Investment Thesis

Fortescue – Iron Ore Producer

On the surface, Fortescue (OTCQX:FSUGY) (OTCQX:FSUMF) is an iron ore miner, at the mercy of fluctuations in commodity prices, and with all its eggs in one basket, selling close to 95% by value of its ore into the Chinese market in 2020. Dig deeper, and one finds Fortescue has established moats through massive lowering of costs, working toward making its products increasingly indispensable to its customers’ production efficiency, and creating a breadth of products for all market cycles. Fortescue will continue to have its highs and lows as market prices for iron ore fluctuate. But, due to the moats it has created and continues to widen, Fortescue will likely be “last man standing” in any sustained and deep downturn in iron ore prices, remaining cash flow and net income positive during even the deepest dips in iron ore prices.

Fortescue – Explorer

Fortescue is exploring around the world for copper and gold and lithium, recognizing these commodities as essential to support decarbonization and electrification of transport systems. These efforts provide some potential “blue sky” should there be success.

Fortescue – Green Energy Producer

I have held the belief for a very long time, in the absence of nuclear as an option, hydrogen is likely the only viable means of providing large scale base load clean power to deal with the intermittency of renewable power generation. For the cost of hydrogen to come down to economic levels, scale and efficiency in production will be required, together with a start to end production and distribution system. That’s the path Fortescue is taking with their subsidiary, Fortescue Future Industries (“FFI”). They’re already off and running, putting all the pieces into place, including production, and means of storage and distribution. One only has to see all the large companies, including Fortune 500 companies, declaring their carbon free targets, and it’s obvious these same companies will inevitably be clamoring for access to FFI products to meet their goals. These products could include carbon offsets as well as clean energy for transport and industry.

Fortescue – Dividend

Fortescue has a commitment to pay out 50% to 80% of earnings by way of dividends. By my calculations, for the four years 2017 to 2020, the average dividend payout ratio was over 70%. That includes the final dividend, declared in respect of FY 2020 earnings, but paid in October 2020. Expect earnings, and thus dividends, to fluctuate in amount. But also expect earnings to remain positive, and to likely receive some level of dividend, even in the worst market downturns, due to Fortescue’s low cost structure.

Fortescue – Share price

In common with most companies involved with commodities, Fortescue attracts a relatively low P/E ratio compared to the high-tech and clean energy sectors. Fortescue will likely not only benefit from FFI earnings, but recognition as a high-tech company involved in AI and automation, and as a clean energy company, could likely cause a re-rating lifting P/E ratios, and thus share price.

Fortescue – Near-term earnings

SA Premium analysts’ EPS estimates for Fortescue are not presently available through SA Premium. This is an instance where it’s likely justified for me to carry out an independent estimate of forward EPS, and that may well provide surprising results.

Review: Fortescue Metals Group Limited

I have been quiet for a period, carrying out in-depth review and analysis of Fortescue Metals Group Limited.

There’s still much work to be completed to do justice to laying out the huge potential of this company. My analysis will continue in the weeks and months ahead with a view to projecting potential financial outcomes from growth of the existing iron ore business and the development of a world leading green hydrogen business. In this article, I wish to introduce you to this highly efficient mining business, and cover the following topics.

- Fortescue Metals Group is often described as a miner of a single commodity, iron ore.

- Fortescue may be the world’s most efficient miner and shipper of iron ore, but this dynamic technology powerhouse is much more than that.

- Fortescue is truly a technology company, with its Fortescue Hive remote control hub and autonomous drilling and haulage.

- Fortescue has demonstrably driven down cash operating costs over at least the last nine years.

- Exploration and development is ongoing, aimed at increasing volumes and maintaining and improving overall ore grades.

- An industry-leading emissions reduction goal to achieve net zero operational emissions by 2040 with potential for surprising benefits.

- Fortescue and the coming stampede into Renewable Energy/Green Industry

- Fortescue, exploring for commodities that support decarbonisation and electrification of the transport system

- Fortescue – Historical returns from a US investor’s perspective.

- Fortescue: Sound management of the “Equity Bucket”

- Fortescue: Summary and conclusions

Fortescue: Truly A Technology Company

From the Chairman’s, Dr Andrew Forrest AO, message in the Fortescue 2020 Annual Report:

We are now entering a period in which our world is changing at a pace that is unprecedented in global history. Against this backdrop, it’s very clear that artificial intelligence, including autonomy, will undoubtedly be one of the greatest industrial revolutions in history. Fortescue is leading by example and our Board and leadership understands the deep challenges and opportunities, for Fortescue and for humanity, that these technologies bring. This year, we welcomed Dr Ya-Qin Zhang to our Board. Dr Zhang’s knowledge and experience in the areas of autonomy, technology and innovation will be highly valuable as we successfully navigate this time of rapid technology advancement.

Dr Ya-Qin Zhang joins the Fortescue board –

The fact Dr Zhang could be attracted to joining the board of an iron ore miner says a lot about Fortescue – what it has achieved with technology, and what it plans for the future. Here’s a summary of Dr Zhang’s credentials excerpted from the Fortescue 2020 Annual Report, for fiscal year ended June 30, 2020.

* Dr Ya-Qin Zhang is a renowned scientist, technologist and business executive. * Founder and Chairman of Blue Entropy LLC, a Seattle-based technology consulting firm. * Joined Tsinghua University as the Chair Professor of AI Science in 2020, starting the Tsinghua Institute for AI Industry Research (AIR). * President of Baidu Inc. (NASDAQ: BIDU) Sep. 2014 to Oct. 2019, a leading Chinese multinational technology company specializing in Internet related services, mobility, artificial intelligence and cloud computing. * Prior to joining Baidu, he was a key executive of Microsoft Corporation for 16 years, including Corporate Vice President for Mobile and Embedded Products, Managing Director of Microsoft Research Asia and Chairman of Microsoft China. * Dr Zhang has made significant contributions to digital media, AI, autonomous driving and cloud computing industries, with over 60 granted US patents, 500 peer-reviewed publications, and numerous contributions to international standards. * He serves on the Board of Stewardship for the Future of Mobility of the Davos World Economic Forum and Chairman of the Apollo Alliance, the largest open platform for autonomous driving in the world.

The Fortescue Hive –

From the 2020 annual report,

When our Train Control Centre opened in 2009, we were the first operation in Western Australia to control a railway from outside the region. Now known as the Fortescue Hive, the expanded, purpose-built remote operations facility was opened in 2020 and includes our planning, operations and mine control teams, together with port, rail, shipping and marketing teams. The newly refurbished space allows team members across our complete supply chain to work together, 24 hours a day, seven days a week, to deliver improved safety, reliability, efficiency and commercial outcomes

and

The Fortescue Hive, our expanded Integrated Operations Centre, brings together our entire supply chain to deliver significant safety, productivity, efficiency and commercial benefits and will underpin our future use of technology, including artificial intelligence and robotics.

The image below shows a section of the Fortescue Hive

Image kindly provided by Fortescue

Autonomous Drilling and Haulage –

From the 2020 annual report,

Fortescue was the first company in the world to deploy Caterpillar (CAT) autonomous haulage on a commercial scale when trucks fitted with autonomous haulage system (AHS) technology began operating at the Solomon Hub in 2012. Today, our AHS deployment represents the largest fleet conversion to autonomous haulage in the industry and demonstrates our unique capability to manage and operate a multi-class truck size autonomous haulage site.

Images kindly provided by Fortescue

Fortescue completes world leading autonomous haulage project –

Excerpts from Fortescue news release Oct 28, 2020,

Fortescue Metals Group (Fortescue) has celebrated an important milestone with the completion of the Company’s Chichester Hub autonomous haulage project. The project, which represents one of the largest fleet conversions to autonomous haulage (AHS) in the industry, has expanded the Fortescue autonomous haulage fleet to 183 trucks operating at Fortescue’s Solomon and Chichester Hubs. The multi-class fleet includes Cat 793F, 789D and Komatsu 930E haul trucks and has safely traveled more than 52 million kilometers and moved 1.5 billion tonnes of material since 2013. An additional 900 assets, such as excavators, wheel loaders and light vehicles, are integrated with the autonomous fleet using CAT Minestar Command for Hauling Technology which is operated from the Fortescue Hive, the Company’s integrated operations centre in Perth, Western Australia.

Chief Executive Officer, Elizabeth Gaines said, “… the introduction of AHS technology has improved safety outcomes across our operations…. “Around 3,000 Fortescue team members have been trained to work with autonomous haulage, including over 200 people trained as Mine Controllers and AHS system professionals,” Ms Gaines said. Chief Operating Officer, Greg Lilleyman, said, “Fortescue’s autonomous haulage fleet has delivered a 30 per cent increase in productivity. Looking ahead, the flexibility of our efficient, multiclass autonomous fleet offers considerable potential for further productivity and efficiency gains.

Group president, Resource Industries, Caterpillar Inc., Denise Johnson, said “Fortescue is a leader in the implementation of autonomous solutions. This important milestone further reinforces the transformation Fortescue has made with autonomy to improve safety, site productivity and machine utilisation. We congratulate Fortescue on this significant achievement.”

Author’s note – The Fortescue Hive operations center in Perth, the capital city of Western Australia, is over 800 miles (1,300 km) from Fortescue’s mining operations.

Fortescue: Demonstrably Driving Down Cash Operating Costs

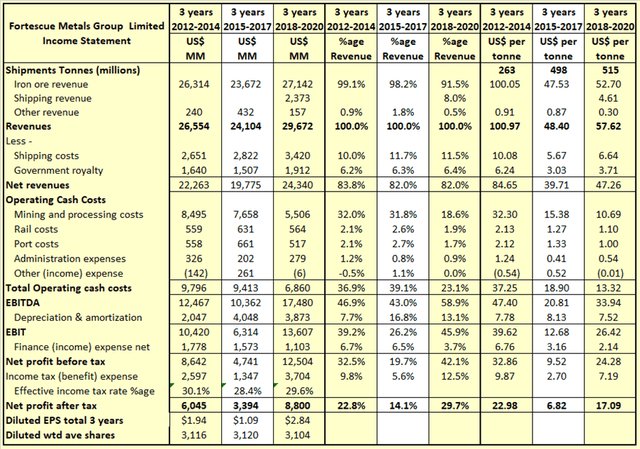

Table 1

The criticality of low unit production costs –

Table 1 above compares operating and financial results for Fortescue for the three-year periods ending 2014, 2017, and 2020. On a per tonne shipped basis, for the three years ended 2020, compared to the three years ending 2014, mining and processing cash costs have been cut by two thirds, rail costs have almost halved, and port and administration costs have more than halved. Some of that per tonne reduction is due increased volumes. But, even between three years ended 2020 vs. three years ended 2017, there’s almost one-third reduction in mining and processing cash costs and significant decreases in rail and port costs, certainly not attributable to volumes. Mining companies generally have little to no control over fluctuations in the prices of the commodities they produce and sell in international markets. However, they do have considerable control over the cost of production of their products and can forecast with reasonable accuracy the long-term cost of production per tonne, subject to inflation levels. For example, the key factor in Utah International Inc. and its partners proceeding with Escondida, the world’s largest copper mine, was the projected landed cost of copper concentrate at refinery in Taiwan, was always below the lowest historical inflation adjusted selling price of copper concentrate, for the life of mine. This is enormously important as it means a project will always be cash flow positive even at the lowest market lows. Mines often have to continue operations through market downturns, despite negative cash flows, because the costs of a temporary mothballing and restart of operations can be prohibitive, and the length of the downturn cannot be predicted. Table 1 shows there was a severe downturn in the iron ore market in the 2015 to 2017 period (and into the 2017 to 2020 period), but Fortescue’s cost structure allowed it to not only operate cash flow positive, but also net income positive.

Fortescue: Low ore grades –

It’s worth mentioning at this stage, Fortescue produces a relatively low grade iron ore, which attracts a lower price for the Fe content. At times of high steel demand, iron ore prices and volumes will increase across the board, but those ores with higher metal content will be more in demand because they facilitate greater steel output. Conversely, at times of lower steel demand, when throughput capacity is not a constraint, lower grade iron ore will be in favor because the price for the metal content is lower. Of course, a higher grade ore is desirable, but it’s believed this demand aspect provides some cushioning for Fortescue when demand is low. And, with Fortescue’s low per tonne operating costs, low market prices do not create an existential crisis for the company. This November 2018 article provides some useful color on the aspect of low grade iron ore pricing, including this excerpt,

PORT HEDLAND – Australia’s Fortescue Metals Group is set to ship the first cargo of its new mid-grade iron ore next month just as a rout in Chinese steel prices helps it improve its margins in competition with higher grade products.

Fortescue: Ongoing Exploration and Development

Increases in ore production capacity

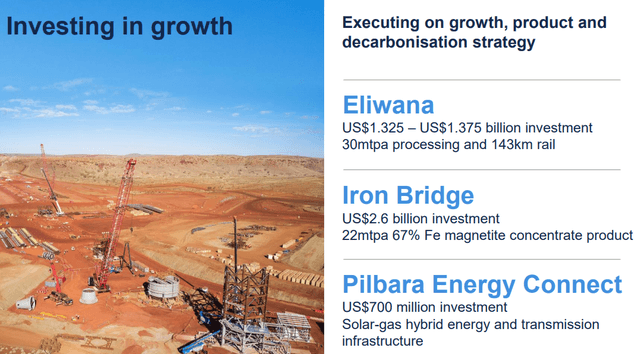

Figure 1 below, from the Fortescue 2020 AGM presentation, provides details of Fortescue’s current expansion projects.

Figure 1

The Eliwana ore is hematite, similar to ore from the existing ore bodies being mined. First ore is scheduled to be on train in December 2020 (see here).

Eliwana will contribute to Fortescue’s core iron ore business as it underpins the ramp up of our 60.1% Fe West Pilbara Fines product. The operation will maintain our low cost status, providing greater flexibility to capitalise on market dynamics (see here)

Increase in port throughput –

From Fortescue press release of Sept. 4, 2020,

Fortescue Metals Group Ltd (Fortescue) confirms that it has received approval under the West Australian Environmental Protection Act 1986, to increase the material handling capacity of its Herb Elliott Port facility from 175 million tonnes per annum (mtpa) to 210mtpa on a staged basis. This includes provisions for 188mtpa of hematite ore and 22mtpa of magnetite concentrate. The high-grade magnetite product will be produced from the Iron Bridge Magnetite operations (Iron Bridge), with first ore on ship from Iron Bridge scheduled for mid-2022. The revised licence utilizes the capacity of Fortescue’s existing port infrastructure, comprising five berths and three ship loaders, and supports the Company’s FY21 iron ore shipments guidance of 175mt to 180mt.

While guidance indicates 175mt to 180mt shipments of hematite ore through the company’s June 30, 2021, fiscal year end, there’s now capacity for this to increase to 188mtpa in subsequent fiscal years. In addition, the company expects to commence shipping of the much higher value magnetite ore, at a rate of 22mtpa, from around the commencement of its FY 2023 year on July 1, 2022.

Breadth of product for all market cycles –

From the Fortescue 2020 annual report,

Our US$4.0 billion investment in the world class Eliwana Mine and Rail and Iron Bridge Magnetite projects, once complete, will position Fortescue as the only major iron ore company with a breadth of product offering to meet all market segments from its Australian operations. This is a key differentiator for Fortescue, ensuring we continue to deliver growth in earnings and cash flow and enhanced returns to our shareholders through all market cycles.

Fortescue: Emissions reduction goal to achieve net zero operational emissions by 2040.

Fortescue’s FY20 Climate Change Report discusses its aim of net zero carbon emissions by 2040. Initiatives of particular interest gleaned from the report –

- 150MW of solar photovoltaic (PV) generation and large scale battery storage enabling avoidance up to 285,000 tonnes of CO2, as compared to generating electricity solely from gas.

- Integrating carbon pricing into the project evaluation and investment decision making process, to identify climate-related risks and opportunities. Incentivises projects which use low or negative emission technologies.

- Engaging customers on opportunities to reduce their emissions from iron and steel making. Fortescue low grade ores undergo a high level of beneficiation providing opportunities to maximize metallurgical performance and minimize emissions through deep-bed sintering. This process has the potential to double productivity with minimal increase in coking coal consumption and is actively promoted by Fortescue to its customers. Fortescue is undertaking collaborative research with a major Chinese steelmaker to assess the benefits of deep-bed sintering by introducing Fortescue ore into its blends.

- 2018 landmark partnership agreement with the CSIRO to develop its metal membrane technology, providing the potential for the bulk transportation of hydrogen through ammonia. A portfolio of additional projects associated with hydrogen production, storage, and use is under development to position to meet the demand for hydrogen as a major export opportunity. Working with vehicle manufacturers to maximize opportunities to use hydrogen as a fuel source for mining vehicles and equipment (Fortescue’s current fleet consumes around 400 to 450 million litres of diesel per year). Entered into a partnership to deploy hydrogen refuelling infrastructure across Western Australia.

Fortescue and the coming stampede into Renewable Energy/Green Industry

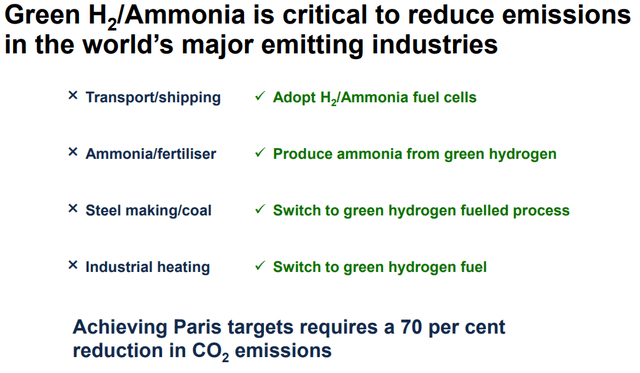

The heading above can be found in presentation at the Fortescue 2020 AGM which took place on Nov. 11, 2020. I encourage anyone interested in the transition from fossil fuels to a hydrogen fuel-based economy to read this presentation in detail. Here are some excerpts from the presentation:

Figure 2

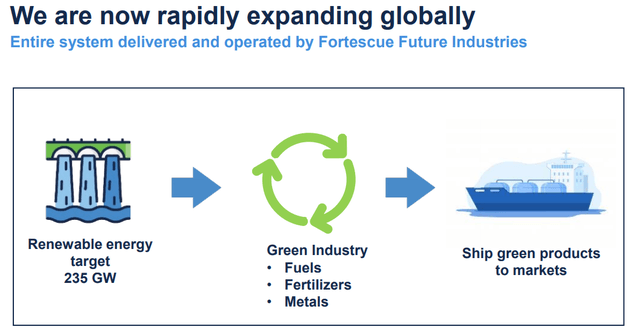

Figure 3

Figure 4

According to this article, “Fortescue to take on fossil fuel giants with expansion into green energy” –

Dr Forrest revealed FFI would aim to build 235 gigawatts of installed energy capacity – greater than Chevron’s 2019 energy production – and had already committed to $1billion out to 2023... He said a team of 40, including himself, had already visited 23 countries to buy up renewable energy patents and intellectual property…”As each project rolls in we will be considering them on their merit and where we establish markets as we did for Fortescue, where we establish independent financing secured only against the assets, exactly like we did with Fortescue, then we will go ahead and finance and develop those projects,” he said… “When we as Fortescue, the pioneer, can really lead the way of large volume, low cost, green hydrogen and green ammonia shipped around the world, then you’ll see others join and you will begin to see the commercial driving end of climate change.”

Some of the initiatives Fortescue is undertaking in the green energy space are indicated above. Fortescue has huge ambitions for green energy based on hydrogen, and the will, the capability, and the financial strength to fulfil its ambitions. Through its wholly-owned subsidiary, Fortescue Future Industries (“FFI”), it plans to establish complete hydrogen supply chains, with the entire system delivered and operated by Fortescue Future Industries. Projects will be financed under arrangements which are non-recourse to Fortescue. Fortescue has indicated it is targeting projects in 47 countries, and so far, 23 countries visited. This is not something being planned for commencement far into the future. Some of the initiatives already underway are detailed in the links, and excerpts from those links, below.

Nov. 17, 2020, Fortescue announces development study into green ammonia plant in Tasmania:

The project envisages the construction of a 250MW green hydrogen plant at the Bell Bay Industrial Precinct with green ammonia production capacity of 250,000 tonnes per year for domestic and international export. It has the capacity to be one of the world’s largest green hydrogen plants, powered entirely by Tasmanian renewable energy. The project is targeted for an investment decision by the Fortescue Board in 2021.

Sept. 11, 2020, The Minderoo Foundation and Fortescue Future Industries establish opportunities in Afghanistan:

Fortescue Future Industries Pty Ltd (FFI), a wholly-owned subsidiary of Fortescue Metals Group Ltd (Fortescue), and the Government of Afghanistan have signed Deeds of Agreement to undertake studies for the development of hydropower and geothermal projects for green industries, as well as studies across a range of mineral resources. Subject to the completion of feasibility studies and approvals, individual projects will be developed by Fortescue Future Industries with ownership and project finance sources to be separately secured without recourse to Fortescue.

Sept. 4, 2020, Fortescue Future Industries and Minderoo Foundation in Indonesia:

Fortescue Future Industries Pty Ltd, a wholly owned subsidiary of Fortescue Metals Group Ltd (Fortescue) has entered into a Deed of Agreement with the Government of the Republic of Indonesia (represented by the Coordinating Minister for Maritime Affairs and Investment)….The Deed of Agreement provides first priority to Fortescue Future Industries to conduct development studies into the feasibility of projects utilising Indonesia’s hydropower and geothermal resources to support green industrial operations, principally for export to global markets… Subject to the completion of feasibility studies and approvals, individual projects will be developed by Fortescue Future Industries with ownership and project finance sources to be separately secured without recourse to Fortescue…. Minister Luhut commented, “For too many decades, proposals have been thrust upon Indonesia that rely on the Indonesian people assuming the full financial risk through the purchase of electricity at prices that underwrote these developments. This agreement allows Fortescue Future Industries to access all the major hydropower and geothermal opportunities in Indonesia and establish downstream value adding industry to fully utilise the power created from sustainable energy sites.”

Sept. 1, 2020, Fortescue Future Industries Pty Ltd & Papua New Guinea Government:

Fortescue Future Industries Pty Ltd (Fortescue Future Industries), has entered into a Deed of Agreement with the Papua New Guinea (PNG) Government and its wholly owned corporation, Kumul Consolidated Holdings Limited (KCH)... Under the Deed, the parties will promptly investigate the feasibility of potential projects for development of PNG’s hydropower resources to support green industrial operations largely for export to global markets, and also for domestic consumption… Subject to the completion of feasibility studies and approvals, individual projects will be developed by Fortescue Future Industries with ownership and project finance sources to be separately secured without recourse to Fortescue.

Aug. 20, 2020, Fortescue joins forces with Hyundai and CSIRO to fast track development of hydrogen technology

The MOU outlines areas of cooperation that involve the development and future commercialisation of the metal membrane technology (MMT) which has been developed by the CSIRO, supported by a landmark partnership with Fortescue. Hyundai will seek to demonstrate the viability of the technology for renewable hydrogen production and vehicle fuelling in Korea.

Aug. 17, 2020, Fortescue advances hydrogen technology at Christmas Creek

The A$32 million renewable hydrogen mobility project – the first for an Australian mining operation – will see the deployment of 10 full-sized hydrogen coaches, custom built by HYZON Motors, to replace the existing fleet of diesel coaches at Christmas Creek from mid-2021. It will be supported by the installation of a refuelling station, which will harness renewable electricity from the Chichester Solar Gas Hybrid Project to generate renewable hydrogen onsite.

Image of Hyzon5 kindly provided by Fortescue

Fortescue, exploring for commodities that support decarbonisation and electrification of the transport system

From the Fortescue 2020 Annual Report,

We are focused on early stage exploration of commodities that support decarbonisation and the electrification of the transport sector, and continue to assess copper, gold and lithium opportunities throughout Australia, South America and Europe. Due to COVID-19, a number of these exploration activities were suspended during FY20, particularly in South America, and we continue to support our team members impacted by the pandemic, with the intention to resume exploration

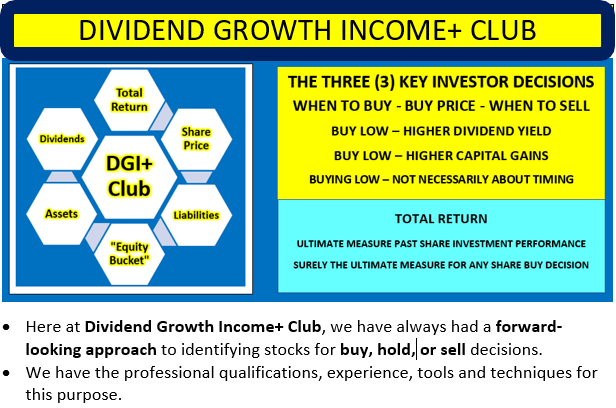

Before proceeding further, I should explain a little about the Dividend Growth Income+ Club approach to financial analysis of stocks.

Understanding The Dividend Growth Income+ Club Approach

Total Return, Dividends, Share Price

Undertaking exercises to determine the current value of a stock is a waste of time when the market continually provides the only current value that matters when it comes to buy a stock. The only way an investor can achieve a positive return on an investment in shares is through receipt of dividends and/or an increase in the share price above the buy price – the only way. It follows what really matters in share value assessment is the expected price at which a buyer will be able to exit shares, and expected cash flow from dividends.

Changes in Share Prices

Changes in share price are driven by increases or decreases in EPS and changes in P/E ratio. Changes in P/E ratio are driven by investor sentiment toward the stock. Investor sentiment can be influenced by many factors, not necessarily stock specific. Such factors include perceived quality of a stock, Warren Buffett or another well-known investor acquiring or disposing of a position, an event such as Brexit or the COVID-19 pandemic, expected future earnings growth for the stock, and the state of the economy, now and in the future.

“Equity Bucket”

Earnings are tipped into the “Equity Bucket” for the benefit of shareholders. It’s prudent to check whether distributions out of and other reductions in the “Equity Bucket” balance are benefiting shareholders.

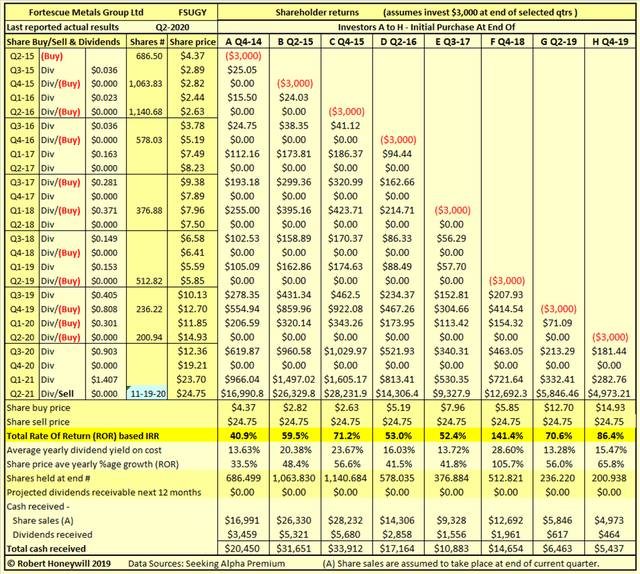

Fortescue – Historical returns from a US investor’s perspective

Fortescue’s financial statements are presented in United States dollars, which is the Group’s reporting currency and the functional currency. Iron ore sale prices are denominated in US currency. While commodity price risk remains, there is no currency risk in respect of revenue for US investors. There is exchange risk in respect of costs incurred and paid for in AUD, but this is no different to a US corporation selling in the US but sourcing, or manufacturing its products overseas.

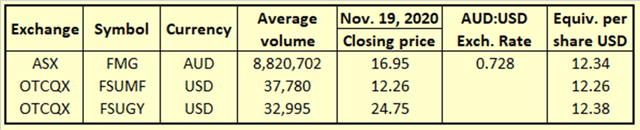

Fortescue is listed on the Australian Stock Exchange – ASX (Symbol: FMG) and on the OTCQX in the US under the symbols FSUMF and FSUGY. FSUGY are ADRs managed by Citi, with two ordinary FMG shares equaling one ADR. Table 2 below summarizes comparative quotes and volumes.

Table 2

Investors will have their own preferences for which market they buy in and will likely have differing brokerage fees. Citi takes a fee on purchase and sale of FSUGY ADRs, and also on payment of dividends. Tax agreements between the US and Australia should result in US investors being eligible to receive offsetting credits for any withholding tax (this is not intended, nor should it be regarded as tax advice, and readers should read and observe the disclaimer at the end of this article). A link to details of dividend payments through Citi can be found here. Details of historical shareholder returns, buying FSUMF or FSUGY, appear in Tables 3.1 and 3.2 below.

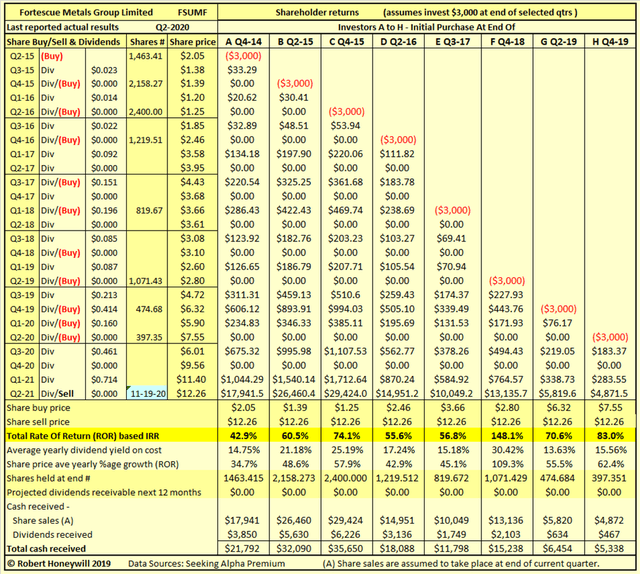

Table 3.1 FSUMF

Table 3.2 FSUGY

For both FSUMF and FSUGY, the returns have been fabulous. The slightly lower returns for FSUGY result from the deduction of the Citi fee on the FSUGY dividends. No account has been taken of Citi fees on the purchase and sale of FSUGY shares.

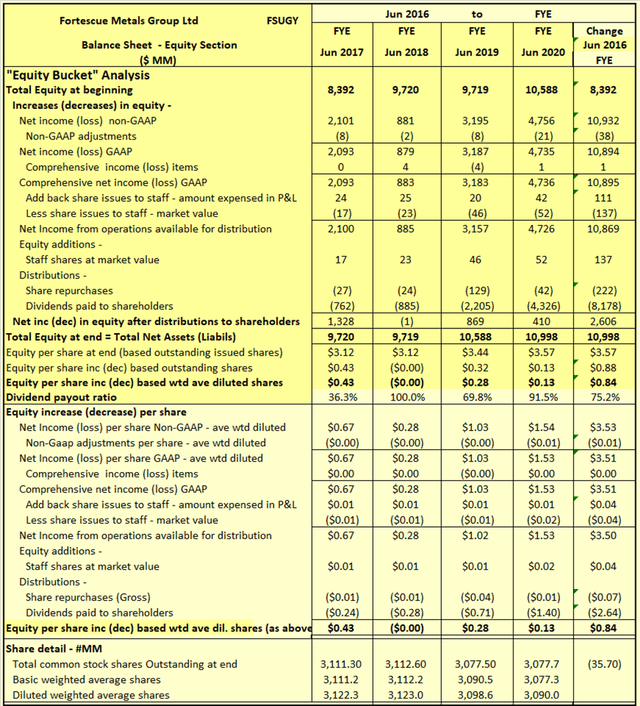

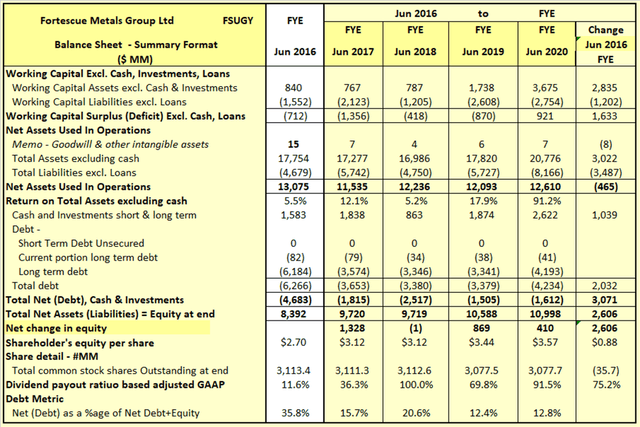

Checking Fortescue’s “Equity Bucket”

Table 4.1 Fortescue Balance Sheet – Summary Format

Note – For purposes of presentation, I have adjusted out of cash and equity, $2,233 million dividends, declared in respect of FYE June 30, 2020, but paid in October 2020. This is, of course, a very conservative approach.

Table 4.1 shows an increase in shareholders’ equity of $2,606 million over four years, July 1, 2017, through June 30, 2020. This $2,606 million increase in equity, together with funds from a $465 million reduction in net assets used in operations, was applied to decreasing net debt by $3,071 million. Further analysis of the $2,606 million increase in equity is provided below.

Table 4.2 Fortescue Balance Sheet – Equity Section

I often find companies report earnings that should flow into and increase shareholders’ equity. But, for various reasons, the increase in shareholders’ equity does not materialize. Also, there can be distributions out of equity that do not benefit shareholders. Hence, the term “leaky equity bucket.” I can say very definitely this has not happened with Fortescue. Over the four years ending June 30, 2020, reported GAAP earnings totaled $10,932 million. After minor adjustments for comprehensive income items, and estimated market value vs. book value of shares issued to staff, the reported $10,932 million, reduces slightly to net income available for distribution to shareholders of $10,869 million. Issue of shares to staff at estimated market value of $137 million increases funds available for distribution to $11,006 million. Of this $11,006 million, $222 million was spent on share repurchases, and $8,178 million distributed to shareholders by way of dividend, leaving $2,606 million increase in shareholder funds, for the benefit of shareholders.

Fortescue Projected Returns

At this stage, I would normally proceed to project a range of potential returns for an investment in Fortescue shares based on SA Premium analysts’ consensus, high, and low EPS estimates, and selected historical P/E ratios. SA Premium does not have EPS estimates available for Fortescue. Fortescue shows such promise I intend to produce my own range of EPS estimates, employing my proprietary 1View∞Scenarios™ modeling system and dashboards. This will necessarily be the subject of a separate exercise from this current article.

Fortescue: Summary and conclusions

Fortescue is one of the more exciting companies I have come across. Quantifying its potential in financial terms is difficult at this embryonic stage of its development into a green energy company. But I’m fairly certain quantification of growth of earnings in just its existing iron ore business will yield surprisingly good potential outcomes. While I cannot quantify at this stage, I expect exponential growth in earnings from the green energy business in due course. One area of risk is the current tension that has developed between Australia and China, but I’m hopeful that will be resolved amicably. It’s some comfort, the very good relations Fortescue has developed with China, may isolate it from any trade difficulties.

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide an