Founded in 2014, Chinese startup car manufacturer Nio (NYSE:NIO) is still a relatively young electric vehicle (EV) company. However, it’s now worth more than General Motors (NYSE:GM). Though, General Motors’ sales overshadow both Tesla’s (NASDAQ:TSLA) and NIO’s. GM sold more than 3 million vehicles in China in 2019. If that is making your head spin, then it shouldn’t. We live in a world where Tesla is now worth about as much as that of the nine largest car companies globally, despite selling a fraction of cars they do. Meantime, NIO stock has outperformed the S&P 500 by 1,238.4% and its sector by 1,202.5% in the past year.

Understandably, it is leading to overvaluation fears. Out of 19 analysts covering NIO stock, only ten have a bullish view on the Chinese EV maker. Citigroup analyst Jeff Chung recently downgraded the China-based electric vehicle maker, citing concerns over competition from Tesla. That’s not to say the company is going through a bad patch. In the past six quarters, NIO reported four positive earnings surprises. In the fourth quarter of 2020, NIO delivered 17,353 vehicles, representing an increase of 111.0% year-over-year. But with valuation multiples so high, you need a more attractive entry point to initiate or add to your position.

NIO Stock: Tesla-Led Frenzy Leading To Unreasonable Valuations

Please make no mistake about it, NIO stock is an investor’s delight. From a fundamental perspective, the Chinese EV maker is going from strength to strength. In the third quarter of 2020, the gross margin was 12.9%, compared with negative 12.1% in the third quarter of 2019 and 8.4% in the second quarter of 2020.

Total revenues were US$666.6 million, representing an increase of 146.4% year-on-year and a 21.7% increase sequentially.

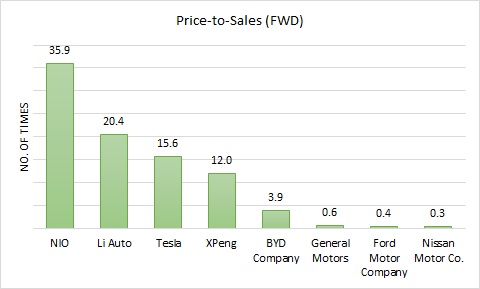

Considering all this, it’s not surprising that investors are valuing the company highly. There is no EV maker out there trading at a higher price-to-sales ratio than NIO. The industry leader, Tesla, trades at a mere 15.6 times forward price-to-sales. You can chalk this down to several factors. NIO performs exceptionally, has a sound outlook, and has the world’s biggest country on its side.

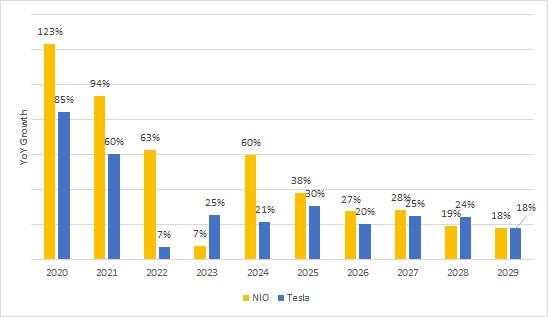

Let’s talk about the outlook first. Sales are expected to grow 48% on average in the 2020-2029 horizon. In comparison, Tesla is projected to increase sales by an average of 32%. Not too shabby, but NIO clearly takes the cake here.

Now let’s talk about the major piece of the puzzle, China, which hopes new energy vehicle (NEV) sales will represent approximately a quarter of all car sales in 2025. NIO will produce a lot of these vehicles. Plus, I have made this point several times that the Chinese are famous for preferring their own brands. And before I move to the next section, it’s important to mention that a local Chinese government bailed out Nio with a crucially-timed $1 billion last year.

Strike While the Iron Is Hot

Nio’s management has taken advantage of strong investor interest by raising $1.3 billion in convertible senior notes. Holders may convert their notes for cash, stock, or a combination of cash and stock. The EV maker plans to use the net proceeds from the offering mainly for general corporate purposes and further strengthen its cash and balance sheet positions.

The 2027 senior notes will pay interest at a rate of 0.50% a year. That isn’t too bad. However, the major issue for me is the potential ballooning of outstanding share capital. It has already grown 4,973.65% from the first quarter of 2018 to the third quarter of 2020. Granted, all of this capital will go towards ramping up production. However, diluting existing shareholding is not an effective way to drum up cash. Regardless, this serves as another sore spot for potential investors.

Too Hot to Handle

Nio came into its own in 2020. It was a banner year for the Chinese automaker and several other electric vehicles (EV) stocks. However, even though the company is doing well, its current valuation doesn’t make sense. Tesla, the darling of the industry, is still a cheaper option. And you’ve probably gone through a dozen articles on how it’s overvalued. Plus, the recent growth in U.S. EV sales is sluggish at best, and almost all of it is coming from the Tesla Model Y. The lack of diversification is a point of concern that Nio needs to address to emerge as a strong EV player outside China.

Considering all these factors, I would wait for shares to cool off before adding more NIO stock to my portfolio. For now, if you invested money in the Chinese EV marker, it’s time to book your profits. As my colleague Thomas Niel points out, the EV bubble is bound to burst soon, and you don’t want to be there when that happens.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. Faizan has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio. Faizan does not directly own the securities mentioned above.