gchutka/E+ via Getty Images

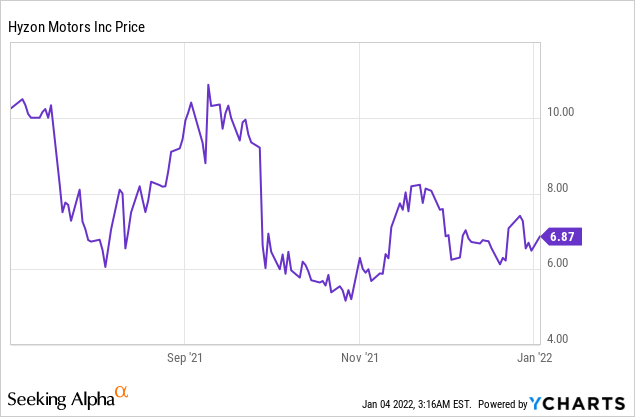

Hyzon Motors (NASDAQ: HYZN), which some people call the “Tesla of Hydrogen Gas“, might be among the most speculative companies that I am aware of in the market today. This high risk-high reward company came public via a SPAC in July and has already been the target of a vicious short seller attack in September by Blue Orca Capital that highlighted some issues, that if true, are troubling about the company. Hyzon almost immediately responded to the report but the issue that the company will have for the foreseeable future, even if the company is indeed viable, is that very early-stage companies that come public via a SPAC are very ripe for criticism, which can make investors nervous and avoid the stock, even if that criticism winds up being unfounded. Adding fuel to the fire is that the current financials for the company are atrocious with the company only achieving close to $1 million in revenue in the latest quarter, while burning up $50.57 million in operating expenses. This is a company that is extremely far from being fully scaled and might still require a lot of investment to achieve scale while entering a rising interest rate environment. Even though, I like to recommend speculative investments, at this point, Hyzon Motors is an uninvestable idea for most investors.

What Does Hyzon Motors do?

Source: Hyzon Motors Investor Presentation

Source: Hyzon Motors Investor Presentation

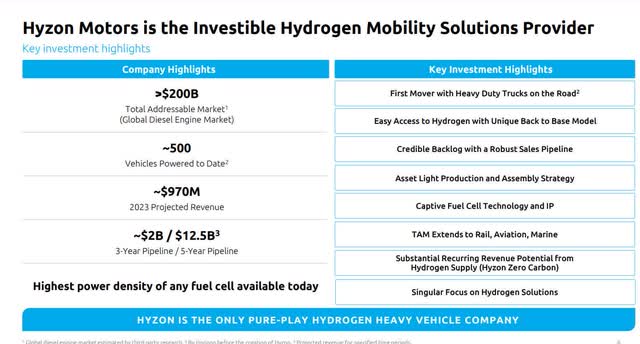

Hyzon Motors currently manufactures zero-emissions hydrogen fuel cell powered commercial vehicles, including heavy duty trucks, buses and coaches. Hyzon Motors is also building out networks of hydrogen fueling stations in four key geographies, which are North America, Asia, Australia, and Europe.

Hyzon Motors’ ultimate goal is to replace polluting diesel-powered trucks and buses with environmentally friendly hydrogen fuel cell powered solutions. Hyzon wants to accomplish this task by building out the three pools of value that it currently sees in the hydrogen fuel cell transportation industry, which consists of hydrogen vehicles, hydrogen fuel, and the servicing of hydrogen vehicles. Essentially, what Hyzon Motors is attempting to do is replicate what Tesla (NASDAQ: TSLA) did with EVs and charging stations, except do it with commercial hydrogen vehicles and hydrogen fueling stations. Unlike Tesla, however, Hyzon focuses on more on the core technology of the fuel cell and electric propulsion system, while using third-party resources to manufacture the rest of the vehicle. Hyzon Motor’s business model should allow the company to scale much faster than Tesla’s more vertically integrated business model. So, while some investors do make comparisons to Tesla, both companies have different business models. Hyzon might even be called “asset light” in comparison to Tesla’s capital-intensive obsession to not only make every part of the vehicle but also make the machines that make the vehicle.

Hyzon views its total addressable market for replacing diesel engines globally at $200 billion. The company is currently projecting $970 million in revenues from the business by 2023, which would be up 969% from reported Q3 2021 revenues of approximately $1 million. So, Hyzon is expecting very rapid expansion in revenues over the next year or two.

Source: Hyzon Motors Investor Presentation

Source: Hyzon Motors Investor Presentation

What is Hydrogen’s Appeal?

Every nation in the world has become acutely aware over the last several decades that Global Warming exists, pollution causes health problems and energy sources like coal, oil & gas are finite. There are a number of alternative energy sources that have been developed over the last 50 years that have the ability to lessen or help eliminate the problems of global warming and pollution, however, the issue with many popular alternative energy sources such as solar or wind is that the electricity developed from sunlight and wind can only provide intermittent power. While batteries have some ability to store energy until it is needed, there is currently no batteries that are good enough to be used to store energy on a 100% renewable energy grid. However, fuel cells are currently one potential solution to affordably resolve the storage power dilemma.

As far as transportation is concerned, the use of batteries in EVs is significantly better to use over gasoline or diesel to solve the problem of global warming and pollution, however, batteries have significant disadvantages in terms of both range and recharging time, which is an even bigger issue when trying to use batteries in commercial vehicles like trucks and buses.

Hyzon’s CFO Mark Gordon also makes an additional case for why hydrogen is a better solution for the environment over batteries in the company’s last earnings call. He makes the claim that battery-powered vehicles might exacerbate the problem of rising electric prices which are being driven by the higher underlying costs of oil, natural gas and coal.

The high commodity prices are leading to higher electricity prices and this trend is only set to become worse. Blackouts are becoming more common from China to Lebanon to California. Many European countries are now making electricity price records with electricity prices in the U.S. at decade highs. A widespread rollout of battery electric vehicles will only exacerbate the situation with the grid and cause a regressive tax on the consumer. The energy transition needs a solution, which is not grid dependent. Hyzon with the help of our partners will produce hydrogen off grid.

Source: Hyzon’s CFO Mark Gordon – Hyzon Q3 2021 Earnings Call

Hydrogen is an off-grid solution that can be developed in almost any location because one huge advantage of hydrogen energy is that it is bountiful in supply and can be found everywhere in some form. Hydrogen gas can be produced from numerous different local sources such as methane, gasoline, biomass, coal or water. Next, hydrogen is the most environmentally-friendly fuel source, since when hydrogen is burnt to produce energy, the byproducts are only electricity, heat, and water.

While fuel cells do have disadvantages, fuel cell technology has recently improved to the point where some experts feel it is now a viable technology to be used in commercial use cases like trucks and buses. Being an investor in Hyzon Motors involves as a starting point, believing that fuel cells are a better solution to use in commercial vehicles over batteries alone.

Reasons To Buy Hyzon Motors

Hyzon Motors has a stated intention of becoming the clear category leader in zero emission commercial vehicles. Hyzon believes the company can scale rapidly to nearly a billion dollars in revenue by using a more “asset light” business model which brings in many third-party resources. The company also claims to have a 3-year pipeline of $2 billion of customers and a 5-year pipeline of $12.5 billion of customers within the TAM of $200 billion that the company cites. Hyzon Motors has already delivered trucks in Europe before the end of Q3 that are currently operating, so this is no vaporware operation. The company has real products that are already in use. After the third quarter ended, the company also announced that they had delivered 29 fuel cell electric trucks to be used by a major steel conglomerate in China in late November. Hyzon is also currently building out hydrogen supply infrastructure with various partners. In addition, Hyzon intends on building out the largest fuel cell membrane electrode assembly (“MEA”) production line for commercial vehicles in the United States.

Imagine going back in time and making an investment in Tesla within its first six months of coming public. Well, Tesla’s stock was up 4125% over its first ten years. While I am not sure Hyzon Motors has the same upside of Tesla, the stock has a very strong potential to scale more rapidly to profitability than Tesla and perhaps 10X to 20X over its first 10 years, if the company successfully executes. So, Hyzon has very high potential upside and it is also a “feel good” stock as the company could potentially help save the world. Also, with ESG stocks being in vogue these days, Hyzon Motors might be attractive to an investor class that believes in the mission of the company, which is all about the environment and the resulting social good.

Last but not least, a major reason that investors should consider buying Hyzon is that the infrastructure bill signed by President Biden helps accelerate the deployment of hydrogen. I believe the bill includes $8 billion to support the development of at least four clean hydrogen hubs across the United States. This investment closely aligns with the hydrogen supply hub strategy already being pursued by Hyzon to support back to base fleet operations. So, it is clear that Hyzon will receive support from the current administration for many of its initiatives.

Risks

The problem with Hyzon Motors is that with high upside comes very high risk. Now that Tesla has achieved a lot of success, many people forget that Tesla came close to failure several times in its history. Tesla was a similar high risk-high reward company at a similar stage in the company’s development and it is possible that Hyzon Motors could also encounter similar financial problems as Tesla did when attempting to scale, which could eventually lead to the company going bankrupt, if anything should go seriously wrong.

Secondly, Hyzon Motors came public as a SPAC and one particular feature of a SPAC, as compared to a traditional IPO, is that the reverse merger process of a SPAC allows a company to hide liabilities and business weaknesses that the market might want to assess. A traditional IPO can be a grueling experience for a company but it gives public investors a deeper insight into a company’s financials than a SPAC does. Therefore, in general, an IPO tends to screen out a lot more potentially very weak and/or fraudulent companies, that the SPAC process might fail to catch.

This has a number of consequences for companies going through the SPAC process with the biggest one being most investors are far more skeptical of the financials and business plans of companies that go through the SPAC process and SPAC companies often have a lot more to prove to the market and it often takes a bit longer to prove to investors that the business model is sound.

Most SPACs that I have observed come public over the past year have fairly similar experiences after coming public, which is namely that they reach the public markets with great hype and the hype can often carry the stock to high valuations compared to the fundamentals, at which point short sellers take advantage of the fact that not many people fully trust the company yet, by slinging mud at the company to see what sticks. Sometimes, short sellers find legit concerns but more often than not, the information the short seller provides winds up being bogus but it doesn’t matter, since the company isn’t trusted by investors yet. Most SPACs on the market today, have poor investor sentiment associated with them and Hyzon Motors is no exception, especially after a short report really dropped the price of the stock in September.

Hyzon Motors is one of the earliest stage public companies on the market today. The company currently is just in the process of building up an initial client-base and initial use cases. The company has a stated strategy of developing use cases through a series of seed or pilot sales, then batch orders, then fleet conversions. Hyzon is still mostly at the pilot sales or batch order stage and has only recently started bringing in actual revenues. This stock might be discounted for the market for quite some time until it can be seen that the company can attract customers beyond the batch order stage, then even after that, many investors will likely be cautious because they might want to see whether has the ability to scale and become profitable. At this point, Hyzon Motors is still a “Story Stock” and the big problem for Hyzon is that they could face an extremely difficult 2022, as interest rates rise and investors avoid high risk stocks.

Third, there is still enormous push-back against the “story” of Hyzon Motors, which is led by Elon Musk, who still to this day is disparaging the idea of hydrogen fuel cells. The major problem with Elon Musk being against hydrogen power is that Musk is considered a genius by many people and many people follow the things that he says without question, so there is enormous pushback by followers of Musk to the idea that evidence from other less well-known geniuses is showing that Musk’s objections to hydrogen power are false and hydrogen power might indeed be viable. Things that were believed true about hydrogen power perhaps 20 years ago might not necessarily be true today but are still heavily believed by some people. It is possible that there might be large sections of the renewable energy investing base that might think that hydrogen fuel cells and Hyzon are an uninvestable idea and these investors might only be convinced after the company becomes an “obvious” winner.

Last but not least, the company might simply prove out that its business model can’t scale and isn’t financially viable. It is the fear that the company’s business model isn’t long-term financially viable, combined with the fact that the company has yet to prove anything, which has kept many investors from considering the stock. Only investors that really understand the advantages and disadvantages of hydrogen power technology might be currently interested in this stock.

Hyzon Q3 2021 Earnings Report

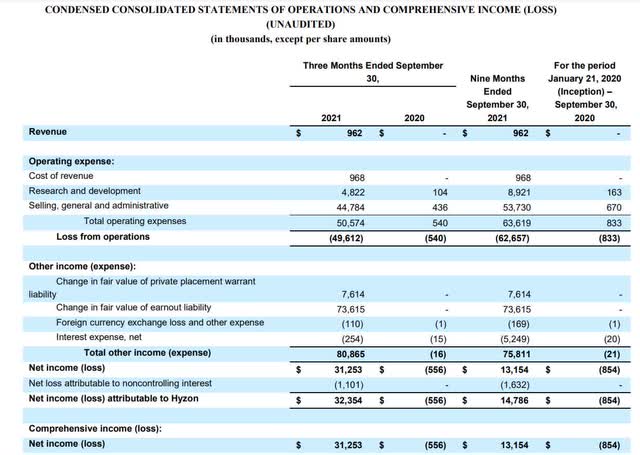

Source: Hyzon Q3 2021 Earnings Release

As stated previously, the company produced close to $1 million in revenue in Q3 2021. Total operating expenses were $50.6 million, loss from operations was $49.6 million and net income was $32.4 million. Operating expenses for the Q3 2021 were comprised mainly of $4.8 million of R&D costs and $44.8 million of SG&A costs.

Within SG&A, there were one-time charges totaling $34.1 million, which were related to foundational equity grants for senior executives and expenses related to the retirement of the former CTO and deal expenses.

Hyzon also reported a positive EBITDA of $31.7 million due to changes in the fair value of earn-out and private placement warrant liabilities. Adjusted EBITDA for the third quarter was negative $15.2 million after backing out the one-time items related to the fair value of the earn-out and private placement warrant liabilities and other one-time charges. Hyzon remains on track to meet company full year 2021 EBITDA projections.

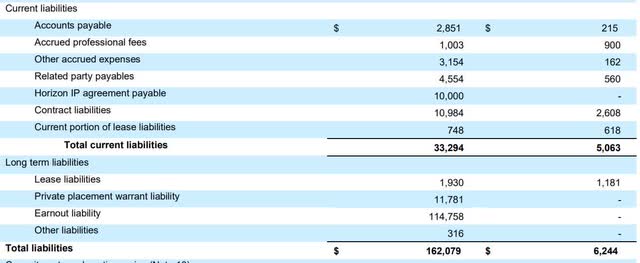

Balance Sheet

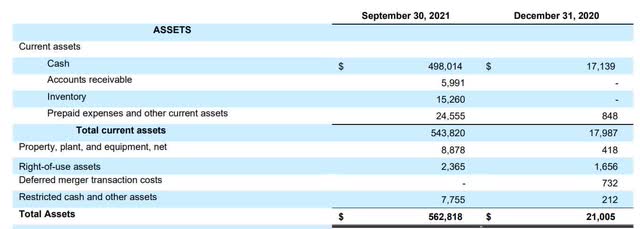

Source: Hyzon Q3 2021 Earnings Release

Source: Hyzon Q3 2021 Earnings Release

Hyzon had $498 million in cash on the balance sheet at the end of Q3 2021.

Source: Hyzon Q3 2021 Earnings Release

Source: Hyzon Q3 2021 Earnings Release

Hyzon had $33.29 million in current liabilities and zero long term debt at the end of Q3 2021. So currently, Hyzon Motors balance sheet is in excellent shape.

Competition

Tesla is Hyzon’s biggest competition and is also a proxy for the competing ideas of BEVs versus FCEVs. Both sides of that debate have both advantages and disadvantages. Currently, the idea of BEVs dominates the market. However, if Hyzon successfully builds out a network of hydrogen stations nationwide while also converting large fleets of trucks to hydrogen fuel cells, then the dynamics of BEVS versus FCEVs could change.

Another stock that is considered a Hyzon competitor is Nikola (NASDAQ: NKLA). Nikola has generated far more hype than Hyzon but in a few different ways Nikola is behind Hyzon. First, Hyzon is generally acknowledged to have the very best FCEV technology. Hyzon’s PEM fuel cell stacks have recently been validated by TUV Rheinland as being the world’s highest power-density fuel cell stack. The second big difference is Nikola uses a capital-intensive strategy similar to Tesla, in that Nikola wants to build a whole truck from the ground up. Hyzon on the other hand has a “capital light” business model closer to Plug Power (NASDAQ: PLUG), in that Hyzon simply wants to supply the fuel cell and powertrain for truck-makers and/or fleet owners and allow them to use whatever truck or bus body that they want. Hyzon’s business model will likely scale faster than Nikola. Additionally, Hyzon is much further ahead in making actual product deliveries as Nikola only recently made a delivery of one truck to great fanfare.

Speaking of Plug Power, both companies have overlapping businesses, with Hyzon Motors appearing to focus more on the systems used to build large trucks and buses, while Plug Power seems more aggressive on building out hydrogen fueling stations but both businesses do overlap and do similar things and have similar business models. If the hydrogen economy does indeed prosper, it is feasible that Hyzon Motors, Plug Power and Nikola could all prosper because the industry is so new.

Right now, the competition for Hyzon Power is more about battling Elon Musk’s vision for transportation rather than battling either Plug Power or Nikola. However, of the three hydrogen companies, I am more interested in Plug Power or Hyzon Motors because of their business models over a Nikola.

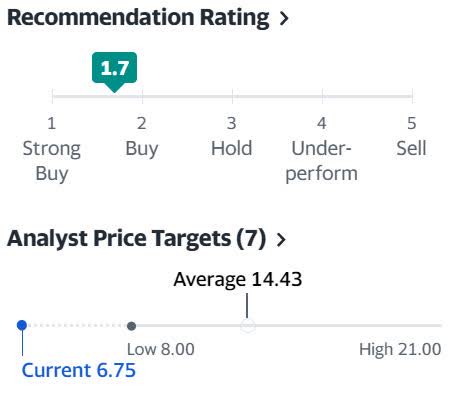

Analyst Price Target

Source: Yahoo Finance

Source: Yahoo Finance

The above is based on 7 Wall Street analysts offering 12-month price targets for Hyzon Motors in the last 3 months. The average price target is $14.43 with a high forecast of $521.00 and a low forecast of $8.00. The average price target represents a 114% increase from the last price of $6.75.

Conclusion

This stock has extremely high upside. This is the type of company that could easily 10X within 3 to 5 years. The reason why I won’t recommend it at this stage is because the company is extremely early stage Hyzon doesn’t have many, if any, large customers yet where they have firm fleet conversion orders. Hyzon is mostly at the tryout stage or batch order stage with many companies. There is a reason why Hyzon only made $1 million in revenues in Q3 and I would like to see more progress in sales from the company before recommending it.

Investors should watch this company for the next few quarters to see how sales progress and deliveries progress before buying. This is a speculative company and there is large downside, even from current prices, if the company disappoints in a rising interest rate environment Only investors that have a Venture Capital type mindset and who have high risk tolerance should buy Hyzon Motors at current prices.