Investment Thesis

After a negative price reaction after going public in July’20, Rackspace is currently significantly undervalued compared to its peers. COVID-19 has created secular tailwinds for the cloud services industry, and Rackspace is well-positioned to capture this demand.

History

Rackspace is a multicloud technology services company that was founded in 1998. Their technology platform enables customers to manage private and public multicloud environments.

Initially Rackspace focused on selling its cloud products (i.e OpenStack Public Cloud) to its customers. However, the cloud offerings by competitors such as AWS, Google and Microsoft created a highly competitive environment for Rackspace.

Rackspace had gone public in 2009 and was taken private in 2016 by Apollo group (around the time when the cloud service market got highly competitive). During the 2016-2020 period, Rackspace transitioned itself from competing with the likes of AWS, Google and Microsoft to enabling customers to adopt their products. Rackspace positioned itself as a technology service company that enabled customers to transform their workloads to the cloud, build new cloud products and modernize applications on the cloud.

Over time, companies started adopting more than one cloud platform for their applications, and Rackspace developed its consulting and technical capabilities in optimizing for multicloud solutions. Today, Rackspace offers multicloud solutions irrespective of their customers technology stack or deployment model. They have deep partnerships with major technology platforms and strong partner relationships. Rackspace has dedicated 12 million hours and over 1bn dollars in developing their proprietary technology platform.

Rackspace eventually went public in mid-2020 during the COVID-19 Pandemic. The pandemic has served as a strong tailwind to Rackspace’s product offerings as customer flocked towards cloud solutions. Given the complexity of multi-cloud solutions and lack of in-house IT cloud resources, Rackspace has seen a surge in demand during the last quarter. This has been reflected in their Q2’20 bookings.

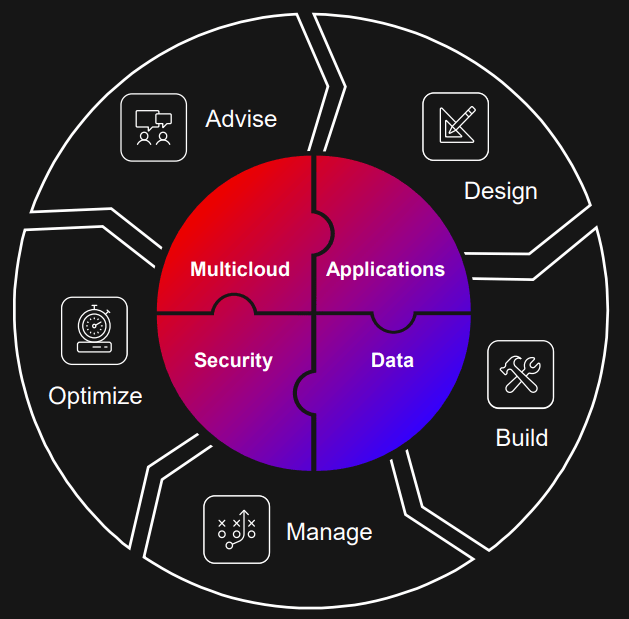

Rackspace’s typical customer journey consists of the following phases:

Source: Rackspace Technologies Q2’20 Presentation

1. The Advise Stage: Rackspace Technology provides initial advisory and support including cloud readiness assessment.

2. The Design Stage: The Company creates a detailed plan and timeline on how it can move the clients workloads to the Cloud.

3. The Build Stage: The Company helps the customer build its technology environments and move workloads across a different mix of cloud providers and deployment models.

4. Manage Stage: Rackspace operates a B2B SAAS model where it continues to maintain the customers cloud applications post building and deployment.

5. Optimize Stage: Over the long term, Rackspace aims to follow its strategy of “Land and Expand”. They company aims to continuously meet its customer requirements of cost reduction and scalability by embracing emerging technology.

Products

Source: Rackspace Technologies Q2’20 Presentation

Rackspace has 3 product verticals, which are as follows:

Multicloud Services (Representing ~79% of total revenue)

Source: Rackspace Technologies Q2’20 Presentation

Consists of Rackspace’s managed cloud services. This consists of both private and public cloud managed services. Private managed cloud services are for large enterprise clients with higher security requirements. Public managed cloud services are deployed in conjunction with AWS/Microsoft/Google.

Apps and Cross Platform (Representing ~12% of total revenue)

Source: Rackspace Technologies Q2’20 Presentation

Consists of various streams of revenue such as: Managing Applications on Cloud such as Oracle, SAP and Microsoft Products. Also consists of security solutions embedded in the cloud services. Besides this, Rackspace also sells its data services such as ETL tools, datacenters and machine learning technology to build insightful information for their clients

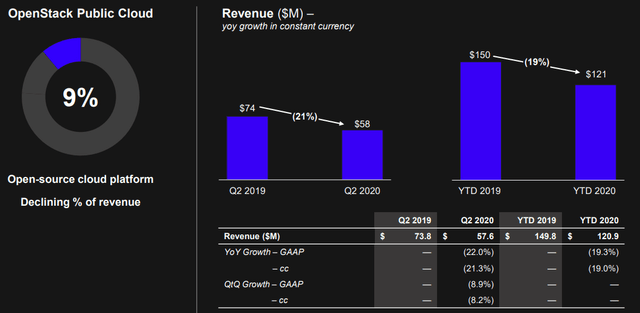

Openstack Public Cloud (Representing ~9% of total revenue)

Source: Rackspace Technologies Q2’20 Presentation

This is Rackspace’s legacy business that has been declining y/y and is expected to represent <5% of total revenue in the future

It consists primarily of customers on the legacy OpenStack Public Cloud Solutions business which stopped being offered to customers as of 2017. The company has been converting these customers to their multicloud business.

Financials, Earnings and Key Drivers of Growth

Over 2017-2019, Rackspace saw slow Revenue Growth y/y as the company transitioned itself into becoming a Multicloud Services Provider

During this period, Revenue grew from 2.1bn (in 2017) to 2.4bn (in 2019) while operating income improved from (117.6)mn to 101.6mn

Source: 10Q Q2’20 ReportIn 2020, Rackspace began to reap the benefits of its transition to a multicloud provider. Rackspace was able to generate revenue of 656.5mn USD in Q2’20 as compared to ~602.4 mn for the same period in 2019

Diving deeper into the core components of its revenue:

- Multicloud revenue increased by 15.4% y/y

- Apps and Cross Platform Revenue increased by 3% y/y

- Openstack Cloud revenue decreased ~20% y/y

Strong Bookings Growth

A strong predictor of future revenue is the bookings signed during the quarter. Typically, it takes Rackspace ~2-3 quarters to fully recognize the revenue generated from the bookings in one quarter.

When the new management team joined Rackspace in Q2’19, they placed a strong emphasis and culture of meeting sales targets. They revamped the team structure and incentive programme to ensure that sales targets were hit. Since then, sales teams have outdone the targets for 13 months in a row.

Source: Rackspace Technologies Q2’20 Presentation

Source: Rackspace Technologies Q2’20 Presentation

Valuation and Forecast

At the time of writing this article, Rackspace trades at a share price of ~$16.6. But valuation methodologies suggest that a fair valuation should be ~28 dollars. This represents a 70% upside within a year.

EV/FCF

Current Enterprise Value = 3.3 (Market Cap) + 4.0 (Debt) – 0.8 (CASH) = ~6.5bn

2021 guidance for revenue is ~2.9bn with FCF of ~400mn

Considering a EV/FCF of ~22x (IT service companies are ~28x and software companies are ~18x from Sell Side research)

This implies an EV of 22*0.4bn = 8.8bn in one year

- Assuming that the Net Debt stays the same at ~3.2bn (4bn Debt – 0.8bn Cash)

- This implies a Market Cap of ~5.6bn in one year (8.8bn – 3.2bn)

- With ~198mn shares outstanding, this implies a share price of ~28 dollars

Strengths

Some of the key strengths of the company are as follows:

Leading Pure-Play Cloud Services Company: Since going private a few years back, Rackspace has transitioned its business model to be flexible with a focus on multicloud applications. This has made it the only pureplay company that offers multicloud, managed applications and security in a single platform.

COVID-19 accelerated digital transformation: During the pandemic, businesses have realized the importance of shifting their workloads to cloud to ensure scalability, reliability and cost reductions of their businesses. More often than not, customers have turned to more than one cloud solution at once. This is a strong tailwind for Rackspace Technologies.

Proprietary software: The company has dedicated 12 million hours and over 1bn dollars in developing its proprietary software called Rackspace Fabric. This has created a strong technological moat preventing competitors from entering its turf. Besides this, Rackspace operates as a SAAS model which has high customer retention.

Key Risks

Competition: While Rackspace has developed a strong technological moat, the cloud services market is expected to get more competitive over the coming years. Competition could arise from 2 different avenues: 1) Legacy IT service providers such as Accenture, Infosys and Capgemini that are market leaders in IT solutions; 2) Big Technology Companies such as AWS, Google and Microsoft that have currently focused on Cloud Solutions.

Capital Structure: As shown below, as of the end of Q2’20, Rackspace had ~3.9bn debt and had raised ~658mn from its IPO proceedings. This implies a leverage Ratio of ~4.3x which is high for a technology service provider. The company has a target leverage of 3.0-3.5x and it is imperative for the company to continue to grow its EBITDA while paying down debt. Fortunately, the term loan is due in 2023.

Source: Rackspace Technologies Q2’20 Presentation

Source: Rackspace Technologies Q2’20 Presentation

Sales strategy and business development: While Rackspace has been successful in developing a strong technology product, the next chapter of the company’s success would be to upsell and maintain its customer base. The new management team was brought in during Q2’19 and has emphasized focus on growing bookings. It is imperative for the company to continue its strong bookings momentum and retain the customer base.

Source: Rackspace Technologies Q2’20 Presentation

Source: Rackspace Technologies Q2’20 Presentation

Conclusion

Rackspace has successfully transitioned itself to become a pure play multicloud services provider. The negative share price reaction post-IPO is unwarranted and as the company continues to show strong Revenue growth, the market should reward shareholders eventually.

Disclosure: I am/we are long RXT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.