading at a premium relative to peers on a deeper analysis. Therefore, these risks must be considered by longer-term investors.

Nonetheless, we are bullish on CBAY, and considering our DCF scenario modeling, we assign a price target of $14 over the coming 6-12 month period, in the upside case. We understand that our blue-sky modeling separates much of the risk, however we are confident the company will continue to progress forward, through ancillary study requirements that will be attached to Seladelpar, such as renal impairment studies, drug interaction studies, marketed formulations and so on. We look forward to providing additional coverage, and encourage investors to stay on top of the CBAY story.

Disclosure: I am/we are long CBAY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.