Brandon Bell/Getty Images News

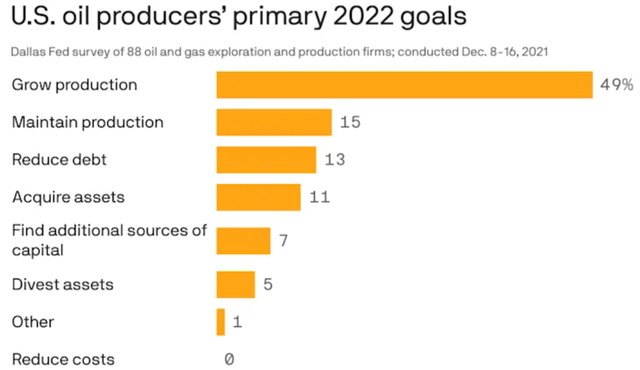

Investment thesis: With the DUC inventory in the shale patch cut in half and still declining at a brisk rate, there are only two ways that the industry can go this year. It can opt to allow shale production to decline once the DUC inventory dwindles to the lowest possible point that is technically possible. A recent survey suggests that US oil & gas producers are mostly looking at increasing production this year, therefore it is unlikely that they will opt for the first option. The second option is to significantly ramp up drilling activities, which is very good news for Halliburton (NYSE:HAL), which provides such services to the shale industry. While Halliburton is already upbeat on the shale drilling outlook for this year, there may be a significant upside surprise, which does provide a prospect of significant upside for investors.

Halliburton’s recent financial results reflect an improvement in shale activity and are a reflection of what we should expect in future years

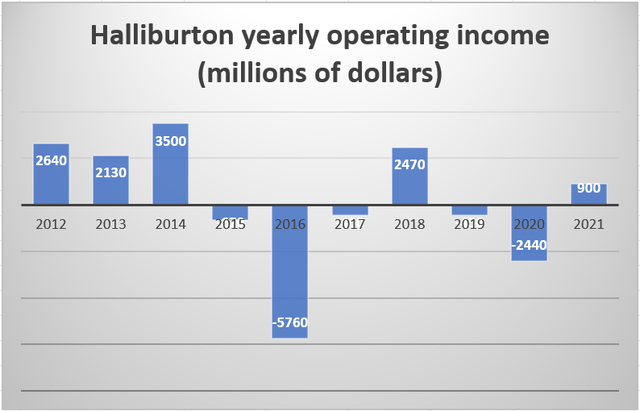

For the third quarter of 2021, Halliburton posted a net income of $236 million on revenues of $3.9 billion. It is by no means a very robust profit margin and it more or less mirrors the results of the previous quarter. It does signify an end to the hardships experienced last year when oil demand collapsed to the point where no one wanted to drill anymore. It is also in my view a settling into a new normal, after the wild ride that Halliburton experienced last decade, as it was riding the shale boom.

Data source: Halliburton.

Data source: Halliburton.

Note: For 2021 I used an estimate, based on the assumption that the fourth quarter will more or less see similar results as in the previous few quarters.

As we can see, in the past decade, Halliburton’s financial results were anything but steady. It is therefore seemingly hard to anticipate the way forward. Personally, I expect returns to become far more steady, with profits swinging to occasional potential losses within a more narrow range. Needless to say that volatility in terms of returns will still occur, with profits swinging into losses whenever another oil & gas price downturn will lead to a dramatic slowdown in drilling & fracking. We are unlikely to see the deep losses of 2016 or 2020 again. We are equally unlikely to see massive profits as we did in 2014 for Halliburton. We will most likely see profits in most years this decade on the back of high oil & gas prices. This year, we should also see a further improvement in revenues and profits compared with 2021 on the back of growing drilling & fracking demand.

DUCs are dwindling fast, meaning that pent-up demand is about to make itself felt when it comes to oil services companies

As I pointed out recently when I covered shale oil & gas producers such as Continental (CLR), EOG (EOG), or Diamondback (FANG), 2021 has been a year of very healthy profit margins for some of the more solid shale producers. Part of the story however has a lot to do with the fact that shale producers have been working down their sizable DUC inventories.

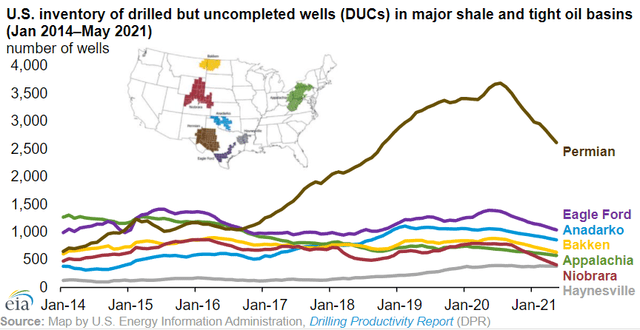

Source: EIA.

In June 2020 there was an all-time peak in DUCs at just under 8,900 wells. The chart above is a little bit outdated. At the time when it was published, there were 6,500 DUCs in the shale patch. The latest monthly EIA drilling productivity report suggests that we may be down to 4,850 wells as of November of 2021. In other words, we are close to only half the DUCs the industry had in inventory just a year and a half ago.

One important aspect we have to understand when we are looking at the shale DUC data is that the inventory will never drop to zero, as long as new well drilling continues to occur. It is impossible to pinpoint at what level the DUC count is likely to bottom, after which it becomes technically impossible to further decline. My guess is that the DUC count will always be in the thousands, as long as shale oil & gas production remains near current levels. At the point when that bottom will occur, there will either be a steep decline in US oil & gas production, or there will be a significant increase in drilling that will help to preempt a decline in production.

At the moment US oil & gas drillers are expressing their intention to continue increasing oil & gas production, therefore it is logical to conclude that a robust increase in drilling services needs to occur at some point this year.

Source: Yahoo

Source: Yahoo

Halliburton is already expecting to see a robust year in regard to demand for drilling. Perhaps a combination of higher oil & gas prices and a need to stave off a decline in production due to the dwindling DUC inventories can combine this year and most likely also in 2023 to provide Halliburton with a more robust than expected increase in demand, with a resulting positive impact on its financial results.

Long-term debt is an issue for Halliburton

Back in 2014 when shale exuberance was at its height, Halliburton had long-term debt of $7.84 billion. Since then it increased to $9.83 billion as of the end of 2020, even as the very bullish outlook for Halliburton’s services has diminished compared with 2014. The debt to revenues ratio should not be compared with 2020, given that it was such an unusual year. The final numbers for 2021 are not out either, therefore it makes the most sense to compare to 2019 when Halliburton brought in $22.4 billion in revenues for the year. It is a debt/revenue ratio of 44%. It is not a grave situation by any means, but it is on the high side.

Servicing the debt cost $116 million in the third quarter of this year, which took up 3% of revenues for the same period. It is not excessive, given that I tend to consider a 5% threshold as a reason to begin to worry, while a 10% threshold for companies involved in resource extraction should be considered as dangerously high. We should keep in mind that the era of low-interest rates may be coming to an end as soon as this year, therefore the cost of servicing debts could potentially rise significantly in coming years. It should not be a short-term concern, but rather a longer-term issue that investors should keep an eye on. It would help to see a further decline in debt levels, which could be achieved in the next few years, given the improving prospects for revenues as well as profits.

Given the volatile financial returns that Halliburton experienced in the last decade, it may be hard for investors to now envision a prolonged period of perhaps not spectacular, but somewhat steady returns for a number of years, only to be briefly interrupted by a slight yearly loss perhaps once or twice this decade. Much of the volatility that Halliburton’s financial results exhibited in the past decade was due to a very volatile oil & gas price environment, as well as the crazy ride that was the shale boom, which did cause investors losses in the hundreds of billions of dollars range last decade by some estimates, but it also provided the world with most of the global oil & gas supply increase. The shale patch is much matured now, so it is unlikely to be the source of too much excitement. The oil & gas price situation should similarly provide far less volatility in the coming years. In the absence of a significant demand destruction event, it seems that we are looking at years of a global tight supply/demand scenario. It means that oil & gas prices are likely to remain high, which will provide for a steady increase in demand for Halliburton’s services, thus years of steadily improving financial results.