MikeMareen/iStock Editorial via Getty Images

Gilead Sciences (NASDAQ:GILD) is one of the few investments in my rather concentrated portfolio, which is marked red as my position is 13% down (FX-impacted as I live in Germany). And of course, there are other positions which are also down – Alibaba (BABA) and Tencent (OTCPK:TCEHY) for example – but Gilead Sciences was bought already 5 years ago, and the investment is still not profitable (the investment is profitable when including dividends).

So far, I kept Gilead Sciences in my portfolio, and I will continue to hold as I am still confident that Gilead Sciences is undervalued and will move higher at some point. When focusing on positive news, we can state that Gilead Sciences has returned 20% in the last year (not including dividends) and the stock is trading close to its 52-week high. And in the following article, I will show once again why I think Gilead Sciences has the potential to move even higher.

Quarterly Results

Gilead Sciences could once again report a strong quarter with high growth rates for the top and bottom line. Total revenue increased from $6,577 million in the same quarter last year to $7,421 million this quarter – an increase of 12.8% YoY. Income from operations almost doubled and increased from $2,001 million in Q3/20 to $3,842 million in Q3/21. And earnings per share increased from $0.29 in Q3/20 to $2.06 in Q3/21 – an increase of 610%. But non-GAAP earnings per share also increased 25.6% YoY from $2.11 to $2.65. And finally, free cash flow increased 48.6% YoY from $2,095 million to $3,114 million.

(Source: Gilead Sciences Q3/21 Presentation)

And similar to past years, Gilead Sciences has once again a dominant product, which is responsible for a huge part of its revenue: Biktarvy, which generated $2,276 million in sales this quarter (over 30% of total sales). Compared to the same quarter last year, Biktarvy increased its sales 20.4% and it is therefore one of the few products contributing to growth right now.

Veklury

And while it is correct, that Biktarvy is generating the highest revenue of all products, we also must mention Veklury, which is contributing to growth and was basically responsible for revenue growth in the third quarter. Veklury sales increased from $873 million in the same quarter last year to $1,923 million this quarter. When excluding Veklury, total product sales declined from $5,620 million in Q3/20 to $5,433 million this quarter.

(Source: Gilead Sciences Q3/21 Presentation)

But analysts are rather careful about including Veklury sales in any estimates for the quarters and years to come – and we should be too. Veklury, which is better known as “remdesivir”, was originally developed to treat hepatitis C. Since 2020, remdesivir is used to treat COVID-19 patients and the current sales are therefore linked to the COVID-19 pandemic. And analysts are justifiably expecting Veklury sales to decline in the quarters and years to come as COVID-19 cases (and hospitalizations) are hopefully declining as well.

(Source: Gilead Sciences Q3 2021 Resource Book)

So far, more than 9 million patients globally have been treated with Veklury and 3 in 5 patients hospitalized in the United States were treated with Veklury. In my last article about Fresenius SE (OTCPK:FSNUY) I wrote about the fact that I (and probably many others) was too optimistic about COVID-19 cases in the last few months and the statements I made in articles before December 2021:

At the beginning of December, we now know, that this statement was way too optimistic, and COVID-19 hit many European countries with full force again. Vaccination rates are still too low in many countries – including Germany – and most likely more people will have to be treated in hospitals (especially the intensive care unit) than last year.

In the meantime, COVID-19 cases also exploded in the United States with numbers never seen before and – with the usual time-lag – hospitalizations are also increasing again.

(Source: New York Times)

Right now, there are several studies and publications indicating lower hospitalization rates and lower death rates for the Omicron variant of the virus, which is already dominant in many countries around the world. But while in relative numbers, hospitalizations and deaths might decrease, in absolute numbers hospitalization might still increase due to much higher number of infections.

And when considering these facts, there is also the possibility that Gilead Sciences will profit from high Veklury sales much longer than we expect right now. Analysts are expecting lower revenue for the next quarters again as the positive impact from Veklury is missing. But it is not unlikely that Gilead Sciences might surprise again and Veklury sales in the fourth quarter of fiscal 2021 are higher than expected. For the fourth quarter, management is expecting Veklury sales to be between $300 million and $600 million but considering $4.2 billion in sales in the last nine months, the estimates might be too low. And considering rising hospitalizations, Veklury sales might also be high in the first quarter of fiscal 2022.

Many experts (like Professor Christian Drosten from Berlin) assume that COVID-19 will become endemic during 2022 in most countries around the world and hopefully new reported cases, hospitalizations and deaths will decline. And in this case, Veklury sales will also decline again. And while Veklury sales could once again be high in 2022, sales for 2023 will probably be much lower.

Growth

Right now, Veklury is contributing to growth, but over the next few years, Gilead Sciences will need other contributors to growth. And when looking at the pipeline and investor presentations, we must assume that Gilead Sciences has several opportunities to grow. But we could identify a similar growth potential in the last few years and Gilead Sciences did not really manage to grow in these years but was struggling.

(Source: Gilead Sciences Q3/21 Presentation)

After the expected decline in EPS in fiscal 2022 (due to lower Veklury sales), analysts are expecting earnings per share to increase again between 2022 and 2030 and analysts are expecting a CAGR of 3.1%. I also won’t expect phenomenal growth rates from Gilead Sciences in the years to come, but see solid growth rates in the low-to-mid single digits.

In the past, Gilead Sciences also made two major acquisitions. In 2017 it bought Kite for almost $12 billion and recently, it bought Immunomedics for $21 billion. And while there is the risk, that Gilead Sciences overpaid for these two acquisitions, we also must expect that both acquisitions will contribute to growth in the years to come.

Balance Sheet

And these two acquisitions certainly had a negative effect on the balance sheet of Gilead Sciences and resulted in much lower “cash and cash equivalents” on the balance sheet as well as higher debt levels. Don’t get we wrong, Gilead Sciences still has a solid balance sheet, but it was better in the past with higher cash reserves and rather low debt levels.

On September 30, 2021, Gilead Sciences had $2,511 million in short-term debt and $25,175 million in long-term debt. When comparing the total debt to the stockholders’ equity of $21,471 million we get a D/E ratio of 1.29, which is a bit higher than I would like to see, but no reason to panic. Additionally, we can compare total debt to the operating income Gilead Sciences can generate (in the last four quarters operating income was $11,870 million) and it would take about 2.3 years to repay the outstanding debt.

When looking at the asset side, Gilead Sciences has $8,332 million in goodwill on its balance sheet (compared to total assets of $67,098 million this seems acceptable). Additionally, Gilead Sciences has $33,900 million in intangible assets, which is a lot, but intangible assets do not necessarily have to be a bad thing and pharmaceutical companies have a lot of patents which certainly are valuable. And finally, Gilead Sciences has $4,362 million in cash and cash equivalents, $1,376 million in short-term marketable securities and $1,099 million in long-term marketable securities.

Dividend and Share Buybacks

And Gilead Sciences is still interesting for its dividend. As the stock price was not really able to move higher in the last five years (we saw fluctuations, but overall, it was a sideway range) and management increased the dividend with a CAGR of 9.07% in the last five years, it resulted in an increasing dividend yield over the last few years. Right now, Gilead Sciences is paying a quarterly dividend of $0.71 (probably dividend raise next quarter) resulting in a dividend yield of 3.93%. When using trailing twelve months’ GAAP EPS, we get a payout ratio of 48.4%. When using non-GAAP diluted EPS for fiscal 2021 (according to guidance), we get a payout ratio of 35.5% and when using free cash flow, we get a similar ratio (37.6%). And these payout ratios are acceptable and leave room to increase the dividend.

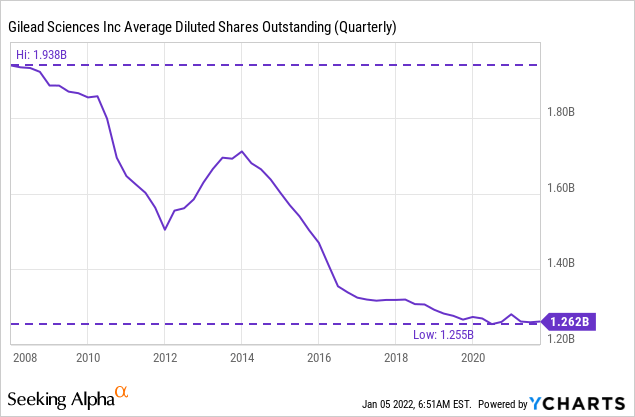

Gilead Sciences is also continuing to buy back shares, and this was also a contributor to growth in the last 15 years. Between 2008 and now, Gilead Sciences decreased the number of outstanding shares from 1,938 million to 1,262 million and GILD decreased the number of outstanding shares with a CAGR of 3%.

Intrinsic Value Calculation

When trying to calculate an intrinsic value for Gilead Sciences by using a discount cash flow calculation, we can take the free cash flow of the last four quarters as basis ($9,491 million). Additionally, we must make assumptions how much free cash flow will increase (or decline) in the years to come. And even when assuming that Gilead Sciences will have troubles to grow in the years to come (0% growth till perpetuity), the stock is fairly valued right now with an intrinsic value of $75.21 (assuming 10% discount rate).

However, I think we can be a little more optimistic and assume 3% annual growth for the years to come. This can be achieved by share buybacks and is also the growth rate analysts are expecting. When calculating with these numbers instead, we get an intrinsic value of $107.44. Of course, we can also point out that the free cash flow of the last four quarters is quite high and probably including positive effects of Veklury sales (which we should not count on in the years to come). Therefore, it might make more sense to use the free cash flow of fiscal 2020 instead (which was $7,518 million) and 3% growth. But when calculating with these amounts, the intrinsic value of Gilead Sciences would still be $85.10 making the stock still 15% undervalued.

Conclusion

I remain convinced that Gilead Sciences is a good pick and solid long-term investment. In my last article about the US stock market, I argued to be cautious. Even if the US stock market could move higher again in 2022, the inevitable stock market crash will come. And I am trying to prepare by identifying stocks that are undervalued and rather recession-proof. And Gilead Sciences trading for a P/E ratio of 12 (GAAP numbers) as well as operating in the recession-proof pharmaceutical sector seems like a good pick.